Motive to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business specialists and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

Contemporary on-chain knowledge means that regardless of Bitcoin (BTC) buying and selling near its all-time excessive (ATH), long-term holders (LTHs) should not offloading their holdings. As an alternative, these buyers are persevering with to build up the world’s largest cryptocurrency by market capitalization, signaling their confidence in additional value positive aspects within the coming weeks.

Lengthy-Time period Bitcoin Holders Are Not Promoting But

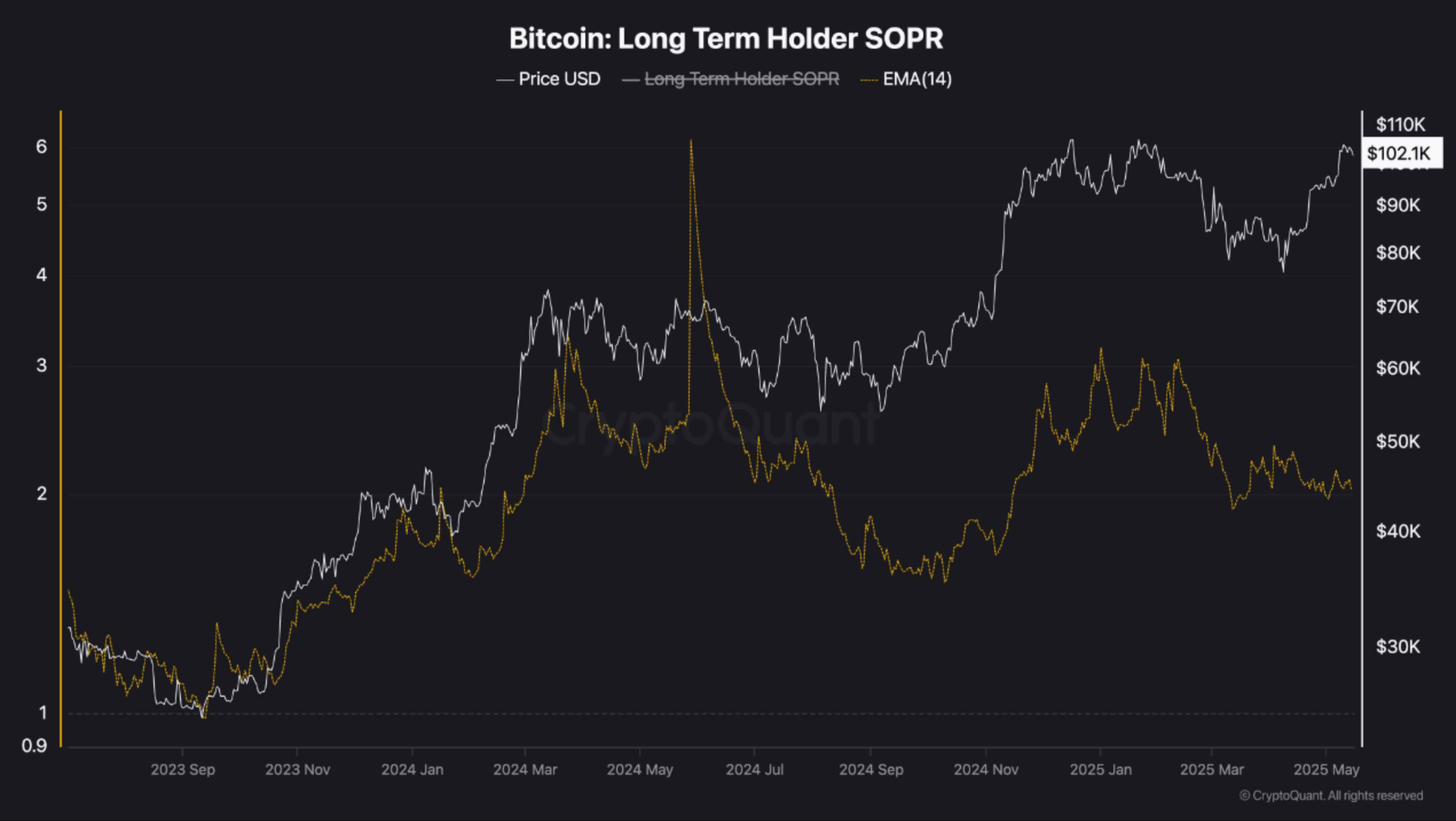

In keeping with a latest CryptoQuant Quicktake publish by contributor ShayanMarkets, profit-taking amongst long-term holders stays comparatively low, whilst BTC trades close to its ATH. Traditionally, profit-taking exercise tends to extend considerably when Bitcoin approaches its earlier excessive, as many buyers look to lock in positive aspects. Nevertheless, that has not been the case within the present market cycle.

Associated Studying

The analyst highlighted that Bitcoin consolidating close to ATH ranges usually ends in important revenue realization by market members. But, present knowledge reveals that LTH – those that have held BTC for greater than 150 days – haven’t begun large-scale profit-taking.

Particularly, the LTH Spent Output Revenue Ratio (SOPR) metric is heading downwards even when BTC continues to steadily surge towards a brand new ATH round $109,000. The analyst explains:

This decline means that long-term holders haven’t but engaged in notable profit-taking. As an alternative, they look like accumulating, signaling confidence in greater value targets and anticipating new all-time highs.

In essence, the continued BTC consolidation section appears to be pushed extra by short-term holders (STHs) and retail merchants. Traditionally, these investor segments are extra reactive to cost swings, responding swiftly to each upward and downward actions.

The analyst additional said that Bitcoin is prone to resume its bullish development following this era of consolidation. If historical past repeats itself, the subsequent upward motion might propel BTC to new document highs within the mid-term.

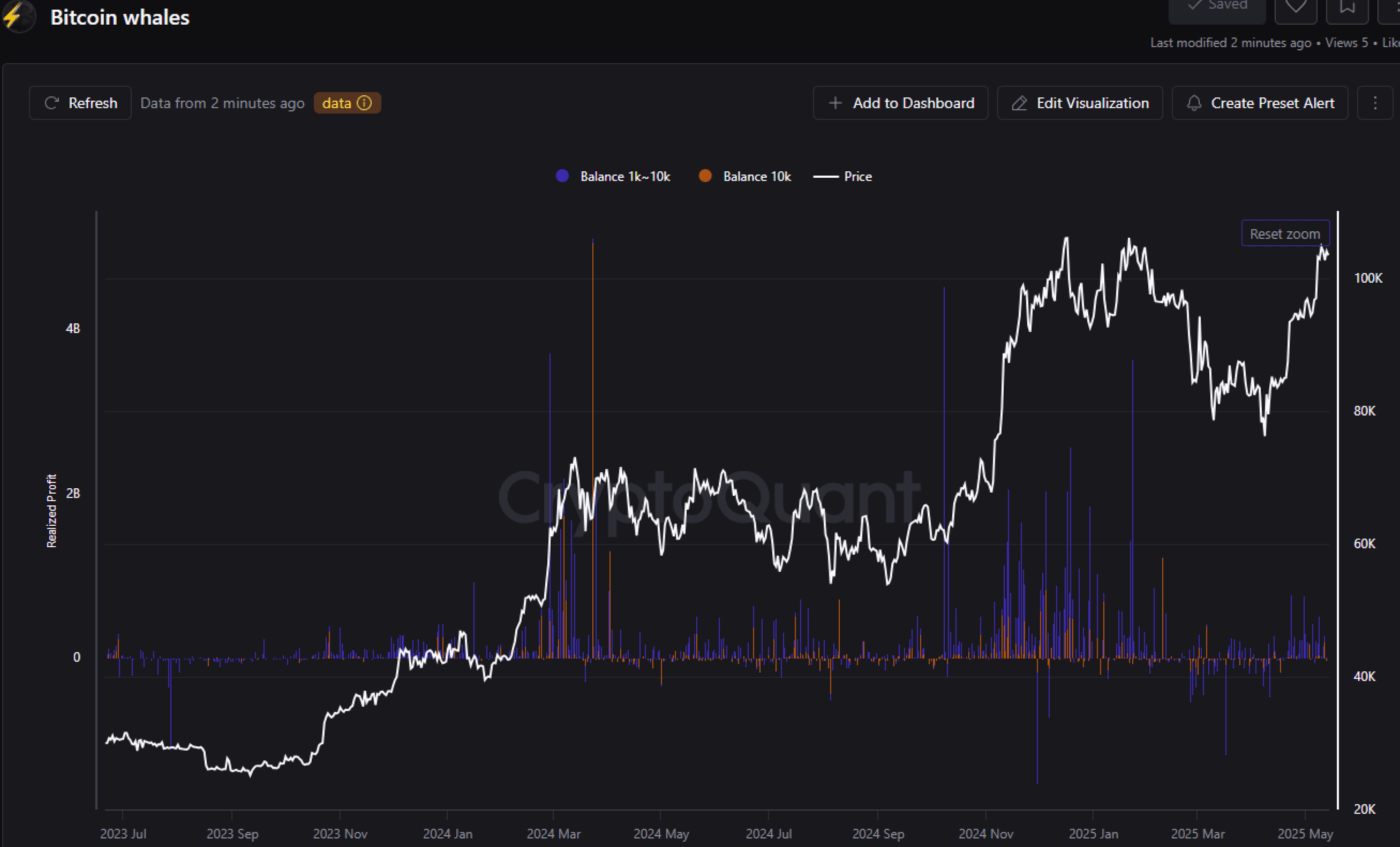

Evaluation from fellow CryptoQuant contributor BlitzzTrading helps this outlook. BlitzzTrading noticed that BTC whales – wallets holding important Bitcoin holdings – have taken a lot much less revenue in comparison with earlier bull runs.

This habits suggests a long-term funding mindset amongst whales, aligning them extra intently with LTHs than retail merchants or short-term speculators. It’s truthful to say that BTC whales are usually long-term buyers, usually holding their positions by means of market cycles, in contrast to smaller holders who are likely to commerce extra ceaselessly.

BTC Could Comply with Gold’s Historic Value Motion

Curiously, comparisons at the moment are being drawn between Bitcoin and gold. Gold has seen spectacular positive aspects over the previous two years, rising from round $1,800 per ounce in mid-2023 to about $3,200 per ounce at present – a rise of almost 75%.

Associated Studying

Crypto analyst Cryptollica lately remarked that BTC is prone to observe gold’s footsteps and expertise comparable extraordinary positive aspects in 2025. The analyst forecasted that BTC could surge as excessive as $155,000 this yr.

Equally, the Bitcoin Bull-Bear Market Cycle indicator is pointing towards the continuation of bullish momentum for the apex cryptocurrency. At press time, BTC trades at $101,852, down 1.5% prior to now 24 hours.

Featured picture from Unsplash, charts from CryptoQuant and Tradingview.com