Fast Take

The most recent US inflation information has shocked analysts, with headline inflation year-over-year (YoY) coming in at 3.5% — 0.1% above forecasts.

The event is important contemplating the Federal Reserve’s most aggressive mountain climbing cycle in a long time, in response to Statista, which aimed to tame the rampant inflation that the central financial institution initially claimed was transitory.

Regardless of headline inflation bottoming out at 3% in June 2023, it has since risen to three.5% over 9 months later, with Fed funds at present hovering between 5.25% to five.5%.

Core inflation has maintained stability, hovering just under 4% since September 2023, as reported by Buying and selling Economics. Consequently, Bitcoin remains to be handled as a risk-on asset in the mean time and as a spinoff of the Nasdaq-100 Index (QQQ) based mostly on its drop beneath $68,000 on the CPI information.

Nonetheless, there have been cases the place Bitcoin behaved like a risk-off asset, equivalent to in the course of the Cyprus disaster.

The inflation information has additionally impacted bond yields, with the entrance finish of the treasury curve (3 and 6 months) indicating no charge cuts till Q3 on the earliest.

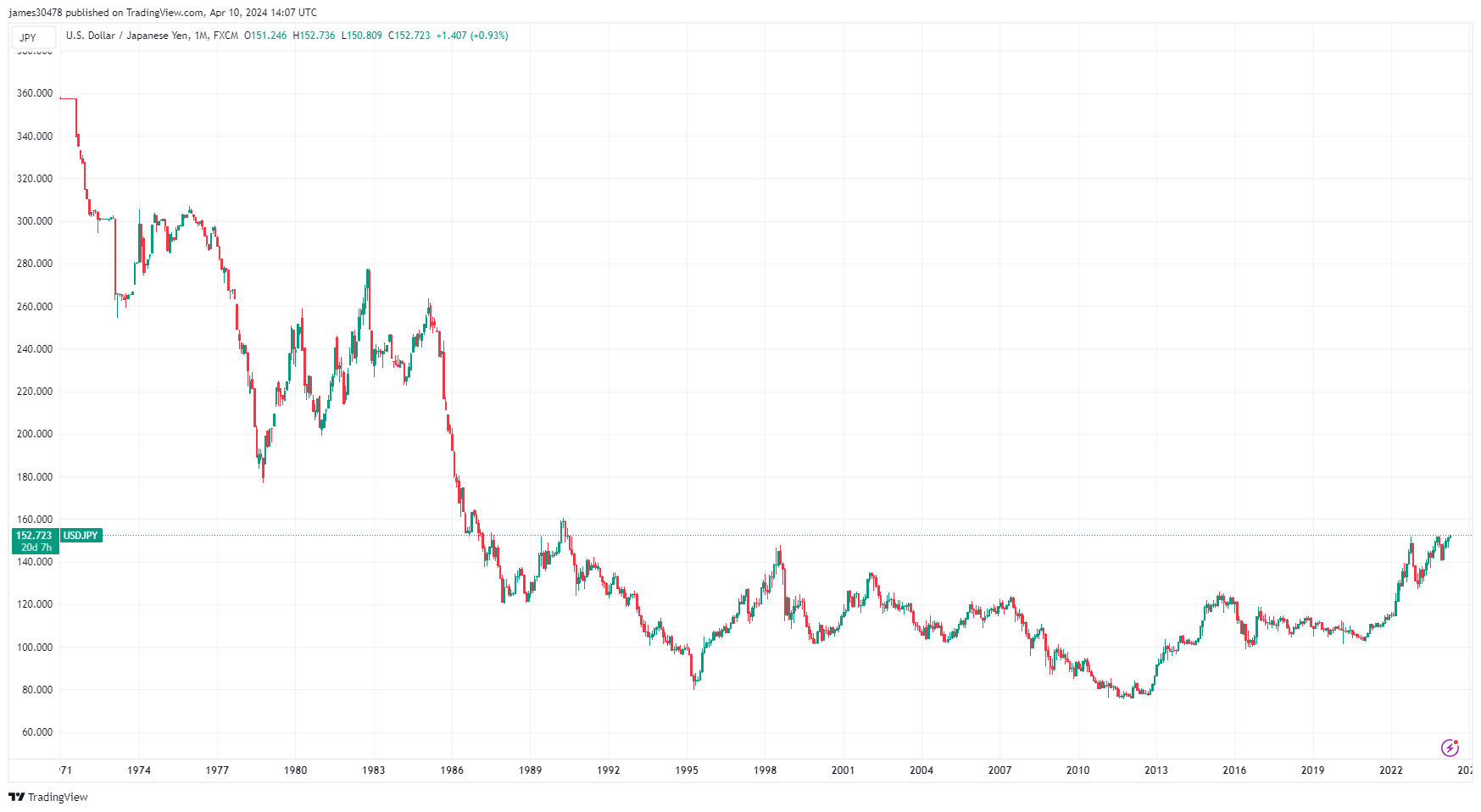

The DXY index moved larger above 105, and the USDJPY broke 152, a degree not seen since 1990. This may increasingly immediate the Financial institution of Japan to extend rates of interest to defend the weakened foreign money and its implications for the yen carry commerce.

The publish Bitcoin’s twin nature: shifting between risk-on and risk-off amid market turbulence appeared first on CryptoSlate.