Be part of Our Telegram channel to remain updated on breaking information protection

Binance, the highest alternate by quantity, has formally eliminated Monero from its platform as of Tuesday, February 20. This transfer follows the announcement made on February 10, signaling the top of XMR’s presence on the main international buying and selling platform. Amidst this improvement, Binance is navigating a difficult interval, searching for to align with regulatory calls for worldwide. The alternate’s earlier CEO, Chanpeng Zhao, is underneath investigation in the US and faces journey restrictions, regardless of residing within the UAE.

The choice to delist Monero didn’t come out of the blue. In 2023, Binance declared its intention to take away XMR and different privacy-focused cryptocurrencies within the European Union to stick to regulatory requirements. Nevertheless, the alternate retracted its determination a month later.

Monero, identified for its privacy-enhancing options that render transactions untraceable, has more and more caught the eye of regulatory our bodies. These authorities contend that the coin’s anonymity capabilities might facilitate the financing of illicit actions.

At present, the most important exchanges that proceed to help XMR embrace Kraken Worldwide, KuCoin, and Bitfinex. Binance has not supplied an elaborate rationale for Monero’s removing. The alternate said:

At Binance, we periodically overview every digital asset we listing to make sure that it continues to fulfill a excessive stage of normal and business necessities. When a coin or token not meets these requirements or the business panorama adjustments, we conduct a extra in-depth overview and doubtlessly delist it.

This situation is just not unprecedented inside the Monero neighborhood. Different exchanges have beforehand delisted the coin for authorized causes. Kraken eliminated Monero from its platform within the UK in 2021, Huobi adopted swimsuit in 2022, and OKX introduced its determination to stop supporting the coin as a buying and selling pair on January 4, 2024.

Because the delisting course of unfolds, all Monero commerce orders will probably be robotically canceled after buying and selling ceases. Binance has hinted at the potential of changing delisted tokens into stablecoins for customers after Could 21, 2024, although this stays unconfirmed. In anticipation of the delisting, Binance withdrew XMR from its “earn” program and halted loans for the cryptocurrency.

Monero Customers Hit With Difficulties Throughout the Delisting

Nevertheless, Monero holders have encountered challenges in the course of the delisting course of. Regardless of the withdrawal deadline not being reached, customers have reported difficulties in withdrawing their cash from Binance. One consumer expressed frustration on X, questioning Binance’s motives for retaining any XMR in a chilly pockets with solely hours left till delisting.

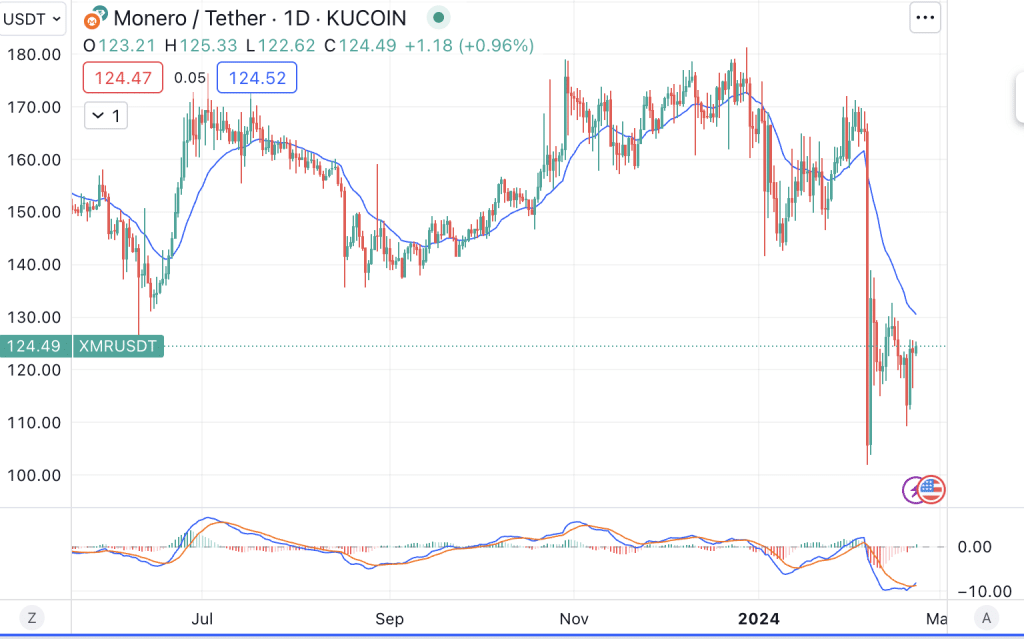

Monero’s value skilled a major 36% drop on the day of the announcement, adopted by a interval of sideways buying and selling. Merchants offered off their cash in anticipation of the delisting, inflicting the worth of XMR to fall from $121.8 to $113.1. Nevertheless, day merchants seem like capitalizing on the dip, because the coin has since recovered 6.4%, reaching its present value of $120.45 and almost offsetting yesterday’s losses.

$XMR refused to be cucked to remain on cucked CEXs. XMR is leaving binance as a result of it will not concede on privateness. That is very bullish, a stand like it will cement Monero in a prime 5 spot long run, finally #1. One of many solely cash that’s really used like cash. Very energetic.

— Goku (@xmrGoku) February 7, 2024

The outlook for Monero stays bearish, significantly following the February 6 crash. The coin is testing the resistance set by its common value during the last 10 days, a hurdle that has confirmed troublesome to beat prior to now week. Moreover, the coin is closely oversold, indicating market concern and a pattern the place sellers outnumber patrons (a Relative Power Index or RSI of 39 means that out of each 100 merchants, 39 need to purchase the coin, and the remaining need to promote it), and the bearish pattern continues.

Associated Information

New Crypto Mining Platform – Bitcoin Minetrix

Audited By Coinsult

Decentralized, Safe Cloud Mining

Earn Free Bitcoin Every day

Native Token On Presale Now – BTCMTX

Staking Rewards – Over 50% APY

Be part of Our Telegram channel to remain updated on breaking information protection

.gif?format=1500w&w=75&resize=75,75&ssl=1)