The Bitcoin market is experiencing a wave of uncertainty as a latest evaluation by CryptoQuant reveals a big shift in investor conduct. Roughly $2.4 billion price of Bitcoin, seemingly acquired by traders this 12 months, has moved throughout the community, sparking debate in regards to the causes behind the exodus.

Associated Studying

Brief-Time period Jitters Drive Promote-Off

Consultants consider these outflows are pushed by short-term traders who made a foray into the market in early 2023. Again then, anticipation surrounding Bitcoin Change-Traded Funds (ETFs) and the mining reward halving – an occasion anticipated to scale back provide and probably enhance costs – fueled a shopping for spree. Nonetheless, the present bear market appears to have dampened their enthusiasm, main them to chop their losses.

Newbie traders are capitulating and growing promoting strain

“Roughly $2.4 billion price of #Bitcoin aged between 3 and 6 months moved on the community throughout the drop.” – By @caueconomy

Learn extra 👇https://t.co/W46LKwg9Hb pic.twitter.com/C3OzfIMbSo

— CryptoQuant.com (@cryptoquant_com) July 4, 2024

This conduct highlights the distinction between true long-term believers and people chasing fast income. Whereas short-term sentiment is driving the sell-off, it’s essential to keep in mind that Bitcoin has weathered comparable storms earlier than.

Calm Amidst The Chaos: Lengthy-Time period Traders Keep The Course

A beacon of stability on this uneven market is the unwavering confidence displayed by long-term Bitcoin holders. CryptoQuant’s knowledge signifies that traders with holdings older than a 12 months haven’t been swayed by the latest market turmoil. This implies a robust perception in Bitcoin’s long-term potential, which may act as a buffer in opposition to additional value drops.

The contrasting conduct between new and veteran traders is an enchanting dynamic. Whereas short-term holders are swayed by market fluctuations, long-term traders perceive that Bitcoin is a marathon, not a dash. Their continued religion within the expertise can present much-needed stability for all the market.

Uncharted Territory: Market Responds To Investor Tug-Of-Conflict

The million-dollar query stays: how will the market react to this large-scale sell-off by short-term holders? Some specialists fear it may set off a domino impact, resulting in additional value drops. Nonetheless, others consider the unwavering confidence of long-term traders will stop a freefall. The approaching weeks will probably be essential in figuring out which power prevails.

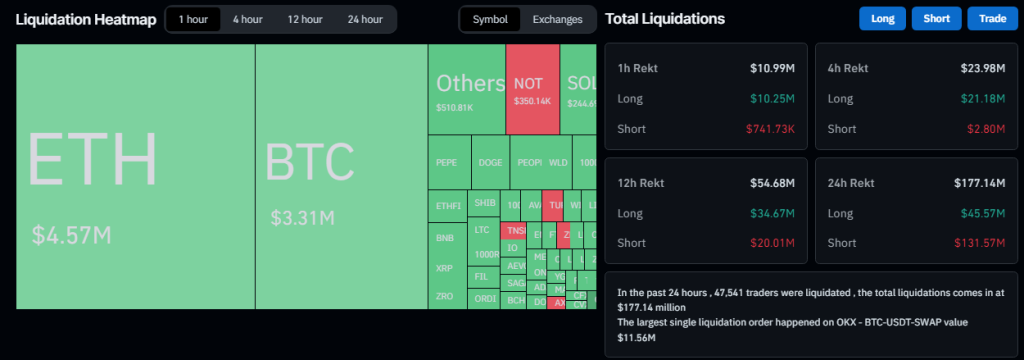

Large Bitcoin Liquidation

In the meantime, including one other layer of complexity is the latest liquidation of over $418 million in Bitcoin positions. Whereas this appears alarming at first look, it’s essential to contemplate Bitcoin’s dominance within the cryptocurrency market (over 50% market share).

Associated Studying

This dominance interprets to a naturally larger greenback worth of liquidated positions for Bitcoin, regardless of the decrease share in comparison with different cryptocurrencies. Actually, the info means that Bitcoin fared higher than many altcoins throughout the latest value decline.

The Bitcoin market finds itself at a crossroads. Brief-term jitters are inflicting some traders to leap ship, whereas long-term holders stay steadfast of their conviction. The interaction between these contrasting forces will decide the longer term trajectory of the world’s hottest cryptocurrency.

Featured picture from Alamy, chart from TradingView