An understanding of monetary markets would assist you become familiar with phrases like bull and bear markets. What are animals doing on the earth of monetary companies? Apparently, the phrases bull and bear markets have transitioned successfully from conventional monetary companies to the crypto panorama.

The bull market vs bear market comparability with respect to cryptocurrencies can result in a greater understanding of the crypto market. Phrases like bull and bear markets describe the efficiency of inventory markets, relying on whether or not the worth is rising or lowering. For instance, a declining market could be referred to as a bear market, whereas a rising market is a bull market.

The crypto market is considerably risky, and it modifications steadily in a day. Due to this fact, the bull and bear market distinction helps in defining the longer intervals of upward and downward motion out there. The modifications that may result in classification of crypto markets into bull and bear markets are typically substantial, ranging as much as 20% in any course. Allow us to uncover the bull market vs bear market distinction within the cryptocurrency house.

Embrace the technological leap and world adoption that awaits within the upcoming bull run of 2024-2025 with Crypto Bull Run Prepared Profession Path.

Definition of Bull Markets in Crypto

Bull markets typically deal with favorable financial circumstances. It means that the market is rising and entails optimistic investor sentiments concerning the crypto market. One other vital trait of bull markets is the sustained progress in asset costs alongside greater employment ranges and a stronger economic system.

You may perceive the distinction between bull and bear markets within the crypto house by figuring out how bull markets work in crypto. Apparently, the crypto market witnesses extra constant and stronger Bull Runs. Generally, a 40% progress in worth of crypto belongings over a interval of 1 to 2 days may induce a bull run. Crypto markets are smaller than typical monetary markets and showcase extra volatility.

The bullish sentiments in any market showcase optimism concerning the continual progress in worth of belongings. Within the crypto house, you may anticipate the identical as favorable financial circumstances result in progress of cryptocurrencies. Consequently, buyers search alternatives to capitalize on constantly increasing crypto portfolios.

Construct your identification as an authorized blockchain skilled with 101 Blockchains’ Blockchain Certifications designed to offer enhanced profession prospects!

How Can You Establish Bull Markets in Crypto?

The identification of a bull market within the crypto trade focuses on identification of various indicators, comparable to real-life indicators and buying and selling indicators. You may assessment the historical past of bear and bull markets to acknowledge the pointers that differentiate bull markets from bear markets. Initially, you could discover the rise in inventory costs throughout a bull run within the crypto market. You may establish a bull market immediately by monitoring the worth motion of the favored cryptocurrencies alongside the efficiency of normal crypto market. For instance, when you discover the costs rising for a couple of months or weeks, you may verify the rise of a bull market.

The subsequent vital differentiator in a bear vs bull market comparability is the expansion of buying and selling quantity. Important surges in buying and selling exercise can function a clearly seen sign for the rise of bull markets. Moreover, you can too establish a bull market within the crypto house by staying up to date with the newest developments within the crypto trade. Constructive information and sentiments out there can enhance investor confidence, thereby resulting in the formation of bull markets. Talking of market sentiment, you may decide the extent of optimism in crypto markets through the use of specialised instruments such because the Crypto Worry & Greed Index.

Most vital of all, a complete assessment of bear and bull market historical past also can allow you to establish bull markets. Historic market developments present that bull markets occur in cycles. You need to decide the common period of the bull market and assessment it with respect to present market circumstances to anticipate the timing of the following bull market.

Study the basics, working precept and the longer term prospects of cryptocurrencies from Cryptocurrency Fudamentals Book

Definition of a Bear Market

The bear markets are reverse of bull markets and point out a decline within the worth of crypto belongings. You may distinguish a bear market by checking for decline within the worth of cryptocurrencies. In bear markets, the worth of crypto belongings may fall by a minimal of 20% and proceed declining. Essentially the most well-known instance of a bull market in crypto refers back to the cryptocurrency crash in December 2017. The infamous Bitcoin crash witnessed the autumn of the largest cryptocurrency by an enormous margin inside a couple of days. With the downward pattern within the bull market, investor confidence would additionally fall, thereby strengthening the downward sample.

You may surprise about queries like “Why is it referred to as a bear market?” whereas determining the explanations and components influencing the bear market. The patterns in a bull market are just like the preventing fashion of a bear. The bear market begins at a excessive level after which pushes down with all its may, like a bear, because it claws down on the prey.

Within the bear market, you’d discover sluggish financial progress and better unemployment charges. The circumstances of the bear market may emerge from geopolitical crises, pure disasters, popping of market bubbles, and poor financial insurance policies. Most significantly, bear markets function restricted optimism from buyers attributable to unfavourable sentiment.

Need to get an in-depth understanding of crypto fundamentals, buying and selling and investing methods? Enroll now in Crypto Fundamentals, Buying and selling And Investing Course.

How Can You Establish Bear Markets in Crypto?

The method of recognizing bear markets in crypto is nearly just like that of recognizing bull markets. Yow will discover out the bull and bear market variations by checking totally different real-life indicators and buying and selling indicators. Similar to bull markets, a bear market would showcase the same pattern, albeit with a downward sample.

Bear markets showcase a steady decline in efficiency of crypto belongings for an extended time frame. Should you discover an abrupt and long-lasting downturn, then you may anticipate that it is perhaps a bear market. On prime of it, indicators of rising unemployment charges might point out downfall of the broader monetary market.

The subsequent essential signal of a bear market is the exponential progress in market volatility. Sharp worth declines of crypto belongings, particularly the massive gamers, may counsel the opportunity of an impending bear market. You should additionally evaluate the bull market vs bear market by evaluating vital financial indicators. The notable financial indicators you could be careful for to foretell bear markets embody inflation and rates of interest. It is usually vital to look out for unfavourable developments within the crypto house, comparable to safety breaches or regulatory crackdowns.

Begin studying about Cryptocurrencies with World’s first Cryptocurrency Ability Path with high quality sources tailor-made by trade specialists Now!

What are the Variations between Bull Markets and Bear Markets?

The comparability between bull and bear markets largely revolves across the course of costs of cryptocurrencies. Nevertheless, you may take note of particular components that may mark the distinction between bull markets and bear markets in crypto. Listed below are the notable highlights you could find in a comparability between bull and bear markets within the crypto house.

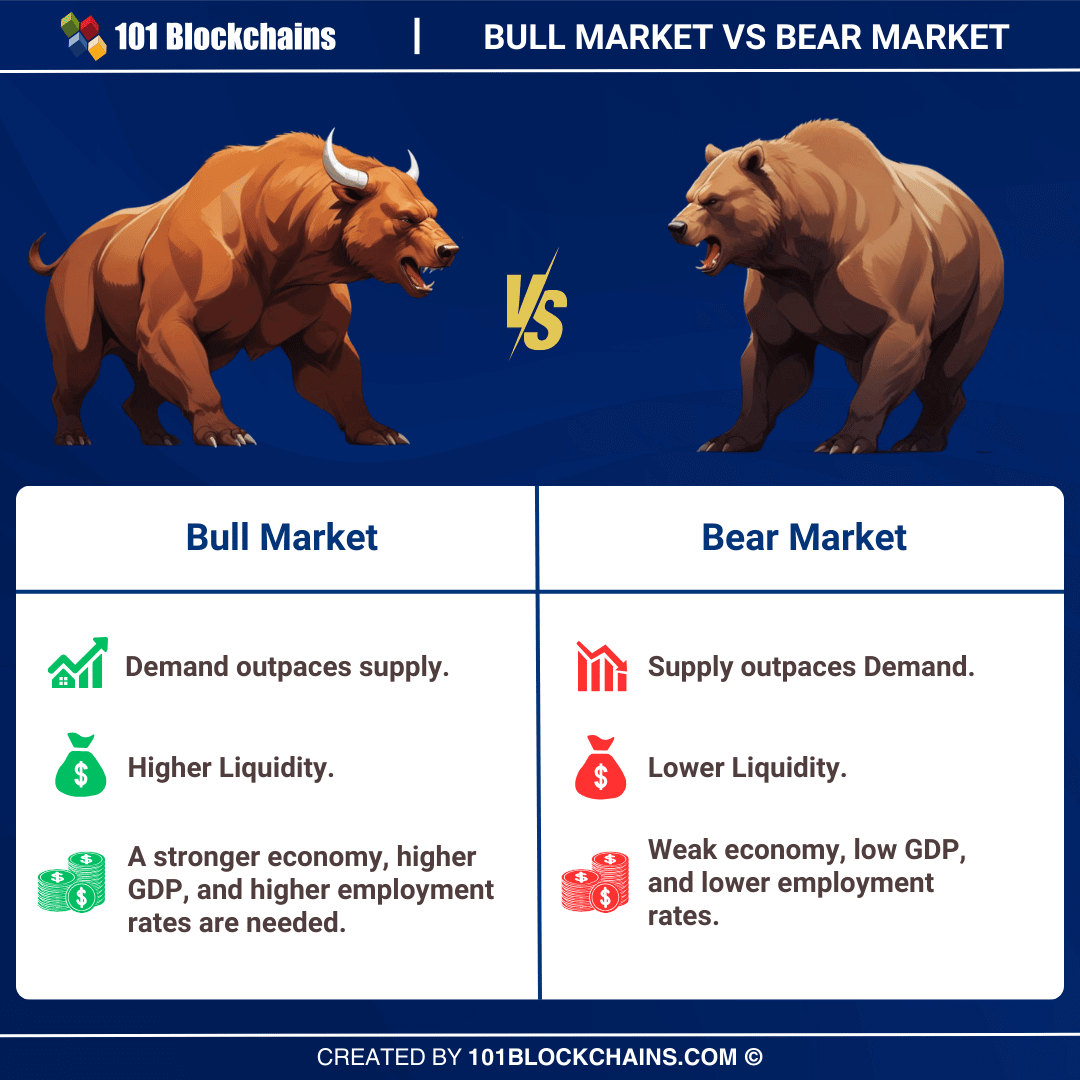

The demand for cryptocurrencies is robust in bull markets owing to optimistic investor confidence. It will possibly result in rising costs of crypto belongings as buyers compete in opposition to one another to purchase obtainable crypto belongings. However, persons are extra inclined to promote their crypto belongings in a bear market. With provide outperforming demand, bull markets are typically characterised by declining costs of crypto belongings.

One other notable facet of the distinction between a bull and bear market is liquidity. You may discover greater liquidity in a bullish market as crypto belongings are tradable at decrease transaction charges. Nevertheless, bear markets in crypto have decrease liquidity as a result of lack of belief out there situation.

You may distinguish a bear market from a bull market by the influence on the economic system. In bear markets, you may discover declining ranges of GDP, whereas bull markets point out potentialities for an increase in GDP. Growing GDP in a bull market additionally accompanies progress in firms’ income alongside higher employment prospects. Due to this fact, it results in higher and optimistic market sentiment.

On the opposite aspect, falling GDP ranges would result in financial recessions and failure to satisfy income targets. It will subsequently result in unfavourable market sentiments, and other people would hesitate earlier than investing in crypto belongings. Bear markets are additionally identified for reducing employment ranges that, subsequently, prolong the period of bear markets.

Right here is an outline of the variations between bear and bull markets.

Remaining Phrases

The variations between bull markets and bear markets within the crypto house present a unique facet of cryptocurrencies. You need to study extra concerning the bull vs bear market comparisons, as they may help you discover the best methods across the crypto market. The volatility of the cryptocurrency market is without doubt one of the largest considerations of buyers.

Nevertheless, the power to establish bear and bull markets may help you keep away from doubts concerning unsure developments within the crypto market. The best rationalization for the distinction between bear and bull markets is the distinction in pricing developments of cryptocurrencies. Discover out extra concerning the historical past of bull and bear markets within the crypto trade.

*Disclaimer: The article shouldn’t be taken as, and isn’t meant to offer any funding recommendation. Claims made on this article don’t represent funding recommendation and shouldn’t be taken as such. 101 Blockchains shall not be liable for any loss sustained by any one that depends on this text. Do your personal analysis!