Bitcoin is beneath immense promoting strain at press time, and printing discourages decrease lows. Whereas the coin finds a ceiling at $66,000 and bears focusing on a retest of $60,000 and even Might lows, one analyst is defiant.

Bitcoin Analyst Upbeat: Subsequent Cease $500,000?

In a put up on X, the analyst admitted that the coin is at the moment treading on a precarious path. As issues stand, Bitcoin is teetering between the potential of mass institutional adoption within the subsequent few months and the crashing probability of a harmful worth dump from the colossal Mt. Gox payout set for July 2024.

Even so, whereas there’s a likelihood Bitcoin may crash, even retesting $60,000 within the coming days, the analyst mentioned the prospect of worth features subsequent 12 months far outweighs the potential of a crash dump. In accordance with the dealer’s evaluation, Bitcoin might dump to $40,000 on the decrease finish.

Nevertheless, if consumers take cost, the coin might float to as excessive as $500,000 inside 12 months. This evaluation presents a compelling risk-reward proposition that will massively profit HODLers who can’t be shaken by short- or medium-term bear cycles.

Contemplating what’s on the desk, the analyst emphasised the “uneven alternative introduced by Bitcoin.” It’s a function, the dealer argues, that makes the world’s Most worthy coin the “most tasty funding out there.”

Spot ETF Inflows To Counter Mt. Gox BTC Sale?

Particularly, the analyst banks on BTC to rise as a consequence of institutional inflows. Based mostly on this outlook, the dealer assesses that if pension funds and advisors allocate $200 billion to identify Bitcoin exchange-traded funds (ETFs), it might be sufficient to propel costs by almost 12X within the coming months.

In a current report, Bernstein mentioned establishments will possible begin allocating funds in spot BTC ETFs in Q3 and 4 2024. If true, this growth could be a game-changer since it might pave the best way for a brand new wave of deep-pocketed traders.

Regardless of the billions of inflows to identify Bitcoin ETFs within the final 5 months, there have been ready on the sidelines for improved liquidity. If something, Bernstein is bullish, predicting the coin to succeed in $200,000 by 2025 and $1 million by 2033.

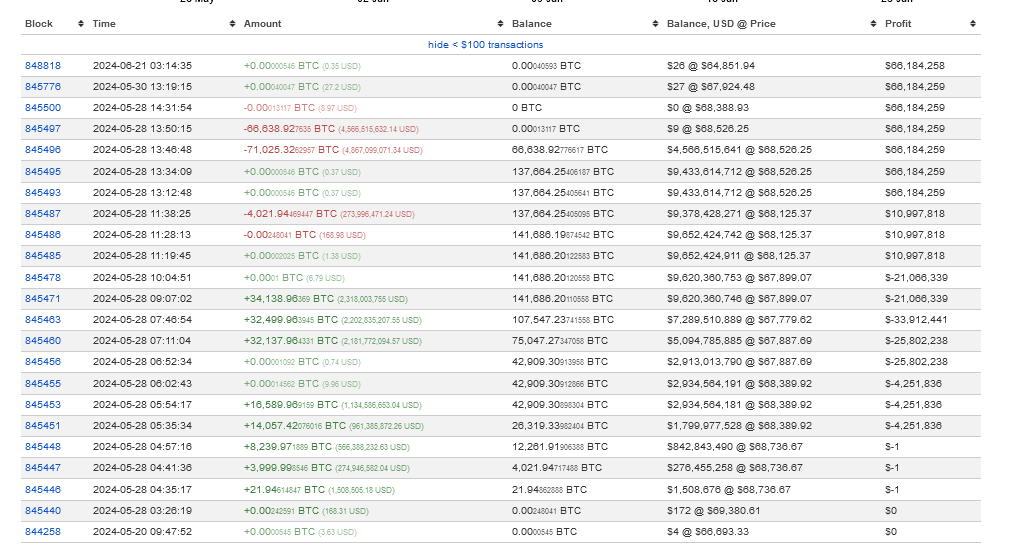

Bullish as analysts could also be, there are potential roadblocks alongside the best way. In late Might, over 140,000 BTC have been moved from a number of wallets belonging to the defunct Mt. Gox trade to a brand new deal with, information from Bitinfocharts present. To compensate the Mt. Gox hack victims, collectors will promote BTC and distribute them from July 2024.