The U.S. greenback has been the go-to forex for international commerce and finance for many years. This dominance started after World Warfare II when the Bretton Woods Settlement made the greenback the world’s primary reserve forex. Over time, the scale and power of the U.S. economic system, together with the belief in U.S. establishments, helped solidify the greenback’s international place.

However now, there’s a brand new improvement on the horizon: U.S. dollar-backed stablecoins. These are digital currencies which are tied to the worth of the U.S. greenback. They’re constructed on blockchain expertise, which makes them sooner, cheaper, and safer for transferring cash throughout borders in comparison with conventional methods. This could possibly be a recreation changer for international commerce, particularly in areas the place banking methods are gradual or costly.

May U.S. dollar-backed stablecoins really reinforce the Greenback dominance in international commerce?

The U.S. Greenback’s Dominance in World Commerce

The USD performs a central function on the planet economic system. For many years, it has been probably the most trusted and broadly used forex for worldwide commerce. Whether or not international locations are shopping for items, making investments, or dealing with money owed, the greenback is often the forex of selection.

From oil offers to airplane gross sales, most main international transactions are priced and paid for in {dollars}. This provides the U.S. a singular benefit and positions the greenback as a key participant in international commerce.

One of many large causes the greenback holds a lot energy is as a result of it’s the world’s most popular reserve forex. Meaning central banks in numerous international locations preserve large quantities of {dollars} available to assist stabilize their very own economies and management alternate charges.

In response to the Chatam Home, over 58% of all international forex reserves throughout the globe are in U.S. {dollars}, far more than every other forex just like the euro, yen, or Chinese language yuan.

So why is everybody so into the greenback? It’s regular, trusted, backed by the U.S. authorities, and accepted just about all over the place. Take oil, for instance. Most international locations want {dollars} to purchase it as a result of oil is often bought in {dollars}, a setup usually referred to as the “petrodollar” system. That alone retains international demand for {dollars} excessive.

Relating to worldwide funds, the greenback can also be the go-to. If an organization in Brazil desires to pay a provider in Germany, or a financial institution in India must ship cash to the U.Ok., odds are they’ll use {dollars} to make it occur. It’s simply the best and most dependable possibility.

The greenback can also be constructed into the very methods that run international finance. The SWIFT community, which banks use to ship cash all over the world, largely runs on {dollars}. Tons of commerce agreements and worldwide contracts are written in {dollars} too.

Even for international loans and bonds, like when international locations or large firms elevate cash, they’re usually issued in {dollars}. All of this helps preserve the greenback locked in as the inspiration of the worldwide monetary system.

U.S. Greenback-Backed Stablecoins because the Way forward for World Transactions

U.S. dollar-backed stablecoins are beginning to play a significant function in how cash flows the world over. Consider them as digital variations of the greenback that work sooner, price much less, and don’t include all of the purple tape of conventional banking.

As an alternative of going by a number of banks and ready days for a cross-border fee to clear, a stablecoin transaction may be completed in simply minutes, and with far decrease charges. In reality, some stablecoin transfers can lower prices by as much as 40%, which makes a giant distinction once you’re sending or receiving cash internationally.

This type of velocity and financial savings is a large benefit for companies, particularly small and medium-sized ones. Stablecoins remove the same old hassles like changing currencies or coping with costly middlemen.

If an organization in Mexico desires to pay a provider in South Korea, it will possibly simply use stablecoins and skip the delays and additional prices that typically include cross-border funds.

And it’s not simply small companies paying consideration. Massive firms like PayPal and Visa already use stablecoins of their fee methods. Additionally, governments all over the world are beginning to put collectively guidelines to ensure stablecoins are protected and safe to make use of at scale.

All of this exhibits how a lot stablecoins are being taken significantly, they’re not only a tech experiment. They’re changing into a trusted a part of international finance.

How Greenback-Backed Stablecoins May Strengthen the Greenback’s World Position

In an more and more digital world, U.S. dollar-backed stablecoins are rising as a strong software that might reinforce and develop the greenback’s affect globally.

1. Extending Greenback Entry Past Borders

Greenback-backed stablecoins like USDC and USDT permit folks and companies all over the world to carry and switch digital {dollars} shortly and cheaply. That is particularly transformative in areas with:

Restricted entry to U.S. banks

Unstable native currencies

Outdated or gradual monetary infrastructure

In locations like Latin America, Africa, and Southeast Asia, stablecoins have gotten an on-ramp to U.S. greenback liquidity, serving to people and companies bypass banking bottlenecks and inflationary native currencies.

2. Driving Extra Greenback Demand By means of Utility

As extra customers depend on stablecoins for on a regular basis funds, financial savings, and worldwide commerce, they’re naturally growing international demand for U.S. {dollars}. Every stablecoin is backed 1:1 by U.S. {dollars} or equivalents, so larger utilization means extra {dollars} held in reserves, straight reinforcing the greenback’s international significance.

This digital type of the greenback can:

Simplify cross-border commerce

Velocity up remittances

Allow provide chain financing in creating markets

3. Bypassing Conventional Banking with Blockchain

Stablecoins function on public blockchains, making them accessible 24/7, no checking account required. This decentralized nature permits dollar-backed stablecoins to develop the attain of the U.S. greenback with out counting on legacy monetary networks like SWIFT.

Additionally they supply:

Quicker settlement instances (seconds, not days)

Decrease transaction prices

Better transparency and auditability

4. Actual-World Adoption is Already Underway

World companies, fintechs, and governments are adopting dollar-backed stablecoins to:

Pay worldwide suppliers

Ship remittances

Present digital wallets for the unbanked

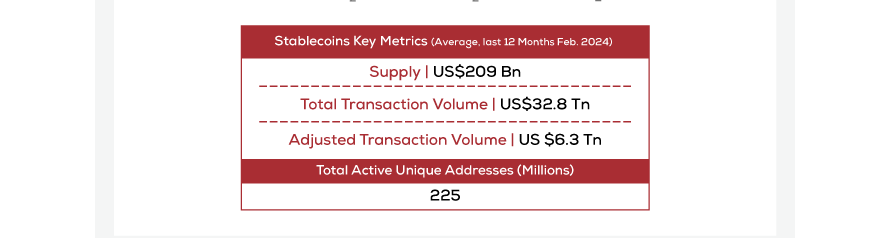

In 2024, stablecoins facilitated over $6 trillion in funds, representing 15% of all retail cross-border transactions globally.

As utilization grows, stablecoins are positioning the U.S. greenback because the default forex of the digital age. In brief, dollar-backed stablecoins give the U.S. greenback a digital improve, serving to it keep dominant in a quickly altering monetary house.

Regulatory Frameworks and Their Influence on Greenback-Backed Stablecoins

In early 2025, the U.S. launched the GENIUS Act (Guiding and Establishing Nationwide Innovation for US Stablecoins), which units out clear guidelines for stablecoin issuers. One of many primary necessities is that every stablecoin have to be backed by an actual U.S. greenback asset, basically guaranteeing that for each stablecoin in circulation, there’s an precise greenback to again it.

The regulation additionally mandates that stablecoin issuers observe anti-money laundering (AML) and know-your-customer (KYC) rules, which assist shield customers and construct belief in these digital belongings.

So as to add one other layer of oversight, the STABLE Act goals to put all stablecoin issuers beneath the Federal Reserve’s management, stopping algorithmic stablecoins (these not backed by belongings) and stablecoins issued by large tech firms.

The objective right here is to steadiness innovation with monetary stability, guaranteeing that stablecoins can safely develop into a part of the broader economic system. Moreover, the U.S. authorities is pushing to advertise lawful dollar-backed stablecoins globally, ensuring the U.S. greenback stays a dominant pressure within the digital world.

Central banks all over the world are beginning to see the potential of stablecoins. Within the U.S., the Federal Reserve is taking steps to create a stable regulatory framework to supervise using stablecoins whereas encouraging innovation and minimizing dangers. This can assist be certain that stablecoins proceed to develop in a means that’s protected for the broader monetary system.

Challenges and Dangers to Greenback Dominance from Stablecoins

Whereas U.S. dollar-backed stablecoins have the potential to bolster the greenback’s international function, additionally they introduce a number of challenges and dangers that might undermine its dominance.

Competitors from Central Financial institution Digital Currencies (CBDCs)

One large problem is the rise of CBDCs, digital currencies created and managed by central banks. International locations like China and members of the European Union are already rolling out their very own variations, just like the digital yuan and digital euro.

These new digital currencies are designed to maneuver cash throughout borders immediately, 24/7, with out counting on the U.S. greenback. That might make them extra interesting to international locations doing worldwide commerce and slowly scale back the world’s dependence on the greenback.

Dangers of Market Fragmentation and Lack of Management over World Liquidity

With extra stablecoins and CBDCs floating round, managing international liquidity, the circulate of cash throughout monetary markets, may develop into more durable. Proper now, the system runs pretty easily with the greenback taking part in a central function.

But when everybody begins utilizing totally different digital currencies, it may get messy. With no common system to trace how all this cash strikes, markets develop into extra fragile and extra more likely to crash when issues go improper.

Considerations Concerning Privateness, Safety, and Centralization

One other large fear with stablecoins is privateness and safety. Some platforms may open the door to critical knowledge assortment and monitoring, elevating questions on how a lot non-public info customers give to firms or governments. If every thing’s recorded on a blockchain, it’s clear however not essentially non-public.

There’s additionally the problem of centralization. Suppose a single firm controls a preferred stablecoin, as an example. This creates a single level of failure. If that system is hacked or offline, it may have an effect on many individuals and trigger vital monetary disruptions.

Lastly, since there’s no international rulebook for regulating stablecoins, the principles range from nation to nation. That inconsistency can result in weak safety practices in some locations, making the entire system riskier and extra susceptible to fraud or monetary instability.

Greenback-Backed Stablecoins – The Subsequent Part of Greenback Hegemony?

U.S. dollar-backed stablecoins are redefining how the greenback maintains its international affect. By pairing the belief of the greenback with the effectivity of blockchain, they provide a sooner, cheaper, and extra accessible strategy to transfer cash throughout borders, particularly in areas with restricted banking infrastructure.

Within the quick time period, stablecoins are already enhancing remittances, commerce, and digital funds. Over the long run, they may develop into the default rails for international commerce, reinforcing the greenback’s dominance in an more and more digital world.

If backed by sensible regulation, stablecoins received’t simply protect the greenback’s function, they’ll develop it. As digital finance grows, these tokens may develop into a key pillar of U.S. financial management, guaranteeing the greenback stays central in international transactions.

Disclaimer: This text is meant solely for informational functions and shouldn’t be thought of buying and selling or funding recommendation. Nothing herein must be construed as monetary, authorized, or tax recommendation. Buying and selling or investing in cryptocurrencies carries a substantial danger of economic loss. All the time conduct due diligence.

If you want to learn extra articles like this, go to DeFi Planet and observe us on Twitter, LinkedIn, Fb, Instagram, and CoinMarketCap Group.

Take management of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics instruments.