The under is an excerpt from a latest version of Bitcoin Journal Professional, Bitcoin Journal’s premium markets e-newsletter. To be among the many first to obtain these insights and different on-chain bitcoin market evaluation straight to your inbox, subscribe now.

Bitcoin miners haven’t been working beneath regular circumstances for the previous a number of months. Bitcoin’s blockchain has seen a very intense diploma of demand over the previous a number of months, and it appears to be like like BRC-20s, and to a lesser extent, picture inscriptions, all made doable by the Ordinals protocol, bear a substantial amount of duty. Basically, this protocol permits customers to inscribe distinctive knowledge on probably the most minute denominations of bitcoin, permitting them to create new “tokens” straight on Bitcoin’s blockchain. Because of this portions of bitcoin value pennies by way of their fiat worth might nonetheless be purchased and bought a number of instances, with each one in every of these transactions needing to be processed by the identical blockchain, to not point out the excessive demand seen whereas initially minting.

That is the place the Bitcoin miners are available in. The energy-utilizing computations undertaken by specialised mining {hardware} should not solely meant to generate new bitcoin, however additionally they can be utilized to confirm the blockchain’s transactions and hold the digital financial system flowing easily. With community utilization about as excessive because it’s ever been, miners have greater than sufficient alternatives to earn income simply by processing these transactions, and the precise manufacturing of newly-issued Bitcoin can take one thing of a backseat. As of February 2024, these situations have created a scenario the place mining problem is larger than ever earlier than in Bitcoin’s historical past, but the business is raking in giant earnings. Nevertheless, some of the dependable patterns within the Bitcoin market has been the sheer chaos that sees charges spike after which plummet. So, what is going to occur to miners after these situations change?

It’s this ecosystem that grew to become fairly disturbed on January 31 when federal regulators declared a brand new mandate: the EIA, a subsidiary of the US Division of Power (DOE), was going to start a survey of electrical energy use from all miners working in america. Recognized miners can be required to share knowledge on their power utilization and different statistics, and EIA administrator Joe DeCarolis claimed that this examine will “particularly concentrate on how the power demand for cryptocurrency mining is evolving, determine geographic areas of excessive progress, and quantify the sources of electrical energy used to satisfy cryptocurrency mining demand.” These targets appear simple sufficient at first look, however a number of elements have given Bitcoiners pause. For one factor, Forbes claimed that this directive got here from the White Home, which referred to this motion as an “emergency assortment of knowledge request.” This survey is explicitly created with the objective of analyzing the potential for “public hurt” from the mining business, and even included an apart that this “emergency” assortment may result in a extra routine assortment anticipated from each miner within the close to future.

Clearly, language like this has left many in the neighborhood extraordinarily uneasy, and a number of other main miners have already made statements condemning the initiative. The tone coming from regulators appears to be of an awesome narrative that these companies are a possible menace, whether or not by rising carbon emissions, taxing electrical infrastructure, or being a public nuisance. A few of the most egregious claims are simply debunked, but it surely doesn’t change the fact that a couple of hostile authorities actions may enormously upset this ecosystem. Moreover, the world of mining already has a significant upset on the horizon, within the type of the upcoming Bitcoin halving. This common protocol baked into Bitcoin’s blockchain is ready to robotically minimize mining rewards in half someday in April, at block 840,000, and already some pessimists are claiming that this upset can be sufficient to place practically the complete business out of enterprise. What are the precise worst case eventualities right here? What are the almost certainly ones?

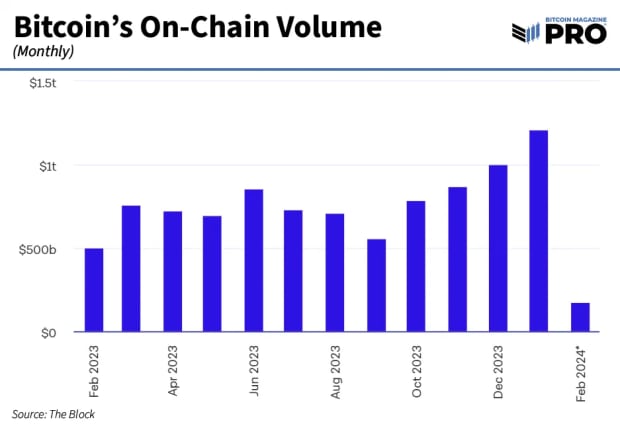

First, it’s vital to look at a few of the elements inherent to Bitcoin which can be prone to impression miners, no matter authorities stress. The miners are in a weird market scenario as a result of transaction charges can generate income on the identical degree as precise mining, however the scenario could also be stabilizing. New knowledge exhibits that Ordinals gross sales plummeted by 61% in January 2024, displaying that their impression on blockspace demand is prone to diminish. So, if sure miners are relying on these tokens to keep up earnings, that income stream just isn’t trying notably reliable. Nevertheless, regardless that community utilization from these microtransactions is prone to plummet, common transactions are literally trying nice. The buying and selling quantity of bitcoin is larger than it has been since late 2022, and it exhibits no indicators of stopping. Absolutely, then, there can be loads of demand for the minting of recent bitcoin.

Bitcoin visitors has been rising for a number of months because the prospect of a legalized Bitcoin ETF grew to become increasingly actual, and now that this battle is over, the buying and selling quantity has elevated at a larger price. Whereas the halving can current alternatives and challenges for miners, none can declare that it’s an sudden occasion. Companies have been getting ready for it as a matter after all, with round $1B of this elevated buying and selling quantity coming from miners themselves. Reserves of bitcoin held by miners are at their lowest level since earlier than the spike in 2021, and miners are utilizing the capital from these gross sales to improve tools and prepared themselves.

In different phrases, impartial of any authorities motion, evidently the market situations are prone to shift as a consequence of these elements. The underside might fall out for a few of the smaller corporations that function on slim margins, however the general progress in Bitcoin buying and selling quantity implies that there’ll all the time be alternatives to make income. Because it’s probably the most well-capitalized corporations that may take advantage of intensive preparations for the halving, it might very properly come to go that a few of the extra inefficient mining firms will be unable to outlive. From a regulatory standpoint, maybe that could be a wished end result.

The federal authorities appears principally involved with perpetuating the concept that the mining business is a tax on society as an entire, consuming huge quantities of electrical energy for an unclear profit. Nevertheless, solely probably the most environment friendly operations can be assured to outlive the halving and its financial fallout. Because the much less environment friendly ones shut their doorways, the survivors can be left with a a lot bigger slice of a smaller general pie. In addition to, if the open letters from a number of main corporations are something to go by, these firms are totally ready to make a vocal battle in opposition to any tried crackdown on the business. Contemplating that the survey itself continues to be in its first week of knowledge assortment, it’s tough to say what conclusions it is going to draw, or how the EIA can be empowered to behave afterwards. A very powerful factor to contemplate, then, is that these new traits are happening with or with out the EIA’s affect.

The survey is just simply starting, and the halving is just months away. There are many causes to be involved concerning the EIA’s impression on the mining business, but it surely’s not like that is the one issue. From the place we’re sitting, it looks like the entire ecosystem could also be considerably modified by the point regulators are prepared for any motion, even when the motion is harsh. The individuals left to face them can be hardened themselves, survivors and innovators from a chaotic market. Bitcoin’s nice energy has been its capacity to vary quickly, permitting new fans the prospect to make the most of one algorithm, after which rise or fall as the principles change. It’s this spirit that propelled Bitcoin to its world heights over greater than a decade of progress. In comparison with that, what likelihood do its opponents have?