Bitcoin is at the moment buying and selling at essential ranges, holding firmly above $105,000 however struggling to interrupt via the $109,000 resistance zone. This vary has develop into a decisive battleground between bulls and bears, with market members intently looking ahead to a breakout or breakdown within the coming days. Whereas bulls stay in management and proceed to defend key assist ranges, the failure to push into value discovery has raised issues {that a} correction could also be looming.

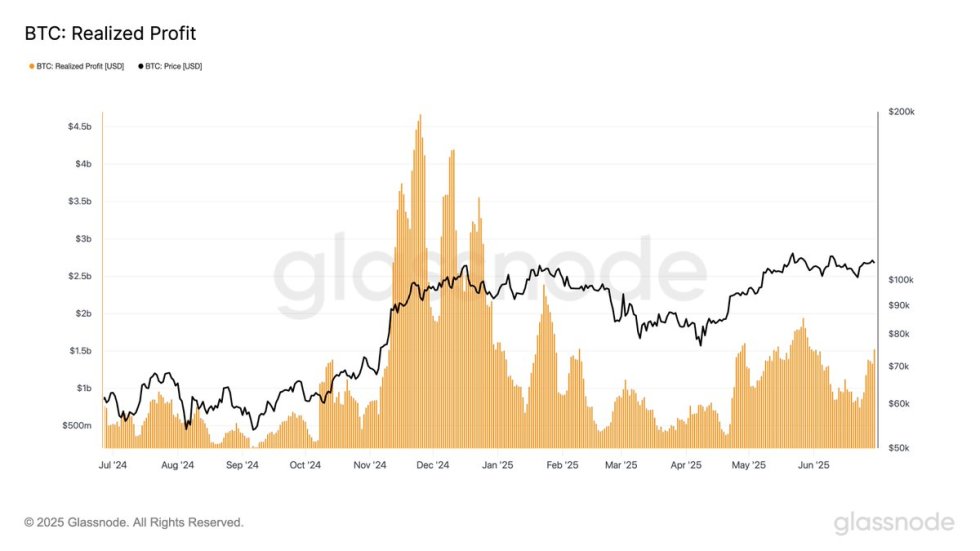

Including to this cautious sentiment, contemporary information from Glassnode reveals a notable uptick in profit-taking exercise throughout the Bitcoin community. Realized earnings surged to $2.46 billion in a single day, whereas the 7-day transferring common climbed to $1.52 billion, properly above the year-to-date common of $1.14 billion. Although nonetheless under the peaks seen in late 2024, this pattern alerts that buyers are starting to safe features, probably making ready for elevated volatility.

With sentiment break up and macro situations in flux, the approaching days could also be essential for Bitcoin’s subsequent main transfer. If bulls can reclaim the $109K stage, momentum might return. But when profit-taking intensifies, a deeper correction might convey BTC again towards the $100K mark.

Revenue-Taking Accelerates As Bitcoin Battles Resistance

Bitcoin has skilled important volatility in 2025, marked by aggressive value swings which have stored merchants on edge. The previous month alone has seen Bitcoin surge to a brand new all-time excessive close to $112,000 earlier than retracing to an area low of $98,000. Regardless of this uneven motion, the broader pattern stays constructive. Since rebounding from the $75,000 stage in April, Bitcoin has climbed over 15%, with bulls sustaining management and defending key assist zones.

This power coincides with a broader risk-on surroundings, because the US inventory market just lately reached a brand new all-time excessive. Many analysts consider Bitcoin and the broader crypto market might be subsequent in line to learn from improved sentiment and elevated investor urge for food.

Nevertheless, on-chain information from Glassnode reveals that profit-taking is ramping up once more. Yesterday, realized earnings on the Bitcoin community hit $2.46 billion, whereas the 7-day easy transferring common (SMA) climbed to $1.52 billion. This determine sits properly above the year-to-date common of $1.14 billion, suggesting a renewed wave of revenue realization amongst buyers. Nonetheless, these ranges stay significantly decrease than the $4–5 billion revenue spikes seen through the peak frenzy of November and December 2024.

Whereas these metrics don’t essentially sign a right away high, they replicate rising warning out there. As Bitcoin hovers just under its all-time excessive, the stability between bullish momentum and investor profit-taking can be key in figuring out whether or not BTC breaks greater or retraces additional within the classes forward.

BTC Struggles Under Crucial Resistance

The 12-hour chart of Bitcoin exhibits a transparent consolidation section that started in early Could. After a pointy rally above $100,000, BTC has been buying and selling inside an outlined vary, with key assist at $103,600 and stiff resistance close to $109,300. Worth briefly pushed above the 50- and 100-period transferring averages, however robust promoting stress has continued to dam any decisive breakout above the $109K zone.

At the moment, Bitcoin is buying and selling at roughly $106,557, barely under the short-term transferring averages, suggesting a possible cooling-off interval. Worth motion stays uneven, with a number of failed makes an attempt to ascertain a transparent pattern. Regardless of bullish makes an attempt to retest the higher resistance band, quantity has not confirmed a breakout, and wicks above $109K point out exhaustion at these ranges.

The $106K mark—aligned with the 50 and 100 SMAs—is performing as a dynamic assist, however a break under might rapidly ship BTC to retest the $103,600 stage. On the upside, bulls should clear $109,300 with conviction to set off a possible rally towards new all-time highs.

Featured picture from Dall-E, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent assessment by our group of high expertise consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.