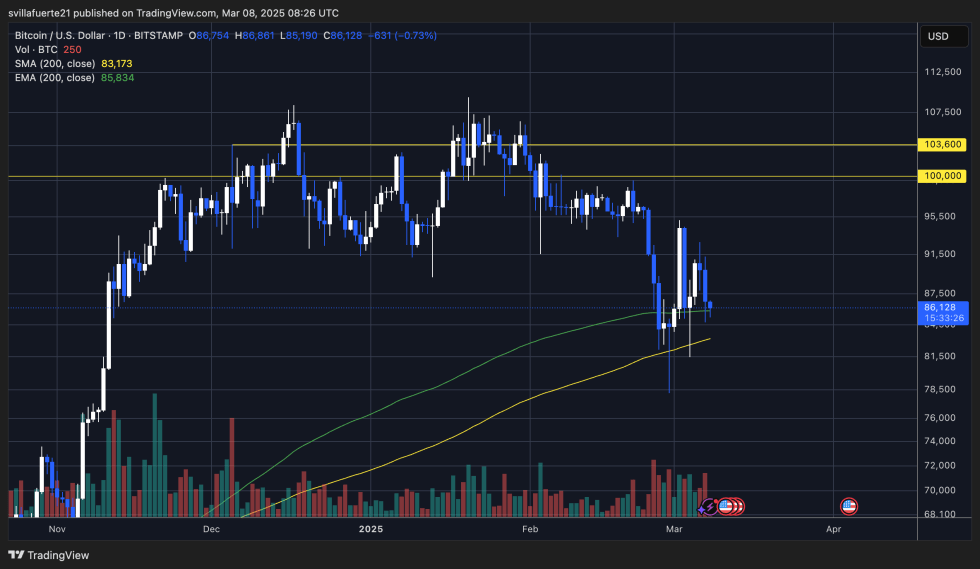

Bitcoin is presently buying and selling beneath the $87,000 degree, struggling to seek out momentum as bearish strain and market volatility proceed to create uncertainty. Regardless of makes an attempt to stabilize, BTC stays below strain, with merchants searching for indicators of a possible development reversal or deeper correction.

On Thursday, US President Donald Trump signed an govt order to determine a Strategic Bitcoin Reserve, a transfer that many believed would enhance market confidence. Nonetheless, Bitcoin fell after the announcement as the chief order failed to fulfill investor expectations, resulting in additional sell-offs and volatility. The market response means that merchants had been anticipating extra readability on how the US authorities plans to handle and make the most of the reserve.

Regardless of the value drop, key on-chain information from Santiment reveals that whales have amassed over 30,000 Bitcoin prior to now two weeks, signaling a powerful shopping for development. This means that giant buyers are positioning themselves for a possible market shift, whilst BTC struggles within the brief time period.

Bitcoin Fundamentals Differ From Market Sentiment

Bitcoin is struggling to reclaim the $90,000 mark however continues to carry agency above $85,000, a vital help degree that might function a definitive level of inflection if bulls fail to defend it. With market sentiment nonetheless bearish, BTC stays below strain, unable to generate the momentum wanted for a decisive breakout.

The decline in cryptocurrencies has mirrored the downtrend in U.S. inventory markets as buyers react to fears of a widening world commerce battle. Macroeconomic uncertainty, mixed with ongoing regulatory considerations, has stored danger belongings, together with Bitcoin, in a risky state. Nonetheless, this turbulence might fade if upcoming developments, similar to tax cuts and regulatory readability, present advantages for buyers. These elements might function catalysts for renewed confidence in each conventional markets and crypto.

Regardless of the present weak point, high analyst Ali Martinez shared on-chain information from Santiment, revealing that whales have amassed over 30,000 Bitcoin prior to now two weeks. This sturdy accumulation development stands in distinction to the broader market sentiment, which continues to ship BTC towards decrease ranges.

Traditionally, whale accumulation is a bullish sign, as giant buyers sometimes purchase during times of worry and uncertainty to place themselves forward of the following market transfer. If Bitcoin maintains help above $85,000 and whales proceed to build up, a possible restoration could possibly be on the horizon. Nonetheless, if BTC fails to carry its present vary, one other leg down towards decrease demand zones could comply with.

With Bitcoin’s value motion at a vital juncture, the approaching days can be key in figuring out whether or not BTC can escape above resistance or if bears will regain management and push costs decrease.

BTC Holding Above $85K

Bitcoin (BTC) is presently holding above $85,000 regardless of persistent promoting strain and bulls struggling to reclaim key resistance ranges. The market stays extremely unsure, with BTC failing to verify a transfer into increased provide zones or a breakdown into decrease demand ranges.

For bulls to regain momentum, Bitcoin should push above $90,000 with energy and purpose for a fast transfer towards $100,000. A decisive reclaim of those ranges would shift sentiment bullish and doubtlessly set off a brand new uptrend. Nonetheless, and not using a clear breakout, BTC stays weak to additional draw back strain.

If Bitcoin fails to carry $90K and loses help at $85K, the market might see one other wave of promoting, resulting in a drop towards $78,000 or decrease. This degree could be vital, as breaking beneath it might set off panic promoting and a extra prolonged correction.

For now, merchants are watching BTC’s capability to defend $85K and push increased. The subsequent few days can be essential in figuring out whether or not Bitcoin can reclaim key resistance ranges or if bears will regain management and ship the value decrease. Uncertainty continues to dominate, protecting each bulls and bears on edge.

Featured picture from Dall-E, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent assessment by our workforce of high expertise specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.