Bitwise CIO Matt Hougan predicts a Bitcoin growth in 2026, breaking the four-year cycle. Regulatory readability within the U.S. and institutional demand to drive costs.

Matt Hougan, Chief Funding Officer of Bitwise Asset Administration, predicts a crypto growth in 2026. In 2025, crypto costs peaked in January earlier than correcting. BTC ▲0.92% slumped to $75,000, driving among the prime Solana meme cash like TRUMP crypto decrease.

Discover: Greatest Excessive-Danger, Excessive-Reward Crypto to Purchase in July 2025

Will 2026 Be an “Up 12 months” for Bitcoin?

The sell-off was the washout the market wanted to flush out speculative 100X leveraged merchants throughout a number of crypto exchanges.

After the dip, costs rose, breaching $110,000, earlier than extending positive aspects to $123,000. As of July 28, 2025, costs are at close to all-time highs, however bulls want to interrupt above $120,000 and July highs for the uptrend to proceed.

Hougan believes this bull run is inevitable, not in 2025 however in 2026. In an interview, the CIO expressed confidence in a significant worth restoration, stating that 2026 might be an “up yr,” with a “sustained, regular growth” for Bitcoin. In contrast to the risky peaks and troughs of previous cycles, he predicts Bitcoin will march steadily, printing “god candles” to new all-time highs.

DID I HEAR SUPER CYCLE???

The four-year cycle is useless and adoption killed it.@Matt_Hougan says we're going greater in 2026.

Early revenue takers might be left behind!!!

Full break down with @JSeyff and @Matt_Hougan in feedback

pic.twitter.com/Ffn9penapN

— Kyle Chassé / DD

(@kyle_chasse) July 25, 2025

If Bitcoin breaks $123,000 and reaches, say, $150,000 or $500,000 in 2026, it might break the four-year cycle traditionally related to the coin. Bitcoin costs, and thus, among the greatest cryptos to purchase, have loosely adopted a four-year cycle pushed by halving occasions for over a decade.

The Bitcoin community halves miner rewards roughly each 4 years, making the coin deflationary. The final halving was on April 20, 2024, lowering block rewards to three.125 BTC.

The bitcoin halving will lower incoming provide by 50%.

You don't must overthink it.

If demand is 10-20x greater than provide, Economics 101 taught you that worth has to go as much as accommodate everybody.

Right here is my phase with @cvpayne on Fox Enterprise in the present day. pic.twitter.com/qNvAO5Uk9E

— Anthony Pompliano

(@APompliano) March 11, 2024

This provide shock typically drives costs upward, as seen in 2013, 2017, and 2021. Hougan believes this cycle is now out of date on account of structural shifts shaping Bitcoin costs.

Regulatory Readability and Curiosity Charges to Drive Costs

Macroeconomic and regulatory developments are key drivers.

After Donald Trump’s election, he declared the US the house of crypto and Bitcoin.

POMPLIANO: "The U.S. authorities will announce in some unspecified time in the future that they’re shopping for Bitcoin."

Bitcoin strategic reserve is imminent

pic.twitter.com/pzGvpMGkhB

— Bitcoin Archive (@BTC_Archive) July 28, 2025

The institution of a Bitcoin reserve and the passing of the GENIUS Act, which supplies a authorized framework for stablecoins, sign regulatory readability.

Whereas in a roundabout way tied to Bitcoin, this advantages good contract platforms like Ethereum and Solana and reduces the chance of crackdowns seen throughout Gary Gensler’s tenure.

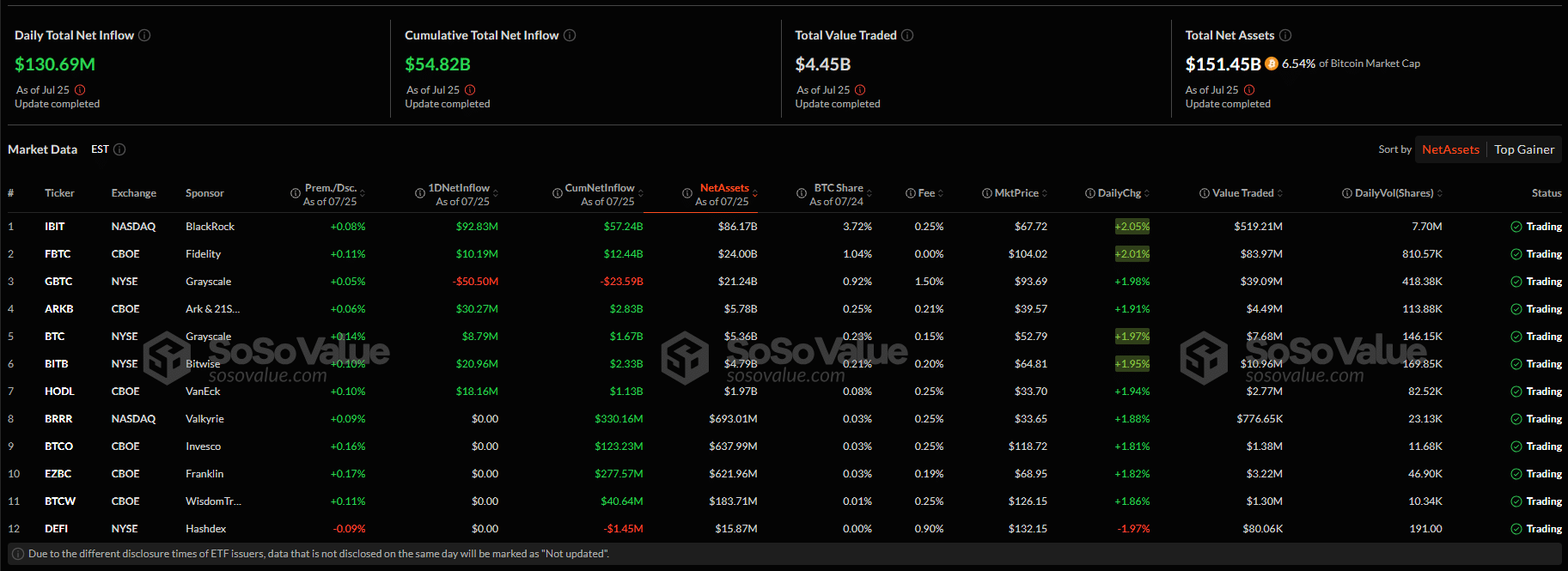

As a consequence of regulatory readability, establishments have invested over $151 billion in spot Bitcoin ETFs, with $130 million in BTC-backed ETF shares bought on July 25, 2025.

(Supply: SosoValue)

Moreover, President Trump is pushing for decrease rates of interest. Since April, Hougan notes, Trump has pressured Jerome Powell to chop charges, which may drive capital to Bitcoin and gold.

A low-interest-rate setting is usually “optimistic for crypto,” as seen within the 2020–2021 bull run when the Federal Reserve slashed charges to close zero to stimulate the economic system. If charges are lower on July 30, 2025, Bitcoin costs may soar.

DISCOVER: 18 Subsequent Crypto to Explode in 2025: Skilled Cryptocurrency Predictions & Evaluation

Bitwise CIO Matt Hougan Predicts a New Period for Bitcoin

Matt Hougan predicts a crypto and Bitcoin growth in 2026

Will Bitcoin break its four-year cycle?

Regulatory readability boosts investor confidence

Federal Reserve more likely to slash charges in July

The put up Bitwise CIO Matt Hougan Predicts a New Period for Bitcoin, Forecasts 2026 Rally appeared first on 99Bitcoins.