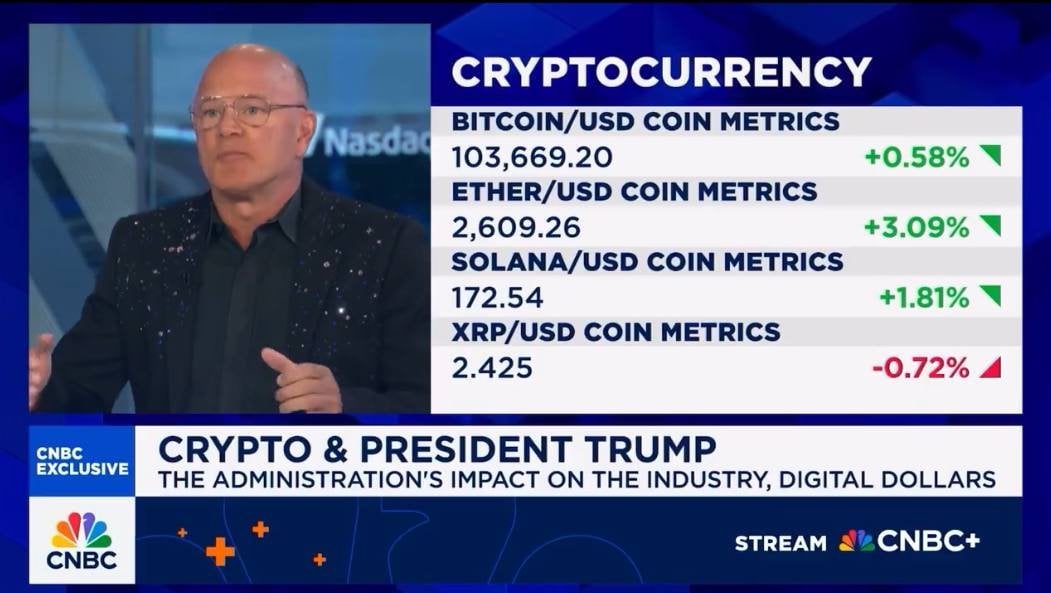

In a current CNBC look, Mike Novogratz, the CEO of Galaxy Digital, shared an optimistic outlook for Bitcoin, predicting it may surge to $130,000 to $150,000 within the close to future.

Mike Novogratz describes ‘unfair, infuriating’ path to Galaxy Digital’s Nasdaq itemizing https://t.co/ECDc57HwqS

— CNBC (@CNBC) Could 16, 2025

Mike Novogratz’s Formidable Forecast for Bitcoin

His insights, mentioned within the context of the Trump administration’s affect on the crypto business, present an in depth perspective on Bitcoin’s market trajectory and its comparability to conventional property like gold.

Novogratz highlighted Bitcoin’s important rally since Donald Trump’s election in November 2024, with the worth climbing almost 50% to round $103,700 by Could 16, 2025. He attributed this surge to a mixture of things, together with elevated investor confidence following Trump’s pro-crypto stance and the market’s response to conventional property like gold.

Supply: CNBC

The CEO of Galaxy Digital famous that Bitcoin BTC typically follows gold’s actions, and with gold experiencing substantial positive factors, Bitcoin is poised to do the identical. He predicted that Bitcoin may quickly break by resistance ranges at $106,000, $107,000, and $108,000, probably reaching $130,000 to $150,000, getting into a part of “value discovery.”

Bitcoin’s Emergence as a Digital Gold within the Macroeconomic Panorama

The billionaire additionally pointed to the euphoria surrounding Trump’s inauguration and the rise of Trump-themed cryptocurrencies as catalysts for market pleasure. Nevertheless, he cautioned that such enthusiasm may result in risky corrections, as seen in previous cycles.

Learn extra: CEO Pantera Capital Predicts Explosive Bitcoin Progress for Many years Amid Macroeconomic Shifts

Regardless of this, Novogratz stays assured in Bitcoin’s long-term prospects, that are pushed by growing adoption amongst youthful traders and institutional gamers.

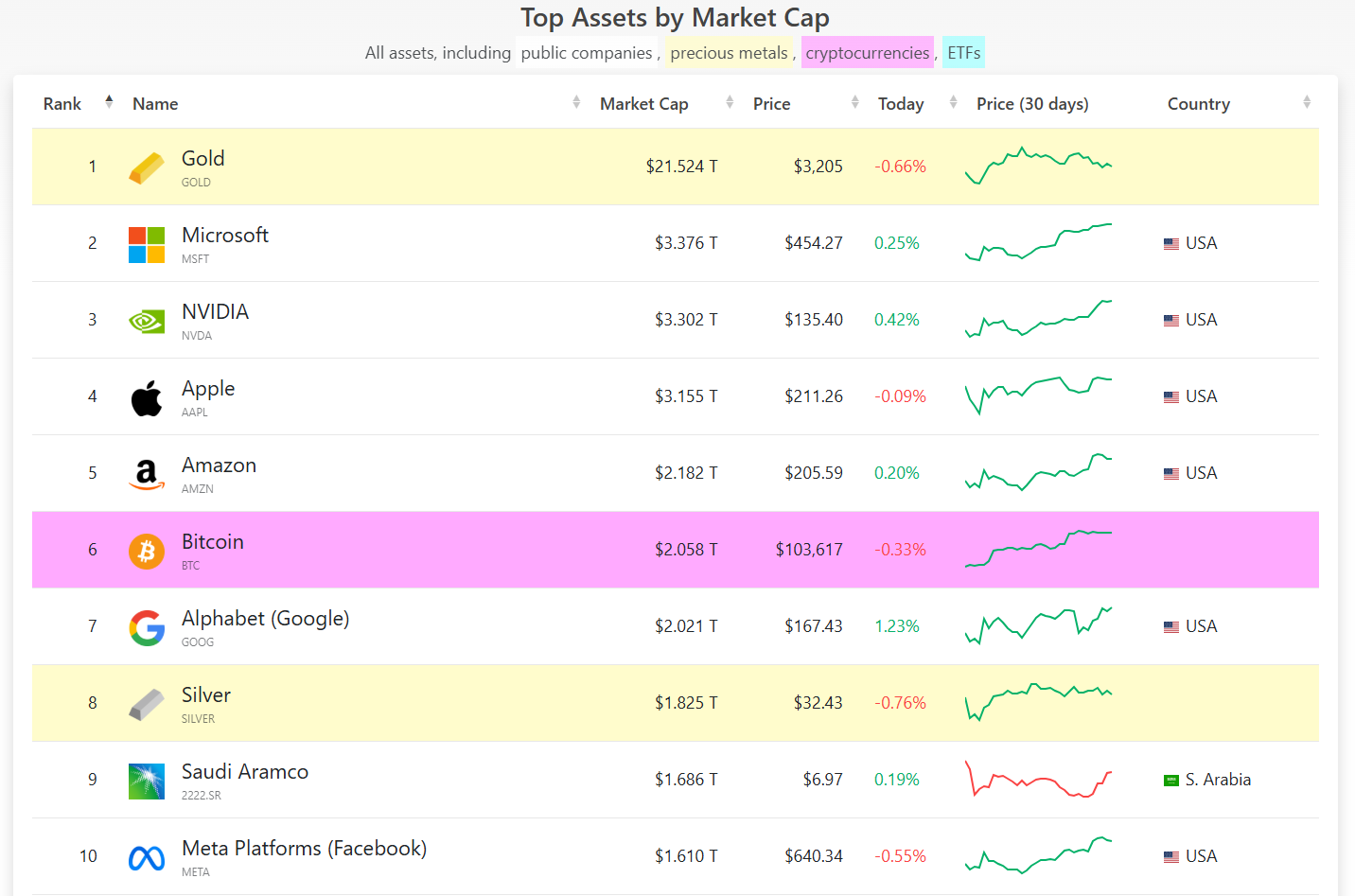

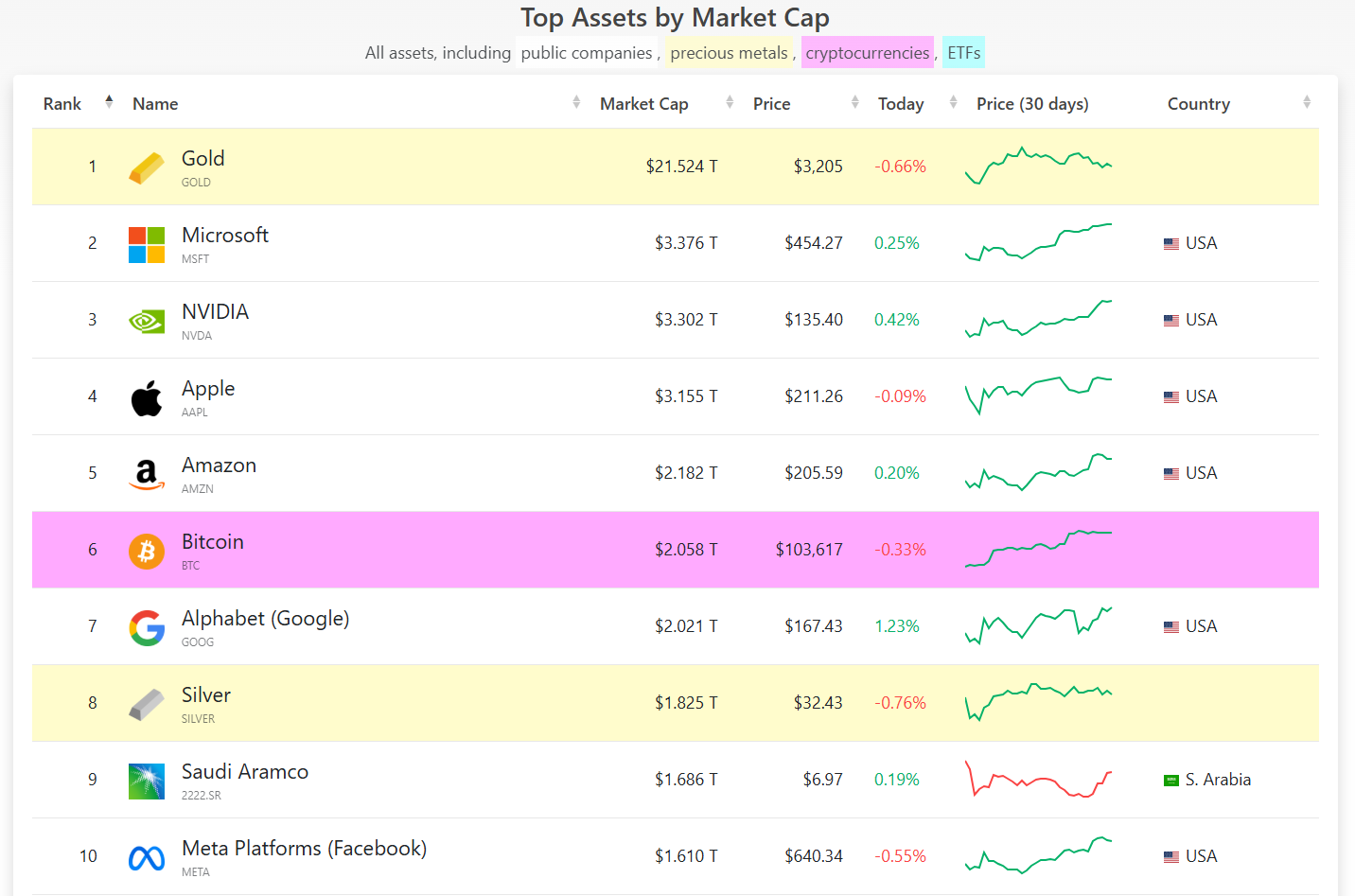

Evaluating Bitcoin to gold, Novogratz emphasised the cryptocurrency’s rising position as a digital retailer of worth. He famous that whereas gold boasts a $22 trillion market cap, Bitcoin, at the moment valued at round $2 trillion, has appreciable room for development.

Supply: CompaniesMarketcap

Novogratz believes that as youthful generations inherit wealth from older ones, Bitcoin may obtain parity with gold, albeit within the distant future. This attitude aligns with broader macroeconomic traits the place low rates of interest and quantitative easing have traditionally bolstered each property.

Learn extra: Tim Draper: Bitcoin to Hit $250,000 and Substitute the Greenback in a Decade

The connection between Bitcoin and macroeconomic elements is intricate. Whereas Bitcoin’s value actions are sometimes pushed by hypothesis and market sentiment, in addition they correlate with durations of low volatility and unfastened financial insurance policies. As an illustration, the 2021 bull run coincided with ultra-loose financial circumstances, and comparable patterns are rising in 2025.