Suilend’s first-mover benefit, coupled with its modern roadmap, together with SpringSui for liquid staking and STEAMM AMM. All of those options place it as a cornerstone DeFi platform poised for important progress throughout the increasing Sui ecosystem.

Mission Overview: What’s Suilend?

Suilend is a decentralized lending and borrowing protocol constructed on the Sui blockchain. It first launched on Sui community in March 2024 as the primary enlargement of the Solend staff outdoors Solana. Behind the protocol is the pseudonymous founder “Rooter” and the core staff from Solend (often known as Save on Solana).

Their purpose is to carry Solend’s experience in DeFi lending to Sui, offering a safe, environment friendly, and user-friendly platform for incomes yield on crypto or accessing liquidity with out promoting holdings.

In essence, Suilend goals to democratize entry to monetary companies by eliminating intermediaries and lowering prices, thereby making lending/borrowing extra accessible to a broader viewers.

For extra: Sui’s DeFi Ecosystem: Fast Progress and Strategic Positioning

Suilend Homepage

Who’s backing Suilend?

Suilend has garnered robust help from the crypto trade. It raised $6 million by late 2024 to fund improvement, $2M in early 2024 and one other $4M in Dec 2024. Main blockchain traders from Delphi Ventures, Robotic Ventures, Mechanism Capital, DeFi Alliance, and Karatage, alongside distinguished angels like Balaji Srinivasan and DCFGod. This backing not solely supplied capital but additionally alerts confidence in Suilend’s imaginative and prescient and know-how.

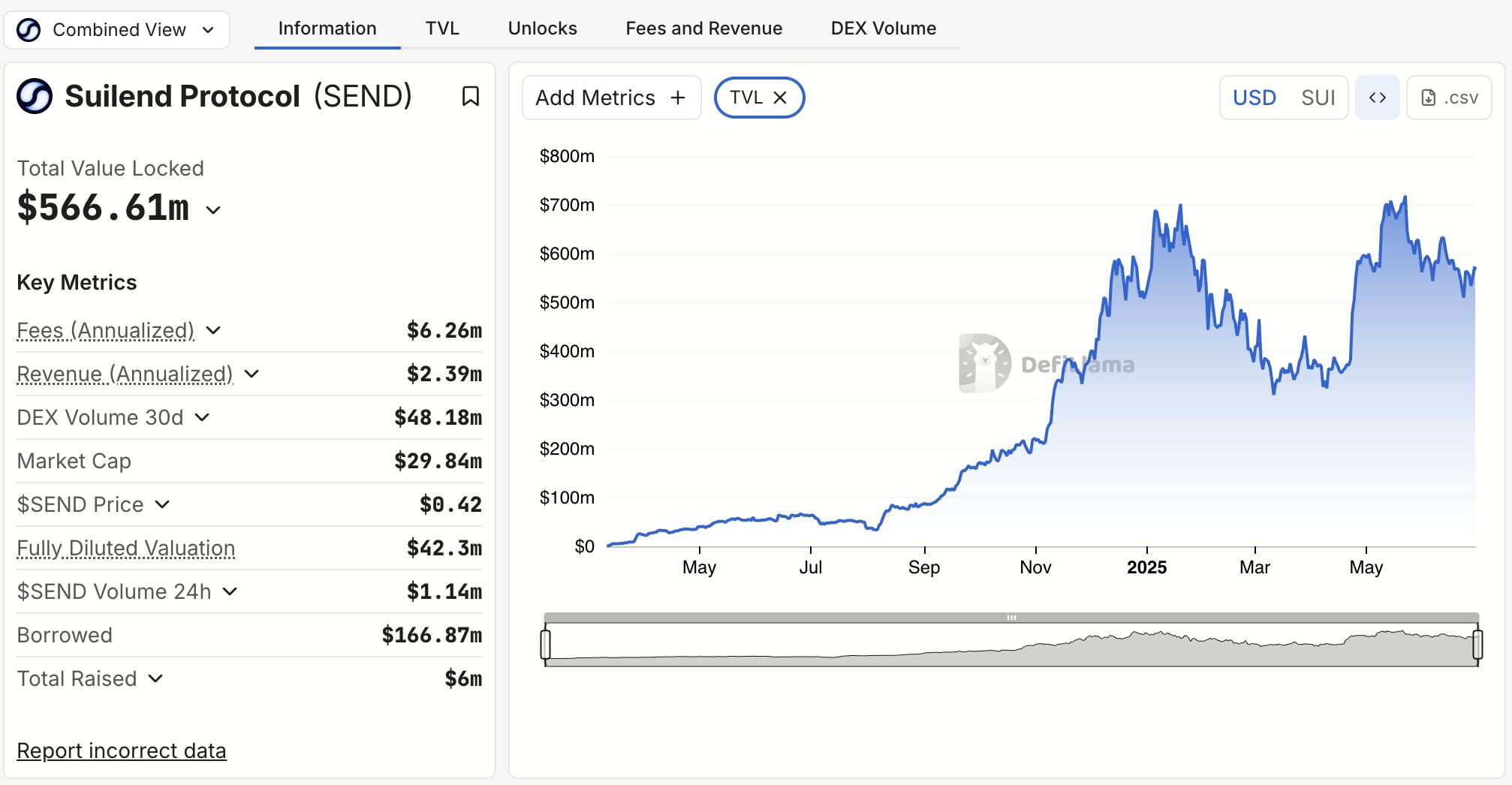

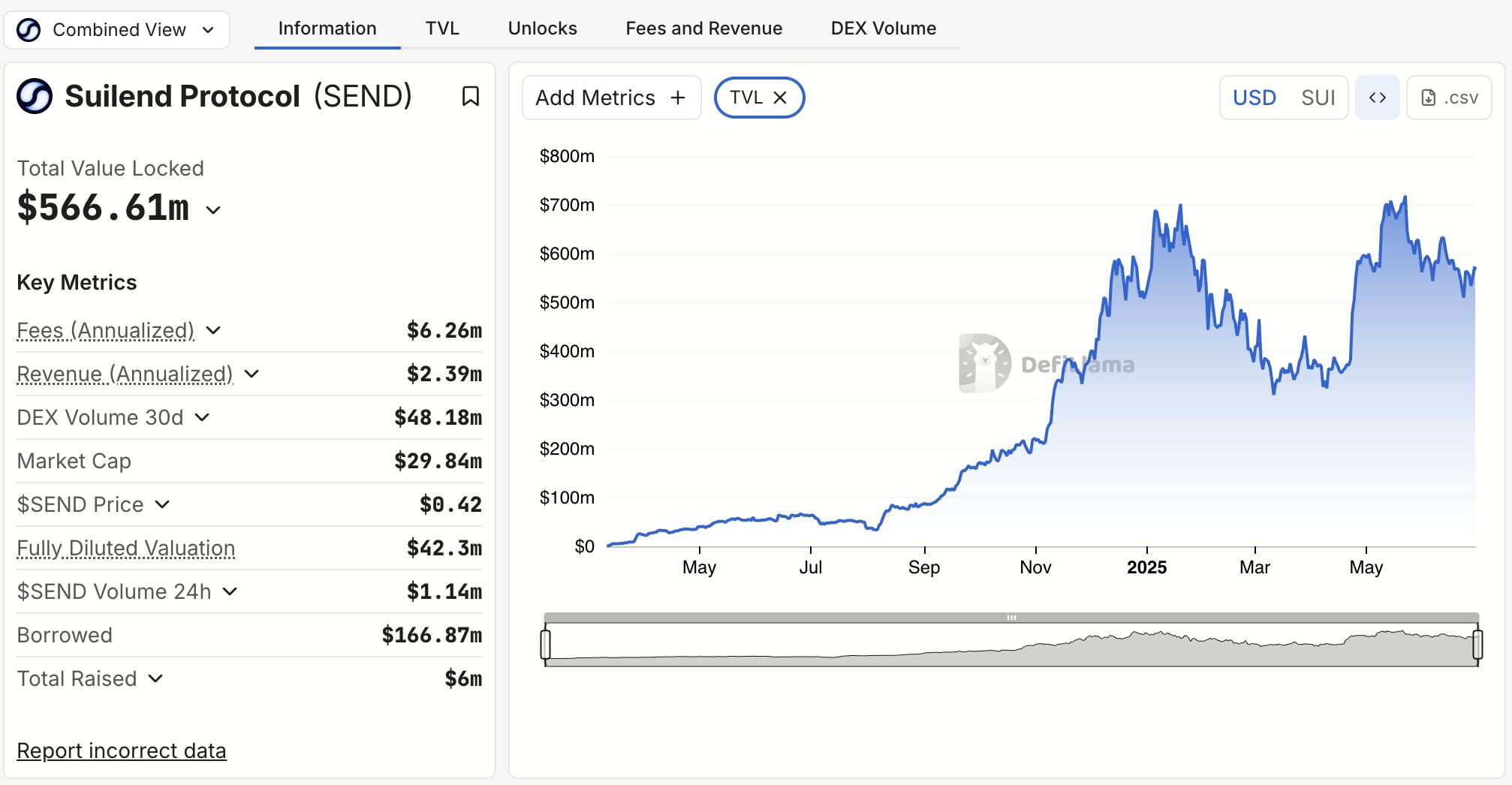

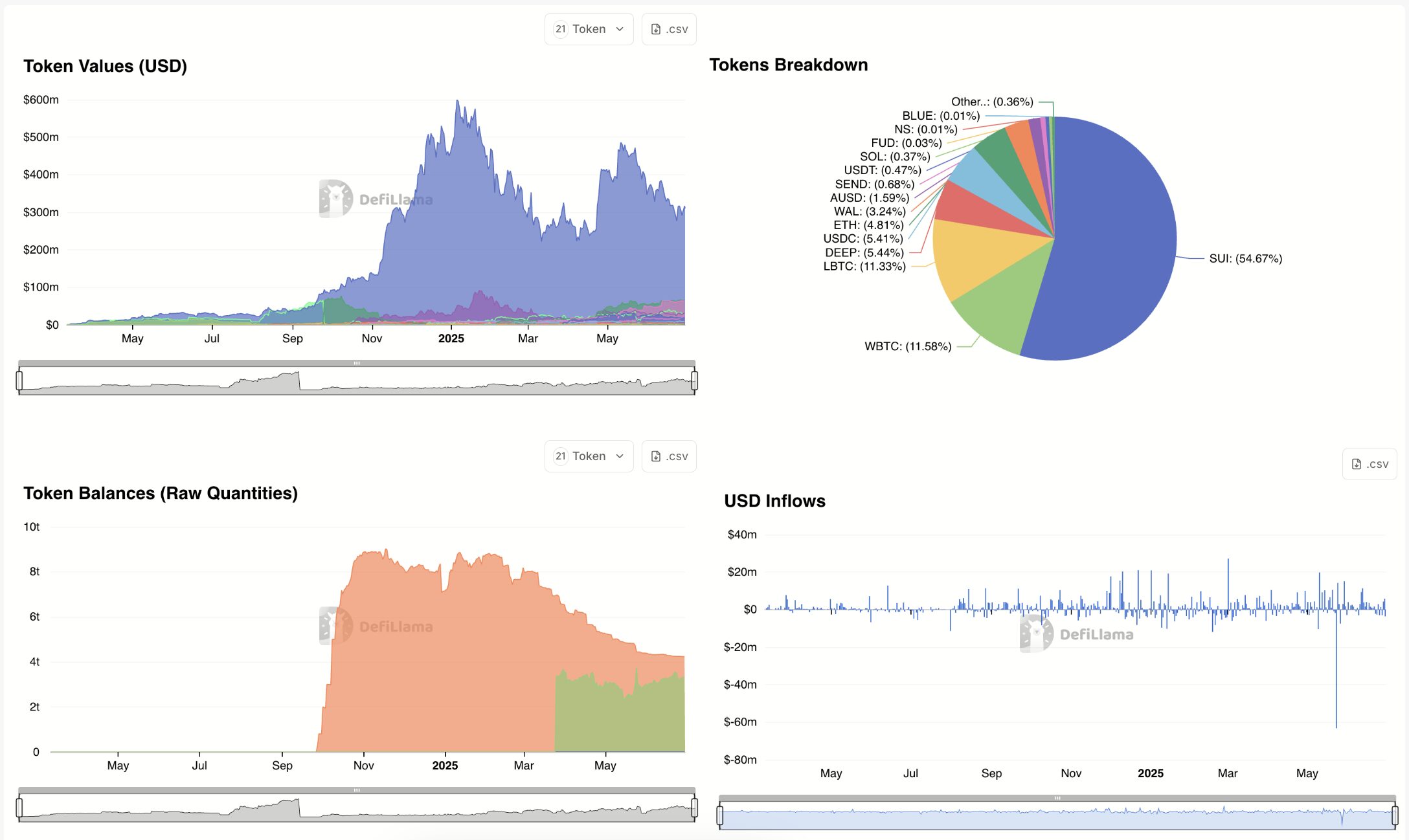

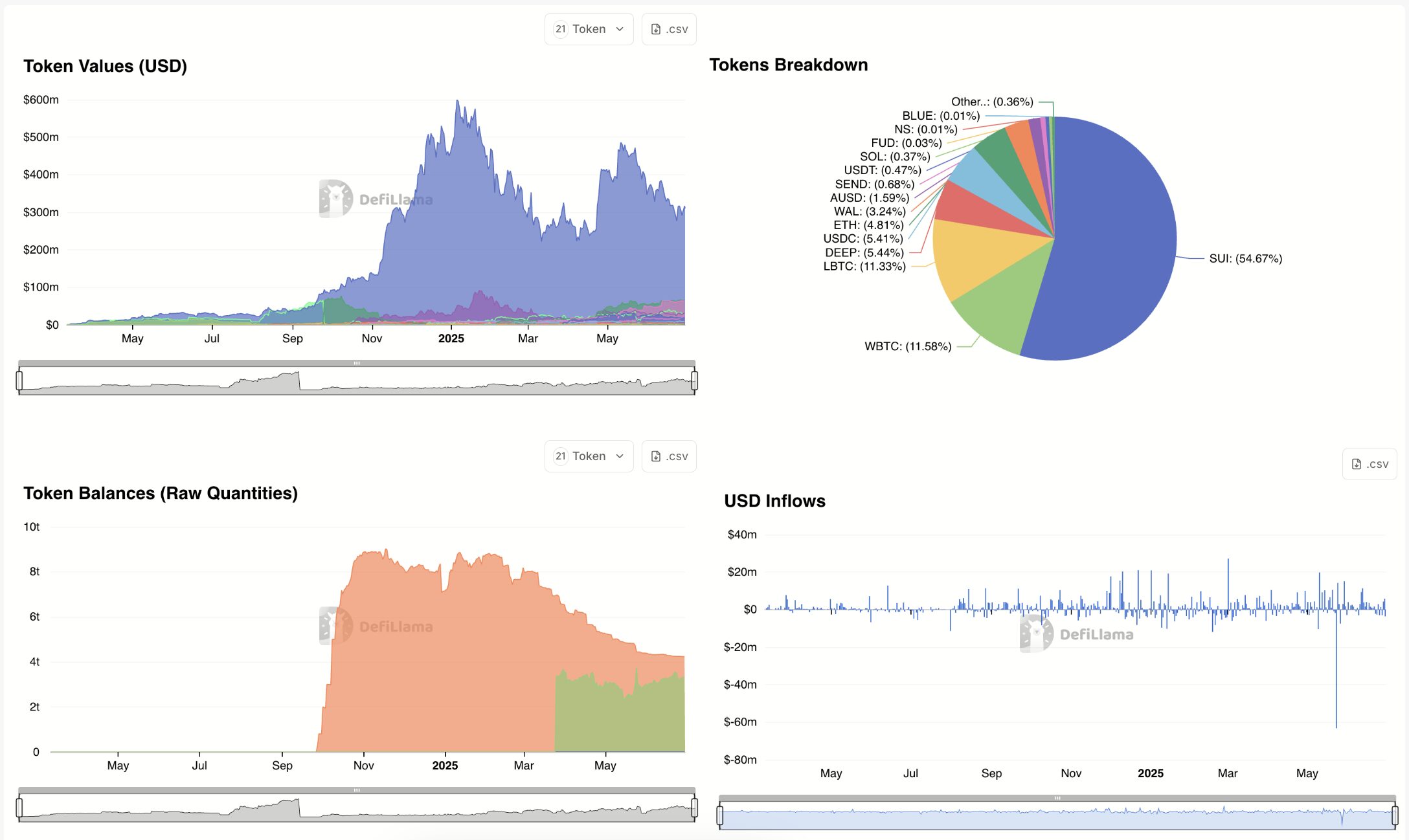

In response to the Sui Basis staff, Suilend rapidly turned certainly one of Sui’s largest DeFi protocols. By late 2024, the protocol was already the chain’s largest lending platform with practically $470 million TVL (Complete Worth Locked) and important month-to-month income. In January 2025, Suilend (along with its liquid staking arm SpringSui) reached $1 billion in TVL on Sui, underscoring its fast progress.

Supply: DefiLlama

Since its launch, Suilend boasts over 50,000 month-to-month energetic wallets and has solidified its place because the #1 DeFi protocol on Sui by TVL. Total, Suilend’s mission overview will be summed up as a community-driven lending platform on a high-performance blockchain, led by skilled DeFi builders and fixing the necessity for a sturdy money-market within the rising Sui ecosystem.

For extra: Driving Forces Behind Sui Progress Just lately

Technical Structure: How Does Suilend Work?

Suilend’s technical structure intently resembles different money-market protocols (equivalent to Compound or Aave protocol). Nevertheless it’s carried out in Sui’s Transfer language to leverage the Sui’s distinctive technical benefits in pace and security. At a excessive stage, Suilend makes use of a pool-based lending mannequin with on-chain objects to trace markets, deposits, and loans.

Key parts of the protocol embrace:

Lending Markets and ReservesDeposits and cTokensObligations (Account NFTs)Collateral and LiquidationGood Contracts and Safety

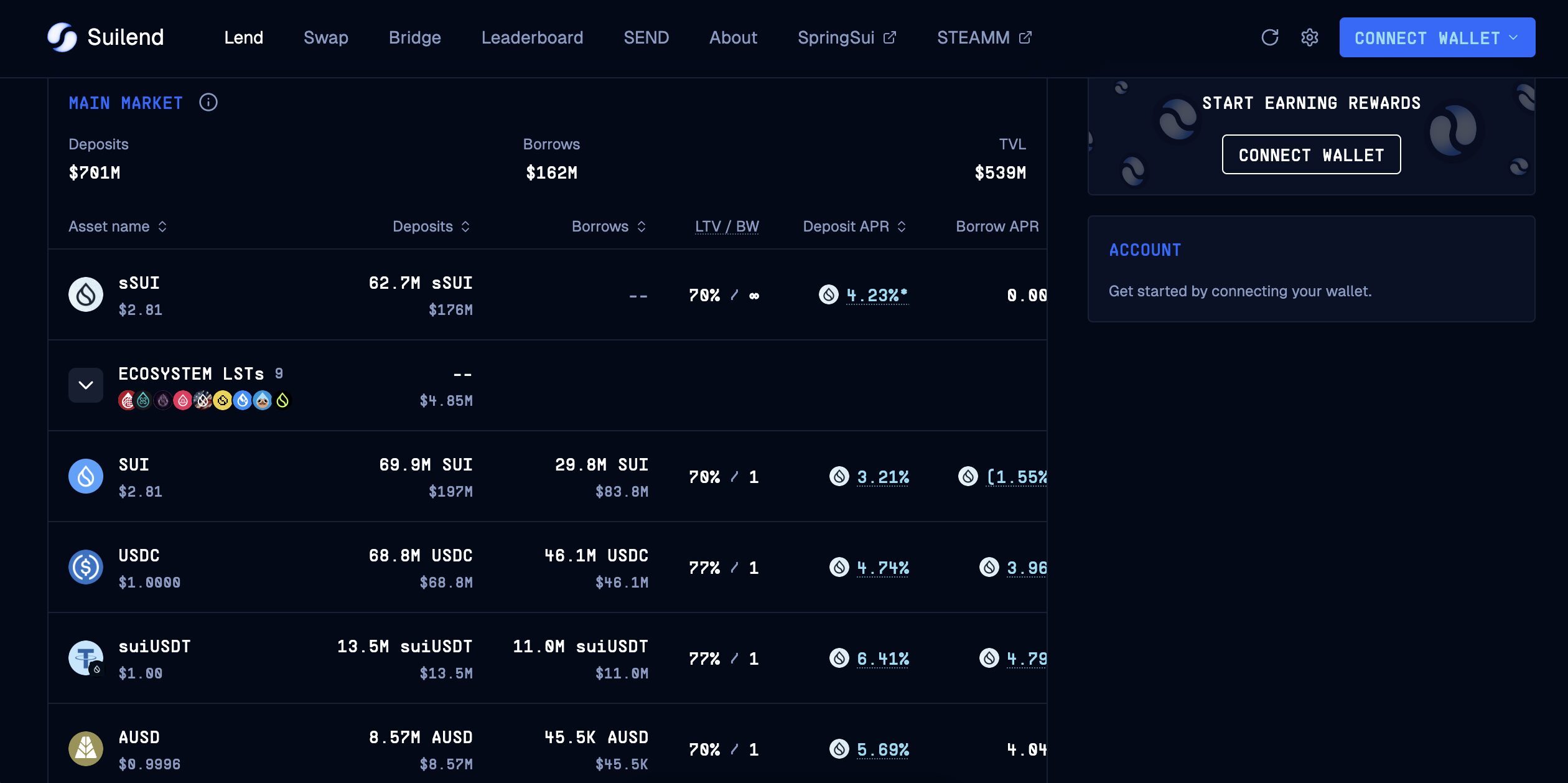

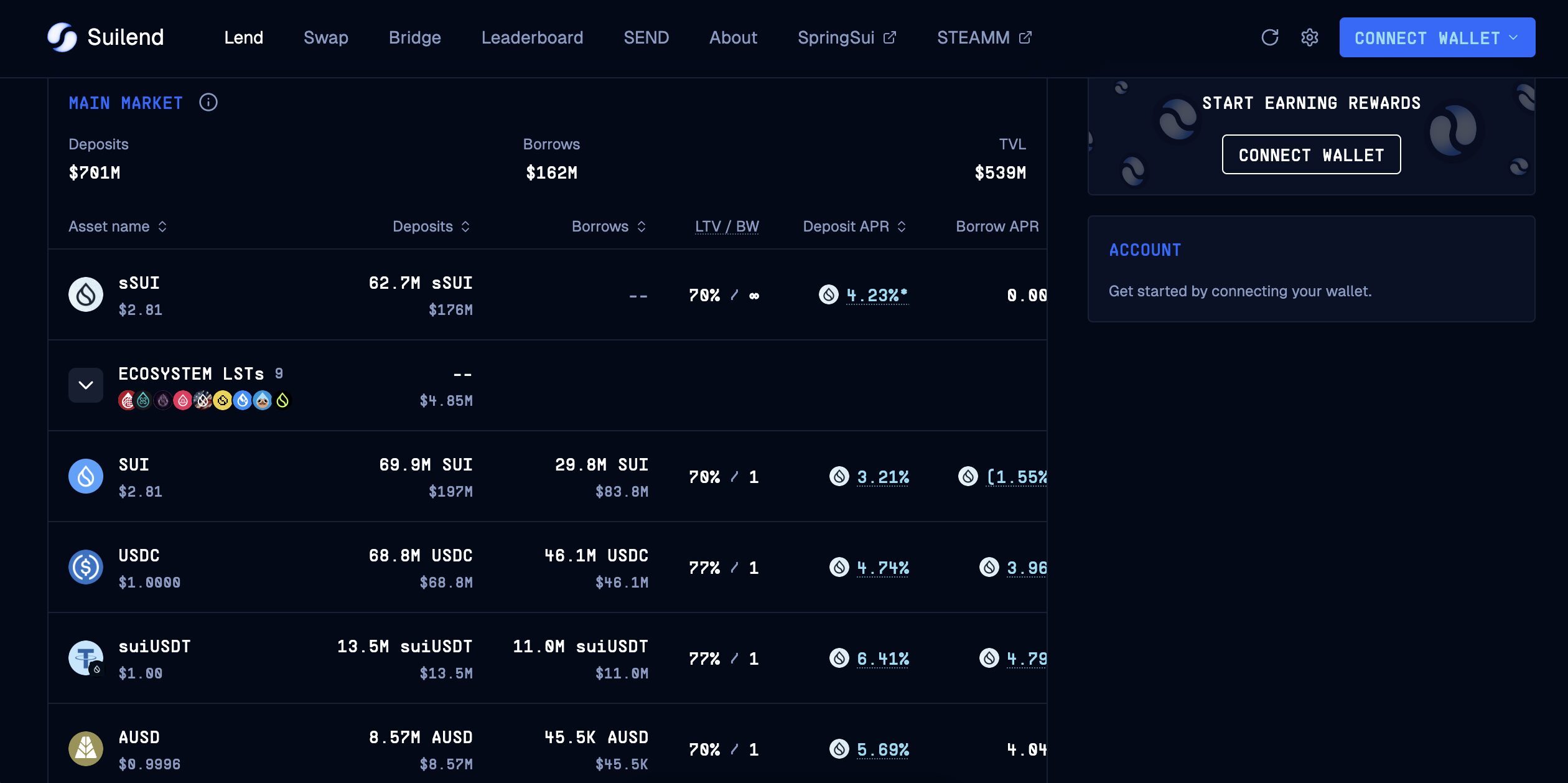

Suilend operates as a sturdy money-market protocol on the Sui community, leveraging its distinctive options for pace and safety. The core of its operation revolves round a pool-based lending mannequin the place a Lending Market object comprises a number of Reserve swimming pools, every topic to a selected asset like SUI or USDC.

Suilend Lending Market

Customers deposit crypto property into these reserves to supply liquidity and earn curiosity. In return for his or her deposits, customers obtain cTokens, that are yield-bearing tokens representing their share of the deposited property plus accrued curiosity.

Every person’s total monetary place, encompassing their deposits and borrows, is tracked effectively via an Obligation object, typically represented as an NFT distinctive to their handle. This enables for the calculation of borrowing energy throughout all collateralized property.

All loans on Suilend are over-collateralized, with particular Mortgage-to-Worth (LTV) ratios and liquidation thresholds. The protocol depends on trusted worth oracles (like Pyth Community and Switchboard) to repeatedly feed correct asset costs.

If a borrower’s collateral worth falls beneath a sure threshold as a consequence of worth fluctuations, their place closes to liquidation threshold. The liquidators repay the undercollateralized loans and seize collateral at a reduction, guaranteeing protocol solvency.

A whale’s ~$20M lengthy place on $SUI is on the verge of liquidation!

This whale deposited 4.1M $SUI($19.3M) and 100K $sSUI($470K) into #Suilend and borrowed $14.4M in stablecoins.

If the value of $SUI drops to $4.56, the place will probably be liquidated.https://t.co/nR510DfO9a pic.twitter.com/Z66m5PUMa6

— Lookonchain (@lookonchain) January 8, 2025

Total, Suilend’s structure marries the time-tested design of DeFi cash markets with the next-generation infrastructure of the Sui blockchain. By utilizing multi-asset collateral help, dynamic rates of interest, and strong danger controls, Suilend gives a dependable spine for the lending sector on Sui.

SEND Tokenomics and Suilend’s Incentives

Suilend launched its personal native token, SEND, in December 2024 as a part of the protocol’s enlargement. SEND coin is a utility and governance token designed to reward the group and align incentives between customers and the protocol.

Right here’s a dive into SEND’s tokenomics:

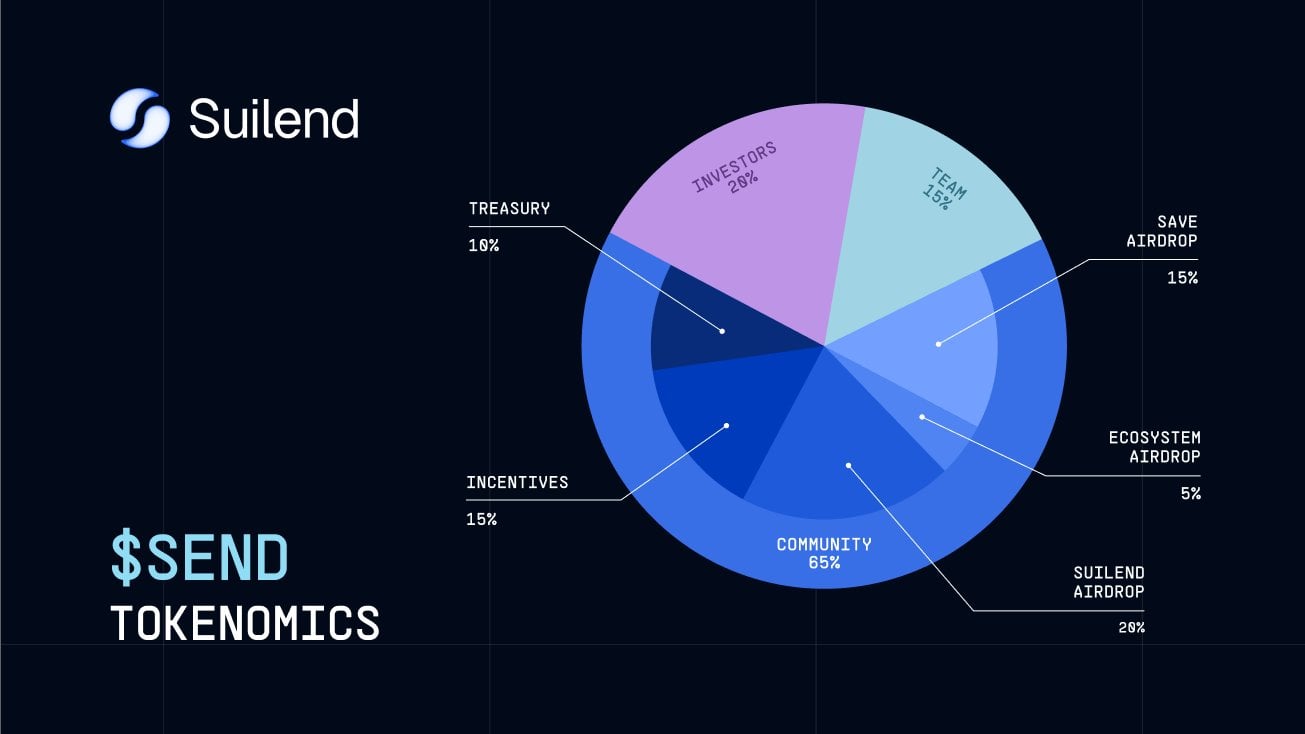

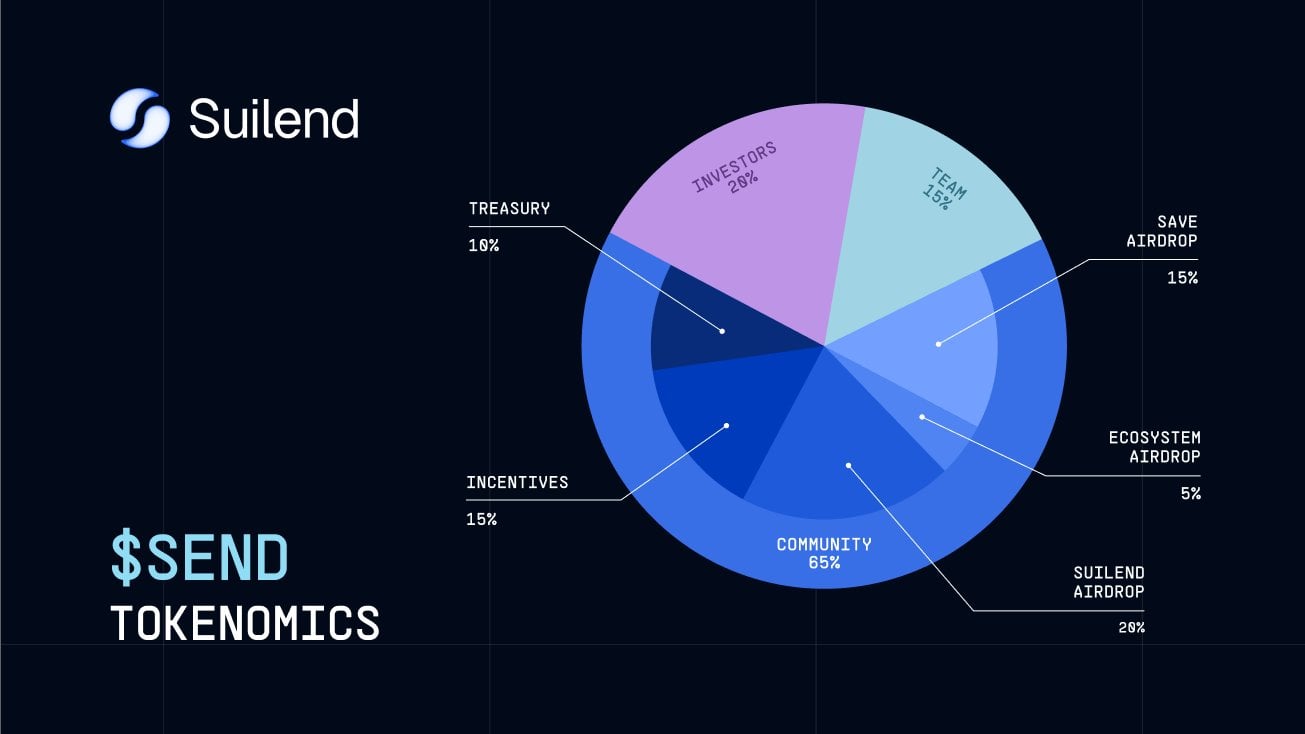

Complete provide and allocation: SEND has a set complete provide of 100 million tokens.The allocation is closely skewed towards the group, reflecting Suilend’s “community-first” ethos. Precisely 65% of the availability is earmarked for the group (together with airdrops, rewards, and treasury), 20% is allotted to early traders, and 15% to the founding staff. This balanced allocation ensures that the protocol’s customers and contributors maintain the bulk stake, whereas nonetheless offering significant incentives rewardings to the staff and backers for long-term dedication. Each investor and staff tokens are topic to lock-ups (traders vest over ~2 years, staff over ~4 years) to forestall sudden provide shocks.

Supply: Suilend

M-Drop Distribution Mechanism

A singular side of Suilend’s token launch was its “Mdrop” distribution mannequin. Reasonably than a typical instant airdrop or token sale, Suilend carried out a vesting voucher method for group distributions.

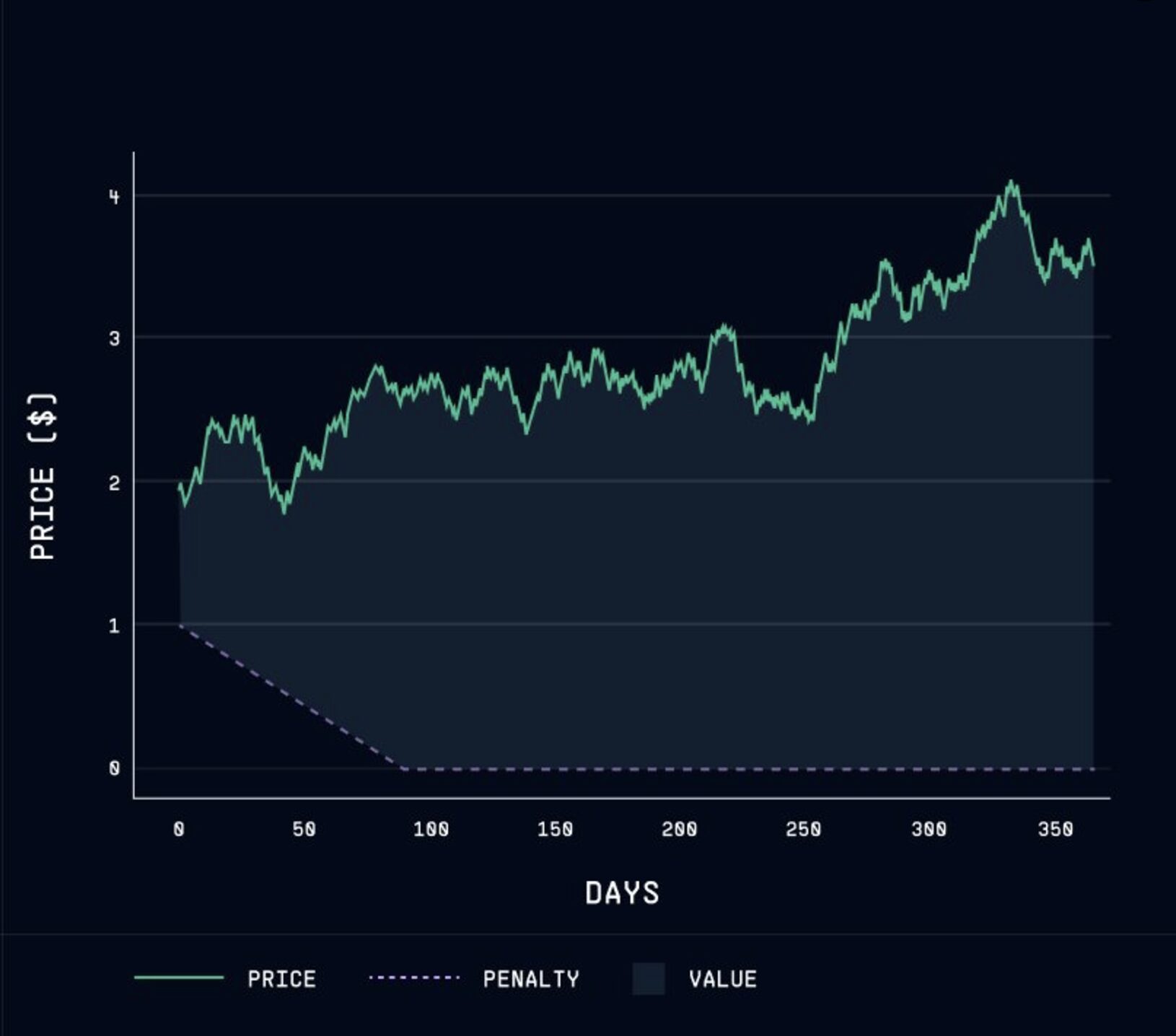

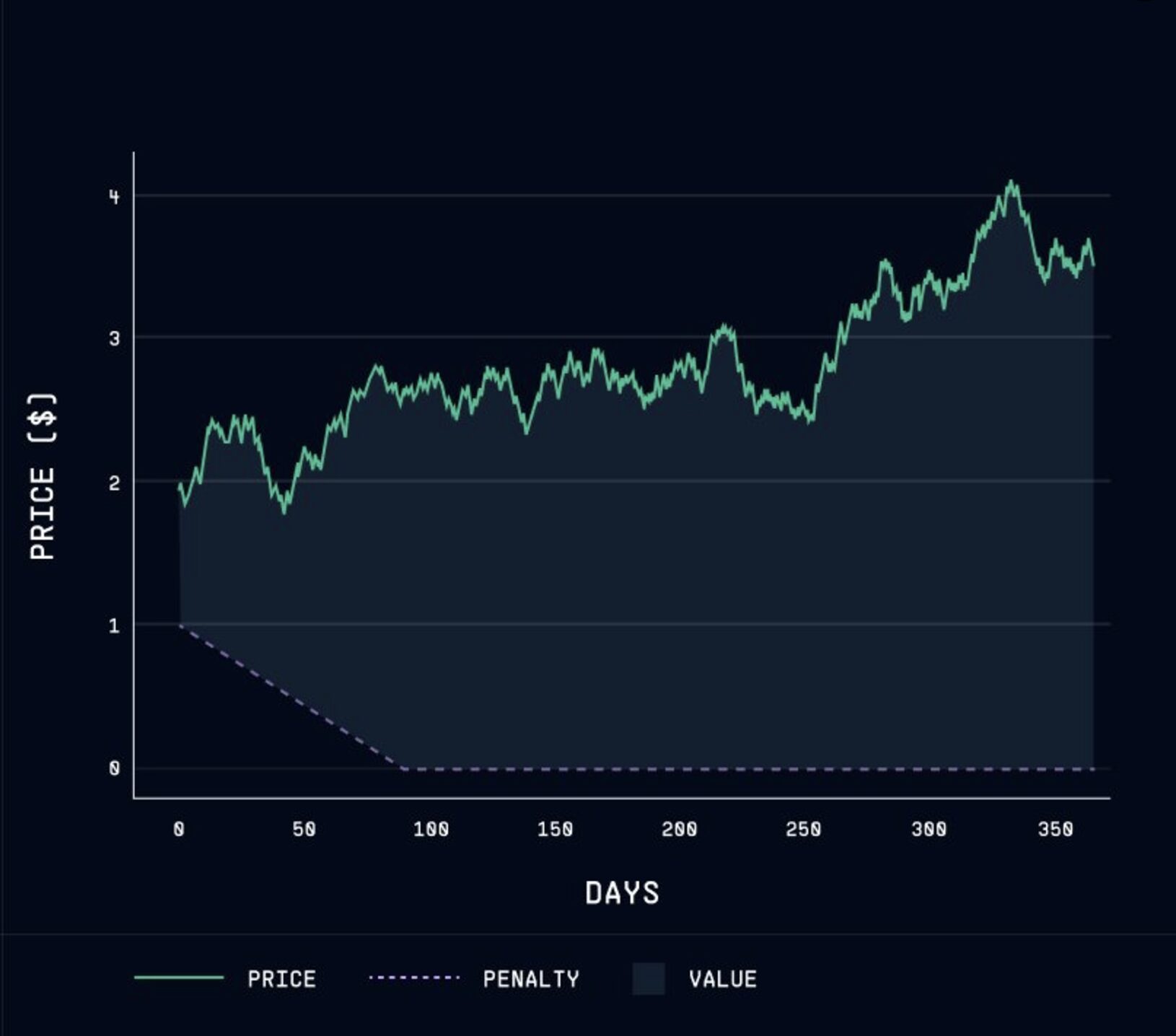

Eligible customers (equivalent to early platform customers, Suilend Factors holders, and Solend/Save group members) obtained an allocation that might be redeemed for mSEND tokens. mSEND acts as a time-locked token voucher: holders can convert mSEND into precise SEND, however doing so early incurs a penalty charge in SUI.

Supply: Suilend

The penalty begins excessive and reduces linearly over time – for example, group reward mSEND had a 3-month decay interval, investor/staff allocations 6 months, and the Solana Save holders allocation 12 months. After the required maturity (e.g. 3 months), mSEND will be redeemed one-for-one for SEND with no penalty.

This mechanism achieved two targets: it allowed a big preliminary token distribution (40% of SEND) to the group with out instant promote strain, and it inspired longer-term holding as customers had an incentive to attend for full unlock.

Notably, the Mdrop design additionally created demand for SUI token, since penalties are paid in SUI and get burned or in any other case faraway from circulation, including a sink for SUI.

Neighborhood Airdrops and Conversions

Inside the group’s 65% allocation, 40% of SEND was distributed through Mdrop airdrops throughout three principal teams:

20% to Suilend early customers and factors holders 5% to Sui ecosystem communities (e.g. holders of Suilend’s “Rootlets” NFTs and different contributors)15% allotted to Save (Solend) token holders on Solana.

By rewarding Save holders, the staff acknowledged their Solana group and invited them to affix Suilend’s progress on Sui. The remaining group tokens (25% of provide) are designated for ongoing incentives, rewards, liquidity provision, and DAO treasury.

As an illustration, Suilend ran a factors marketing campaign the place customers earned non-transferrable Suilend Factors for depositing property (10 million factors per day have been distributed) – these factors later translated into Mdrop allocations of SEND.

Supply: Suilend

Suilend additionally issued particular Capsule NFTs to group contributors (content material creators, meme-makers, integrators, and so forth.), which carried hidden advantages revealed at token launch (certainly, seemingly offering additional token rewards). This modern use of factors and NFTs gamified early participation and ensured a broad, engaged distribution of the token.

Token Utility – Governance and Rewards

The core objective of the SEND token is to empower the group in guiding and benefitting from the platform. SEND holders will govern the upcoming Suilend DAO, with the flexibility to suggest and vote on protocol modifications equivalent to adjusting rate of interest fashions, including new collateral varieties, or treasury allocations. Suilend explicitly notes that SEND holders have a “key function in shaping the longer term” of the protocol.

Income Sharing

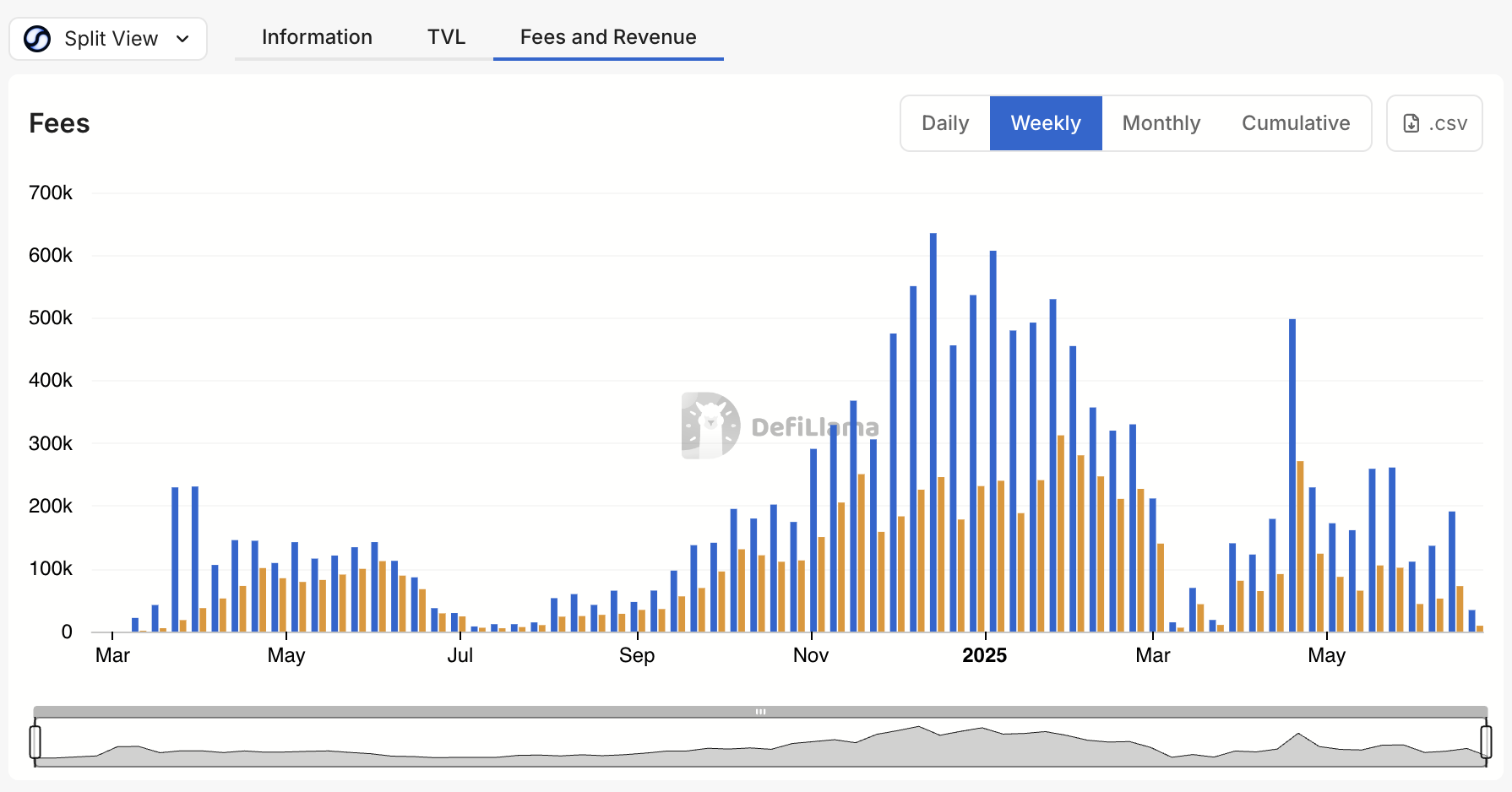

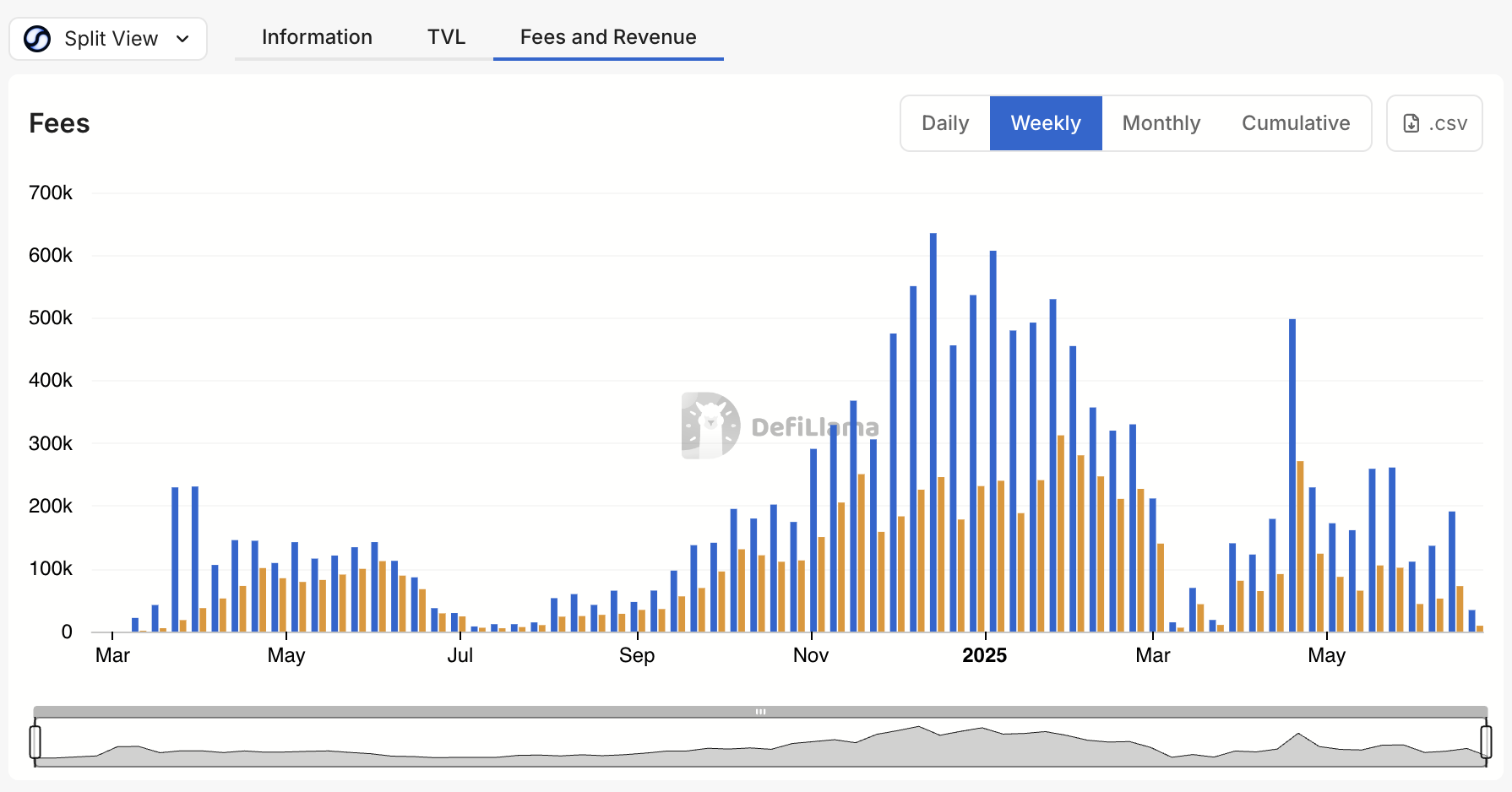

Past governance, SEND is poised to seize the financial success of Sui’s DeFi Suite. The staff plans to allow charge sharing to token holders from the protocol’s income. Suilend’s income comes from rate of interest spreads and charges. As an illustration, Suilend earns a portion of curiosity paid by debtors, and the STEAMM AMM prices a 0.06% protocol charge on swaps.

Supply: DefiLlama

Initially of 2025, Suilend was producing about $16 million annualized income from its lending operations, and this might develop as new merchandise like STEAMM mature. If a share of those charges is shared with SEND stakers or holders, it creates a robust worth accrual mannequin for the token. This aligns holders with the long-term well being of the ecosystem.

Incentives

SEND additionally capabilities as a reward token to incentivize utilization. For instance, liquidity suppliers, energetic debtors, or individuals in particular campaigns can earn SEND reward. This bootstraps liquidity and person progress. By distributing tokens to energetic customers, Suilend encourages platform loyalty whereas decentralizing possession.

In abstract, SEND’s tokenomics are designed to reward early adopters and align stakeholders. This mannequin mirrors the playbook of profitable DeFi protocols, the place tokens assist decentralised management and incentivize participation. Nonetheless, Suilend has added its personal twist with the Mdrop mechanism to advertise long-term engagement over fast flips.

Suilend Upside Potential and Alternatives

Suilend presents important upside potential as a flagship DeFi protocol throughout the quickly increasing Sui DeFi ecosystem. Sui’s Complete Worth Locked (TVL) has surged to over $2 billion in early 2025, demonstrating strong progress. Suilend, as a number one contributor, advantages straight from this elevated on-chain exercise and liquidity.

The protocol attracts new property, equivalent to stablecoins, as they launch on Sui, additional boosting its markets. This progress interprets into increased lending demand and elevated charge technology, doubtlessly accruing important worth to SEND token holders.

For extra: Greatest Sui Gaming and NFT Ecosystem

Supply: DefiLlama

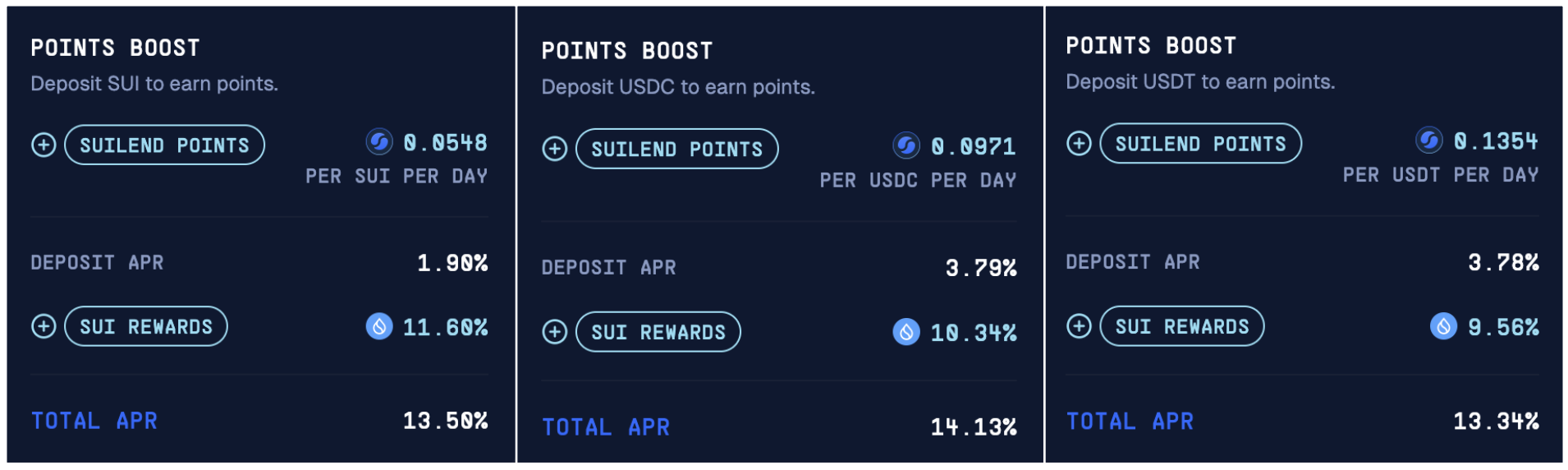

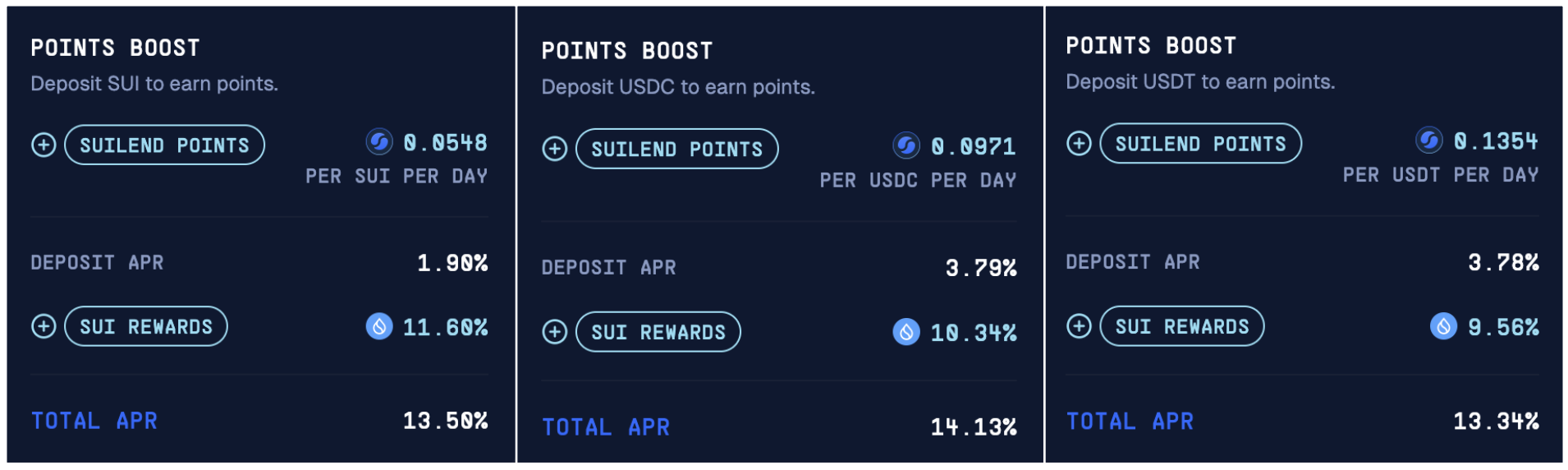

Lenders on Suilend discover aggressive, algorithmically decided rates of interest. SEND rewards and liquidity mining incentives typically increase these, creating engaging APYs. Debtors use these alternatives for yield farming. The SEND token gives robust worth. It permits governance and can seemingly entitle holders to a share of protocol revenues. These revenues have grown considerably, reaching an annualized fee of $16 million by early 2025.

Suilend’s modern staff has delivered a number of protocols. Its first-mover benefit positions it to evolve past conventional lending. This might combine new income streams like a perpetual change and launchpad, solidifying its function as a cornerstone DeFi platform on Sui.