Please see this week’s market overview from eToro’s world analyst staff, which incorporates the most recent market knowledge and the home funding view.

New inflation knowledge fosters a “higher-for-longer” sentiment,

Hotter than anticipated US inflation numbers formed market dynamics. The Client Worth Index (CPI) rose to 2.7% from 2.6%, whereas the Producer Worth Index (PPI) climbed to three.0% from 2.6%, marking the most important improve since February 2023. These figures prompted bond traders to push the yield on the US 10-year Treasury bond from 4.15% to 4.40%, reflecting a “higher-for-longer” charge outlook.

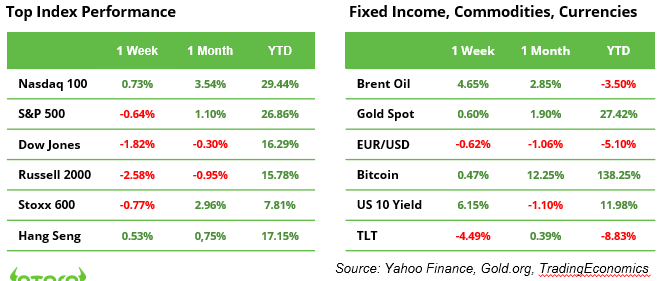

Fairness markets responded to the inflation knowledge with combined actions, partially reversing latest tendencies. The small-cap Russell 2000 Index dropped 2.6%, and the value-heavy Dow Jones Index declined by 1.8%. Nonetheless, the Nasdaq 100 gained floor, pushed by sturdy performances from Google, that made headlines with a breakthrough in quantum computing, and Broadcom, that projected $90 billion in income from customized AI chip by 2027, reigniting a rally in AI shares.

Within the commodities market, oil costs surged 4.7%, whereas cocoa spiked 17%, as unfavorable local weather circumstances threatened the upcoming harvest and pressured current contracts.

Fed, BoJ and BoE to announce their rate of interest choices

Following final week’s charge cuts by the ECB and SNB, (SNB shocking markets with a 0.50% “jumbo” reduce), consideration now shifts to the Ate up Wednesday and the BoJ and BoE on Thursday. The US Federal Reserve is anticipated to chop charges by 25 foundation factors to a spread of 4.25% to 4.50%, a choice priced in by the market with a 96% likelihood. Nonetheless, a Bloomberg survey signifies that the Fed’s rate-cutting path will seemingly decelerate in 2025. The up to date dot plot and Jerome Powell’s press convention are anticipated to offer beneficial insights.

There’s a sturdy correlation between rates of interest and bond yields. Taking a look at 10-year bond yields globally (see chart), UK and US lead the pack. Within the US, Trump’s debt insurance policies stay a focus. In Europe, political crises in France and Germany dominate consideration. In the meantime, China’s 10-year bond yield hit a document low, with solely Japan and Switzerland providing decrease yields.

Bonds stay a beneficial addition to portfolios for stability. Nonetheless, their long-term return potential is considerably decrease than that of equities. Increased returns within the fastened earnings markets are presently solely achievable with high-risk bonds.

Can the US Manufacturing PMI Break By 50?

US financial knowledge dominates this week, with Monday’s PMI figures in focus. The Companies PMI is anticipated to dip barely from 56.1 to 55.7, whereas Manufacturing PMI is forecast to rise modestly from 49.7 to 49.8. A breach of the 50 mark might sign the tip of the sector’s recession. Later within the week, retail gross sales knowledge and PCE inflation figures will present additional clues on the economic system’s course.

Musk’s profitable funding in Trump

Elon Musk, the world’s wealthiest man, invested not less than $274 million in Donald Trump’s election marketing campaign. Past monetary contributions, Musk performed an energetic position in influencing public opinion, together with his election-related posts on X garnering an estimated 17 billion views.

Was it a very good funding? Within the brief time period, it seems so. Tesla’s inventory, the place Musk owns a 13% stake, surged over 70%, including $80 billion to his internet value. The impression prolonged past Tesla. SpaceX, the place Musk holds a 42% stake, noticed its valuation bounce to $350 billion final week, up from $210 billion in June. Moreover, Musk’s different ventures, together with Neuralink, X, and xAI, are reported to have skilled vital valuation will increase since 5 November.

The following key query for traders is how Trump’s insurance policies will impression Musk’s various portfolio of companies. As the brand new administration takes form, market watchers will carefully monitor potential regulatory and financial shifts that might have an effect on Musk’s wide-ranging ventures.

Which inventory markets outperformed the US in 2024?

The Nasdaq 100 Index delivered a 29% return, and the broader S&P 500 Index gained 27% to this point in 2024 (see desk). Whereas few markets have outperformed these spectacular figures, a handful stand out. Argentina and Pakistan’s inventory markets have surged by roughly 70% this yr. The International X MSCI Argentina ETF, listed in USD, benefited from profitable reforms underneath the Milei authorities, which targeted on cost-cutting measures and curbing inflation. Equally, the Xtrackers MSCI Pakistan Swap ETF, listed in EUR, posted sturdy positive factors, pushed by inner reforms and the very best ranges of international funding inflows since 2014.

Earnings and occasions

Macro: PMI (16/12) Retail Gross sales (17/12), Fed (18/12), BoE, BoJ (19/12). PCE inflation (20/12)

Earnings: Micron, Lennar (18/12), Nike, Fedex (19/12)

This communication is for data and schooling functions solely and shouldn’t be taken as funding recommendation, a private suggestion, or a suggestion of, or solicitation to purchase or promote, any monetary devices. This materials has been ready with out bearing in mind any explicit recipient’s funding aims or monetary state of affairs and has not been ready in accordance with the authorized and regulatory necessities to advertise impartial analysis. Any references to previous or future efficiency of a monetary instrument, index or a packaged funding product are usually not, and shouldn’t be taken as, a dependable indicator of future outcomes. eToro makes no illustration and assumes no legal responsibility as to the accuracy or completeness of the content material of this publication.