Initially printed on Unchained.com.Unchained is the official US Collaborative Custody accomplice of Bitcoin Journal and an integral sponsor of associated content material printed via Bitcoin Journal. For extra data on providers supplied, custody merchandise, and the connection between Unchained and Bitcoin Journal, please go to our web site.

You don’t usually see the time period “Roth IRA” trending on-line, however in 2021, tech investor Peter Thiel made headlines for his $5 billion tax-free Roth IRA piggy financial institution. How did he do it? The reply is different investments. He used a self-directed IRA to put money into early-stage tech firms a number of occasions over. Is it a loophole? Presumably. But it surely occurred, it acquired consideration, and the IRA construction in query may come underneath additional scrutiny.

“Thiel has taken a retirement account price lower than $2,000 in 1999 and spun it right into a $5 billion windfall.” – ProPublica (2021)

Let’s have a look at six frequent dangers related to self-directed and checkbook IRAs, how they could apply within the context of bitcoin, and why there could also be elevated regulation coming sooner or later. However first, we have to outline our phrases and differentiate between IRA buildings.

The totally different IRA buildings

The totally different IRA buildings can behave in an “each sq. is a rectangle, however not all rectangles are squares” type of means. IRAs will be Conventional (pre-tax) or Roth (post-tax) no matter custodial relationship/construction. All IRAs are custodial. A custodian, within the context of IRAs, is a licensed monetary establishment overseeing and administering the IRA.

Brokerage and Financial institution IRAs

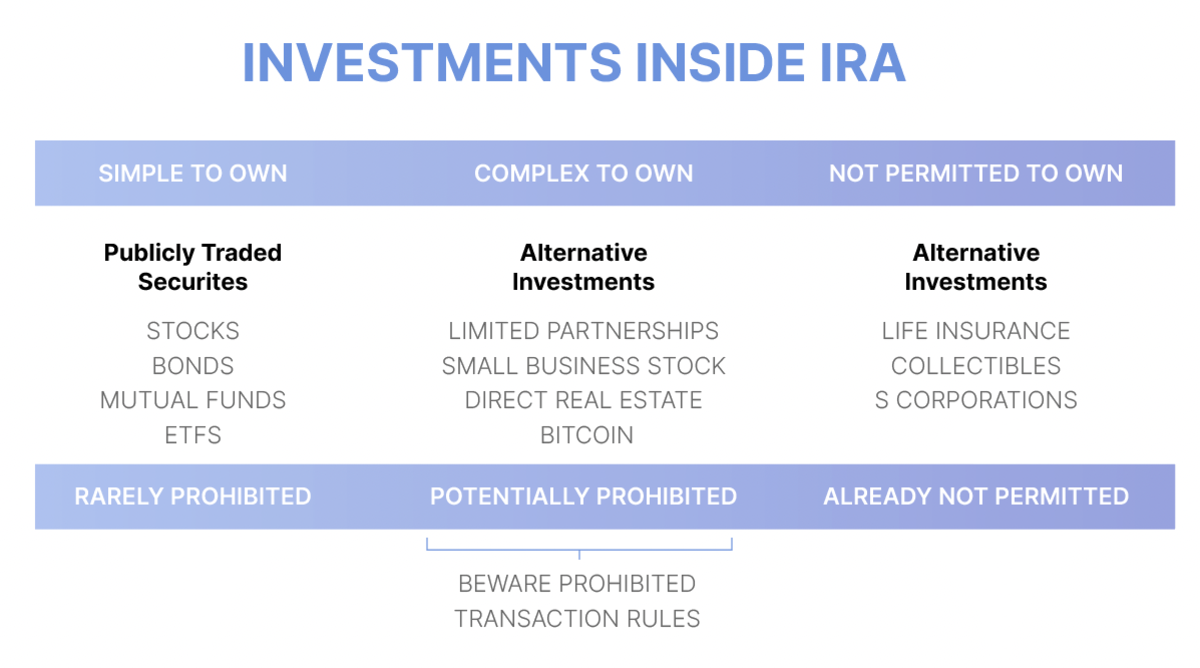

Brokerage and financial institution IRAs are probably the most acquainted and customary sorts. Brokerage and Financial institution IRAs permit buyers to put money into shares, bonds, ETFs, mutual funds, and different securities, in addition to banking merchandise (CDs, deposit accounts, and many others.). Examples embrace your typical Constancy, TD Ameritrade, or Charles Schwab IRA. The Unchained IRA is closest to this construction on this hierarchy.

Self-directed IRA (SDIRA)

A self-directed IRA is a custodial IRA the place the custodian permits for expanded funding choices outdoors of or along with typical brokerage and financial institution property (shares, bonds, CDs, and many others.). House owners of self-directed IRAs can put money into non-traditional property like actual property, companies, personal loans, tax liens, treasured metals, and digital property. Though the IRS doesn’t have a definitive record of allowed investments, it definitely has a couple of that aren’t allowed (collectibles, life insurance coverage, sure derivatives, S-Corps, and many others.).

Checkbook IRA

Checkbook IRAs are a subset of self-directed IRAs. The time period “checkbook IRA” shouldn’t be commonplace, but it surely normally refers to a self-directed IRA that offers an account proprietor management of investments via a checking account, normally via an LLC conduit. The account holder can then make investments with IRA funds just by writing a verify (“checkbook management”). With the added freedom of further funding selections comes added duty of administration, in addition to authorized ambiguity as as to whether the construction nonetheless qualifies as a tax-exempt IRA.

Non-checkbook self-directed IRA

A subset of self-directed IRA the place the custodian approves transactions earlier than investments are made. Traders should look forward to the custodian to evaluation every potential funding and formally settle for title to the underlying asset. These had been generally used for actual property and personal fairness investments and commenced regaining reputation as soon as further authorized uncertainties arose concerning checkbook IRAs in late 2021 (mentioned in part 4 under).

Dangers to look at for when utilizing a self-directed or checkbook IRA

1. Liquidity

Sadly, many self-directed property lack liquidity, making them tough to promote rapidly. Examples embrace actual property, privately held companies, treasured metals, and many others. If money is ever wanted for a distribution or inside expense, promoting an asset quick may very well be an issue (which compounds into different issues, i.e., unintentionally commingling funds). Self-directed IRA house owners ought to conduct thorough due diligence on asset liquidity earlier than committing to an funding technique.

2. Formation and authorized construction

When forming a checkbook IRA, a self-directed IRA LLC is established first. Then, the LLC establishes a checking account identical to every other enterprise entity. Subsequent, the LLC is funded by sending the IRA funds to the checking account.

With the right authorized construction, the IRA proprietor can grow to be the only managing member of the LLC and have signing authority over the checking account. Nevertheless, improper authorized construction, registration, or titling may all trigger critical issues for the tax-advantaged standing of the IRA. Many checkbook IRA facilitators are competent, however errors may at all times result in points and potential disqualification/lack of your complete IRA.

3. Misreporting transactions

Inside a checkbook IRA, house owners can fund investments rapidly and freely, however this comes with the duty of correctly following guidelines and self-reporting transactions.

On the finish of every 12 months, the proprietor of the LLC might want to present full transaction particulars to its IRA custodian and submit truthful market valuation (FMV) data. With out oversight into every transaction you make, a custodian is extra more likely to misreport earnings in your investments. At all times make sure the custodian has correct data to keep away from unintentionally breaking the legislation.

4. “Deemed distribution” therapy

Shoppers seeking to purchase treasured metals, actual property, or digital property ought to know the chance of “deemed distributions” therapy. A current United States tax courtroom case, McNulty v. Commissioner, illustrates the appreciable dangers of sustaining a checkbook IRA. Within the McNulty case, a taxpayer used her checkbook IRA LLC to buy gold from a treasured metals vendor. She saved the LLC’s gold at house in her private secure. The courtroom dominated that her “unfettered management” over the LLC’s gold with out third get together supervision created a deemed taxable distribution from her IRA.

It’s inconceivable to understand how far a tax courtroom will go making use of “deemed distribution” therapy to any given transaction or funding inside a checkbook IRA. For checkbook IRA house owners that maintain the keys to bitcoin in an unsupervised construction, there’s a threat that the McNulty ruling may trigger your whole IRA to be topic to tax. Additional, since different investments had been pretty not too long ago (2015) added to IRS Publication 590, it’s fully potential that the IRS and Congress may apply extra scrutiny to checkbook IRAs going ahead. Learn extra concerning the McNulty case and its implications.

5. Prohibited transactions

All self-directed IRA house owners are at all times prohibited from commingling private and IRA property or utilizing any private funds to enhance IRA property. “Self-dealing” is among the most typical pitfalls for self-directed account holders. For instance, in the event you use your IRA to buy actual property, you aren’t allowed to make use of the property your self—not even a bit bit. You can not stay there, keep there, or hire workplace house to your self there. You aren’t even allowed to make your personal repairs or present “sweat fairness.”

It’s not solely the IRA proprietor that may’t take part in any “self-dealing,” however spouses, kids, and grandchildren as effectively. They’re thought-about disqualified people, and penalties are stiff. These are stringent guidelines and can lead to big tax complications if breached. I don’t intend to crush any desires, however investing your 401k/IRA into your lakefront Airbnb trip house and having you or your loved ones keep there even as soon as is a nasty concept. No buying a rental house and renting it out to members of the family both. For additional enjoyable, see the IRS record of prohibited transactions right here.

Listed here are a couple of examples of how prohibited transactions guidelines may very well be utilized to digital asset buyers:

Commingling private wallets with IRA walletsLeverage and not using a non-recourse loanInvesting in sure collectible NFTs1

6. Financing

Financing inside a self-directed IRA can be extra difficult for a number of causes:

Usually, a non-recourse mortgage and bigger down fee are wanted for any property purchases.Surprising prices and costs can add up rapidly and eat into any earnings.IRA-owned lively companies may run into the problem of UBIT (Unrelated Enterprise Revenue Tax). This additionally impacts the overlap of bitcoin mining inside an IRA.Any earnings and bills should stay throughout the IRA construction and by no means commingled with private funds. For instance, when the water heater goes out (actual property) or salaries should be paid (companies), the IRA itself should pay for these providers out of the IRA’s personal money. IRA house owners may very well be tempted to co-mingle funds quickly as they search for short-term liquidity to resolve their money wants.

What does this imply for bitcoin IRAs?

The self-directed IRA house has many potential dangers if not correctly managed. The IRS and Congress have been paying particular consideration to how these buildings are used and abused. Mix this with their curiosity in regulating digital property, and the panorama seems ripe for additional scrutiny. With that, bitcoin IRAs want a novel strategy that mitigates these pitfalls.

Unchained IRA shouldn’t be a checkbook IRA

When you’re seeking to maintain precise bitcoin in your IRA account, it is best to take into account the Unchained IRA. It’s not a “checkbook IRA” the place transactions should be self-reported, and Unchained makes use of its key within the collaborative custody setup to trace inflows and outflows of IRA vaults. That visibility mechanism permits the custodian to actively monitor the IRA and due to this fact permits customers to stay compliant with present IRA guidelines and rules.

There isn’t any self-reporting required, and the non-checkbook construction helps mitigate the chance of potential pitfalls (McNulty, misreporting transactions, and many others.). If bitcoin appreciates like many buyers hope and count on, holding cash in an IRA construction correctly is of the utmost significance.

This text is supplied for academic functions solely, and can’t be relied upon as tax recommendation. Unchained makes no representations concerning the tax penalties of any construction described herein, and all such questions needs to be directed to an legal professional or CPA of your alternative. Jessy Gilger was an Unchained worker on the time this submit was written, however he now works for Unchained’s affiliate firm, Sound Advisory.

1While not technically a part of the Prohibited Transaction Guidelines (part 4975 of the Inner Income Code), collectibles are individually prohibited from being held in an IRA underneath part 408(m).

Initially printed on Unchained.com.Unchained is the official US Collaborative Custody accomplice of Bitcoin Journal and an integral sponsor of associated content material printed via Bitcoin Journal. For extra data on providers supplied, custody merchandise, and the connection between Unchained and Bitcoin Journal, please go to our web site.