With BlackRock and its BUIDL fund surpassing $1b in AUM, buyers at the moment are on the lookout for the following 100x RWA alternative. Enter ONDO and Landshare (LAND).

The BlackRock USD Institutional Digital Liquidity Fund, higher often known as ‘BUIDL’, has surpassed $1 billion in property underneath administration (AUM), based on an organization announcement on Thursday (March 13).

This marks a major milestone for the tokenization sector as the primary tokenized fund issued by a Wall Avenue establishment to succeed in the billion-dollar milestone.

On-chain finance is right here and it’s #BuiltOnBUIDLWe are thrilled to announce that the @BlackRock USD Institutional Digital Liquidity Fund (BUIDL), tokenized by Securitize, has reached $1 billion in property underneath administration (AUM).

This marks a major milestone within the… pic.twitter.com/Gt66Kdz2kx

— Securitize (@Securitize) March 13, 2025

Significance Of BlackRock’s BUIDL Fund Hitting $1 Billion

BUIDL was launched in March 2024 and is BlackRock’s first tokenized fund to be issued on a public blockchain. The world’s largest asset supervisor, with over $11 trillion in AUM, provides certified buyers the power to earn onchain US greenback yields.

Yields are paid every day by way of dividends earned by way of its basket of short-term Treasury reserves. The BUIDL token is pegged to the US greenback, which means it operates like a revenue-earning different to stablecoins like USDT and USDC.

Till yesterday, Hashnote’s USYC was listed because the world’s largest tokenized cash market fund backed by tokenized Treasuries. DefiLlama information reveals that USYC has $851.81m in AUM whereas BUIDL now has a tad over $1 billion.

With BUIDL main the best way for tokenized asset tasks, we are going to check out two premier RWA cryptocurrencies that everybody ought to be contemplating as a part of a balanced portfolio:

DISCOVER: Will Popcat Crypto Make a Comeback? POPCAT Worth Reveals First Indicators of Life in Weeks

Greatest RWA Crypto #1: Ondo Finance (ONDO) – Market Main Tokenized Asset Platform

(COINGECKO)

Ondo Finance (ONDO) continues to develop. Just like BUIDL, ONDO simply surpassed $1 billion in total-value locked, the biggest TVL of any particular person real-world asset (RWA) challenge proper now.

The expansion in TVL for ONDO has been unbelievable, with its newest spike of over $1 billion, which means a 53% enhance month-on-month. This highlights two issues: one, the market’s urge for food for funding within the RWA sector. Two, ONDO’s exponential TVL development reveals its place because the main tokenized asset challenge available on the market.

The bullish catalysts for ONDO are seemingly endless as a result of staff’s nonstop supply of its roadmap targets. It additionally helps that ONDO is owned by each BlackRock’s BUIDL fund and President Trump’s World Liberty Monetary challenge.

ONDO is at the moment buying and selling at round $0.87, and lots of analysts are calling for a surge again towards its February excessive of $1.42 as a short-term value goal. As RWA sentiment continues to develop and ONDO is already effectively positioned because the blue-chip challenge inside the sector, anticipate a climb again towards its earlier all-time excessive of $2 within the coming months.

Greatest RWA Crypto #2: Landshare (LAND) – Hidden Gem Main The Approach For Utility Initiatives On BNB Chain

Winners take note of promising tasks!

The ultimate dip earlier than full ship is right here!

I’ve my full conviction in $LAND. Actual property tokenization will develop exponentially and Landshare is the

pic.twitter.com/dr7qeUx79x

— Luke Mayfield (@may2_luke) February 28, 2025

Landshare (LAND) has over 4 years of actual property tokenization expertise, making it one of many extra established and skilled RWA groups. It maintains this standing whereas nonetheless being a low-cap, low-supply challenge.

The LAND token is constructed on the Binance Sensible Chain. On a series typically recognized for its meme cash, resembling BROCCOLI, Landshare stands out as one of many premier utility-focused tasks on the Binance Sensible Chain.

By holding LAND, buyers achieve entry to crowdsourced actual property buys, renovations, and eventual gross sales. Traders should buy and maintain shares in rental properties by holding the token. That is an attractive alternative for these on the lookout for decentralized passive earnings and actual property publicity.

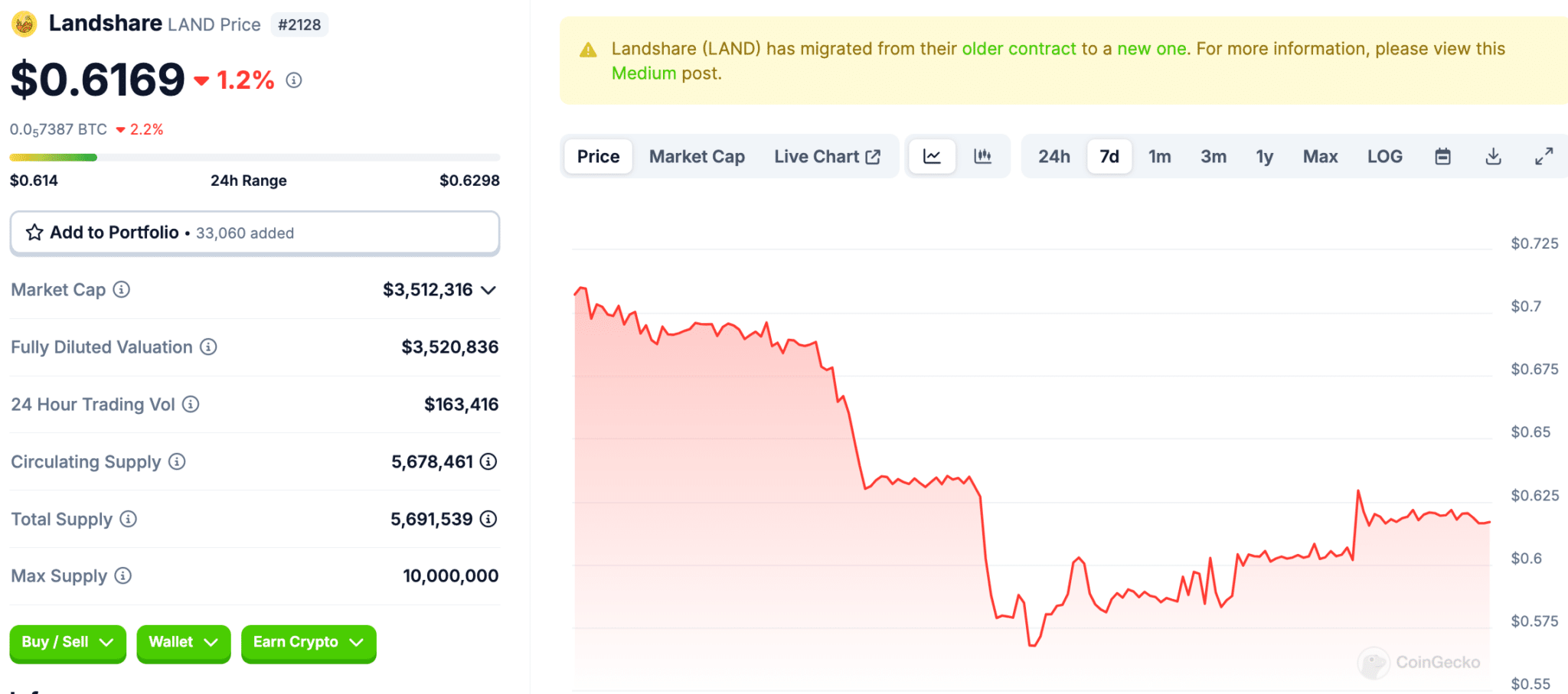

LAND is at the moment buying and selling for round $0.62 per token and represents a real microcap with a market cap of simply $3.5 million. With the staff’s long-standing presence and steady product supply, Landshare represents a very undervalued RWA play.

(COINGECKO)

EXPLORE: Greatest New Cryptocurrencies to Put money into 2025

Be part of The 99Bitcoins Information Discord Right here For The Newest Market Updates

BlackRock's BUIDL RWA fund hits $1b in property underneath administration

This marks a key milestone for the tokenized asset sector as the primary fund to hit $1b

The RWA sector is heating up, and buyers are searching for the following large play

Ondo Finance (ONDO) is already effectively positioned because the premier RWA challenge available on the market

Landshare (LAND) is a riskier RWA play with the next upside. With a longtime staff and over 4 years of expertise, this tokenized actual property challenge is a steal at lower than $4m in market cap

The submit BlackRock RWA Fund ‘BUIDL’ Simply Crossed $1 Billion AUM: Greatest RWA Crypto to Purchase in 2025? appeared first on 99Bitcoins.