As Bitcoin as soon as once more finds itself in value discovery mode, market watchers and fans are curious: has retail FOMO set in but, or is the retail surge we’ve seen in previous bull cycles nonetheless on the horizon? Utilizing knowledge from energetic addresses, historic cycles, and numerous market indicators, we’ll look at the place the Bitcoin market at the moment stands and what it’d sign in regards to the close to future.

Rising Curiosity

Some of the direct indicators of retail curiosity is the variety of new Bitcoin addresses created. Traditionally, sharp will increase in new addresses have typically marked the start of a bull run as new retail traders flood into the market. In latest months, nevertheless, the expansion in new addresses hasn’t been as sharp as one may count on. Final yr, we noticed round 791,000 new addresses created in a single day—an indication of appreciable retail curiosity. As compared, we now hover considerably decrease, though we’ve not too long ago seen a modest uptick in new addresses.

View Dwell Chart 🔍

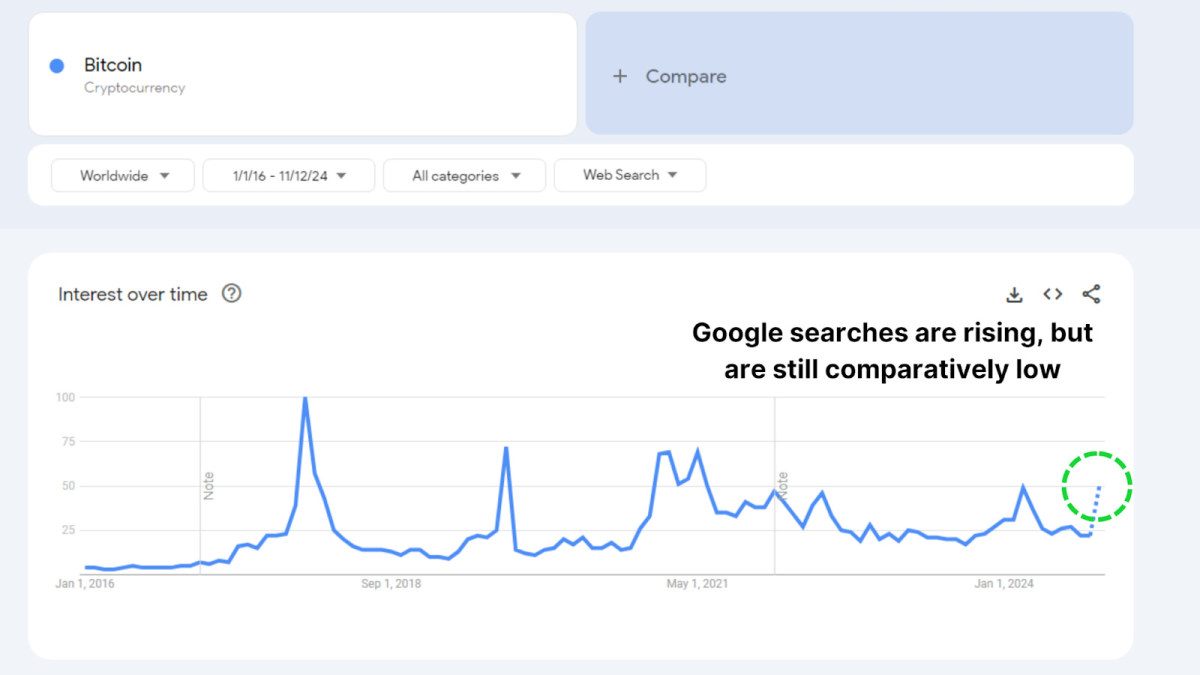

Google Developments additionally displays this tempered curiosity. Though searches for “Bitcoin” have been growing up to now month, they continue to be far beneath earlier peaks in 2021 and 2017. Plainly retail traders are displaying a renewed curiosity however not but the fervent pleasure typical of FOMO-driven markets.

Provide Shift

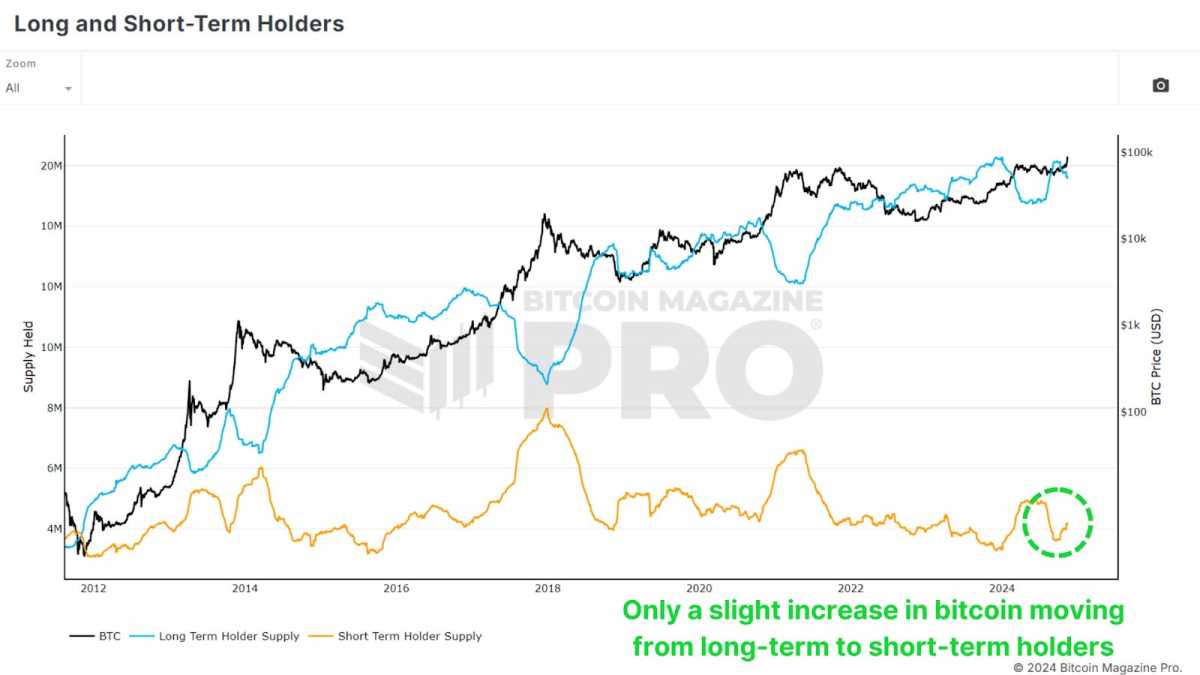

We’re witnessing a slight transition of Bitcoin from long-term holders to newer, shorter-term holders. This shift in provide can trace on the potential begin of a brand new market section, the place skilled holders start taking earnings and promoting to newer market individuals. Nevertheless, the general variety of cash transferred stays comparatively low, indicating that long-term holders aren’t but parting with their Bitcoin in important volumes.

View Dwell Chart 🔍

Traditionally, over the past bull run in 2020-2021, we noticed massive outflows from long-term holders to newer traders, which fueled a subsequent value rally. At present, the shift is just minor, and long-term holders appear largely unfazed by present value ranges, opting to carry onto their Bitcoin regardless of market beneficial properties. This reluctance to promote means that holders are assured in additional upside potential.

A Spot-Pushed Rally

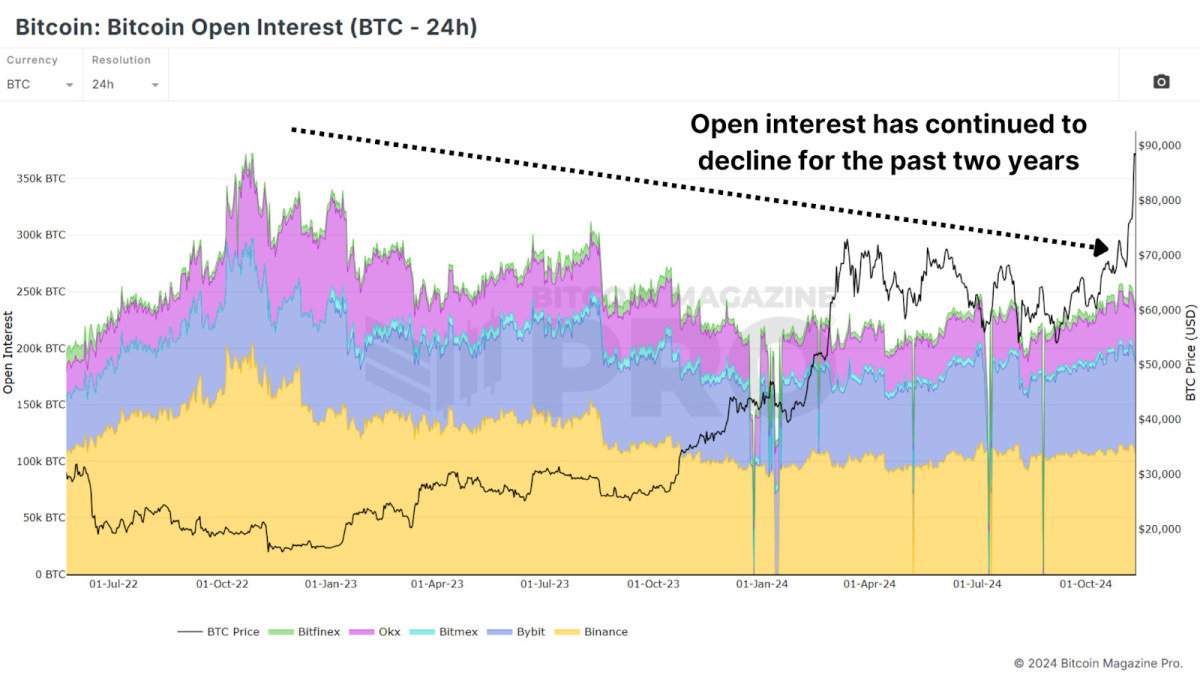

A key facet of Bitcoin’s newest rally is its spot-driven nature, in distinction to earlier bull runs closely fueled by leveraged positions. Open curiosity in Bitcoin derivatives has seen solely minor will increase, which stands in sharp distinction to prior peaks. As an illustration, open curiosity was important earlier than the FTX crash in 2022. A spot-driven market, with out extreme leverage, tends to be extra secure and resilient, as fewer traders are vulnerable to compelled liquidation.

View Dwell Chart 🔍

Massive Holders Accumulating

Apparently, whereas retail addresses haven’t elevated considerably, “whale” addresses holding a minimum of 100 BTC have been rising. Over the previous few weeks, wallets with massive BTC holdings have added tens of 1000’s of cash, amounting to billions of {dollars} in worth. This improve indicators confidence amongst Bitcoin’s largest traders that the present value ranges have extra room to develop, whilst Bitcoin reaches all-time highs.

View Dwell Chart 🔍

In previous bull cycles, we noticed whales exit or lower their positions close to market peaks, a habits we’re not seeing this time. This development of accumulation by skilled holders is a powerful bullish indicator, because it suggests religion out there’s long-term potential.

Conclusion

Whereas Bitcoin’s rally to all-time highs has introduced renewed consideration, we’re not but seeing the telltale indicators of widespread retail FOMO. The subdued retail curiosity suggests we could also be solely at first section of this rally. Lengthy-term holders stay assured, whales are accumulating, and leverage stays modest, all indicators of a wholesome, sustainable rally.

As we proceed into this bull cycle, the market’s construction means that the potential for a bigger retail-driven surge stays forward. If this retail curiosity materializes, it may propel Bitcoin to new heights.

For a extra in-depth look into this subject, try a latest YouTube video right here: Has Retail Bitcoin FOMO Begun?

![[LIVE] July 31 Crypto Updates – Bitcoin Holds $118K as Powell Freezes Rates Despite Trump’s Pressure: Best Crypto to Buy Now?](https://coindigestdaily.com/wp-content/themes/jnews/assets/img/jeg-empty.png)