Analyst Weekly, June 16, 2025

Oil Spikes, Danger Premium Builds: What Issues for Buyers

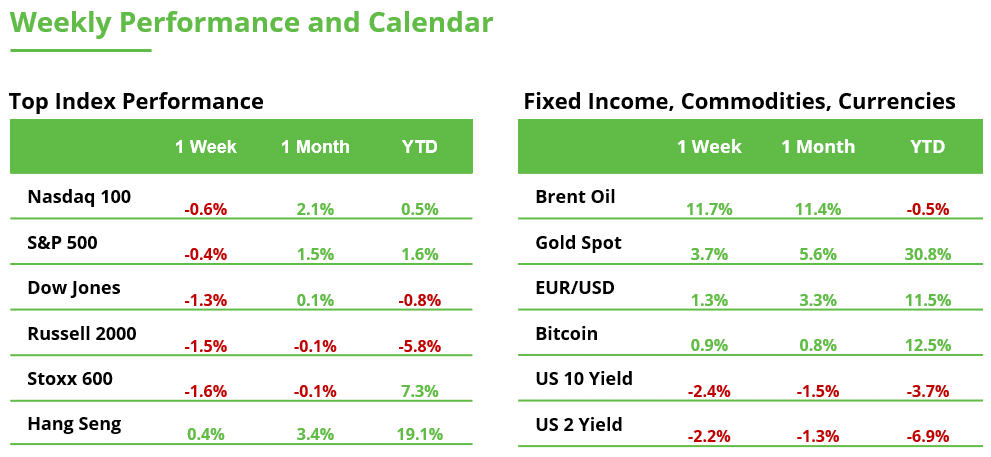

Tensions within the Center East have escalated in current days, lifting oil costs and reviving geopolitical danger throughout markets. Brent crude surged greater than 13% intraday on June 13, 2025, its greatest single-day transfer since Russia’s 2022 invasion of Ukraine, earlier than settling 7% increased.

Regardless of the spike, the oil market wasn’t structurally tight heading into this occasion. World demand remained agency, and OPEC+ had been limiting provide, however spare capability was ample. Iran, as an example, produces round 3 million barrels per day (~4% of worldwide output), and OPEC holds roughly 4 million barrels per day in spare capability, principally in Saudi Arabia. That buffer considerably reduces the chance of a sustained oil value shock from remoted disruptions.

The Strait of Hormuz is a crucial chokepoint, carrying roughly 30% of worldwide seaborne oil commerce. Nonetheless, a full closure, whereas usually threatened, stays unlikely. Iran’s personal exports depend upon this passage, and any try to dam it could danger alienating key patrons like China and destabilizing regional commerce. Traditionally, the strait has by no means been totally blocked, even in instances of heightened battle.

Historic Context

Oil costs usually react sharply to geopolitical occasions within the Center East, however historical past exhibits that such value strikes are usually short-lived. Market habits in June 2025 mirrors prior episodes, significantly the 1990 Gulf Warfare and the 2022 Ukraine invasion. In all three, oil spiked on broader battle fears and elevated danger premium, as buyers rotated into protected havens like gold. In contrast, the 1973 oil embargo triggered a 300% surge in oil costs and a deep recession.

At this time, sooner data move, extra balanced provide chains, and better-informed buyers permit markets to evaluate danger and reprice extra effectively. In distinction, buyers in 1973 and 1990 had been caught off-guard by embargoes and invasions, and the macro backdrop – excessive inflation within the Nineteen Seventies and recession danger within the early Nineties – amplified the fallout.

In right this moment’s setting of stable development and tight labor markets, value shocks like rising oil costs can contribute to inflation persistence. Central banks could reply by delaying charge cuts, however a full coverage reversal is unlikely until oil costs stay elevated for an prolonged interval or inflation expectations turn out to be unanchored. For now, policymakers are anticipated to look by way of the volatility.

Funding Implications

Be Able to Act When Markets Overshoot: When geopolitical tensions spark market volatility, concern can usually drive costs under fundamentals. One should gauge whether or not the battle is a regime-changing occasion or a brief shock. Moderately than retreating, be ready to place capital into high quality belongings which have been unjustly offered off.

Historical past exhibits that conflict-driven pullbacks can current engaging entry factors: in the course of the 2022 Ukraine invasion, many European equities had been indiscriminately offered, solely to rebound as circumstances stabilized. Equally, after occasions just like the Gulf Warfare and Iraq Warfare, the S&P 500 delivered positive factors of over 20% inside a 12 months. Use these moments of dislocation to your benefit: concentrate on high-conviction names with sturdy fundamentals, and purchase selectively when panic creates market alternative.

The prudent course: keep diversified, don’t overreact, and alter portfolios to soak up short-term volatility with out sacrificing long-term targets.

Diversify and Concentrate on High quality: Portfolios ought to lean into high-quality belongings, developed market bonds, investment-grade credit score, and equities with sturdy steadiness sheets and pricing energy. These have a tendency to face volatility higher. Inside equities, buyers could favor firms with dependable money flows and restricted sensitivity to increased enter prices.

Choose Publicity to Power and Protection: A modest chubby to power and protection shares gives upside if oil costs stay elevated or protection budgets increase. Publicity may be added through sector ETFs ($OilWorldWide), commodity-linked funds, or choose equities. Likewise, commodities like oil futures or broad commodity funds can act as hedges: if inflation goes up, these actual belongings have a tendency to realize worth. Nonetheless, place sizing is necessary; over-concentration needs to be averted, since commodity costs may be unstable and coverage actions (like coordinated oil reserve releases) might restrict positive factors.

Preserve Secure-Haven Allocations: Gold stays a well-liked hedge. Many buyers have added to gold positions or used ETFs ($GoldWorldWide) to supply ballast. Authorities bonds proceed to function a stabilizer regardless of restricted value appreciation potential.

Hedge Tail Dangers: For extra superior methods, hedging in opposition to excessive outcomes could also be prudent. Tail dangers, akin to a chronic provide disruption (i.e. the closure of the Strait of Hormuz), can have disproportionate market penalties. These situations should not basecase, however they require cautious monitoring. Devices like out-of-the-money oil name choices or VIX futures can present asymmetrical safety within the occasion of a pointy escalation. These hedges could function low-cost insurance coverage that may mitigate losses in a worst-case situation.

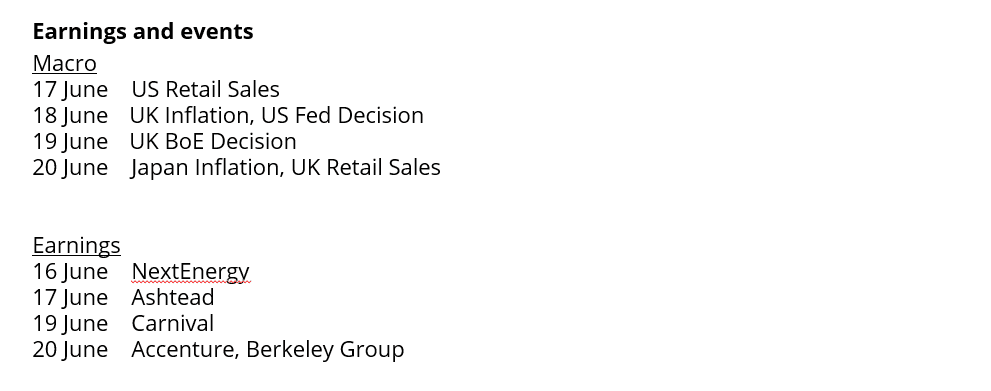

Restoration Rally Within the US Inventory Market Stalls

Geopolitical tensions, skepticism relating to the China deal, and the upcoming Fed charge resolution are unsettling buyers. The S&P 500 turned decrease simply earlier than reaching its all-time excessive and closed final week barely within the purple.

From a technical perspective, the market nonetheless gives clear indicators. The idea of Truthful Worth Gaps and the pattern construction might help establish potential setups for the brand new buying and selling week.

Rationalization: A Truthful Worth Hole arises when the market strikes in a short time in a single path, leaving no overlap between the excessive of the earlier candle and the low of the following one (violet zones on the chart).

Truthful Worth Gaps are sometimes thought-about “magnetic” value areas to which the market may later return. They’re due to this fact steadily used as retracement zones, i.e., potential entry or goal areas. Nonetheless:

Not all Truthful Worth Gaps are reached (blue zone)

Not all gaps maintain (purple zone)

Ideally, affirmation is required, for instance by way of candlestick formations (see constructive reactions, inexperienced arrows)

Present state of affairs within the S&P 500: The final two Truthful Worth Gaps within the current upswing have been defended. This ends in three potential situations:

Continuation of the brand new upward transfer: The market might kind a brand new increased excessive and ensure the present upward pattern.

Bullish breakout with new gaps: A dynamic upward motion might result in new honest worth gaps over the course of the week.

Break of the latest Truthful Worth Gaps: This might sign a pattern reversal. Additional declines could result in quick setups based mostly on new gaps.

Suggestions: The best strategy is to search for lengthy alternatives in an uptrend and quick alternatives in a downtrend. Buying and selling in opposition to the pattern is after all not forbidden, however one ought to pay attention to the related dangers. You certainly know the saying “The pattern is your pal.”

Moreover, the market is fractal. Which means that Truthful Worth Gaps happen in each timeframe and can be utilized for all funding horizons.

Backside line: Anybody who thinks they already know on Monday the place the market will likely be by the tip of the week shouldn’t be too assured. Nothing is 100% predictable. In buying and selling, it’s not about making exact predictions, however about chances and danger administration. Success relies on good preparation and the event of a repeatable course of.

S&P 500, H4 chart (supply: eToro)

Key Stage for $ETH: It has not closed above this stage since January

Ethereum but once more is at its crucial stage the place the bulls and bears will battle it out. Traditionally this stage has acted as a key line-in-the-sand for sentiment. If we are able to shut above, the bulls will likely be eyeing up the 2025 highs. If we fail to push increased, the bears will likely be eyeing up the lows of the 12 months once more.

Key Trendline for $ISF.L ETF

After a full restoration from the April lows, it’s price keeping track of the pattern line within the chart for any additional potential strikes to the upside. A break of this stage can be welcome information to the bulls.

This communication is for data and training functions solely and shouldn’t be taken as funding recommendation, a private advice, or a suggestion of, or solicitation to purchase or promote, any monetary devices. This materials has been ready with out considering any specific recipient’s funding targets or monetary state of affairs and has not been ready in accordance with the authorized and regulatory necessities to advertise impartial analysis. Any references to previous or future efficiency of a monetary instrument, index or a packaged funding product should not, and shouldn’t be taken as, a dependable indicator of future outcomes. eToro makes no illustration and assumes no legal responsibility as to the accuracy or completeness of the content material of this publication.