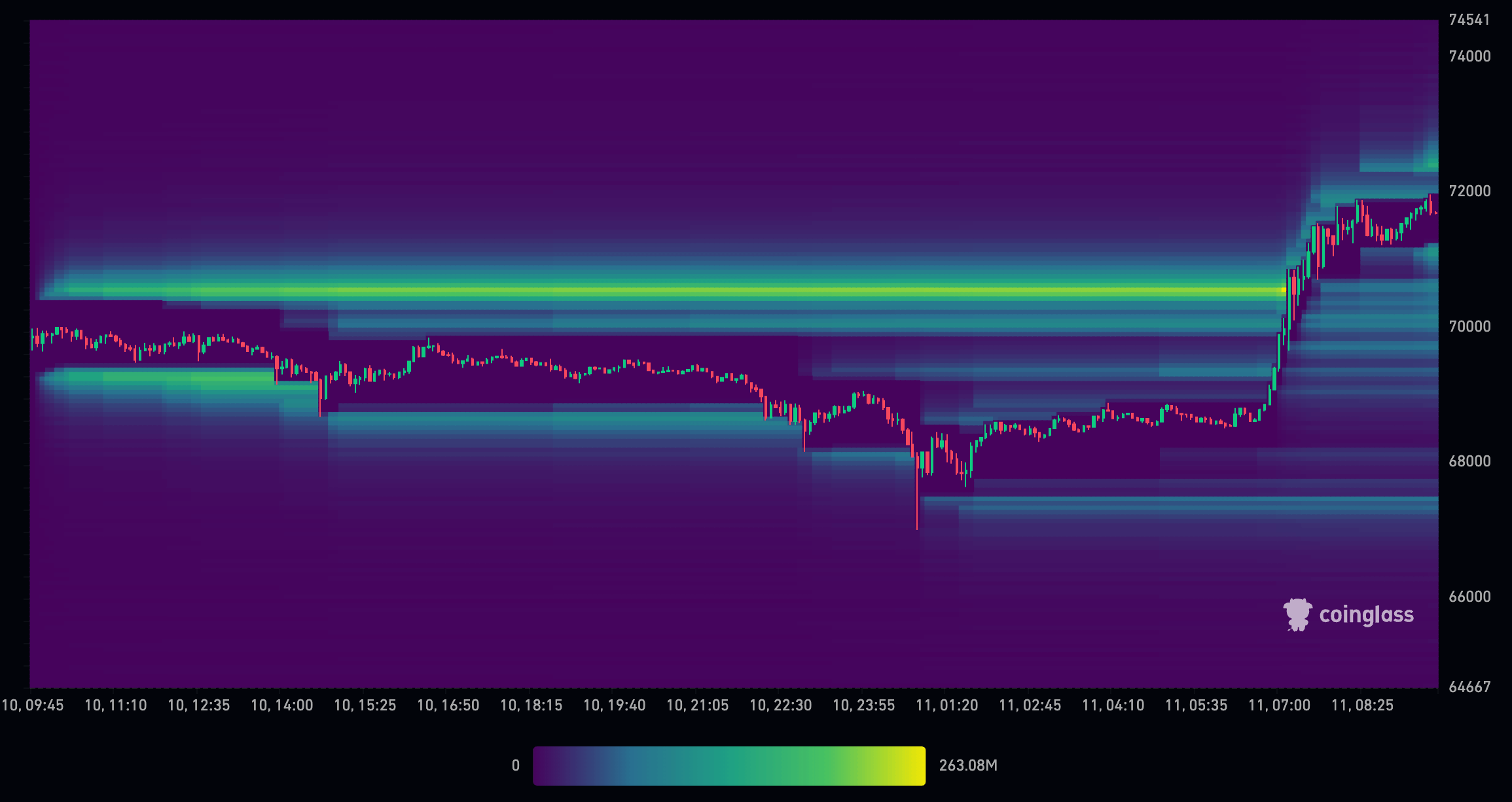

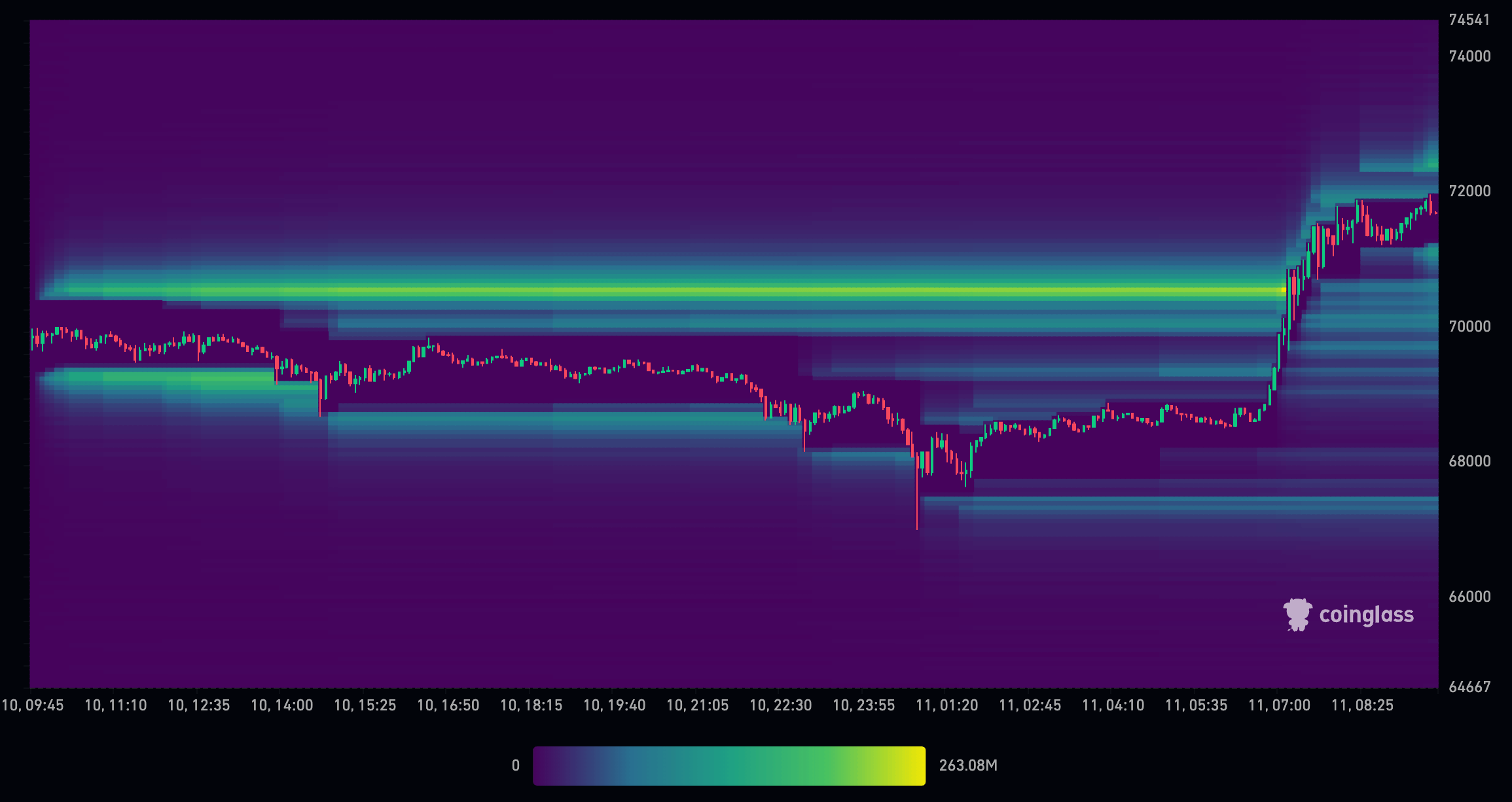

Latest information on Bitcoin liquidations and leverage ranges signifies distinctive value discovery exercise as longs and shorts have been swept from the market. A lot of the leveraged positions had been shaken out final week as Bitcoin noticed risky value actions across the US market open.

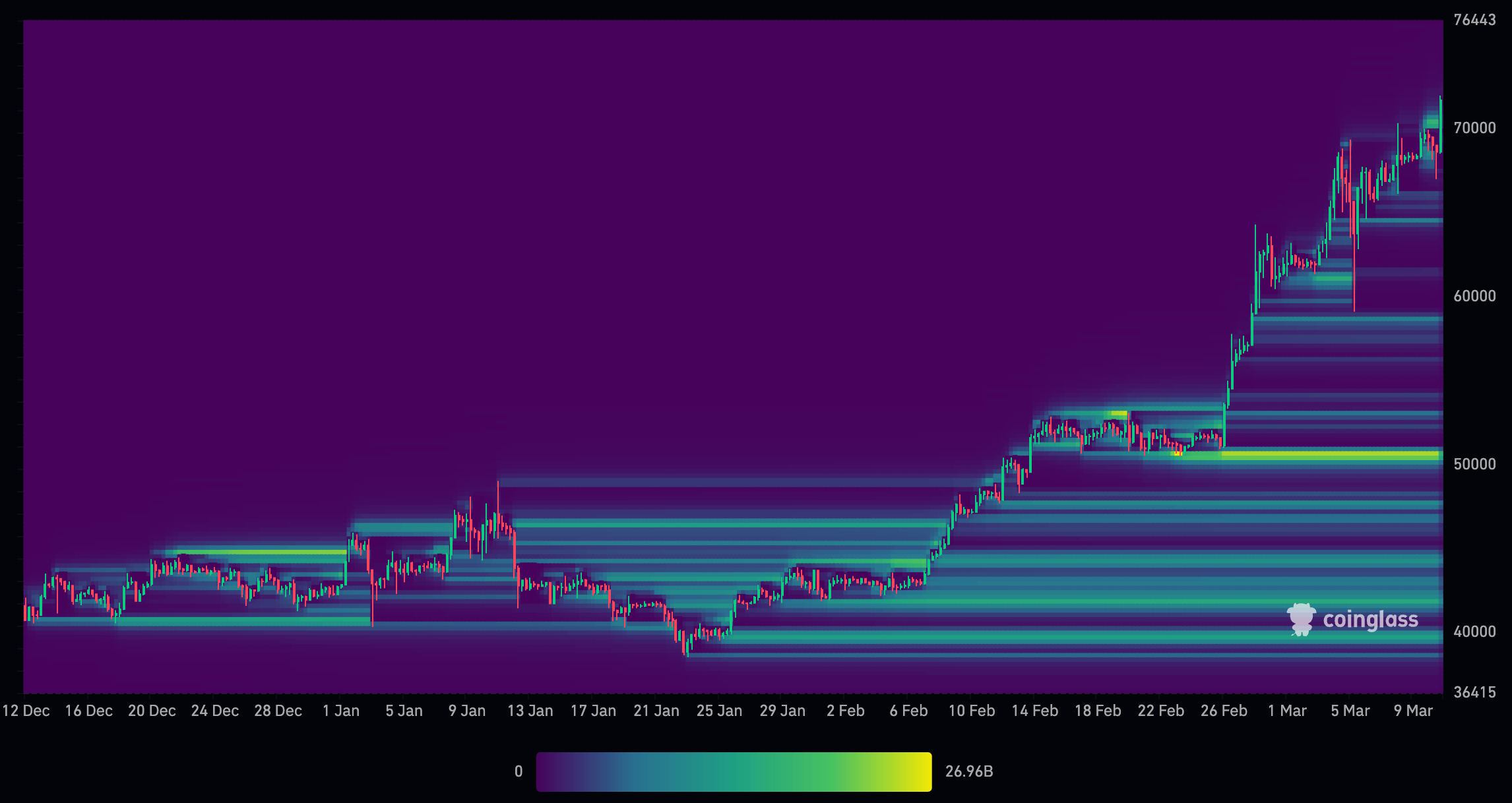

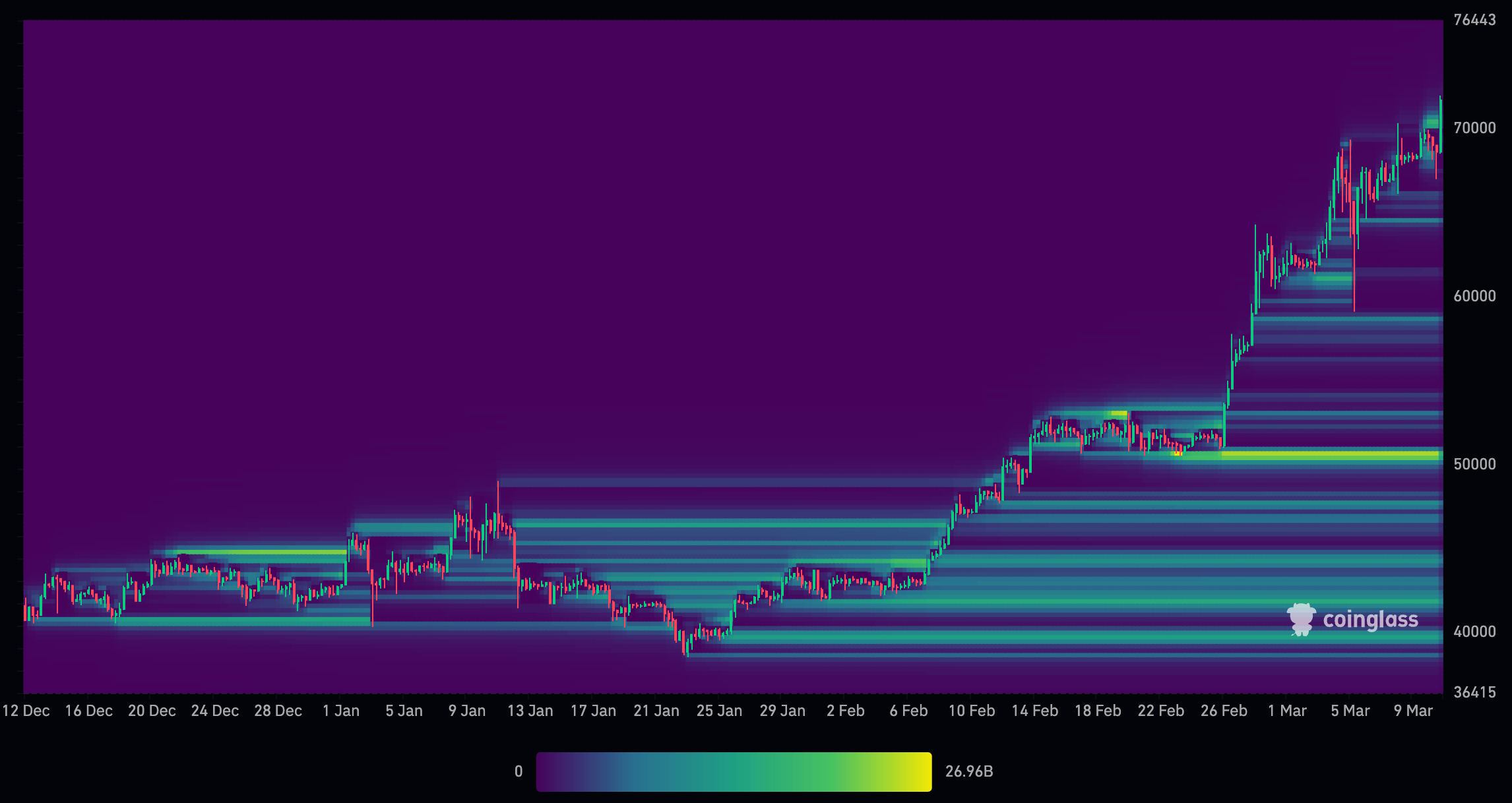

The liquidation chart from CoinGlass under highlights how buying and selling exercise on March 5 and eight round 2.30 pm GMT (US market open) led to heavy liquidations of each lengthy and quick positions. A roughly 2% enhance was adopted by a lower of over 10% on March 5, which swept the order books and flushed out all leverage all the way down to $60,000.

The next speedy V-shaped restoration noticed additional leverage positions created round $70,000 and $66,000. The market open on March 8 shook these out, leaving little to no leverage above $66,000.

As of March 11, the drop to $67,000, adopted by a surge to new highs round $71,500, has once more eliminated most leveraged positions above $66,000, setting a stable ground. The impact of such actions is that Bitcoin now has free reign for pure value discovery above $66,000.

Not like the bull market of 2021, which was closely influenced by extremely leveraged positions, the present cycle seems to be shaking out leverage earlier than it has the prospect to trigger important volatility. Additional, key institutional gamers and market makers could have a hand in clearing the route for Bitcoin’s value discovery via large-scale buying and selling actions.

The function of market makers in value discovery

Market makers and, extra lately, ETF-authorized individuals closely affect monetary markets, conducting the movement of purchase and promote orders with precision, and are answerable for offering liquidity, which is the lifeblood of any asset’s market. By quoting steady bid and ask costs, they goal to revenue from the unfold, however their function extends far past mere revenue technology.

In periods of excessive volatility, market makers have interaction in a strategic maneuver often called “sweeping” the order ebook. This entails putting many orders at various value ranges to probe the market’s depth and confirm the true stability of provide and demand. This sweeping motion is a probe into the market’s current state and a catalyst for value discovery, revealing the degrees at which market individuals are keen to transact in important volumes.

The latest sweep of leverage from the Bitcoin market has profoundly impacted value circumstances. With the removing of leveraged promote orders, the market has witnessed a discount in downward strain, permitting for a extra natural value discovery course of. That is characterised by a market much less influenced by the amplified bets of leveraged merchants and extra by its participant’s real sentiment and valuations.

Because the market adjusts to the brand new equilibrium free from the burden of leveraged positions, the worth of Bitcoin is extra more likely to mirror its precise market worth. This isn’t to say that the trail will likely be linear or devoid of volatility; the crypto market is understood for its speedy value swings. Nevertheless, the present panorama suggests the circumstances are ripe for a extra sustained upward pattern.

Leverage discount and order ebook sweeping since December

A better have a look at the market forces from December 2022 to March 2023 explains the route for additional value discovery.

In December, the market witnessed substantial liquidations of leveraged positions, with many longs liquidated simply above the $41,000 stage and shorts liquidated round $45,000. As Bitcoin approached the ETF approval on January 11, many shorts had been opened across the $45,000 stage, which continued as the worth dropped to round $40,000. Curiously, there weren’t many longs at this stage, suggesting that the worth was supported by holders and basic value discovery moderately than leveraged positions.

As Bitcoin rebounded from $40,000 and climbed towards $45,000 by early February, a number of shorts had been liquidated alongside the way in which. As Bitcoin continued its upward trajectory, longs had been positioned from $40,000 to $50,000. By the point Bitcoin reached $50,000, there have been substantial leveraged positions, amounting to roughly $27 billion. Nevertheless, as the worth elevated, the quantity of leveraged positions above $50,000 diminished significantly.

The value motion in the beginning of March noticed Bitcoin surge to $70,000 after which plummet to $59,000 inside a single candlestick, successfully wiping out almost all leveraged positions out there. Though there was some leverage round $70,000, the vast majority of leveraged positions are actually concentrated under $50,000.

The liquidation of leveraged positions has led to a extra clear market construction, with a extra balanced distribution of longs and shorts. This improvement may pave the way in which for a extra natural value discovery course of pushed by real market demand moderately than leveraged hypothesis.

The latest liquidations and discount of leveraged positions within the Bitcoin market counsel a possible shift in the direction of a extra essentially pushed market. With the vast majority of leveraged positions now concentrated at cheaper price ranges, there may be room for the market to expertise upward strain as real demand and adoption drive costs greater.

Eradicating extreme leverage has set the stage for a more healthy market dynamic, the place value discovery is guided by elementary elements equivalent to rising mainstream acceptance, regulatory readability, and technological developments within the blockchain house.

The latest liquidations and leverage information present a compelling case for a possible upward pattern pushed by natural value discovery.