Crypto copy buying and selling is a straightforward strategy to comply with professional merchants and mechanically copy their trades into your personal account. You don’t have to know technical evaluation or spend hours watching the market. It makes crypto buying and selling simple, particularly for newcomers or individuals with much less time.

The advantages of crypto copy buying and selling embrace passive revenue, professional methods, threat management, time-saving, studying alternatives, diminished stress, and simple entry for newcomers.

On this information, you’ll be taught what copy buying and selling in crypto is. You’ll perceive the way it works, how a lot cash it is advisable begin, and which methods are the simplest. Plus, we’ll provide the rundown on tips on how to discover the proper merchants to repeat and, after all, the easy steps to really begin copy buying and selling your self.

What Is Copy Buying and selling in Crypto?

Copy buying and selling in crypto is a technique that lets you comply with and replicate the very same trades of skilled crypto merchants. So principally, you don’t have to do your deep market analysis or spend time studying technical evaluation. You simply have to select a talented dealer, after which your account will copy their trades mechanically. It means once they purchase or promote a coin, your account may also do the identical.

That is actually helpful for newbie merchants as they don’t have a lot information about buying and selling. And it could actually additionally assist you be taught buying and selling methods over time by seeing what others do. A lot of the finest crypto exchanges now supply copy buying and selling options, like Binance, Bybit, Bitget, or KuCoin.

It’s fairly easy to begin. You might want to discover a platform that gives copy buying and selling. Then, you’ll be able to select merchants by their efficiency, previous revenue fee, threat degree, and variety of followers. Additionally, you’ll be able to management how a lot cash you need to make investments, and you’ll cease copying anytime you need. In easy phrases, copy buying and selling which means is that you just mechanically copy the trades of different profitable merchants into your personal account.

Are you exploring copy buying and selling however unsure the place to start? Bitget affords a clean and beginner-friendly platform the place you’ll be able to copy top-performing merchants and handle threat with ease. Be a part of now!

How Does Copy Buying and selling in Crypto Work?

Copy buying and selling in crypto works via a system that mechanically mirrors the buying and selling actions of a selected professional dealer into your personal buying and selling account. At its most simple degree, the method relies on Utility Programming Interfaces (APIs). So, when a person desires to repeat a lead dealer, they usually hyperlink their cryptocurrency change account to the copy buying and selling platform via safe API keys. Now, these keys allow the platform to make sure actions, equivalent to purchase and promote orders, however importantly, they don’t permit withdrawals.

After linking, the platform’s algorithmic engine retains observe of the real-time buying and selling exercise of the chosen lead dealer. When the lead dealer makes a commerce, whether or not it’s an order placement (purchase/promote), setting stop-loss/take-profit ranges, or place closing, the platform instantly receives this notification. It then makes the exact same commerce on the follower’s account.

For instance, if the lead dealer is opening a place value 10% of their portfolio, the follower’s account will open a proportionate place with 10% of their obtainable copy buying and selling funds.

A lot of the platforms permit versatile management. You possibly can set your most funding quantity, each day loss restrict, stop-copying situations, and leverage settings. Lead merchants are normally inspired to share their methods by the use of profit-sharing mechanisms or subscription charges, the place they get a lower of the earnings made for his or her followers.

Which Copy Buying and selling Technique Is the Finest?

There isn’t one “finest” copy buying and selling technique for everybody, as a result of what works finest relies on what you need and the way a lot threat you’re okay with. However listed below are some frequent and good methods:

Diversify Your Merchants: This implies don’t begin automated buying and selling with all of your cash with only one dealer. As a substitute, choose a couple of completely different merchants to repeat. So, if one dealer has a foul day, your complete funding isn’t hit too onerous as a result of you’ve gotten others doing properly. This helps in threat administration.Comply with Merchants with Constant Efficiency: Don’t simply search for merchants who made some huge cash very quick. You need to search for merchants who’ve been making regular, good returns over an extended time. They may not have big, fast wins, however they’re extra dependable and fewer dangerous in the long term.Begin with Low-Danger Merchants: If you’re new, it’s a good suggestion to start by copying merchants who don’t take huge dangers, like excessive leverage. These merchants normally goal for smaller, extra common earnings slightly than making an attempt to get wealthy shortly. This can be a key a part of copy buying and selling for newcomers who need safer and steadier development.Monitor Efficiency Frequently: Even while you copy merchants, it’s necessary to control how they’re doing. Verify their outcomes typically. Markets change, and a dealer who was good yesterday won’t be doing so properly immediately. So, if a dealer begins dropping cash typically, it’s best to take into consideration stopping copying them and discovering a brand new one.

What Are the Execs and Cons of Copy Buying and selling?

Execs of Copy Buying and selling

The professionals of copy buying and selling embrace being good for newcomers, saving time, providing an opportunity to be taught from specialists, making diversification simple, a chance to earn passive revenue, and good buyer assist.

Good for Rookies: For those who’re new to buying and selling, it is a huge plus. You simply don’t have to know all of the technical particulars about markets or tips on how to choose investments. All it’s a must to do is comply with somebody who does. It makes getting began a lot simpler and fewer scary.Saves Time: Buying and selling can take lots of time. You might want to analysis, watch the information, and take a look at charts. With copy buying and selling, you don’t must do any of that. The professional dealer does the work in your behalf, and your account simply follows alongside.Study from Specialists: By watching what skilled merchants do, over time, you can begin to know their methods and why they make sure decisions. It’s a sensible strategy to be taught in regards to the market and buying and selling with out going to high school for it.Diversification Made Simple: You possibly can copy completely different merchants who use completely different methods or commerce completely different cash. That is referred to as diversification in copy buying and selling. So, if one kind of your funding isn’t doing properly, one other is likely to be, which may make your general outcomes extra secure.Passive Revenue Chance: If the merchants you comply with carry out properly, you’ll be able to earn earnings with out energetic buying and selling. It may possibly simply turn out to be a supply of passive revenue.Good Buyer Assist: One of the best copy buying and selling platforms supply 24/7 buyer assist. If something goes unsuitable, you’ll be able to contact assist via reside chat or e-mail. It provides you fast assist and higher confidence.

Cons of Copy Buying and selling

The cons of copy buying and selling contain the danger of dropping cash, an absence of management over trades, potential charges, and the truth that previous efficiency doesn’t assure future outcomes.

You Can Nonetheless Lose Cash: Simply since you’re copying an professional doesn’t imply you’ll be able to’t lose cash. Even the most effective merchants have dangerous days or make errors. In the event that they lose cash, you lose cash too. There’s no assure of earnings.Lack of Management: Once you copy somebody, you’re principally giving your funds for buying and selling. You don’t determine what to purchase or promote, or when. The dealer you copy makes these choices for you. This may be robust when you wish to be answerable for your personal investments.Potential for Charges: A lot of the crypto copy buying and selling platforms and even the merchants themselves would possibly cost you charges. This might be a small share of your earnings or a set month-to-month payment.Previous Efficiency Doesn’t Assure Future Outcomes: Mainly, you determine a duplicate dealer based mostly on their previous efficiency. So, a dealer may need executed rather well prior to now, however that doesn’t imply they are going to maintain doing properly. Possibly the market volatility works in his favour. Market situations change, and a technique that labored yesterday won’t work tomorrow. It’s dangerous to rely solely on previous success.

What Is an Instance of Copy Buying and selling?

Let’s say you’ve gotten signed up on a fashionable copy buying and selling crypto change like Binance, Bitget, or Bybit. These are among the many finest platforms that provide copy buying and selling options. Now, after creating your account, you go to the copy buying and selling part, and there, you see a listing of professional merchants. This record of every dealer reveals particulars like their win fee, revenue share, threat degree, and variety of followers.

For copy buying and selling, you’ve gotten chosen a dealer named “CryptoMax”. He has had a 90% win fee and regular earnings for the final three months, and now you need to copy his trades. You might want to click on on his profile, then click on “Copy.” Right here, you’ll be able to determine to take a position $500 and set your personal limits, like stop-loss and each day loss cap.

Now, every time CryptoMax opens a commerce, for instance, he buys $1,000 value of Ethereum utilizing 10% of his account. Your account will do precisely the identical and likewise purchase Ethereum utilizing 10% of your $500, which is $50. If he makes a revenue, you additionally make a revenue. If he loses, after all, you’re taking the identical loss.

Additionally, you don’t want to put trades your self. Every thing is automated. You possibly can cease copying anytime, change your dealer, or modify the quantity. This can be a easy and clear instance of how copy buying and selling works in actual life, utilizing real-time trades of an professional.

The way to Copy Commerce?

Step 1: Select a Copy Buying and selling Platform and Create an Account

To begin, you’ll want to pick out the finest crypto copy buying and selling platform. There are fairly a lot of them, some fashionable ones being Binance, Bitget, Bybit, BingX, and even eToro when you’re within the bigger markets past crypto.

After choosing one, you will want to register for an account. This sometimes entails registering together with your e-mail or telephone quantity, making a password, after which present process a “Know Your Buyer” (KYC) process.

Are you new to repeat buying and selling and on the lookout for the most effective change to begin? Attempt Bitget copy buying and selling and comply with prime merchants simply with full management over your funds.

Step 2: Deposit Funds

As soon as your account is ready up and verified, the subsequent step is to fund it. That is the cash you’ll use for copy buying and selling. Most crypto websites have a few strategies for depositing funds. You possibly can sometimes join your checking account for a direct deposit, use a credit score or debit card, and even deposit cryptocurrency when you maintain some.

Simply select the tactic that’s best for you. There will probably be a minimal deposit quantity, which varies from platform to platform, but it surely’s typically fairly low. Now, be sure to deposit sufficient to satisfy the platform’s minimal and what you propose to allocate to the merchants you’ll copy. This may be anyplace between $50-$150.

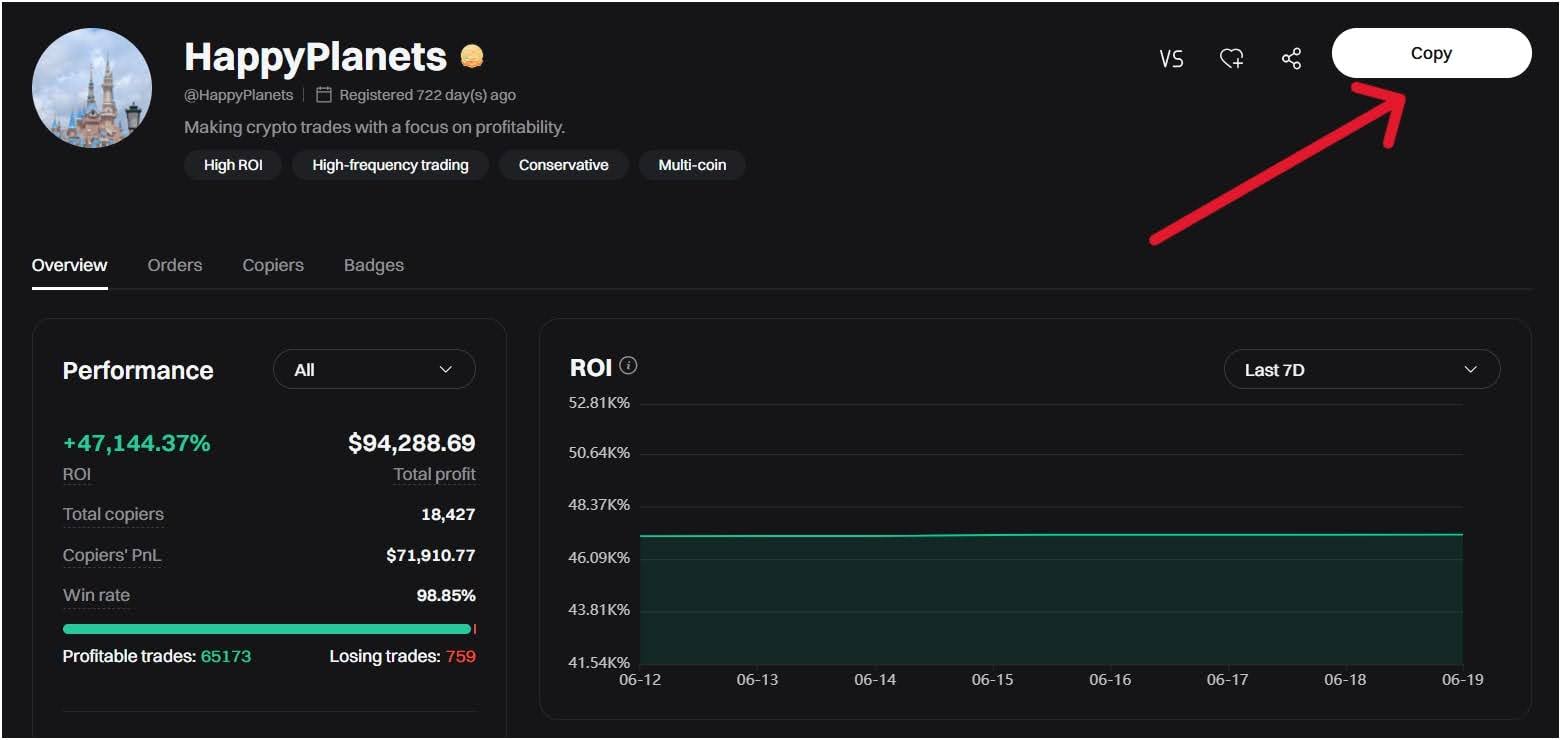

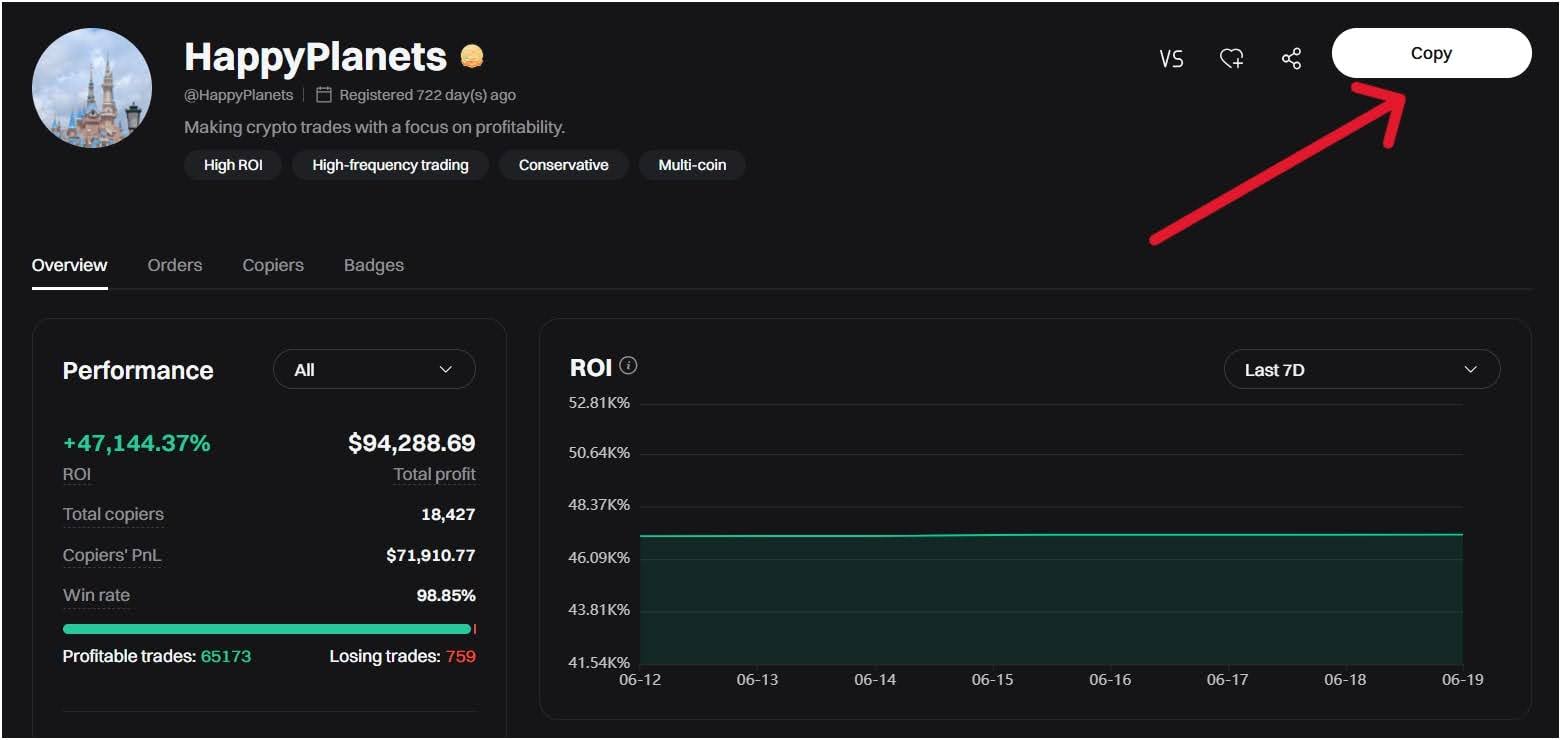

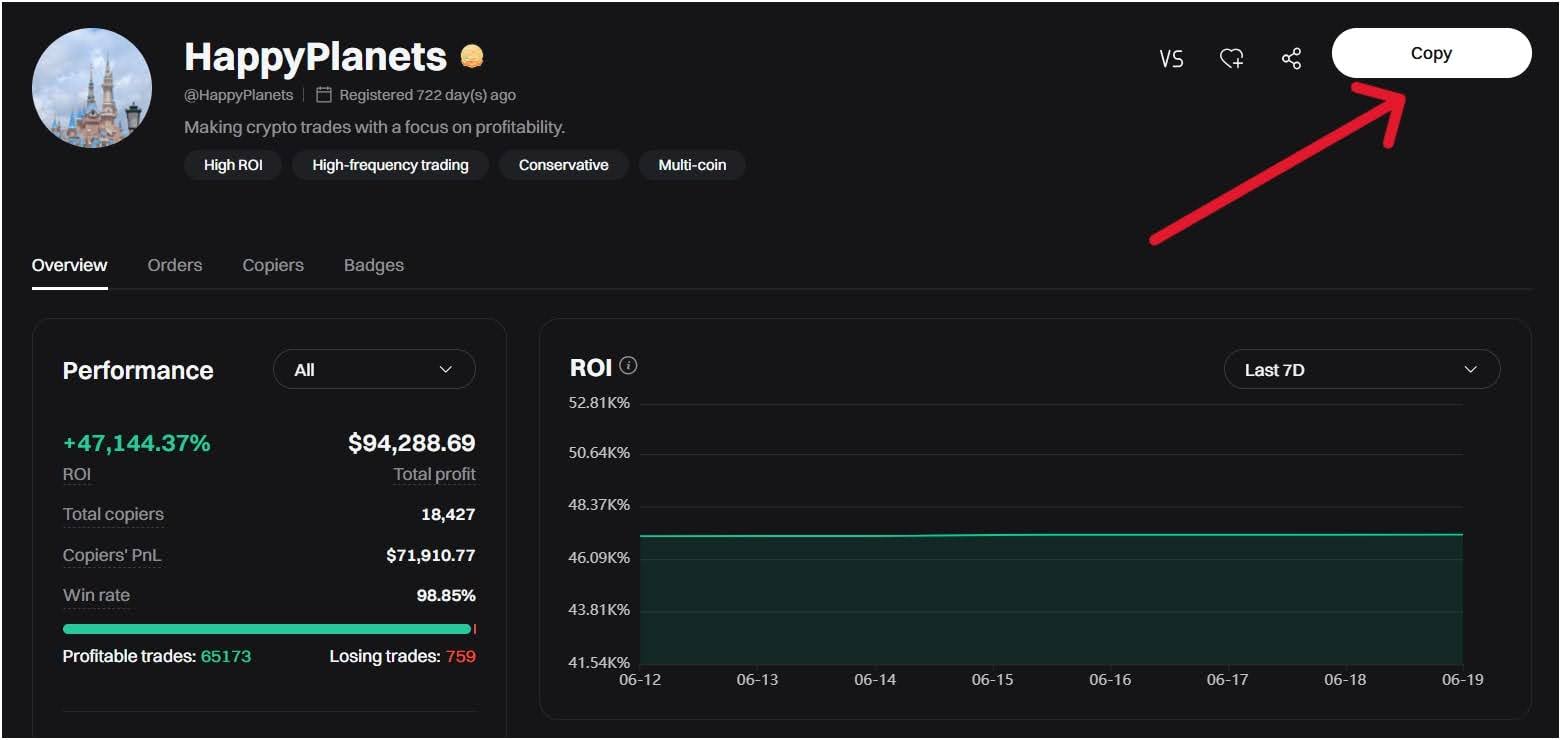

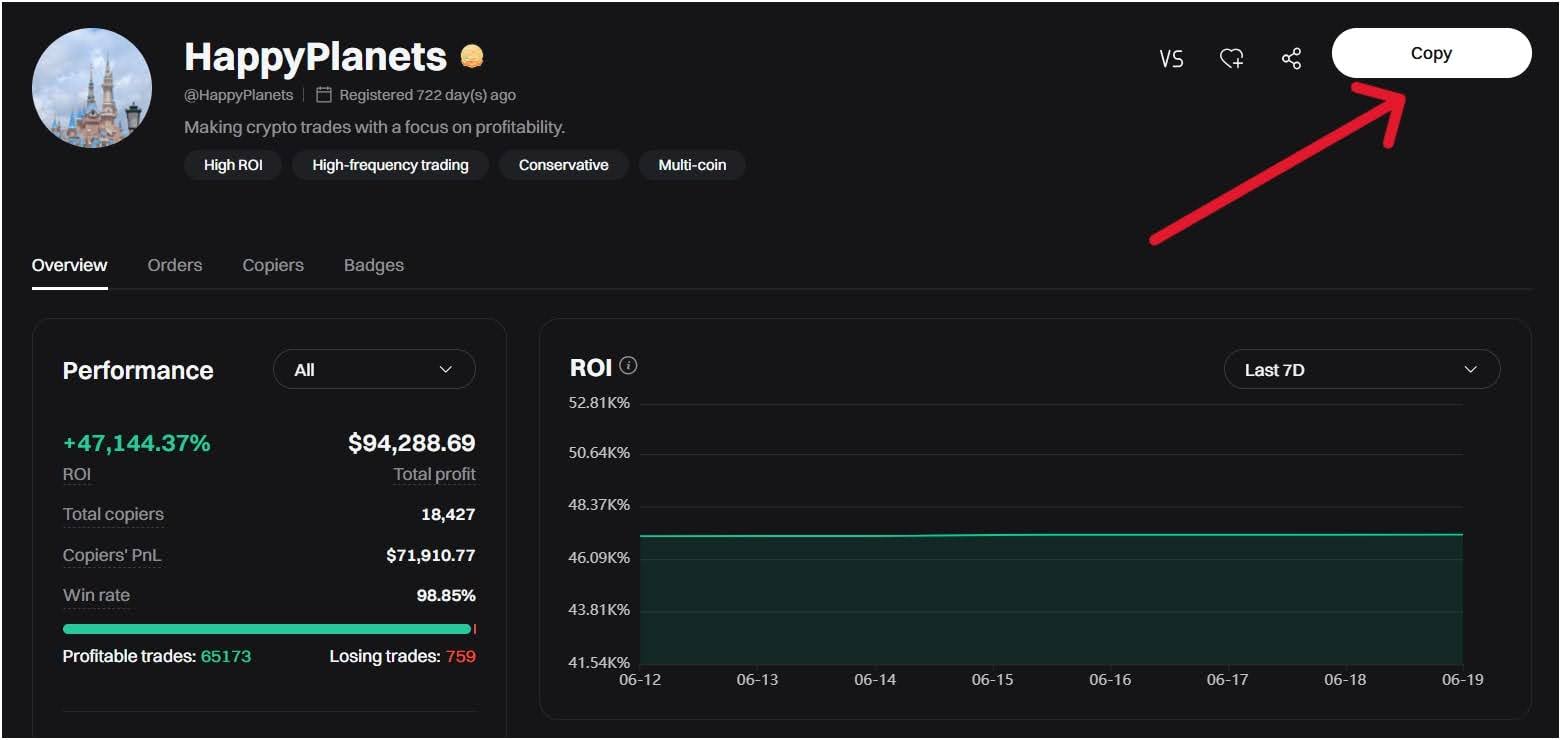

Step 3: Go to the Copy Buying and selling Part and Decide a Dealer

Now, as soon as your funds are in your account, go to the copy buying and selling part of the platform. Right here, you’ll see a listing of merchants you’ll be able to doubtlessly copy. That is the place it is advisable be a bit choosy. Don’t simply click on on the primary particular person you see; however it’s a must to take a look at their profiles fastidiously.

You’ll sometimes discover key info equivalent to their earlier earnings, how a lot threat they’re keen to take (normally displayed as a “threat rating”), what number of different merchants are following them, and their buying and selling historical past. Now it’s a must to discover merchants who’ve regular earnings for the long run, not merely a couple of large wins.

Step 4: Comply with an Elite Dealer and Begin Copying Trades

When you’ve executed your analysis and picked a dealer you want, you’ll see an choice to “Copy” them. Click on that button. The platform will then ask you ways a lot cash you need to allocate to repeat this particular dealer.

Bear in mind, you don’t want to take a position all of your cash in a single dealer; you’ll be able to sometimes cut up your general deposit throughout a number of merchants. When you settle for the quantity, your account will mechanically start replicating trades executed by that prime dealer. In the event that they purchase Bitcoin, your account buys Bitcoin (proportionally to the quantity you allotted). In the event that they promote, you promote. It’s all automated.

The way to Discover Copy Crypto Merchants?

To seek out copy merchants, it is advisable use a trusted crypto change or buying and selling platform that gives copy buying and selling options. The most well-liked platforms immediately are Binance, Bitget, Bybit, BingX, and MEXC, have a built-in copy buying and selling part. After signing up, go to their copy buying and selling tab, the place you will note a listing of merchants obtainable to repeat.

Every dealer’s profile will present many forms of necessary knowledge, like win fee, complete revenue, variety of followers, threat rating, commerce historical past, and common return. You shouldn’t simply choose the one with the very best revenue; it is advisable search for a dealer with regular efficiency, low drawdowns, and a transparent buying and selling type. Additionally, examine how lengthy they’ve been buying and selling and the way constant their outcomes are.

Keep away from merchants with very short-term huge beneficial properties or these utilizing excessive leverage. They could win quick, but additionally lose quick. Select secure merchants with long-term efficiency and those that do correct market evaluation. Eventually, take your time to assessment at the least 3-5 good profiles earlier than choosing.

How A lot Cash Is Wanted to Begin Copy Buying and selling?

The cash wanted to begin copy buying and selling is between $50-$150, and normally, it’s fairly accessible for newcomers. Most platforms require you to begin with a comparatively small sum, typically as little as $50 to $150 USD. Some copy buying and selling websites could even permit you to begin with much less, or they could not implement a minimal deposit for copying trades. Additionally, charges, slippage, and market situations can have an effect on your revenue. So, it’s higher to begin with at the least $150 in order for you extra lifelike returns and smoother commerce copying.

Therefore, the quantity varies relying on the actual copy buying and selling platform or dealer you employ, since they every have various guidelines and minimal deposit necessities.

Does Copy Buying and selling Work?

Sure, copy buying and selling can work, but it surely doesn’t assure earnings, and success relies on a number of key elements. When it “works,” it means you’ll be able to doubtlessly generate income. However, it’s additionally necessary to know that the previous efficiency of a copied dealer doesn’t promise future outcomes, and market situations can change, so even the most effective merchants can have dropping intervals.

Therefore, for copy buying and selling to “work” for you, it is advisable fastidiously choose dependable merchants with a confirmed observe document, handle your personal threat, and typically diversify by copying a number of merchants.

Is Copy Buying and selling Protected?

Copy buying and selling will not be totally “protected” within the sense that no type of buying and selling or investing is totally risk-free, and you’ll lose cash. However once more, you can also make it safer by taking sure steps.

The principle threat is that if the dealer you copy makes a dropping commerce, your account may also take a loss. This threat is all the time there. To make it safer, it’s best to select a regulated and respected copy buying and selling platform like Binance and Bybit. Now, fastidiously analysis the merchants you propose to repeat, and begin their threat tolerance ranges and long-term efficiency, not simply short-term beneficial properties. It’s additionally smart to diversify by copying a number of merchants and to set threat limits, like a “copy cease loss,” to mechanically cease copying in case your losses attain a sure level.