This text is featured in Bitcoin Journal’s “The Halving Concern”. Click on right here to get your copy. Additionally it is report #1 of the “FUD Fighters” sequence powered by HIVE Digital Applied sciences LTD.

F%$Ok Unhealthy Analysis: I spent over a month analyzing a bitcoin mining research and all I bought was this trauma response.

“We should confess that our adversaries have a marked benefit over us within the dialogue. In only a few phrases they will announce a half-truth; and with a view to reveal that it’s incomplete, we’re obliged to have recourse to lengthy and dry dissertations.” — Frédéric Bastiat, Financial Sophisms, First Collection (1845)

“The quantity of vitality wanted to refute bullshit is an order of magnitude larger than that wanted to supply it.” — Williamson (2016) on Brandolini’s Legislation

For too lengthy, the world has needed to endure the fallout of subpar tutorial analysis on bitcoin mining’s vitality use and environmental influence. The result of this bullshit analysis has been surprising information headlines which have turned some well-meaning individuals into offended politicians and deranged activists. So that you simply by no means should endure the brutality of certainly one of these sloppy papers, I’ve sacrificed my soul to the bitcoin mining gods and carried out a full-scale evaluation of a research from the United Nations College, revealed not too long ago within the American Geophysical Union’s Earth’s Future. Solely the bravest and hardest of all bitcoin autists could proceed to the next paragraphs, the remainder of you may return to watching the value chart.

Your gentle child ears may need screamed with shock on the sturdy proclamation in my lede that the most important and squeakiest analysis on bitcoin mining is bullshit. When you’ve ever learn Jonathan Koomey’s 2018 weblog put up on the Digiconomist–often known as Alex deVries, or his 2019 Coincenter report, or Lei et al. 2021, or Sai and Vranken 2023, or Masanet et al. 2021, or… Effectively, the purpose is that there’s 1000’s of phrases already written which have proven that bitcoin mining vitality modeling is in a state of disaster and that this isn’t remoted to bitcoin! It’s a wrestle that information heart vitality research have confronted for many years. Folks like Jonathan Koomey, Eric Masanet, Arman Shehabi, and people good guys Sai and Vranken (sorry, we’re not but on a first-name foundation) have written sufficient pages that would in all probability cowl the partitions of not less than one males’s rest room at each bitcoin convention that’s occurred final yr, that present this to be true.

My holy altar, which I maintain in my bed room closet, is a hand-carved, elegant but ascetic shrine to Koomey, Masanet, and Shehabi for the a long time of labor they’ve accomplished to enhance information heart vitality modeling. These sifus of computing have made all of it very clear to me: when you don’t have bottom-up information and also you depend on historic developments whereas ignoring IT machine vitality effectivity developments and what drives demand, then your analysis is bullshit. And so, with one broad but very surgical stroke, I swipe left on Mora et al. (2018), deVries (2018, 2019, 2020, 2021, 2022, and 2023), Stoll et al. (2019), Gallersdorfer et al. (2020), Chamanara et al. (2023), and all of the others which might be talked about in Sai and Vranken’s complete assessment of the literature. World, let these burn in a single violent but metaphorically majestic mega-fire someplace off the coast of the Pacific Northwest. Reporters, and policymakers, please, I implore you to cease listening to Earthjustice, Sierra Membership, and Greenpeace for they know not what they do. Absolve them of their sins, for they’re however sheep. Amen.

Now that I’ve set the temper for you, my pious reader, I’ll now inform you a narrative a couple of current bitcoin vitality research. I pray to the bitcoin gods that this would be the final one I ever write, and the final one you’ll ever must learn, however my feeling is that the gods are punishing gods and won’t have mercy on my soul–even in a bull market. One deep breath (cue Heath Ledger’s Joker) and Right here… We… Go.

On a considerably bearish October afternoon, I bought tagged on Twitter/X on a put up a couple of new bitcoin vitality use research from some authors affiliated with the United Nations College (Chamanara et al., 2023). Little did I do know that this research would set off my autism so exhausting that I’d descend into my very own form of drug-induced-gonzo-fear-and-loathing-in-vegas state, and hyper-focus on this research for the following 4 weeks. Whereas I’m in all probability exaggerating concerning the heavy drug use, my recollection of this time may be very a lot a techno-colored, poisonous relationship-level fever dream. Do you keep in mind Frank from the critically acclaimed 2001 movie, Donnie Darko? Yeah, he was there, too.

As I began taking notes on the paper, I noticed that Chamanara et al.’s research was actually complicated. The paper was perplexing as a result of it is a poorly designed research that bases its raison d’etre completely on de Vries and Mora et al. It makes use of the Cambridge Heart for Various Finance (CCAF) Cambridge Bitcoin Power Consumption Index (CBECI) information with out acknowledging the restrictions of the mannequin (see Lei et al. 2021 and Sai and Vranken 2023 for an in-depth evaluation of the problems with CBECI’s modeling). It conflates its outcomes from the 2020-2021 interval with the state of bitcoin mining in 2022 and 2023. The authors additionally relied on some environmental footprint methodology that may make you suppose it was really attainable so that you can shrink or develop a reservoir relying on how exhausting you Netflix and chill. Actually, that is what Obringer et al. (2020) inferentially conclude is feasible and the UN research cites Obringer as certainly one of its methodological foundations. By the best way, Koomey and Masanet didn’t like Obringer et al.’s methodology, both. I’ll mild one other soy-based candle on the altar of their honor.

Right here’s a extra clearly said enumeration of the crux of the issue with Chamanara et al. (and by the best way, their corresponding writer by no means responded to my e-mail asking for his or her information so I may, you realize, confirm, not belief. 🥴):

The authors conflated electrical energy use throughout a number of years, overreaching on what the outcomes may reveal primarily based on their strategies.

The authors used historic developments to make current and future suggestions regardless of intensive peer-reviewed literature clearly exhibiting that this results in overestimates and exaggerated claims.

The paper guarantees an vitality calculation that can reveal bitcoin’s true vitality use and environmental influence. They use two units of information from CBECI: i) complete month-to-month vitality consumption and ii) common hashrate share for the highest ten international locations the place bitcoin mining is operated. Remember that CBECI depends on IP addresses which might be tracked at a number of mining swimming pools. CBECI-affiliated mining swimming pools signify a mean of 34.8% of the overall community hashrate. So, the information used seemingly have pretty large uncertainty bars.

After about an hour or so of Troy Cross speaking me off a slightly spectacular, artwork deco and weather-worn ledge that’s in all probability seen a number of Nice Gatsby flappers leap–a results of feeling an amazing sense of terror after my exasperated self realized that no quantity of cognitive behavioral remedy would get me via this research–I decided the equation that the authors used to calculate the vitality use shares for every of the highest ten international locations with probably the most share of hashrate (primarily based on the IP handle estimates) needed to be the next:

Don’t let the mathematics scare you. Right here’s an instance of how this equation works. Let’s say China has a shared share for January 2020 of 75%. Then, let’s additionally say that the overall vitality consumption for January 2020 was 10 TWh (these are made-up numbers for simplicity’s sake). Then, for one month, we’d discover that China used 7.5 TWh of vitality. Now, save that quantity in your reminiscence palace and do the identical operation for February 2020. Subsequent, add the vitality use for January to the vitality use discovered for February. Do that for every subsequent month till you’ve added up all 12 months. You now have CBECI’s China’s annual vitality consumption for 2020.

Earlier than I present the desk with my outcomes, let me clarify one other caveat to the UN research. This research makes use of an older model of CBECI information. To be honest to the authors, they submitted their paper for assessment earlier than CBECI up to date their machine effectivity calculations. Nonetheless, which means Chamanara et al.’s outcomes will not be even near practical as a result of we now consider that CBECI’s older mannequin was overestimating vitality use. Furthermore, to do that comparability, I used to be restricted to information via August 31, 2023, as a result of CBECI switched to the brand new mannequin for the remainder of 2023. To get this older information, CCAF was beneficiant and shared it with me upon request.

Mainland China

44.45

32.89

77.34

73.48

5.25

United States

4.65

25.20

29.85

32.89

-9.24

Kazakhstan

3.18

12.06

15.24

15.94

-4.39

Russia

4.71

7.59

12.29

12.28

0.081

Malaysia

3.31

4.13

7.44

7.29

2.06

Canada

0.80

5.25

6.05

6.62

-8.61

Iran

2.33

3.06

5.39

5.13

4.82

Germany

0.67

3.31

3.98

4.18

-4.78

Eire

0.62

2.69

3.31

3.43

-3.50

Singapore

0.31

1.13

1.43

1.56

-0.083

Different (Excluding Singapore)

3.69

6.73

10.42

10.63

-1.98

Whole

68.72

104.04

172.76

173.42

-0.38

One other difficult factor about this research is that they mixed the vitality use for each 2020 and 2021 into one quantity. This was actually difficult as a result of when you take a look at their figures, you’ll discover that the most important textual content states, “Whole: 173.42 TWh”. It’s additionally barely complicated as a result of the determine caption states, “2020-2021”, which for many individuals can be interpreted as a interval of 12 months, not 24 months. Effectively, no matter. I broke them up into their particular person years so everybody may see the steps that have been taken to get to those numbers.

Have a look at the far proper column with the header, “% Change Between 2020 + 2021 Calculations (%)”. I calculated the % change between my calculations and Chamanara et al.’s. That is slightly curious, isn’t it? Primarily based on my conversations with the researchers at CCAF, the numbers needs to be an identical. Possibly the changelog doesn’t mirror a smaller change someplace, however our numbers are barely completely different nonetheless. China has a better share and the US has a smaller share within the information that CCAF shared with me in comparison with the UN research. Regardless of this, the totals are pretty shut. So, let’s give the authors the advantage of the doubt and say that they did an inexpensive job calculating the vitality share, given the restrictions of the CBECI mannequin. Please keep in mind that noting that their calculation was cheap doesn’t imply that it’s cheap to make use of these historic estimates to make claims concerning the current and future and direct coverage. It isn’t.

One night whereas working by candlelight, I glanced to my left and noticed Frank’s stabbing, black pupils (the Donnie Darko character I discussed earlier) gazing me like two items of Stronghold waste coal, mounted in a quiet mattress of pearly sand. He was reminding me that this report was nonetheless not completed and one thing about time journey. I grabbed my extra-soft curls (I switched to bar shampoo, it’s a godsend for frizz) and yanked as exhausting as I may. Willie Nelson’s 1974 Austin Metropolis Limits pilot episode blasting on my cheap-ass Chinese language knock-off monitor’s mono audio system was shifting via my ears like heroin via Lou Reed’s 4-lanes large community of veins. Begrudgingly, I accepted my destiny. I wanted to go deeper down this rabbit gap. I wanted to do a deeper evaluation of the 2020 and 2021 CBECI information to point out how necessary it’s to do an annual evaluation and never blur the years into one calculation. Realizing I used to be out of my exhausting liquor of alternative, a splash of sherry in a Shirley Temple (shaken, not stirred), I grabbed a bottle of bootleg antiseptic that I bought throughout the pandemic lockdown and chugged.

I flipped via my notes. I’ve numerous notes as a result of I’m a severe individual. What concerning the mining map points? Can we do that via an evaluation of the 2 separate years? What was occurring for every of the ten international locations? Does that inform us something about the place hashrate went after the China ban? What concerning the Kazakhstan crackdown? That’s post-2021, however the UN research acts prefer it by no means occurred after they’re speaking concerning the present mining distribution…

To not the authors’ credit score, they failed to say to the peer-reviewers and to their readers that the mining map information solely goes via January 2022. So, though they speak about bitcoin mining’s vitality combine as if it represents the current, they’re fully fallacious. Their evaluation solely captures historic developments, not the current and positively not the longer term.

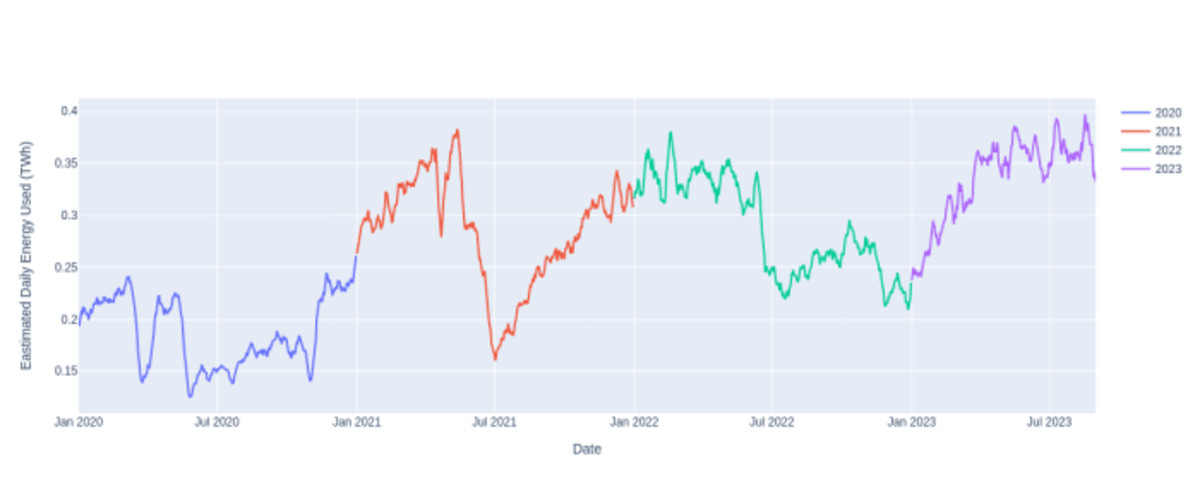

See this multi-colored plot of CBECI’s estimated day by day vitality use (TWh) from January 2020 via August 31, 2023? At this macro scale, we see loads of variability. But additionally it’s obvious simply from inspection that every yr is completely different from the following by way of variability and vitality use. There are a variety of attainable causes for the reason for variability at this scale. Some attainable influences on vitality use may very well be bitcoin worth, issue adjustment, and machine effectivity. Extra macroscale influences may very well be on account of regulation, such because the Chinese language bitcoin mining ban that occurred in 2021. Lots of the Chinese language miners fled the nation for different elements of the world, Kazakhstan and the US are two international locations the place hashrate discovered refuge. In reality, the facility of the Texas mining scene actually got here to be at this unprecedented second in hashrate historical past.

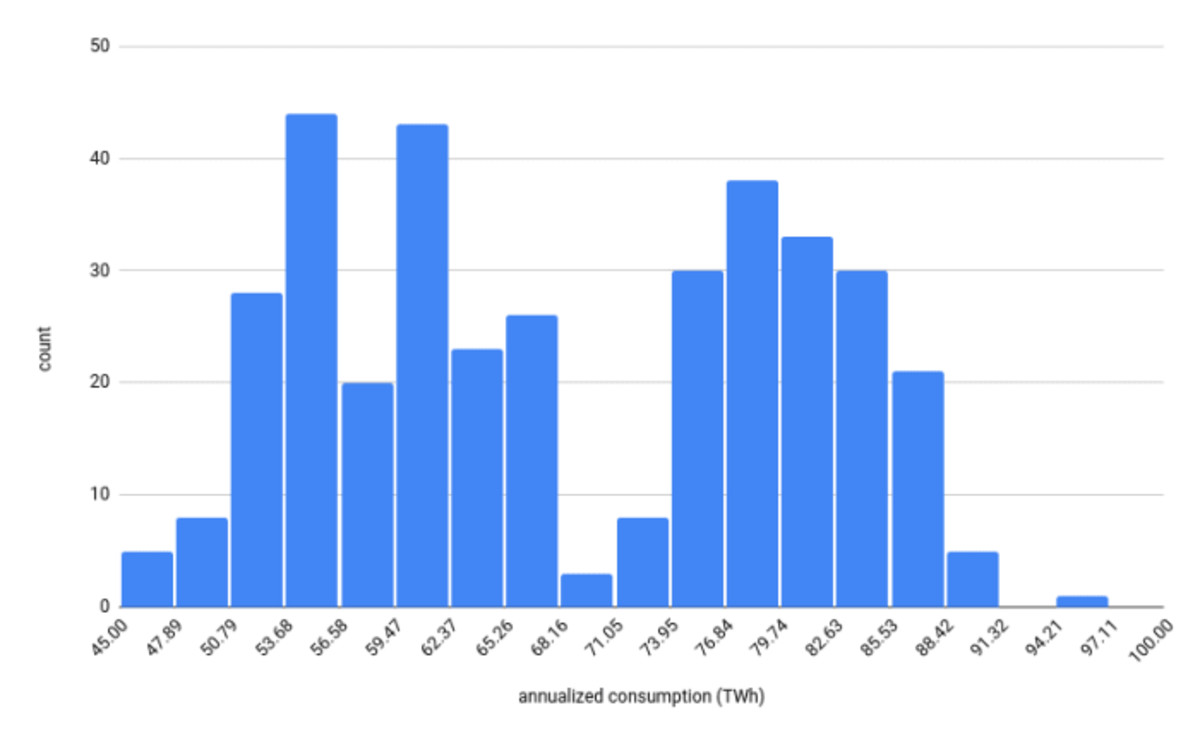

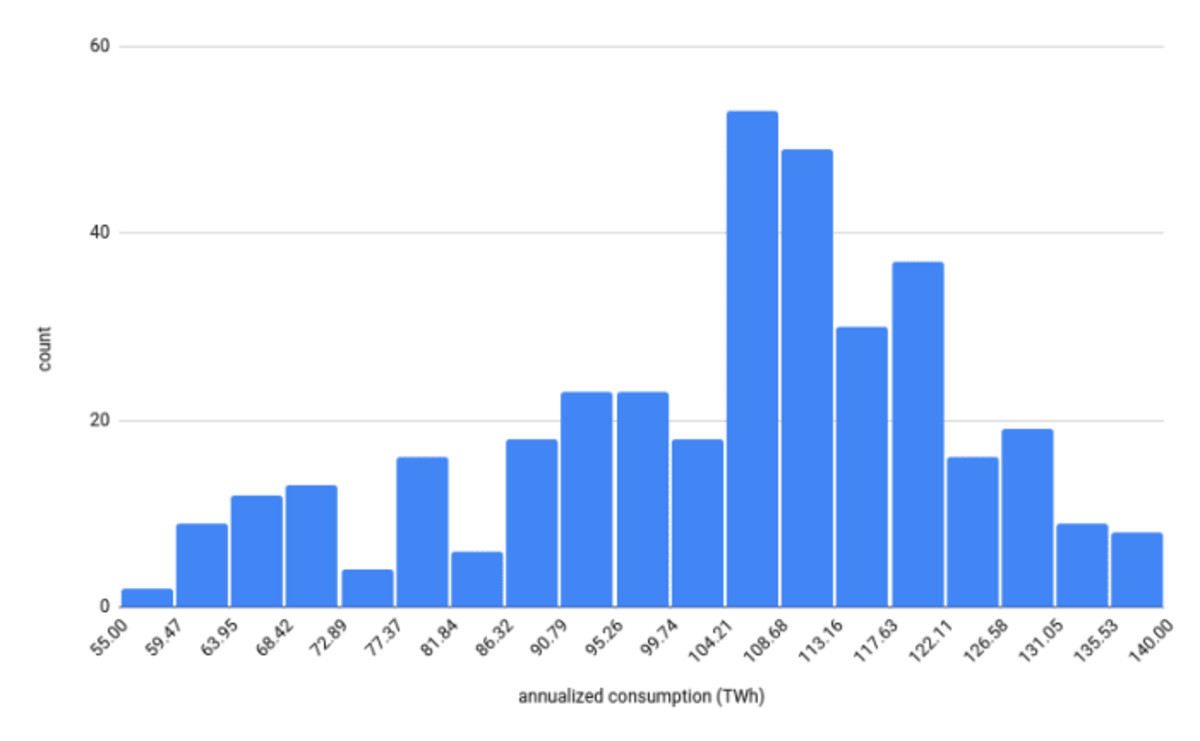

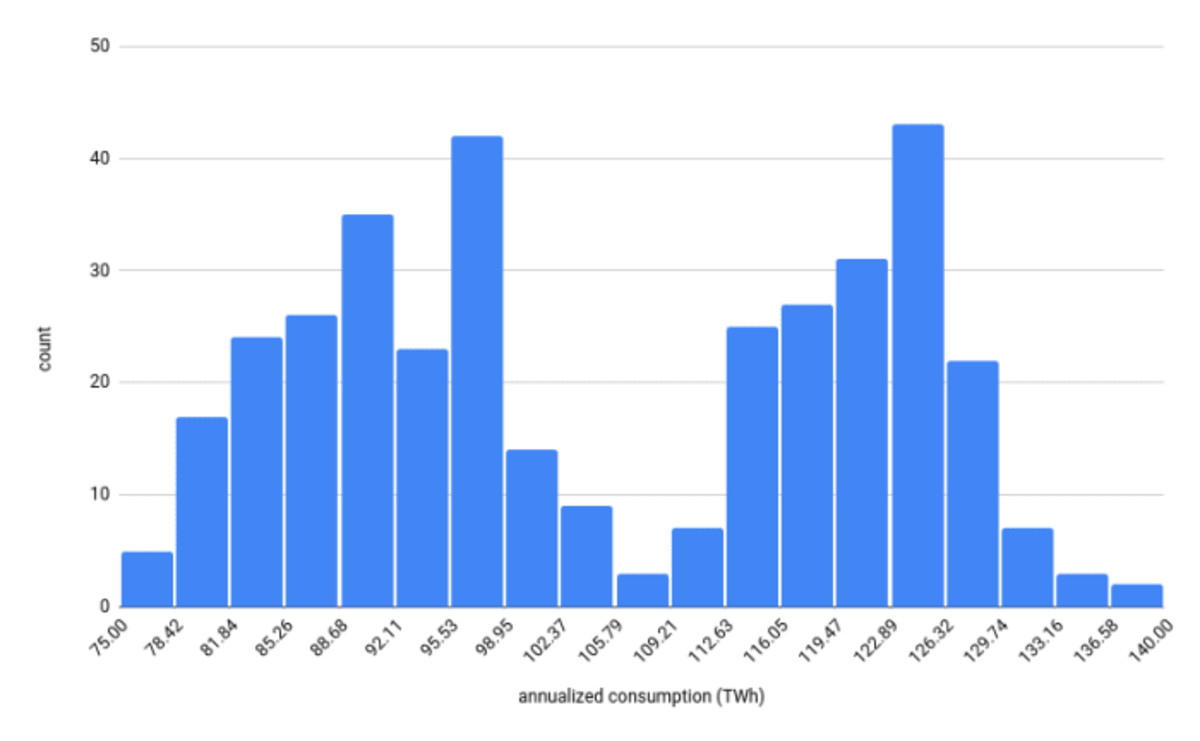

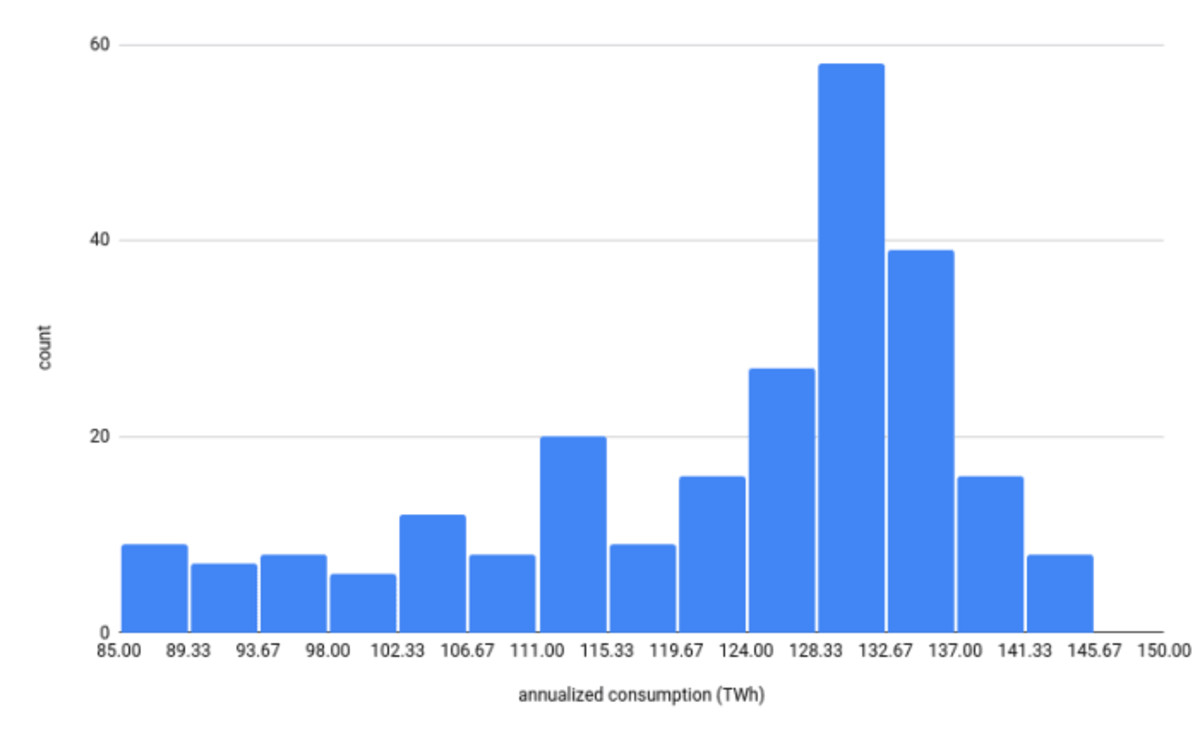

Have a look at the histograms for 2020 (high left), 2021 (high proper), 2022 (backside left), and 2023 (backside proper). It’s apparent that for every year, the estimated annualized vitality consumption information reveals completely different distributions. Despite the fact that we do see some attainable distribution patterns, we’ve to watch out to not take this as a sample that occurs each four-year cycle. We want extra information to make certain. For now, what we are able to say is that some years in our evaluation present a bimodal distribution whereas different years present a form of skewed distribution. The primary level right here is to point out that the statistics for vitality use for every of those 4 years are completely different, and distinctly so for the 2 years that have been utilized in Chamanara et al.’s evaluation.

Within the UN research, the authors wrote that bitcoin mining exceeded 100 TWh per yr in 2021 and 2022. Nonetheless, if we take a look at the histograms of the day by day estimated annualized vitality consumption, we are able to see that day by day estimates range fairly a bit, and even in 2022 there have been many days the place the estimated vitality consumption was beneath 100 TWh. We’re not denying that the ultimate estimates have been over 100 TWh within the older estimated information for these years. As an alternative, we’re exhibiting that as a result of bitcoin mining’s vitality use just isn’t fixed from each day and even minute-to-minute, it’s value doing a deeper evaluation to know the origin of this variability and the way it would possibly have an effect on vitality use over time. Lastly, it’s value noting that the up to date information now estimates the annual vitality use to be 89 TWh for 2021 and 95.53 TWh for 2022.

One final remark, Miller et al. 2022 confirmed that operations (particularly buildings) with excessive variability in vitality use over time are usually not appropriate for emission research that use averaged annual emission components. But, that’s what Chamanara et al. selected to do, and what so many of those bullshit fashions are likely to do. A superb portion of bitcoin mining doesn’t function like a continuing load, Bitcoin mining could be extremely versatile in response to many components from grid stability to cost to regulation. It’s about time that researchers began enthusiastic about bitcoin mining from this understanding. Had the authors spent even a modest period of time studying beforehand revealed literature, slightly than working in a silo like Sai and Vranken famous of their assessment paper, they may have not less than addressed this limitation of their research.

—

So, I’ve by no means been to a honky tonk joint earlier than. At the least not till I discovered myself in a taxi cab with a number of different conferencegoers on the North American Blockchain Summit. Fort Price, Texas, is strictly what you’d think about. Cowboy boots, gallon-sized cowboy hats, Wrangler blue denims, and cowboys, cowboys, cowboys all over the place you seemed via the principle drag. On a brisk Friday evening, Fort Price appeared frozen in time, individuals really walked round at evening. The shops seemed just like the form of mom-and-pop retailers you’d see on an episode of The Twilight Zone. I felt fully disoriented.

My companions satisfied me that I ought to discover ways to two-step. Me, your customary California woman, whose physics advisor as soon as informed her that when you can take the woman out of California, you may’t take California out of the woman, ought to two-step?! I didn’t know a two-step from an electrical slide and the one nation I keep in mind experiencing was a Garth Brooks business I noticed as soon as on tv after I was a toddler. He was actually in style within the nineties. That’s about as a lot nation as this bitcoin mining researcher will get. The place was crammed with kitschy reward retailers and vibrant lights all over the place radiating from neon indicators. On the heart of the principle room, a bartender carrying a black diamond studded belt with a white leather-based gun holster and lined with evenly spaced silver bullets. Who the hell is aware of what sort of gun he was packing, but it surely did remind me of the weapons within the 1986 movie, Three Amigos.

It was right here, in opposition to the backdrop of what appeared like a rustic band that wasn’t completely positive that it was nation, that I watched the Texas Blockchain Council’s Lee Bratcher handle a ball with the form of trigonometric grace that you might solely discover on the finish of a cue and land that billiard in a tattered, leather-based pocket for what appeared just like the hundredth time that evening. The graceful clank of billiard in opposition to billiard awoke one thing inside me. I noticed that I used to be not but out of the rabbit gap that Frank despatched me down. I remembered someplace scribbled in my notes that I had not plotted the hashrate share over time for the international locations talked about within the UN research. So, at half previous three within the morning, I threw my head again to take a swig of some membership soda and bumped it in opposition to the wall of the photograph sales space the place nuclear households may pose with a mechanical bull, and fell unconscious.

Three hours later, I used to be again in my resort room. Fortunately, somebody positioned some nugatory fiat in my hand, loaded me right into a cab, and had the motive force take me again to the non-smoking room I checked into on the very heart of the decay of twenty-first-century enterprise journey, the Marriott Resort. Fuzzy-brained and bleary-eyed, I let the blinding, dangerously blue mild from my laptop display wash over my drained face and improve my possibilities of creating macular degeneration. I continued my evaluation.

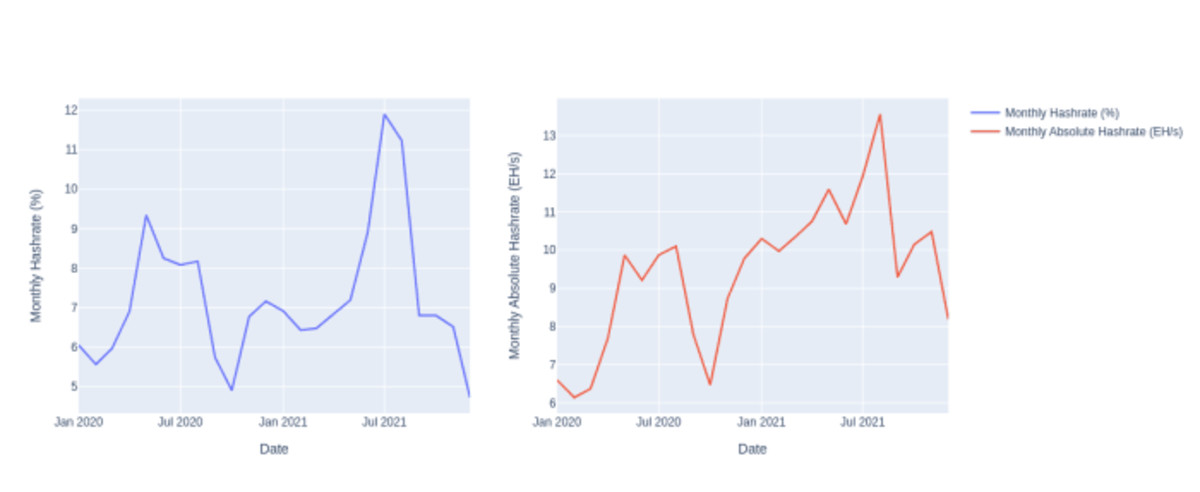

What follows are a sequence of plots of CBECI mining map information from January 2020 via January 2022. Unsurprisingly, Chamanara et al. focus consideration on China’s contribution to vitality use, and subsequently to its related environmental footprint. China’s month-to-month hashrate peaked at over 70 % of the community’s complete hashrate in 2020. In July 2021, that hashrate share crashed to zero till it recovered to about 20 % of the share on the finish of 2021. We don’t know the place it stands at this time, however business insiders inform me it’s seemingly nonetheless hovering round this quantity, which implies that in absolute phrases, the hashrate remains to be rising there regardless of the ban.

Russia, additionally unsurprisingly, will get mentioned as nicely. But, primarily based on the CBECI mining map information from January 2020 via January 2022, it’s exhausting to argue that Russia was an instantaneous off-taker of exiled hashrate. There’s definitely an instantaneous spike, however is that this actual or simply miners utilizing VPN to cover their mining operation? By the top of 2021, the Russian hashrate declined to beneath 5 % of the hashrate and in absolute phrases, declined from a short peak of over 13 EH/s to a bit over 8 EH/s. When trying on the complete yr’s value of CBECI estimated vitality use for Russia, we do see that Russia did maintain a good portion of hashrate, it’s simply not clear that when working with such a restricted set of information, we are able to make any cheap claims concerning the current contribution to hashrate and atmosphere footprint for the community.

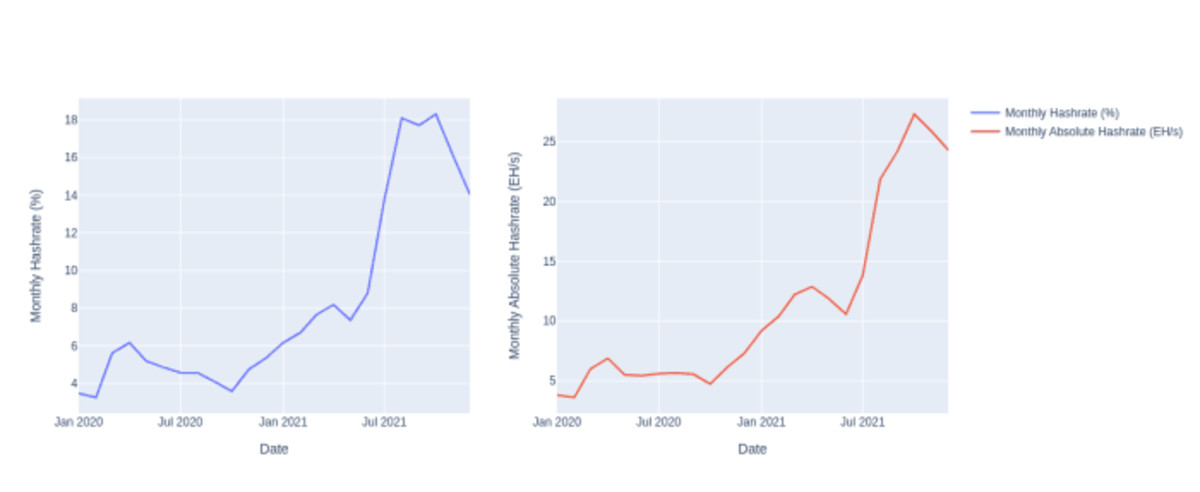

Essentially the most controversial dialogue in Chamanara et al. offers with Kazakhstan’s share of vitality use and environmental footprint. Clearly, the CBECI mining map information reveals that there was a big improve in hashrate share each in relative and absolute phrases. It additionally seems that this pattern began earlier than the China ban was applied, however definitely seems to quickly improve simply earlier than and after the ban was applied. Nonetheless, we do see a pointy decline from December 2021 to January 2022. Was this an early sign that the federal government crackdown was coming in Kazakhstan?

Of their evaluation, Chamanara et al. ignored the current Kazakhstan crackdown, the place the federal government imposed an vitality tax and mining licenses on the business, successfully pushing hashrate overseas. The authors overemphasized Kazakhstan as a present main contributor to bitcoin’s vitality use and thus environmental footprint. If the authors had stayed inside the limits of their strategies and outcomes, then noting the contribution of Kazakhstan’s hashrate share to the environmental footprint for the mixed years of 2020 and 2021 would have been cheap. As an alternative, not solely do they ignore the federal government crackdown in 2022, however additionally they declare that Kazakhstan’s hashrate share elevated by 34% primarily based on 2023 CBECI numbers. CBECI’s information has not been up to date since January 2022 and CCAF researchers are presently ready for information from the mining swimming pools that can enable them to replace the mining map.

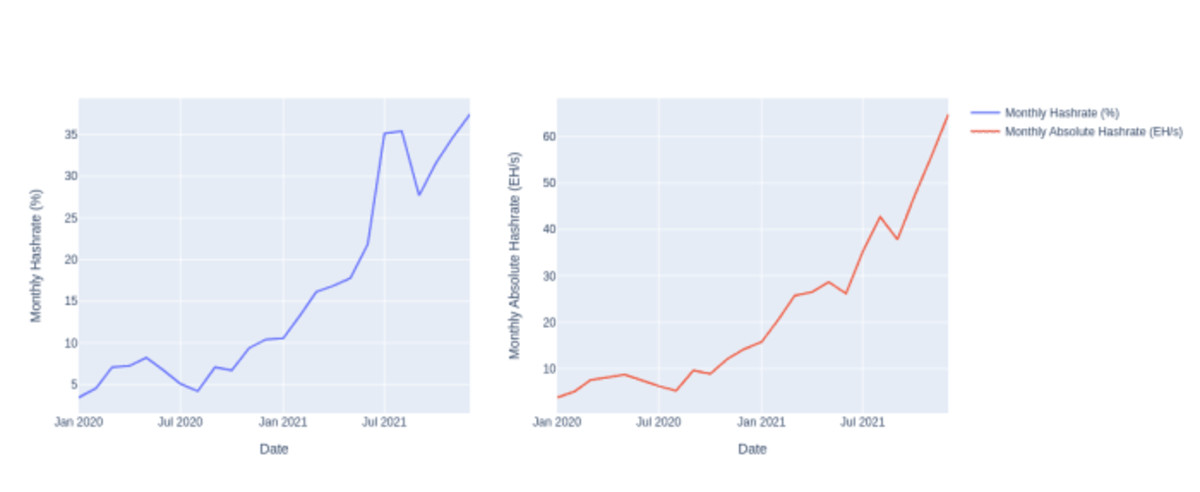

I do know I’ve proven you, my trustworthy reader, quite a lot of information, however go forward and have one other shot of the toughest liquor you might have in your cupboard, and let’s check out yet one more determine. This one represents the US hashrate share within the older CBECI mining map information. The pattern we see for the US can also be related for Canada, Singapore, and what CBECI Calls “Different international locations”, which signify the international locations that didn’t make the highest ten listing for hashrate share. There’s a transparent sign that displays what we all know to be true. The USA took a good portion of Chinese language hashrate and this hashrate share grew quickly in 2021. Whereas we all know that the CBECI mining map information is proscribed to lower than a majority of the community hashrate, I do suppose that their share is not less than considerably consultant of the community’s geographic distribution. Hashrate geographic distribution appears to be closely formed by macro developments. Whereas electrical energy costs matter, authorities stability and pleasant legal guidelines play an necessary position. Chamanara et al. ought to have accomplished this sort of evaluation to assist inform their dialogue. If they’d, they may have realized that the community is responding to exterior pressures at various occasions and geographic scales. We want extra information earlier than we are able to make sturdy coverage suggestions in terms of the consequences of bitcoin’s vitality use.

—

At this level, I used to be not positive if I used to be a bitcoin researcher or an NPC, misplaced in a sport the place the one factors tallied have been for the depth of self-loathing I used to be feeling for agreeing to this enterprise. On the similar time, I may scent the top of this evaluation was close to and that, with sufficient somatic remedy and EMDR, I’d really keep in mind who I was earlier than I bought dragged into this mess. Simply two days prior, Frank and I had a falling out over whether or not Courier New was nonetheless one of the best font for displaying mathematical equations. I used to be alone on this rabbit gap now. I dug my fingers into the dust partitions surrounding me and slowly clawed my manner again to sanity.

Upon exiting the opening, I grabbed my laptop computer and determined it was time to handle the research’s environmental footprint methodology, wrap up this pet, and put a bow on it. Chamanara et al. claimed that they adopted the strategies utilized by Ristic et al. (2019) and Obringer et al. (2020). There are a number of explanation why their environmental footprint strategy is flawed. First, the footprint components are usually used for assessing the environmental footprint of vitality era. In Ristic et al., the authors developed a metric known as the Relative Aggregated Issue that included these components. This metric allowed them to judge the position of latest electrical energy turbines like nuclear or offshore wind. The concept behind this strategy was to be aware that whereas carbon dioxide emissions from fossil fuels have been the principle driver for creating vitality transition targets, we must also keep away from changing fossil gas era with era that would create environmental issues in numerous methods.

Second, Obringer et al. used most of the components listed in Ristic et al. and mixed them with community transmission components from Aslan et al. (2018). This was a foul transfer as a result of Koomey is a co-author on this paper, so it shouldn’t be stunning that in 2021, Koomey co-authored a commentary alongside Masanet the place they known as out Obringer et al. In Koomey and Masanet, 2021, the authors chided the belief that short-term modifications in demand would result in rapid and proportional modifications in electrical energy use. This critique may be utilized to Chamanara et al., which checked out a interval when bitcoin was experiencing a run-up to an all-time excessive in worth throughout a novel financial atmosphere (low rates of interest, COVID stimulus checks, and lockdowns). Koomey and Masanet made it clear of their commentary that ignoring the non-proportionality between vitality and information flows in community gear can yield inflated environmental-impact outcomes.

Extra importantly, we’ve but to characterize what this relationship appears like for bitcoin mining. Demand for conventional information facilities is outlined by the variety of compute cases wanted. What’s the equal for bitcoin mining after we know that the block measurement is unchanging and the block tempo is adjusted each two weeks to maintain a mean 10-minute spacing between every block? This deserves extra consideration.

Both manner, Chamanara et al. didn’t appear to concentrate on the criticisms of Obringer et al.’s strategy. That is actually problematic as a result of as talked about at first of this screed, Koomey and Masanet laid the groundwork for information heart vitality analysis. They need to have identified to not apply these strategies to bitcoin mining as a result of whereas the business has variations from a standard information heart, it’s nonetheless a kind of information heart. There’s rather a lot that bitcoin mining researchers can take from the torrent of information heart literature. It’s disappointing and exhausting to see papers revealed that ignore this actuality.

What extra can I say apart from this shit has to cease. Brandolini’s Legislation is actual. The bullshit asymmetry is actual. I actually need this new halving cycle to be the one the place I not have to handle dangerous analysis. Whereas I used to be penning this report, Alex de Vries revealed a brand new bullshit paper on bitcoin mining’s “water footprint”. I haven’t learn it but. I’m undecided that I’ll. But when I do, I promise that I cannot write over 10,000 phrases on it. I’ve said my case and made my peace with this style of educational publishing. It was a enjoyable journey, however I believe it’s time to observe some self-care, deal with myself to a number of evenings of wholesome binge-watching, and dream of the ineffable.

—

When you loved this text, please go to btcpolicy.org the place you may learn the complete 10,000-word technical evaluation of the Chamanara et al. (2023) research.

It is a visitor put up by Margot Paez. Opinions expressed are completely their very own and don’t essentially mirror these of BTC Inc or Bitcoin Journal.