Bitcoin skilled a wave of volatility following the information that Galaxy Digital executed one of many largest notional Bitcoin gross sales in historical past—an 80,000 BTC transaction on behalf of a long-term shopper. The announcement, made in a press launch on July 25, confirmed that the sale was efficiently accomplished and instantly despatched shockwaves via the market.

The dimensions of the transaction drew widespread consideration, sparking intense hypothesis throughout the crypto area. Whereas Galaxy Digital emphasised the skilled execution and strategic nature of the sale, the sheer quantity concerned created uncertainty round short-term value path. Merchants reacted shortly, inflicting sharp fluctuations in Bitcoin’s value as market individuals weighed the implications.

With sentiment swinging between warning and confidence, Bitcoin’s response to this historic sale might outline its near-term pattern—and supply perception into how the market handles high-volume exits in a maturing ecosystem.

Bitcoin Absorbs Promoting Stress

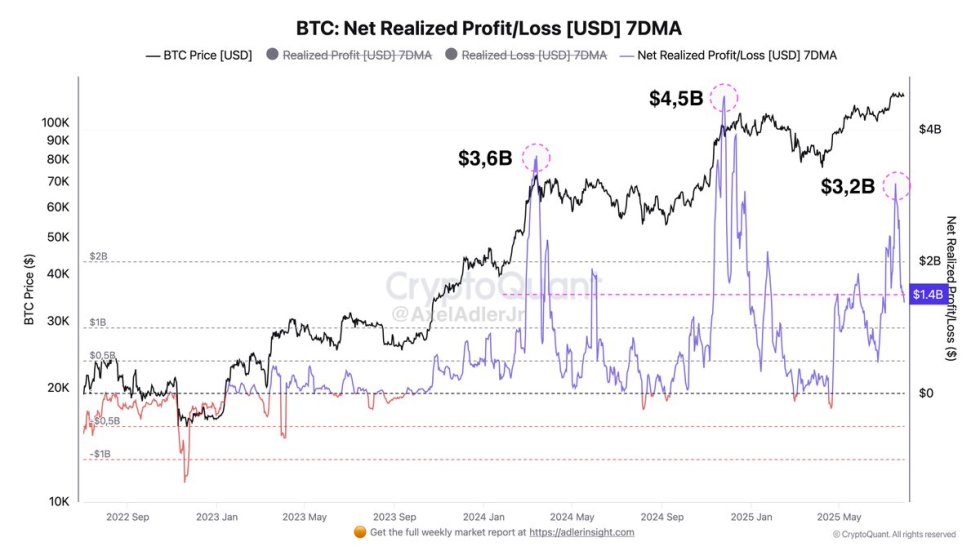

In accordance with prime analyst Axel Adler, the market is steadily digesting the current 80,000 BTC distribution executed via Galaxy Digital. Following the transaction, the Web Realized Revenue/Loss (NRPL) metric, which tracks combination realized positive factors and losses on-chain, surged to a cycle excessive of $3.2 billion. Nevertheless, Adler notes that this determine has now cooled to $1.4 billion, signaling that preliminary profit-taking could have peaked.

Regardless of the dimensions of the distribution, Bitcoin’s value has proven exceptional stability. This means that the market is absorbing the newly circulated provide with out important draw back stress, an indication of underlying power and demand. Nonetheless, Adler cautions that the NRPL stays elevated, which means the distribution part will not be over but. So long as realized earnings keep above baseline ranges, additional promoting stress might persist within the background.

In the meantime, futures market knowledge reveals that bears try to regain management. With open curiosity rising and brief positioning growing barely, some merchants are aiming to push BTC towards the $110,000 stage—a psychological and technical assist zone. Whereas bulls preserve structural dominance for now, these makes an attempt could create short-term volatility.

If Bitcoin continues to soak up provide with out main breakdowns, it might reinforce the bull case. Nevertheless, if NRPL stays excessive and futures-driven stress intensifies, the market could face a deeper pullback earlier than the subsequent leg up. For now, Bitcoin stays at a crossroads, balancing sturdy demand with persistent distribution.

BTC Holds Vary As Momentum Stalls

Bitcoin continues to commerce inside a well-defined vary, with value at present sitting at $118,182.62 on the 4-hour chart. The consolidation zone is clearly marked by resistance at $122,077 and assist at $115,724. After a number of failed makes an attempt to interrupt above $122K, BTC has settled into sideways motion, reflecting a brief stability between patrons and sellers.

The 50, 100, and 200 SMAs—now tightly aligned between $114,000 and $118,000—counsel that momentum is impartial, with short-term pattern path unclear. Value is at present hovering just under the 50 and 100 SMAs, indicating slight bearish stress, however not sufficient to set off a significant breakdown. Quantity has remained comparatively low all through this part, reinforcing the consolidation construction.

Bulls proceed to defend the $115.7K assist stage, however the lack of follow-through on breakouts above $120K is beginning to erode short-term confidence. Bears could try to push the worth decrease, particularly with futures positioning indicating a slight benefit on the draw back.

Featured picture from Dall-E, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluate by our staff of prime know-how specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.