Revealed: July 15, 2024 at 8:36 am Up to date: July 15, 2024 at 8:36 am

Edited and fact-checked:

July 15, 2024 at 8:36 am

In Transient

DeFi faces communication points with totally different monetary techniques, limiting its potential. Cross-chain interoperability goals to eradicate these obstacles, facilitating clean connections throughout blockchain networks and permitting simple asset transfers.

DeFi’s present standing is corresponding to having a number of distinct monetary techniques which can be tough to speak with each other. If a person has belongings on Ethereum, they can’t be used instantly in DeFi apps on different chains, similar to Solana or Binance Good Chain, with out requiring time-consuming bridging procedures. This limits the potential of DeFi general by inflicting friction for each builders and shoppers.

The best way to Clear up This Drawback?

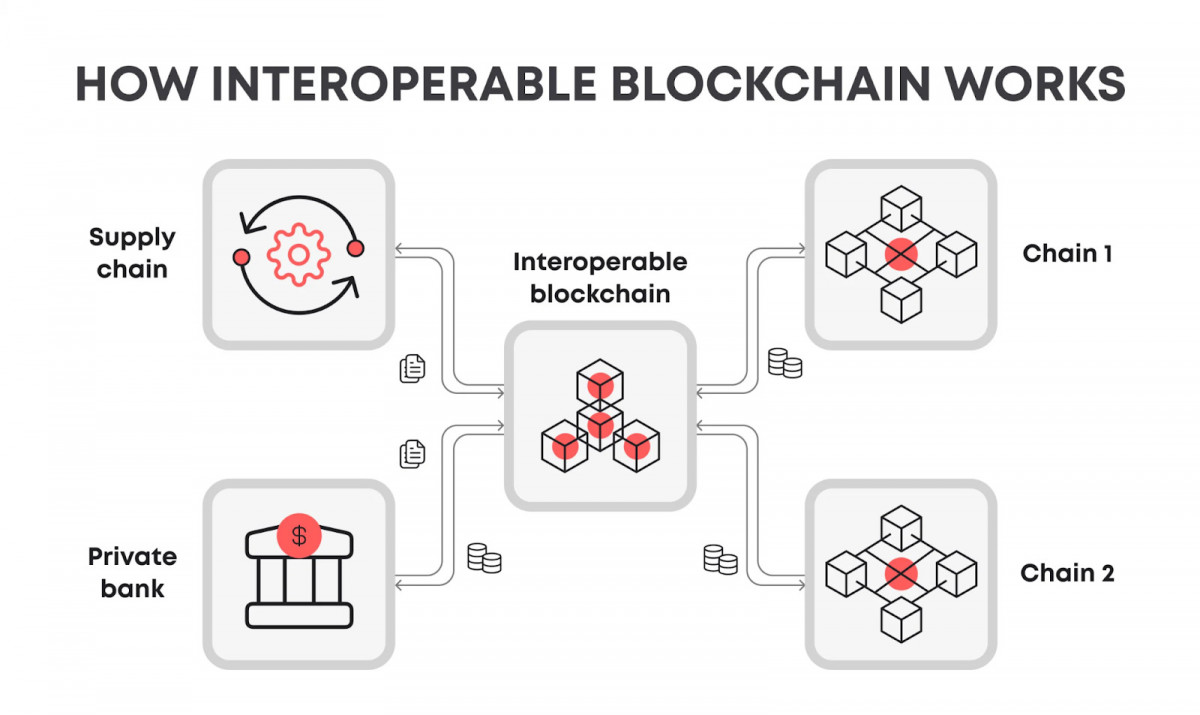

Cross-chain interoperability goals to eradicate these obstacles and supply a powerful DeFi atmosphere. Interoperability options facilitate clean connections throughout varied blockchain networks, which could open up new potentialities for composability and liquidity in DeFi. Liquidity may circulation freely all through the entire ecosystem, customers may switch belongings between chains with ease, and builders may assemble cross-chain apps.

Interoperability for DeFi has monumental potential benefits. Better capital effectivity could end result from it as belongings wouldn’t be remoted on separate chains. It’s doable that new cross-chain monetary companies and merchandise that mix the benefits of many networks could floor. DeFi’s general usability and accessibility would significantly enhance, which might encourage widespread adoption.

Photograph: Blaize Tech

True cross-chain interoperability is a tough technological activity to realize, however. Consensus processes, sensible contract languages, and safety frameworks differ between blockchains. It isn’t a straightforward effort to bridge these gaps whereas preserving decentralization and safety. Quite a few initiatives and techniques have surfaced to handle the interoperability downside from varied views.

One of many first and hottest interoperability options was cross-chain bridges. Though bridges have elevated asset mobility, as proven by plenty of well-publicized bridge hacks, they incessantly depend upon centralized elements and supply further safety points.

Photograph: Primary blockchain bridge schema, Chainlink

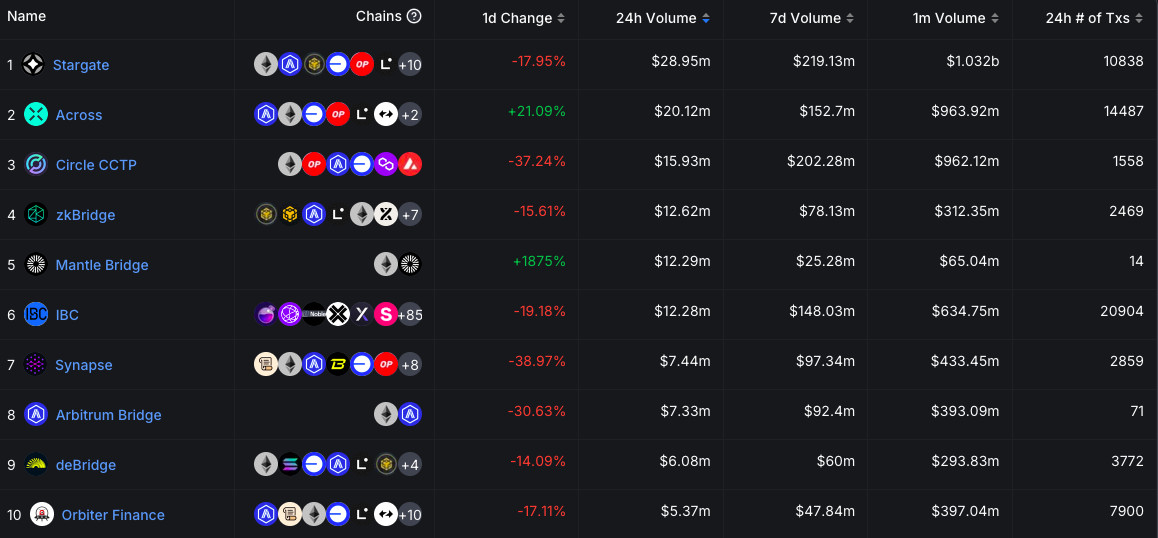

Photograph: Checklist of blockchain bridges, DefiLlama

Ecosystems which can be At present Engaged on the Interoperability

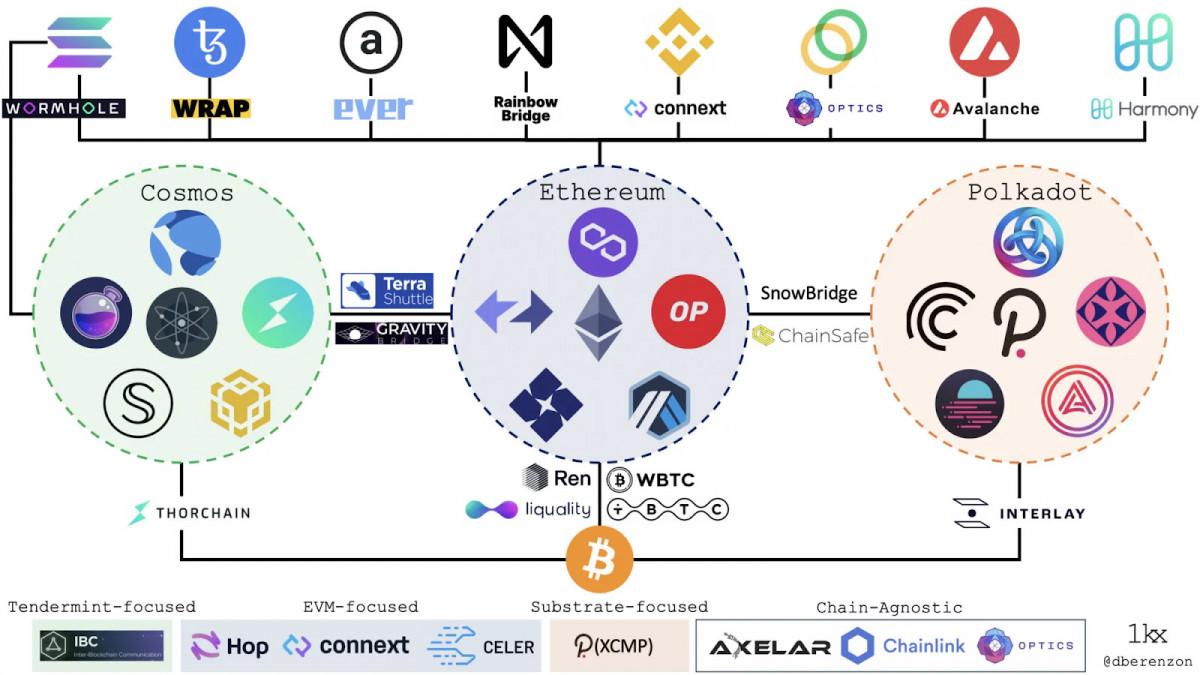

To be able to present trustless operation throughout chains with out creating centralized weaknesses, extra superior interoperability protocols are being developed. Polkadot and Cosmos are two initiatives which can be developing complete ecosystems from the underside up with cross-chain interoperability in thoughts.

A number of parachains are linked by way of a central chain in Polkadot’s hub-and-spoke resolution. The IBC protocol is utilized by Cosmos to facilitate the sharing of belongings and information between a number of chains.

By enabling the switch of belongings and information between the principle chain and L2 networks, layer 2 scaling options like Arbitrum and Optimism are enhancing Ethereum’s interoperability. Scalability is elevated whereas Ethereum’s safety necessities are upheld. The “oracle downside” is being addressed by initiatives similar to Chainlink, which gives decentralized information feeds which can be interoperable with quite a few chains.

One other methodology for facilitating cross-chain connections is thru atomic swaps, which allow peer-to-peer, trustless asset transactions between a number of blockchains. With this know-how, cross-chain trades not require middlemen. Nevertheless, the pace and complexity constraints of atomic swaps have prevented their broad use to this point.

Are There Any Issues with Cross-chain Interoperability?

Safety is crucial as a result of poorly designed interoperability protocols could supply new assault vectors. The hazards concerned are highlighted by the present spherical of bridge cyberattacks. Scalability is one other essential consideration since DeFi purposes require cross-chain connectivity to be fast and inexpensive.

It’s doable that standardization initiatives shall be essential in selling interoperability. Cross-chain communication protocols and customary requirements may make growth extra simpler and enhance interoperability throughout varied techniques. However it’s not so simple as it appears to come back to an settlement on requirements within the disordered blockchain setting.

Moreover, the regulatory atmosphere that surrounds cross-chain DeFi operations is unclear. Regulators could discover it more and more tough to police compliance when belongings transfer freely between chains. The long-term sustainability of cross-chain DeFi will depend upon well-defined regulatory frameworks that strike a stability between client safety and innovation.

The Significance of Cross-chain Interoperability for the Complete Market

There isn’t any denying the momentum in favor of cross-chain interoperability in DeFi, however the obstacles. Cross-chain communication is essential, however Ethereum co-founder Vitalik Buterin has cautioned about doable safety trade-offs in his remarks.

Future DeFi techniques are in all probability going to be multi-chain and appropriate by design. We may see a different ecology of specialised chains and layer 2 networks which can be all fluidly built-in, versus a single dominating chain. By doing so, the distinct benefits and traits of many networks can be mixed whereas their respective shortcomings can be addressed.

Cross-chain interoperability could open the door to complete new DeFi product and software classes. Think about a mortgage protocol that permits customers to collateralize belongings from one chain to borrow belongings on one other, or a decentralized alternate that may instantaneously faucet into liquidity throughout many chains. There are plenty of alternatives for monetary innovation.

Enhanced interoperability may also help in resolving a few of the current points with DeFi. Two of the largest hurdles to the adoption of well-known networks like Ethereum have been fuel costs and community congestion. The person expertise and general effectivity may be enhanced by extra equitably distributing exercise amongst networks with seamless cross-chain capabilities.

Photograph: JMcrypto, Medium

The broader blockchain ecosystem could also be significantly affected by the emergence of cross-chain DeFi. It could reduce the winner-take-all dynamic that has typified a big portion of the historical past of cryptocurrencies by enabling a number of chains to coexist and specialize. Within the business as a complete, this may increasingly encourage elevated inventiveness and resilience.

Widespread cross-chain interoperability in DeFi might be not going to occur in a single day. Earlier than spreading to extra different ecosystems, interoperability could first seem amongst carefully linked chains (e.g., Ethereum and its quite a few layer 2 networks). Battle-testing and auditing shall be essential to steadily acquire belief in cross-chain options.

Adoption of cross-chain DeFi may even be significantly impacted by person expertise and training. Due to the intricacy and lack of expertise with bridging operations, many customers proceed to stick to a single-chain setting. Will probably be essential to supply clean, intuitive person interfaces that summary away the difficulties of cross-chain interactions.

Through the Hack Seasons Convention in Brussels, Abril Zucchi, a DevRel Advocate at Morph, shared her imaginative and prescient on interoperability. She says that their major strategy as L2 EVM is to convey consumer-focused blockchain purposes to our chain. At present, they’re primarily specializing in scaling options for Ethereum. Due to this focus, they’re not prioritizing cross-chain interoperability in the meanwhile.

In accordance with Abril, different firms, like IBC protocols, are engaged on cross-chain interoperability options, whereas Morph is targeted on scaling Ethereum.

Disclaimer

In step with the Belief Challenge pointers, please be aware that the knowledge supplied on this web page shouldn’t be supposed to be and shouldn’t be interpreted as authorized, tax, funding, monetary, or every other type of recommendation. It is very important solely make investments what you’ll be able to afford to lose and to hunt impartial monetary recommendation in case you have any doubts. For additional info, we advise referring to the phrases and circumstances in addition to the assistance and assist pages supplied by the issuer or advertiser. MetaversePost is dedicated to correct, unbiased reporting, however market circumstances are topic to alter with out discover.

About The Creator

Viktoriia is a author on a wide range of know-how subjects together with Web3.0, AI and cryptocurrencies. Her intensive expertise permits her to write down insightful articles for the broader viewers.

Extra articles

Viktoriia is a author on a wide range of know-how subjects together with Web3.0, AI and cryptocurrencies. Her intensive expertise permits her to write down insightful articles for the broader viewers.