Bitcoin has been steadily climbing since crossing the $60,000 mark and is presently hovering nearer to the $70,000 degree, a worth it hasn’t reached in months. With the market sentiment heating up, buyers are questioning whether or not Bitcoin has the energy to succeed in new all-time highs or if it is going to battle to interrupt previous key resistance ranges.

A Wholesome Sentiment

The Concern and Greed Index is a useful gizmo for understanding market sentiment and the way merchants view the trajectory of Bitcoin. Presently, the index is at a “Greed” degree of round 70, which is traditionally seen as a constructive signal however nonetheless a good distance from the acute greed ranges that would point out a possible market high. This index measures feelings available in the market, with decrease ranges indicating worry and better ranges suggesting greed. Usually, when the index surpasses the 90+ vary, the market turns into overly bullish, elevating issues of overextension.

It is essential to notice that final 12 months, when the Concern and Greed Index reached related ranges, Bitcoin was buying and selling at round $34,000. From there, it greater than doubled to $73,000 over the next months.

Key Assist

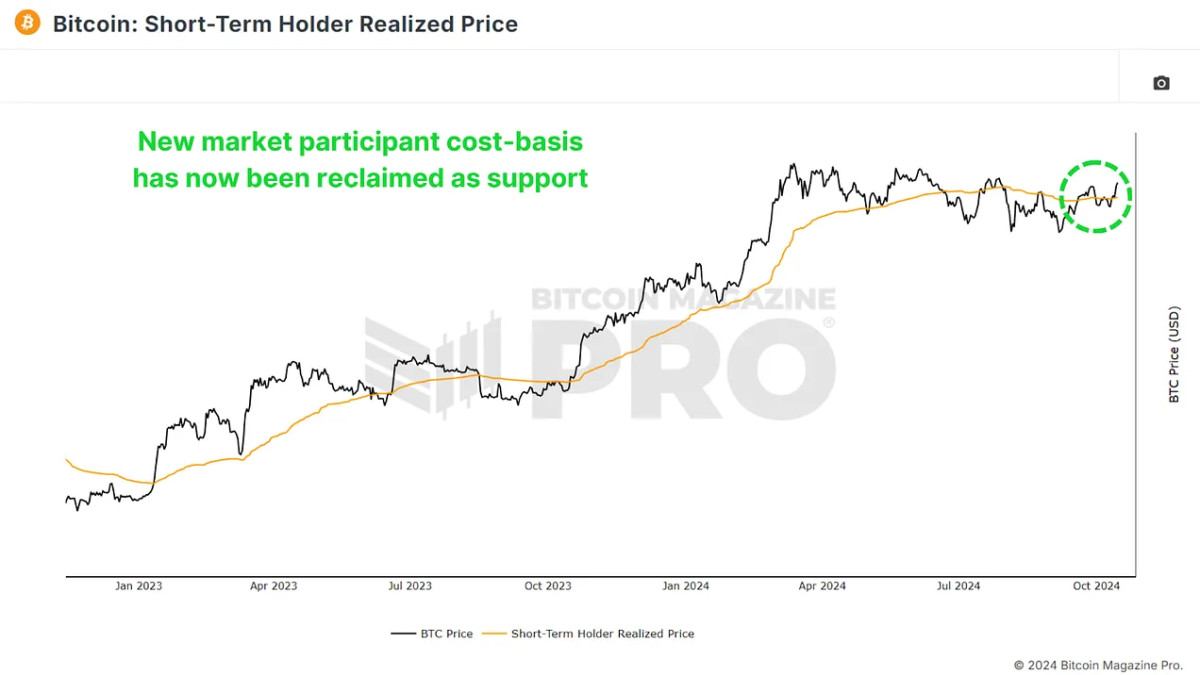

The Brief-Time period Holder Realized Value measures the typical worth new Bitcoin buyers have paid for his or her bitcoin. It is essential as a result of it usually acts as a powerful assist degree throughout bull markets and as resistance throughout bear markets. Presently, this worth sits round $62,000, and Bitcoin has managed to remain above it. It is a promising signal, because it reveals that newer market individuals are in revenue, and Bitcoin is holding above an important assist zone. Traditionally, breaking under this degree has led to market weak point, so sustaining this assist is vital to any continued rally.

We’ve seen this dynamic in previous cycles, particularly throughout the 2016-2017 bull market, the place Bitcoin retraced to this degree a number of instances earlier than persevering with its climb. If this pattern holds, Bitcoin’s current breakthrough may present a basis for additional positive factors.

Stabilizing Market

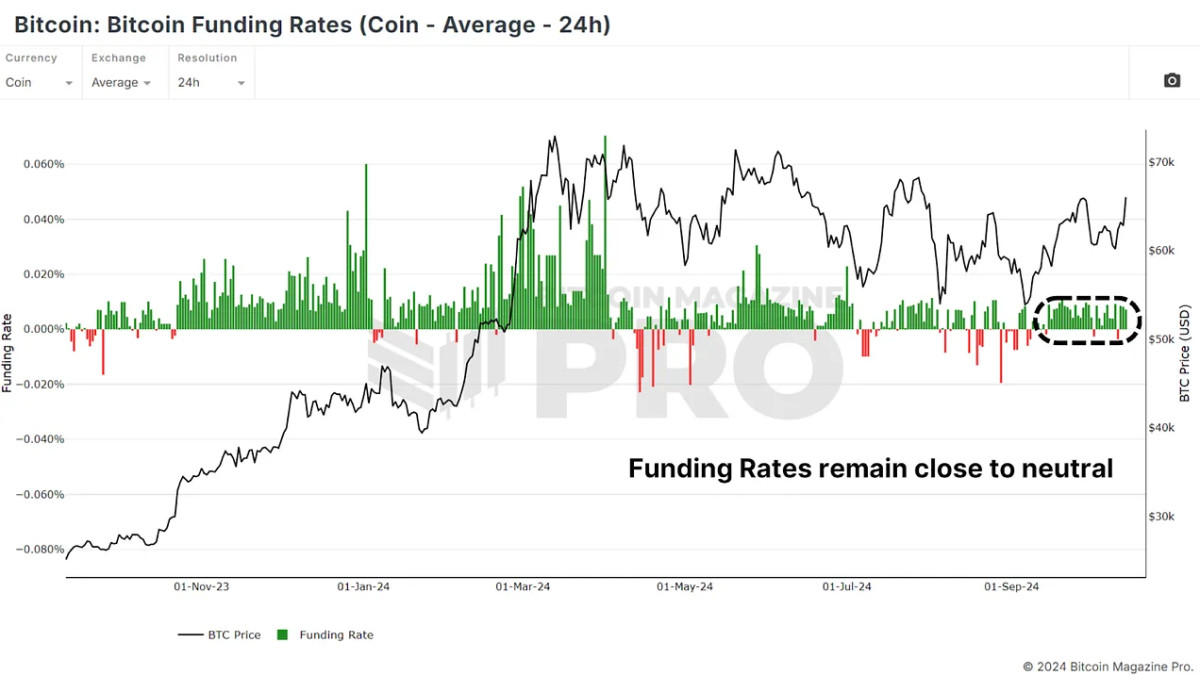

One space that merchants usually watch is Funding Charges, which point out the price of holding lengthy or quick positions in Bitcoin futures. Over the previous few months, funding charges have been unstable, swinging between overly optimistic lengthy positions and overly bearish quick positions. Fortunately, the market has now stabilized, with funding charges sitting at impartial ranges. It is a wholesome signal because it suggests merchants aren’t overly leveraged in both route.

In impartial territory, there’s much less danger of a liquidation cascade, a typical phenomenon when over-leveraged positions get worn out, inflicting sharp market drops. So long as the funding charges stay secure, Bitcoin may have the respiratory room it must proceed rising with out main volatility.

A Powerful Path to $70,000 and Past

Whereas the market sentiment and technicals recommend that Bitcoin is in a wholesome place, there are nonetheless vital ranges of resistance above. First, the present resistance pattern line is one which Bitcoin has struggled to interrupt. This downtrend line has been examined a number of instances, however every time, Bitcoin has retraced after hitting it.

Past this, Bitcoin faces a number of further limitations, equivalent to $70,000. This degree has acted as resistance previously and represents a psychological degree that merchants will probably be watching intently. And above that the all-time excessive between $73,000 and $74,000. Breaking this could be a significant bullish sign, however it may take a number of makes an attempt earlier than Bitcoin clears this degree.

One constructive technical component is the current reclaim of the 200 every day transferring common. A key degree for buyers to look at that had acted as resistance for BTC over the last few months.

The Macro Atmosphere: Institutional and ETF Inflows

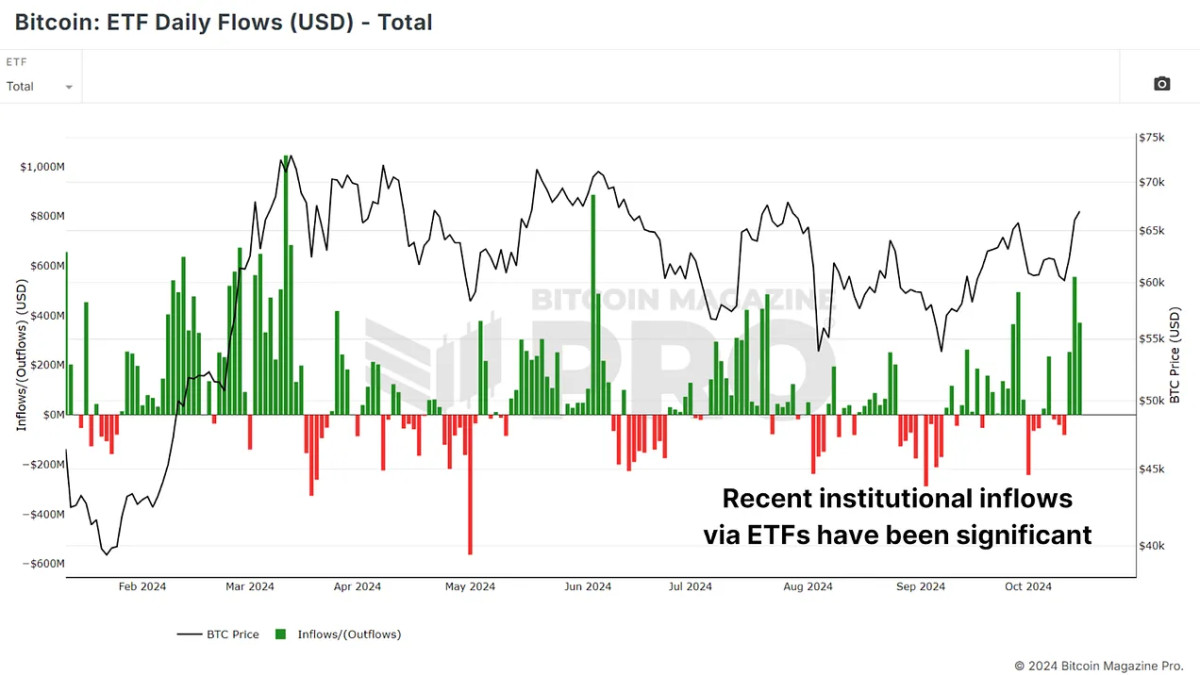

Past technical indicators, the macro setting is more and more favorable for Bitcoin. Institutional cash continues to circulation into Bitcoin Change-Traded Funds (ETFs). Up to now few days, over $1 billion has flowed into Bitcoin ETFs, reflecting rising confidence within the asset. Over the previous few weeks, we have seen tons of of tens of millions extra in ETF inflows, signaling that good cash, significantly institutional buyers, is bullish on Bitcoin’s future.

That is vital as a result of institutional cash tends to take a long-term view, offering a extra secure base of assist than retail hypothesis. Furthermore, as equities and even gold have been gaining floor in current months, Bitcoin seems to be lagging barely behind. This might set the stage for Bitcoin to play catch-up, significantly if buyers rotate from conventional property into the extra risk-on realm of Bitcoin.

Conclusion

Bitcoin’s worth motion, funding charges, and sentiment all recommend that the market is in a more healthy place than it has been in months. Institutional inflows into ETFs and enhancing macro situations add additional bullish tailwinds. Nonetheless, vital resistance lies forward, and any rally will probably face challenges earlier than Bitcoin can really get away to new highs.

For a extra in-depth look into this matter, take a look at a current YouTube video right here:

Can Bitcoin Now Make A New ATH