With the U.S. election day casting its lengthy shadow, BTC is teetering on the sting of chaos, and the potential of a brand new Bitcoin All-Time Excessive appears very actual.

Merchants are on purple alert, with choices markets hinting at a wild 10% swing — a cool $7,000 worth shift — because the electoral drama performs out between former President Donald Trump and Vice President Kamala Harris. It’s a cocktail of political and financial tempest. Right here’s what you must know in regards to the choices market influence on a Bitcoin All-Time Excessive.

Bitcoin All-Time Excessive? Studying the Possibility’s Market Tea Leaves

In an interview with Trustnodes, Nick Forster, founding father of the on-chain choices DeFi protocol Derive.xyz, make clear the state of affairs:

“There’s a one in three probability that BTC may see a swing larger than 10% on election day, with a extra risky state of affairs of 20% motion sitting at a 5% chance.” – Nick Forster, Derive.xyz CEO

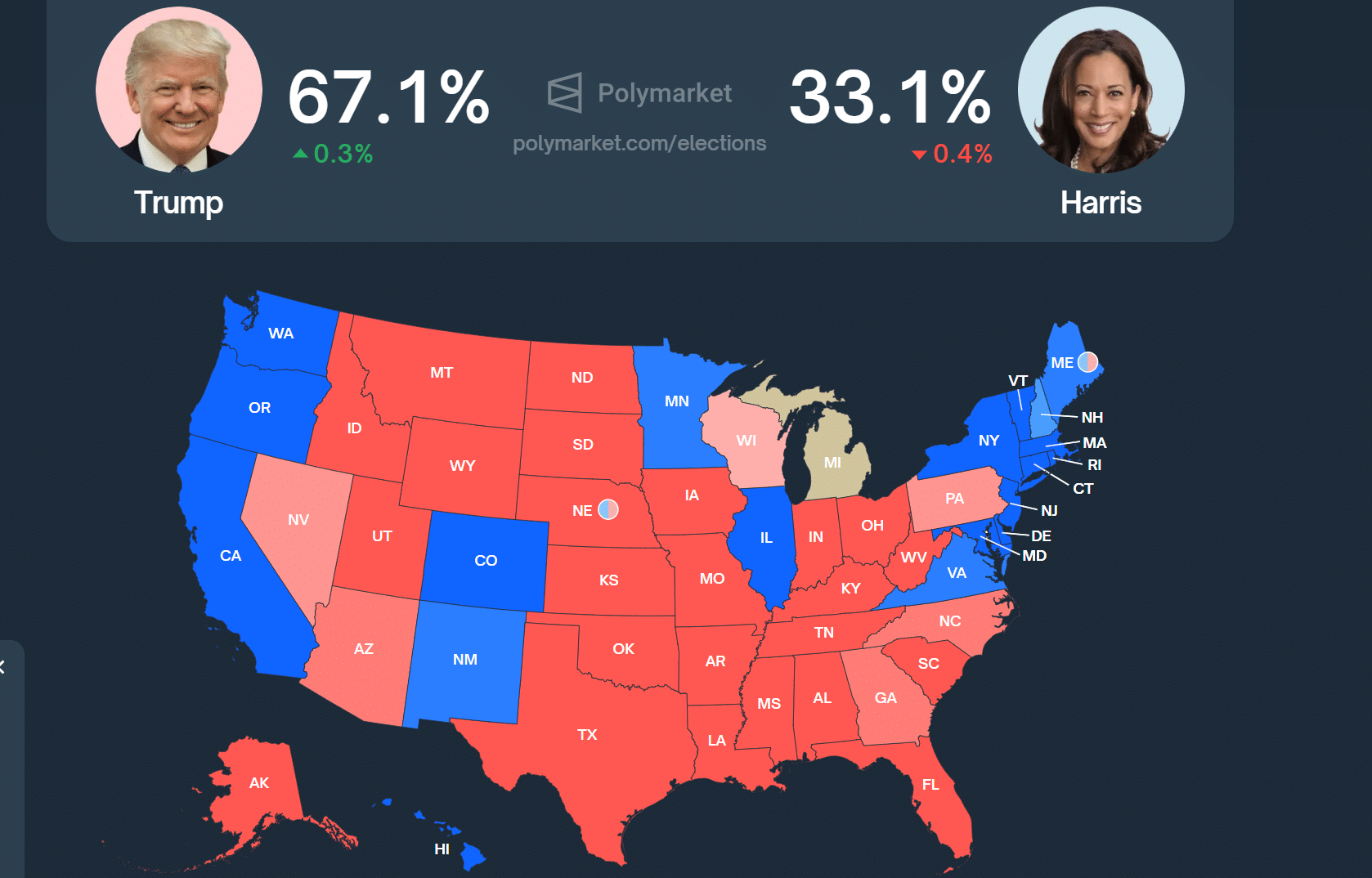

I don’t find out about you, however I’ve had the betting odds for Polymarket and Kalshi open on my laptop computer all week. In keeping with Forster, it appears many individuals are doing the identical as his figures underscore the market’s anticipation of great worth motion linked to the election outcomes.

In choices buying and selling, a measure referred to as time period construction signifies that the short-term implied volatility is larger than the long-term, highlighting the market’s expectation of event-driven fluctuations.

Election Day Drama: Trump vs. Harris (Bitcoin All-Time Excessive?)

Election day, set in opposition to a backdrop of Fed price cuts, doable imprisonments of Trump and Hunter Biden, financial uncertainty, and Hitler accusations, guarantees to be something however predictable.

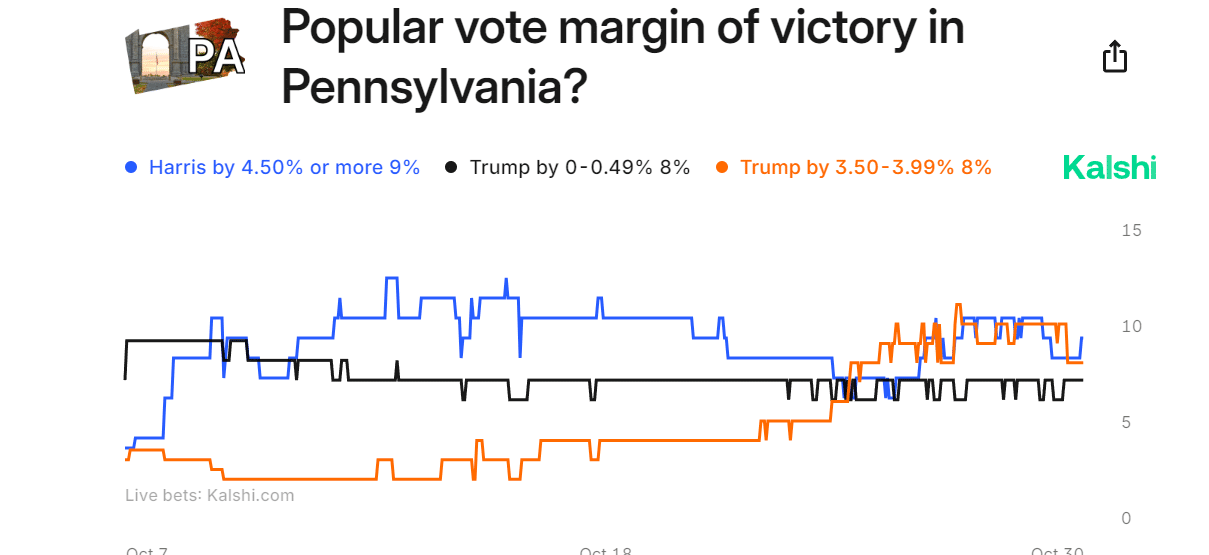

Polls recommend a decent race, with Pennsylvania, Nevada, and Michigan rising as pivotal battleground states. At this level, solely six states will determine the election.

Betting markets add one other layer of opaque intrigue. Most predict a Trump landslide, whereas others argue that Kalshi and Polymarket are biased. This uncertainty feeds into Bitcoin’s potential volatility as merchants grapple with the implications of both consequence.

Because the election’s consequence teeters, a brand new Bitcoin all-time excessive hangs within the stability—BTC’s response is as unpredictable because the vote itself. Presently, Bitcoin

.cwp-coin-chart svg path {

stroke: ;

stroke-width: ;

}

Value

Buying and selling quantity in 24h

<!–

?

–>

Final 7d worth motion

is buying and selling at $72,000, up 1%, and a Trump win would possibly shoot BTC upward, driving the wave of his crypto-friendly vibe. However don’t be fooled; a few of this will likely already be baked into the present worth.

In the meantime, a Harris win may ship the market scrambling for reassessment, although simply how far that shift goes is anybody’s guess.

Rep. Tom Emmer, a powerful advocate for crypto in Congress, believes that #cryptocurrency rules are inevitable, no matter who wins the upcoming election.

Talking on the Messar Mainnet convention, Emmer said that digital asset laws will seemingly transfer ahead in… pic.twitter.com/1JTAnD8HOA

— 99Bitcoins (@99BitcoinsHQ) October 17, 2024

Wanting past election day, Bitcoin’s implications hinge on broader political and financial insurance policies. Each Trump and Harris deliver totally different potential impacts to the desk. Trump’s rhetoric round making a Bitcoin reserve fund suggests bullish short-term prospects, however his monitor file leaves room for skepticism.

Harris is getting into the ring, providing crypto a ‘recent handshake.’ She guarantees much less baggage than Trump and a eager eye for readability via the FIT21 act, which may pave a golden street for Bitcoin’s future.

Who is aware of which candidate truly cares about Bitcoin? I suppose we’ll quickly see in 6 days (or extra as a result of election shenanigans are already happening)

DON’T MISS: The Hottest Undervalued Altcoins in November 2024

A Last Thought on Election Day Value Impacts

Because the election attracts close to, Bitcoin fans and traders ought to brace for essentially the most pivotal occasion for the worth all 12 months—sure, greater than the Bitcoin halving and the Fed price cuts.

The interaction between political outcomes and market reactions will set a recreation the place fortunes can change immediately. This goes past Bitcoin, seemingly impacting AI, tech, and Tesla.

Remember to take a look at the 99Bitcoin’s YouTube channel for our election protection!

EXPLORE: Elon Musk’s Shiba Inu Tweet Ignites Dogecoin Rally: Can It Hit 2021 Highs Once more?

Be part of The 99Bitcoins Information Discord Right here For The Newest Market Updates

The publish 2024 Election Day May Set off 10% Transfer in BTC and Bitcoin All-Time Excessive appeared first on .