Bitcoin (BTC) has been gathering some momentum within the crypto sphere currently, crossing the $60,000 mark towards a number of analysts’ indicators. The world’s main cryptocurrency has been on a wild trip, with its worth fluctuations going haywire through the previous few weeks.

Bullish Elements Driving Bitcoin Worth

One main driver behind the current worth surge in Bitcoin is the understanding {that a} spot Bitcoin ETF is more likely to be authorised by the SEC. With immense anticipation of such a choice from the SEC, which is more likely to lastly open the door for elevated institutional investments within the cryptocurrency, many buyers are risking an entrance on the present ranges.

One other issue that has been driving Bitcoin’s worth has been the discount in new BTC provide following the halving occasion within the second half of 2024. Usually, costs for Bitcoin have soared after halving by multiples, because the diminished provide straight correlates with larger demand and worth.

#bitcoin 200wma over $38k pic.twitter.com/olAw6BOjgz

— Adam Again (@adam3us) August 21, 2024

Bitcoin’s 200-Week Shifting Common Offers Sturdy Assist

Blockstream CEO Adam Again defined that the 200-week shifting common of Bitcoin had risen previous $38,000, a degree that now supplies strong assist for the cryptocurrency. Certainly, the 200MA has repeatedly been handled as one of the vital indicators in Bitcoin evaluation because the cryptocurrency by no means went under this shifting common.

One other revealing metric so far as new Bitcoin features are involved could be the holding patterns of the asset. In line with info printed by the net website BTCDirect, 69% of BTC supplying has not moved for a 12 months and even longer. After all, one other occasion of a lessening quantity of BTC in circulation helps to alleviate promoting strain on the asset additional, cementing a bullish thesis for Bitcoin.

Bearish Elements To Think about

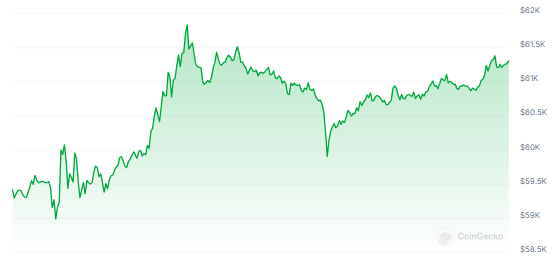

On the time of writing, Bitcoin was buying and selling at $61,245, up 3.0% within the final 24 hours, and sustained a 4.7% achieve within the final seven days, information from Coingecko exhibits.

Regardless of the current worth spike in Bitcoin, there are some bearish elements that stay within the background, one in every of which is the Mt. Gox repayments which might be more likely to put extra promoting strain into the market. Earlier within the week, the notorious trade made one other whopping switch to Bitstamp, setting off attainable promoting strain.

Different bear elements are a scarcity of readily obvious bull catalysts close to time period for Bitcoin, with the next being the most recent from banking behemoth JPMorgan, advising purchasers to be very aware earlier than shopping for into Bitcoin’s current worth restoration, because the cryptocurrency is more likely to face headwinds into the subsequent a number of months.

Featured picture from Pexels, chart from TradingView