In 2025, DAOs management over $32 billion in on-chain treasuries, with top-tier DAOs controlling over a billion every—an unprecedented capital base for a brand new monetary specie. However these reserves aren’t longer idle luggage of governance tokens and ETH. DAOs are evolving into energetic portfolio managers, reallocating capital into stablecoins, real-world belongings (RWAs), and on-chain yield methods.

They’re additionally forging monetary alliances with each other, weaving a rising mesh of cross-DAO possession and strategic alignment—much less like grant-giving committees and extra like sovereign wealth funds for the Web financial system.

From Token HODLers to Strategic Allocators

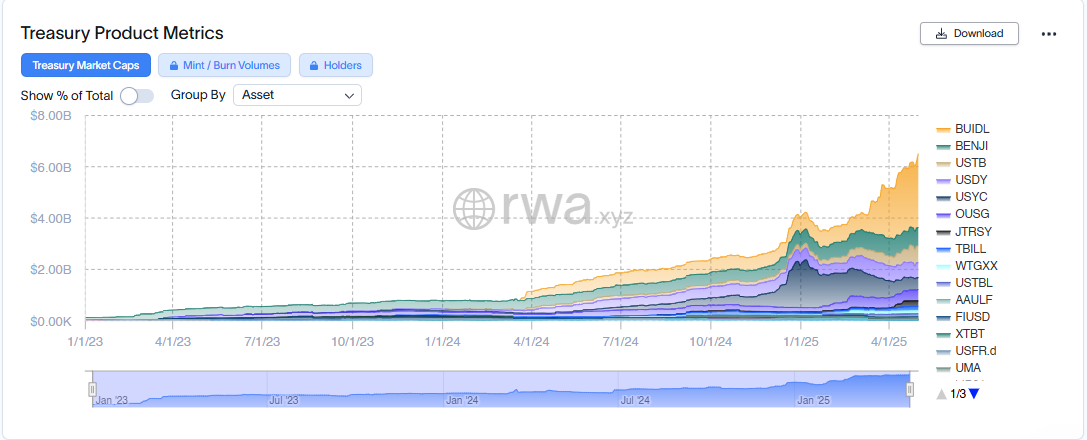

The panorama is shifting: DAO treasuries are maturing from passive token reserves into actively managed portfolios. They’re shifting threat away from unstable governance belongings towards steady, yield-bearing positions. Suppose stablecoins, tokenized Treasuries, non-public credit score, and even DAO-to-DAO fairness stakes. It’s a strategic pivot towards institutional-grade capital administration—designed to make DAOs extra resilient, autonomous, and future-proof. To know this evolution in observe, let’s study how a few of the ecosystem’s main DAOs are already rethinking their treasury methods.

Actual-World Belongings and Stablecoins: Anchors in Unstable Seas

Main the diversification cost is Arbitrum, which expanded its Steady Treasury Endowment Program (STEP 2.0) in early 2025. Working with Karpatkey, Arbitrum transformed a portion of its treasury into stablecoins and deployed them throughout lending protocols and RWA vaults to earn on-chain yield. The DAO cited the objective of making certain “higher monetary stability for the ecosystem,” which sharply contrasts the speculative ethos of early crypto treasuries.

Arbitrum has emerged as a flagship instance of the evolution of DAO treasury. In early 2025, it expanded its Steady Treasury Endowment Program (STEP 2.0), partnering with Karpatkey to reallocate treasury belongings into stablecoins and deploy them throughout lending protocols and RWA vaults to generate on-chain yield. The said objective? “Higher monetary stability for the ecosystem”—a far cry from the token-maxi mindset that when outlined DAO treasuries.

Equally, MakerDAO continues to dominate the RWA narrative. By 2025, it has deployed a whole bunch of tens of millions into U.S. Treasuries, non-public credit score, and tokenized actual property by entities like Monetalis and BlockTower. With the objective of backing 100B DAI by diversified, income-producing belongings, Maker is redefining what it means to be a crypto-native central financial institution.

The Ethereum Identify Service (ENS) DAO lately voted to swap 6,000 ETH for $20 million USDC utilizing a time-weighted common worth (TWAP) sale to attenuate slippage. The choice accompanied an growth of its endowment fund, aiming to cowl core working prices by yield somewhat than ongoing token gross sales. One contributor described the strategy as just like a “Web3 college endowment”—steady, long-term, and mission-aligned.

Cross-DAO Treasury Swaps: Aligning Incentives and Threat

In February 2025, Balancer DAO and CoW DAO accomplished a $500,000 token swap, every agreeing to carry the opposite’s governance token for a minimum of two years. This wasn’t a liquidity play—it was a strategic alignment tied to the CoWAMM initiative, a brand new DEX design constructed collaboratively by each groups. Governance rights had been scoped prematurely to keep away from energy grabs whereas enabling mutual illustration. Consider it as a DAO-native model of a inventory swap with out the legal professionals and company purple tape.

Different DAOs are paying consideration. Treasury professionals at Karpatkey have famous that “token swaps are rising as a solution to formalize collaboration. They’re not simply monetary transactions—they’re declarations of alignment.” The message is evident: DAO treasuries are evolving into instruments of diplomacy, not simply capital reserves.

DAOs as Proto Hedge Funds: Energetic, Delegated, and Information-Pushed

Managing a diversified treasury takes greater than vibes. DAOs are more and more bringing in skilled asset managers like Karpatkey, Llama, and Steakhouse Monetary—or forming inside committees like Arbitrum’s Treasury Administration Committee (TMC). These teams are empowered to rebalance portfolios, select yield methods, and vet counterparties, all inside governance-approved mandates.

Arbitrum’s TMC, as an example, was tasked with figuring out stablecoin managers and liquidity choices, combining group enter with institutional-grade execution. MakerDAO, in the meantime, runs a Strategic Finance core unit to supervise its complicated RWA positions. Day-to-day execution sometimes flows by Gnosis Protected multisigs, whereas key thresholds are determined by way of Snapshot and on-chain votes.

This mannequin echoes the construction of endowments and sovereign wealth funds, the place trustees and execution approve broad mandates is left to professionals. Nonetheless, for DAOs, it introduces a well-known tradeoff: the extra authority is delegated, the extra distance grows between governance and the ruled. Token holders at the moment are compelled to weigh monetary sophistication towards the core worth of decentralization.

The ROI of Treasury Sophistication

Are these diversification methods paying off? Early indicators level to sure. MakerDAO reportedly earns tens of millions in quarterly income from its U.S. Treasury bond holdings alone. ENS expects its endowment to cowl a big share of operational prices, easing the necessity to liquidate ETH. Arbitrum’s STEP 1 outcomes laid the groundwork for STEP 2—signaling clear group help.

As treasuries mature, DAOs are eyeing the following frontier: lending stablecoins to aligned protocols, backing early-stage tasks, or tapping into tokenized TradFi belongings like equities and actual property. They’re evolving into on-chain monetary establishments with diversified portfolios, structured mandates, and macro threat frameworks.

Monetary Complexity Is a Governance Threat

The contours of a brand new DAO financial system are taking form—a rising internet of token swaps, on-chain yield methods, and capital alignment throughout protocols. Half crypto-native, half institutional, this shift marks the emergence of DAOs as energetic monetary entities. However with higher sophistication comes higher duty—and new dangers.

Poorly managed publicity to RWAs, unstable collateral like depegging stablecoins, or misaligned treasury swaps can destabilize complete ecosystems. Extra importantly, monetary complexity usually results in governance opacity. As one contributor on the Maker Discussion board put it, “If token holders can’t perceive the financials, how can they govern them?”

Conclusion

DAO treasuries in 2025 are coming of age. From Arbitrum’s yield-seeking STEP to Maker’s RWA technique and Balancer’s token diplomacy with CoW DAO, we’re seeing a shift from passive reserves to energetic, strategically managed capital. With skilled managers, stablecoin buffers, and cross-DAO coordination, DAOs are shaping not simply their very own future however the structure of Web3 finance.

But, as treasury technique advances, the supporting infrastructure nonetheless trails behind. Governance tooling, reporting, and incentive programs should evolve to maintain tempo. In the meantime, DeFi AI is gaining momentum, with early asset administration instruments already rising—and DAOs might show to be the pure coordination layer between on-chain people and AI brokers.

Trying forward, DAO treasuries might quickly resemble on-chain hedge funds or sovereign wealth DAOs. The road between protocol governance and capital allocation is blurring—and the outcomes of those early experiments might outline the following decade of decentralized finance. As DAOs change into stewards of real-world capital, the large query isn’t simply how they make investments—however who decides. Will decentralized governance maintain tempo with institutional sophistication—or be left behind?

Writer: Roman Melnyk, the chief advertising officer at DeXe.io.

DisclaimerThis can be a press launch. The data supplied on this article is for informational functions solely and doesn’t represent monetary recommendation. DeFi Planet doesn’t endorse or advocate any particular funding selections and reminds readers to conduct their very own analysis and due diligence earlier than taking any monetary actions. DeFi Planet just isn’t accountable, instantly or not directly, for any injury or loss brought on or alleged to be attributable to or in reference to the usage of or reliance on any content material, items or providers talked about within the press launch.

If you wish to learn extra articles like this, go to DeFi Planet and comply with us on Twitter, LinkedIn, Fb, Instagram, and CoinMarketCap Neighborhood.

“Take management of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics instruments.”