Onchain Highlights

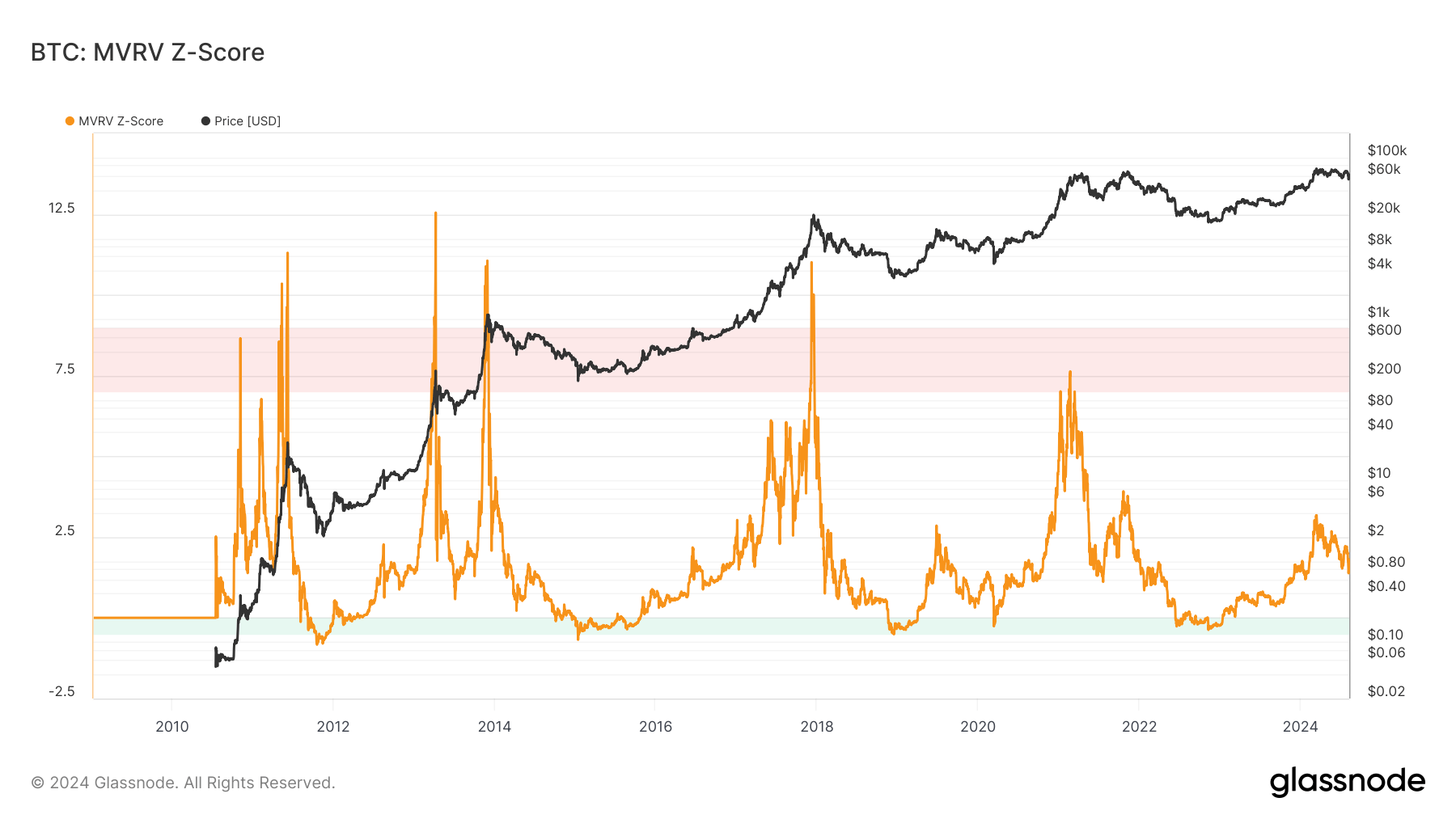

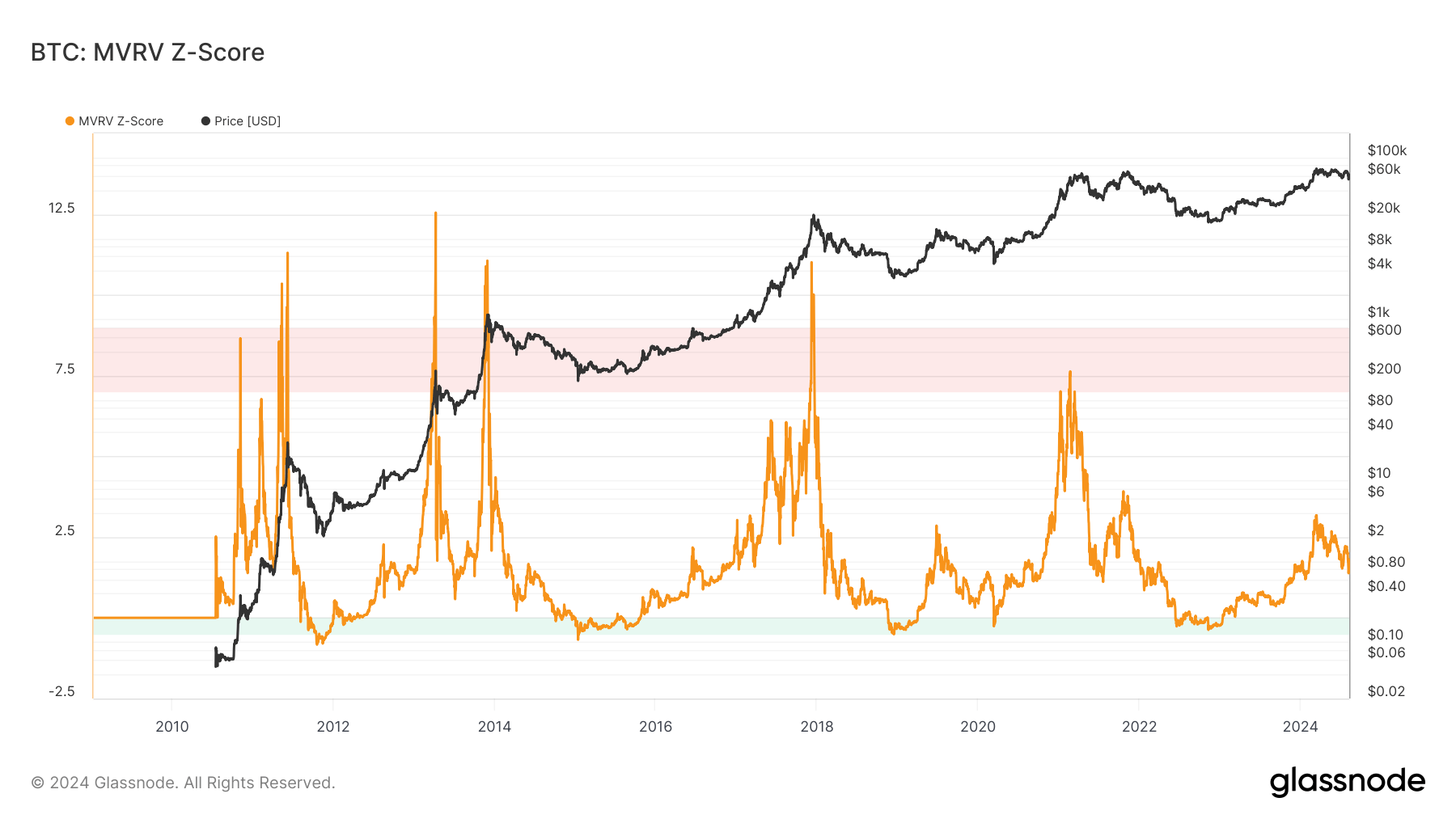

DEFINITION:The MVRV Z-Rating evaluates whether or not BTC is overvalued or undervalued relative to its “truthful worth”. As an alternative of utilizing a standard z-score technique, the MVRV Z-Rating uniquely compares the market worth to the realized worth. When the market worth, measured as community valuation by spot worth multiplied by provide, is considerably increased than the realized worth, represented by the cumulative capital influx into the asset, it has sometimes signaled a market prime (pink zone). Conversely, a considerably decrease market worth than the realized worth has typically indicated market bottoms (inexperienced zone).

Bitcoin’s MVRV Z-Rating signifies that it’s nearer to undervalued ranges, reflecting a possible shopping for alternative. Over the previous yr, the metric has proven important fluctuations, mirroring Bitcoin’s risky worth tendencies.

After reaching a excessive of roughly 3 in March, coinciding with Bitcoin’s pre-halving surge above $70,000, the Z-Rating has since declined sharply. This drop means that the market is transferring away from potential overvaluation and nearer to ranges traditionally related to undervaluation.

Because the Z-Rating tendencies in direction of the decrease finish, it alerts that Bitcoin could also be approaching a interval the place it’s undervalued relative to its realized worth. Traditionally, Z-Rating values round 0 have indicated market bottoms, suggesting that Bitcoin’s present place may supply a positive entry level for long-term traders.