Australian asset supervisor Monochrome lately introduced the appliance with Cboe Australia to checklist a Bitcoin exchange-traded fund (ETF) in Q2 2024.

The “strategic transfer” of its flagship product to Cboe goals to deepen the agency’s attain across the Asia-Pacific area.

A Change of Plans: From ASX To Cboe

In July 2023, the Australian asset supervisor agency Monochrome re-filed for its Monochrome Bitcoin ETF (IBTC) amid rising curiosity within the merchandise. Across the identical time, its counterparts within the US have been submitting their purposes to the Securities and Change Fee (SEC).

The re-filing got here after the Australian Securities and Investments Fee (ASIC) regulatory framework was up to date to permit crypto-asset exchange-traded merchandise.

Right this moment, Monochrome introduced its “strategic transfer” to Cboe Australia for its flagship product, IBTC. The Australian arm is one in every of Cboe World Markets’ 5 world itemizing exchanges.

It’s price noting that Australia’s utility course of differs from that of the US. Australian corporations ought to get approval from the nationwide regulator first earlier than making use of to be listed on an Change.

Monochrome had first deliberate to checklist its Bitcoin ETF on the Australian Securities Change (ASX). ASX usually holds a lot larger buying and selling volumes than Cboe Australia within the nation.

Nevertheless, ASX’s course of to approve Bitcoin ETF is seemingly longer and extra difficult. As reported by native shops, VanEck has been making an attempt to deliver a spot BTC ETF to ASX since 2021.

Arian Neiron, chief govt and managing director of VanEck Asia-Pacific, mentioned, “approval for an ASX-listed bitcoin ETF just isn’t imminent.” Neiron considers that many regulatory and change points have to be addressed “earlier than we see a bitcoin ETF on ASX.”

The Brisbane-based agency commented on its choice of Cboe as their itemizing venue. Monochrome emphasised “key elements” aligning the change and the agency objectives. The agency CEO, Jeff Yew, mentioned:

We’re proud to work with Cboe Australia to deliver Monochrome’s new bitcoin ETF to market, increasing the funding universe for Australian Traders. As leaders in digital belongings globally, their established monitor file and dedication to innovation and secure market accessibility aligns with Monochrome’s strategic aims.

Bitcoin is buying and selling at $66,640 within the 1-day chart. Supply: BTCUSDT on Tradingview.com

Bitcoin ETFs To Obtain A Extra Favorable Welcome

Monochrome’s flagship funding product goals to permit “publicity backed by expertise.” In keeping with its web site, IBTC’s regulated publicity will provide “passive funding” to the flagship cryptocurrency.

The fund can have a “passive purchase and maintain” method. This technique gained’t contain buying and selling, derivatives, or short-term worth hypothesis. Furthermore, the agency affirms that it really works carefully with exterior companies and technical professional advisors.

If accepted, IBTC can be the primary of its sort within the nation. The fund is proposed for launch in Q2 2024, however the date stays topic to regulatory approvals. Equally, the fund’s citation shall be conditioned by the market operator and regulatory approval.

The profitable launch of Spot Bitcoin ETFs within the US has broadened adoption and curiosity in crypto-based funding merchandise. Asset administration corporations are ready for regulatory establishments worldwide to approve their purposes or replace their regulatory framework.

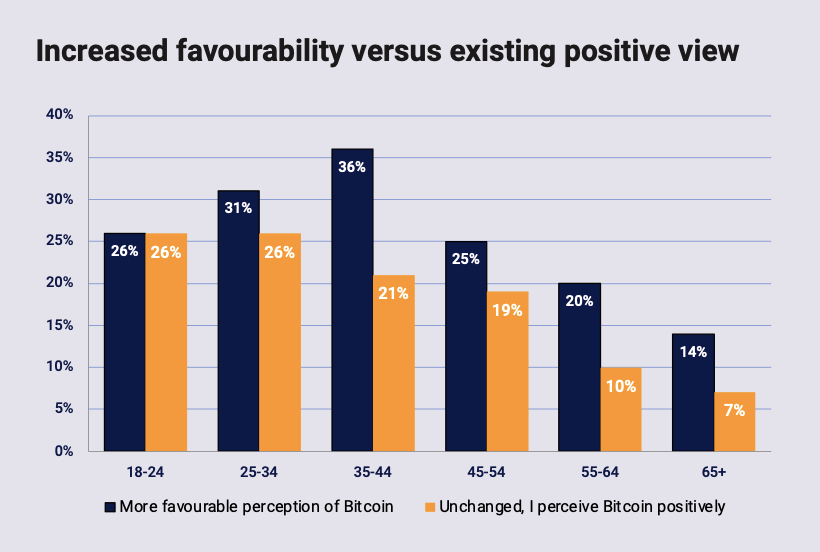

Notably, The Impartial Reserve Cryptocurrency Index (IRCI) Australia 2024 revealed that 25% of Australians see Bitcoin extra favorably after the approval and success of ETFs within the US. The annual research “examines Australian attitudes in direction of cryptocurrency, in addition to their stage of consciousness, adoption, belief and confidence within the rising market.”

Change in Australian’s Bitcoin favorability since BTC ETF’s launch. Supply: Impartial Reserve

In keeping with the research, lots of the interviewed individuals had a “extra favorable notion of Bitcoin.” The change in perspective consists of the older technology, as Australians 55 and older are “warming up” to the flagship cryptocurrency and crypto investments.

Featured Picture from Unsplash.com, Chart from TradingView.com