Purpose to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business specialists and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

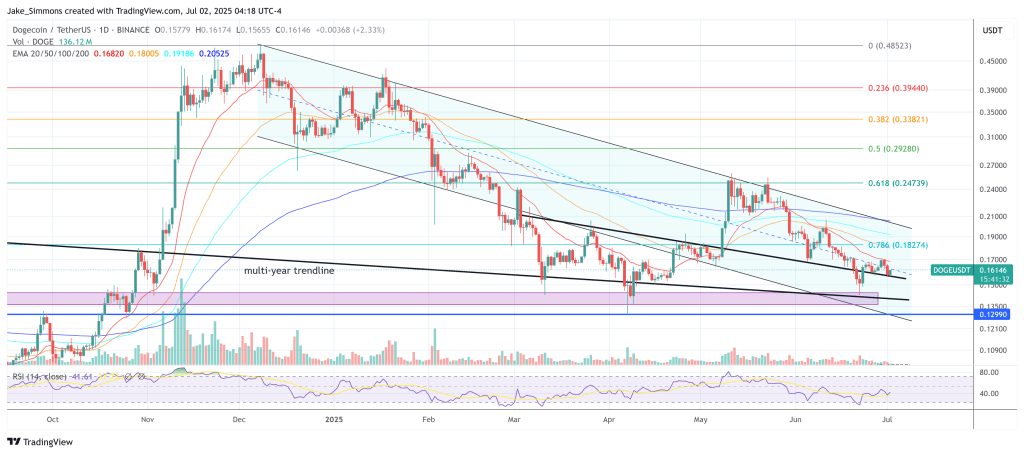

Dogecoin is revisiting a technical juncture it has not seen for the reason that months previous its 2020–21 parabolic rally, in keeping with a comparative chart revealed by the pseudonymous analyst Kaleo to his 705,000 followers on X. Within the annotated TradingView graphic, weekly candles for DOGE-USD hint two multi-year falling wedge constructions—one stretching from the January 2018 excessive to early 2021, and an nearly mirror-image sample extending from the Might 2021 peak till at present.

Historical past Repeating For Dogecoin?

The primary wedge resolved in late 2020 with a decisive breakout above a descending trend-line that had capped each rally for greater than thirty-six months. Kaleo marks that second with a yellow label studying “We’re right here” at roughly $0.003, instantly earlier than the value detonated to the cycle prime close to $0.75 in Might 2021.

Associated Studying

The present construction exhibits the identical downward-sloping resistance—now anchored by successive decrease highs from $0.16 in late 2022 to $0.11 in late 2023—lastly giving means. Because the, DOGE has recorded increased highs in April at $0.22 and in December 2024 at $0.48.

Friday’s shut printed at $0.1604, nonetheless under the psychological $0.20 threshold however fractionally above the dotted secondary resistance that has outlined the wedge’s higher boundary since mid-2022. Kaleo’s overlay initiatives the 2020 breakout trajectory ahead in time, mapping a near-vertical thrust from the current $0.16 space to roughly $0.55, a quick consolidation, and a continuation leg that tops near $3.50.

Whereas this higher goal hasn’t ever been printed in DOGE’s historical past, the analyst’s duplicate path underscores how little overhead construction exists as soon as value escapes the wedge.

Associated Studying

A key function within the chart are taking part in the 2 vertical dashed traces labeled “BTC Halving”: 12 Might 2020 and 21 April 2024. In Kaleo’s learn, Dogecoin’s macro reversals are synchronized with Bitcoin’s quadrennial provide shock, implying that the breakout may very well be a post-halving echo of the 2020 transfer.

Value development inside the wedge additionally mirrors the sooner cycle: successive decrease highs and better lows compress volatility till an impulsive weekly bar pierces resistance. The horizontal line intersecting the brand new breakout—would be the first main take a look at of post-wedge momentum. Under, the decrease dashed boundary intersects within the area between $0.10 and $0.09; a weekly shut beneath that flooring would invalidate the fractal.

Kaleo distills the setup right into a single line: “Dogecoin underneath 20 cents is free.” On the chart’s scale, the crimson quote-box at $0.1604 sits a hair’s breadth underneath the $0.20 psychological band, reinforcing the concept the risk-to-reward profile stays uneven as long as value stays under that quantity.

Whether or not historical past rhymes as exactly because the analyst’s fractal suggests will hinge on broader market liquidity and Bitcoin’s dominance, however from a purely structural perspective the meme-coin has already checked the identical packing containers it did 4 years in the past. And the US Federal Reserve cash printer hasn’t even began roaring once more.

At press time, DOGE traded at $0.161.

Featured picture created with DALL.E, chart from TradingView.com