On-chain knowledge exhibits round 91% of all Bitcoin holders have entered into the inexperienced following the most recent rally in direction of the $66,000 stage.

Bitcoin Has Loved Sharp Bullish Momentum Lately

Bitcoin has kicked off the brand new week on a optimistic word as its worth has surged round 4% to return to the identical highs as again on the finish of final month. The under chart exhibits how the cryptocurrency’s current trajectory has appeared.

The value of the asset seems to have been driving an uptrend in current days | Supply: BTCUSDT on TradingView

On the peak of this newest rally, Bitcoin had briefly touched the $66,500 mark, however since then, the coin has suffered a pullback, though the diploma of it isn’t too important as the worth continues to be buying and selling round $65,500.

The current surge of the asset would naturally have had an impact on the profitability of the traders, which on-chain knowledge has confirmed.

An Overwhelming Majority Of BTC Buyers Are Now Above Water

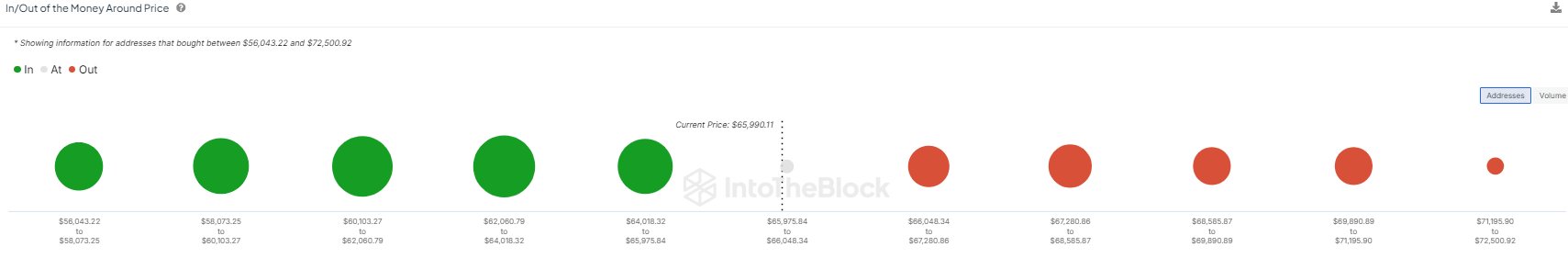

In keeping with knowledge from the market intelligence platform IntoTheBlock, 91% of the Bitcoin userbase is now carrying some unrealized revenue. The analytics agency has shared how the varied BTC worth ranges are presently like by way of the quantity of traders who bought their cash at them.

The most recent value foundation distribution on the BTC community | Supply: IntoTheBlock on X

Within the chart, the dimensions of the dot corresponds to the quantity of BTC that has its value foundation within the corresponding worth vary. It might seem that some massive dots have turned inexperienced after the asset’s current restoration, implying a lot of addresses have gone again right into a web revenue.

It’s additionally seen that the dots forward aren’t too massive, which is smart given the truth that solely 9% of the traders are nonetheless underwater. Such holders in loss can react to a retest of their value foundation by panic promoting, so massive demand zones above the asset’s worth could be potential sources of resistance.

As the worth ranges forward don’t carry the price foundation of too many traders, although, any resistance that emerges might not be too notable. That mentioned, this doesn’t imply BTC would have a simple time mowing by means of these previous couple of ranges on the best way to the all-time excessive.

When a excessive quantity of traders get into earnings, the chance of a mass selloff happening with the motive of profit-taking can turn out to be important. As such, regardless that resistance forward seems to be weak, Bitcoin might nonetheless have hassle reaching a brand new excessive provided that 91% of the traders are sitting on good points.

In another information, the Bitcoin whales have been exhibiting a long-term pattern of accumulation this yr, as an analyst has identified in a CryptoQuant Quicktake publish.

The pattern within the whole stability of the BTC whales over the previous yr | Supply: CryptoQuant

The whales check with the Bitcoin entities who maintain between 1,000 and 10,000 BTC of their wallets. From the graph, it’s seen that the 30-day change of their holdings has nearly totally been optimistic this yr to this point, suggesting relentless shopping for.

Featured picture from Dall-E, IntoTheBlock.com, CryptoQuant.com, chart from TradingView.com