Bitcoin is buying and selling above the $90,000 mark once more, signaling renewed power as bulls achieve momentum regardless of persistent international uncertainty. The broader market stays on edge amid rising tensions between the US and China, coupled with lingering issues over inflation and financial slowdown. Nonetheless, optimism round Bitcoin continues to develop, with a number of analysts suggesting the opportunity of a sustained rally within the months forward.

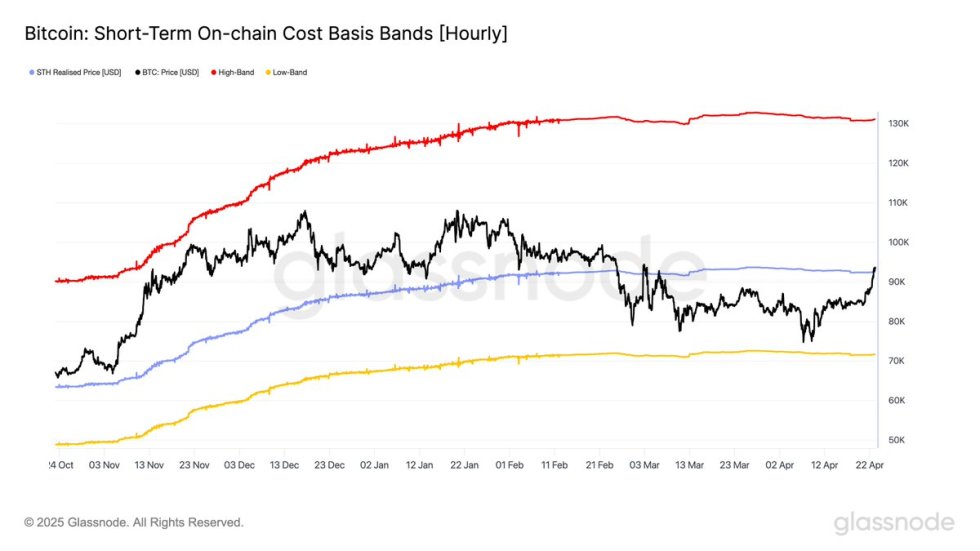

One of many key alerts supporting this view comes from on-chain information shared by Glassnode. The analytics platform revealed that Bitcoin has now damaged above the Quick-Time period Holder (STH) realized worth. This metric, which tracks the common worth at which latest consumers acquired their BTC, is commonly seen as a psychological degree that influences short-term sentiment.

Glassnode has persistently highlighted this degree as a benchmark for gauging market sentiment, and breaking above it’s thought-about a major step in confirming purchaser confidence. Now, all eyes are on whether or not Bitcoin can maintain above $90K and start concentrating on new highs.

Bitcoin Exams Key Resistance as Bulls Regain Management

After weeks of persistent promoting stress and a pointy 30% drawdown from its highs, Bitcoin is lastly displaying indicators of restoration. The asset is now testing a vital resistance zone, and the result of this battle will possible outline the short-term trajectory. Bulls have reclaimed management in latest classes, and the market’s consideration is now centered on whether or not they can defend the $90,000 assist degree and push greater.

This latest power comes regardless of continued macroeconomic turbulence. The battle between the US and China stays unresolved, and the specter of an prolonged commerce battle continues to hold over international markets. A delay in any decision may carry renewed volatility, which can affect Bitcoin’s subsequent main transfer. Nonetheless, BTC’s resilience amid these headwinds is a promising signal for long-term holders.

Supporting the bullish case, Glassnode lately highlighted that Bitcoin has damaged above the Quick-Time period Holder (STH) realized worth — or value foundation — for the primary time because the correction started. This degree is extensively seen as a key benchmark for investor sentiment and positioning.

Traditionally, a sustained transfer above the STH realized worth alerts a shift towards renewed confidence and infrequently serves as a springboard for additional upside. For now, Bitcoin bulls are in management — however holding $90K is crucial to keep away from one other wave of downward stress.

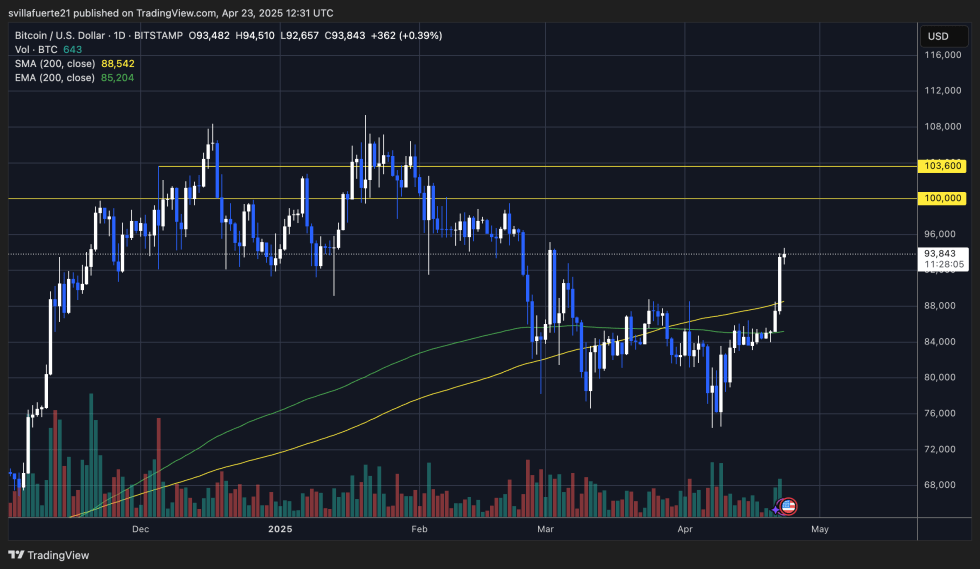

BTC Value Replace: Bulls Eye $100K After 25% Rally

Bitcoin is buying and selling at $93,800 after two days of robust upside momentum, marking a powerful 25% achieve since April 9. The surge has propelled BTC via key resistance ranges and lifted sentiment throughout the broader crypto market. After weeks of consolidation and uncertainty, bulls are firmly again in management — however the subsequent transfer shall be vital in figuring out whether or not the rally continues.

To maintain this momentum, Bitcoin should maintain above the $90,000 assist zone. This degree now acts as a short-term ground, and defending it could solidify the present breakout. If bulls can keep stress and reclaim the psychological $100,000 mark, a full pattern reversal shall be confirmed and sure attract contemporary capital.

Nonetheless, if BTC fails to carry $90K, a wholesome retest of decrease assist across the 200-day easy transferring common close to $88,500 may comply with. This could not essentially invalidate the bullish pattern however may reset key indicators earlier than one other leg greater.

For now, bulls are in a powerful place — however volatility stays elevated, and the approaching days shall be decisive because the market awaits affirmation of a sustained restoration section.

Featured picture from Dall-E, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent overview by our crew of prime know-how consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.