The most recent report from CoinShares, a crypto asset supervisor, has revealed that digital asset funding merchandise skilled a notable shift final week as $147 million in internet outflows have been recorded globally, ending a three-week streak of inflows.

CoinShares revealed that this ended influx streak isn’t unusual, because it outcomes from a notable development within the macroeconomic area.

Detailing The Fund Flows: Who’s Main And Who’s Not?

In line with CoinShares, the sudden outflow seen final week impacted main asset managers, together with BlackRock, Bitwise, Constancy, Grayscale, ProShares, and 21Shares, following practically $2 billion in internet inflows over the prior three weeks.

The outflows have been largely led by Bitcoin-based funds, which accounted for $159 million in internet outflows. In distinction, short-Bitcoin funding merchandise attracted $2.8 million in internet inflows, indicating that some traders are betting on an additional downward worth motion for the asset.

Ethereum-based merchandise, then again, which had simply ended 5 weeks of outflows the earlier week, resumed their adverse development, recording internet outflows of $28.9 million.

James Butterfill, Head of Analysis at CoinShares, defined this was resulting from a “lackluster” investor curiosity within the asset. This means that whereas Ethereum had briefly stabilized within the eyes of traders, confidence in its efficiency has not been absolutely restored, leading to continued outflows.

In the meantime, multi-asset funding merchandise, which give diversified publicity throughout a variety of cryptocurrencies, went towards the general development by attracting internet inflows of $29.4 million.

This marked the sixteenth consecutive week of optimistic flows for these merchandise, with $431 million flowing into multi-asset funds since June.

Butterfill famous that these merchandise have gained reputation amongst traders who favor a diversified strategy, representing roughly 10% of belongings below administration (AUM) at world crypto fund managers.

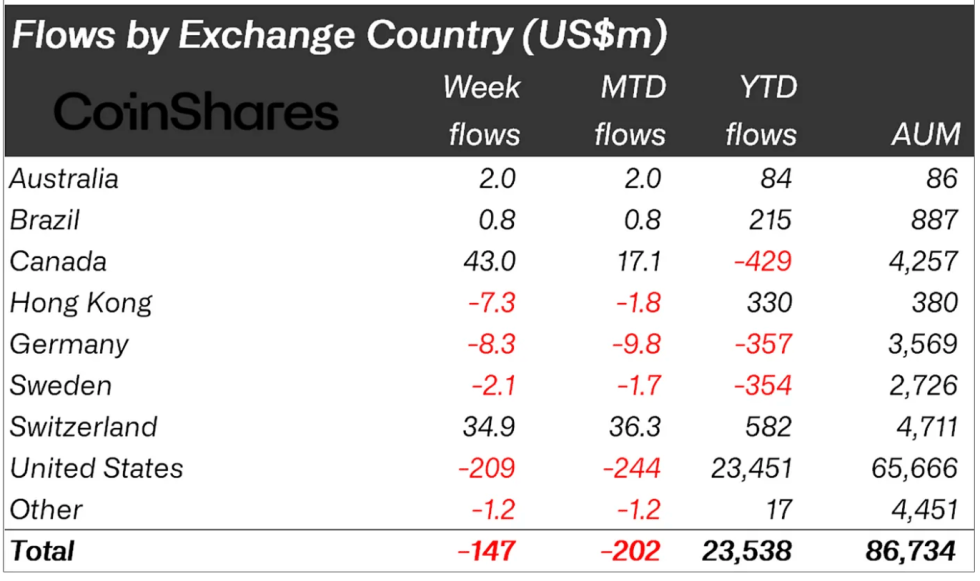

Moreover, relating to area, the biggest adverse flows have been concentrated in funds based mostly within the US, Germany, and Hong Kong, which misplaced $209 million, $8.3 million, and $7.3 million, respectively.

Nevertheless, these losses have been partly offset by internet inflows into merchandise based mostly in Canada and Switzerland, which noticed inflows of $43 million and $34.9 million.

The Actual Cause Behind The Outflows?

Notably, the change in market sentiment, which resulted in tens of millions of outflows, has been linked to stronger-than-expected financial knowledge. James Butterfill, attributing the market reversal to this surprising financial knowledge, wrote within the report:

Increased than anticipated financial knowledge final week, lowering the possibilities for vital fee cuts are the possible cause for the weaker sentiment amongst traders.

Butterfill added alongside these broader financial developments, noting:

Buying and selling volumes have been up marginally by 15% to US$10 for the week in ETP funding merchandise, whereas now we have seen decrease volumes in broader crypto markets.

Featured picture created with DALL-E, Chart from TradingView