Based on the most recent analysis by Coinbase, the connection between cryptocurrencies and inventory markets has turn out to be exceptional. This interaction is about 50% as of September 2024, largely on account of world financial easing initiatives carried out by main international locations such the USA and China. This examine has necessary ramifications particularly for buyers attempting to barter these intertwined markets.

The Impression Of Financial Coverage

The evolution of this hyperlink has been a lot influenced by the Federal Reserve’s aggressive method to rate of interest discount. Following a latest 50-basis-point fee drop, Bitcoin and cryptocurrencies associated shares noticed important positive factors.

Bitcoin exceeded the $64,000 degree, whereas shares like Microstrategy and Coinbase additionally confirmed rising momentum. This synchronization means that, when the Federal Reserve carries out measures meant to spice up financial improvement, each asset sorts present optimistic reactions.

Supply: Coinbase

Curiously, Bloomberg information means that the costs of US fairness futures have been fluctuating in tandem with these of cryptocurrency. For instance, as Bitcoin costs elevated, quite a few US equities additionally achieved new all-time highs.

This co-movement suggests a extra profound correlation between the way through which buyers assess danger in each markets. Caroline Mauron, co-founder of Orbit Markets, noticed that macroeconomic elements are presently driving crypto costs, a development that’s extremely more likely to persist all through the Fed’s easing cycle.

Crypto: Altering Market Dynamics

Up to now, cryptocurrencies functioned independently of standard monetary markets. Nonetheless, the sensitivity of those digital property to macroeconomic circumstances has elevated as they mature.

This transition is clear in Coinbase’s findings, which point out that Ethereum has outperformed Bitcoin throughout this era of elevated correlation. Ethereum’s 8% improve over Bitcoin within the week following the Federal Reserve’s announcement means that investor curiosity in altcoins could also be shifting.

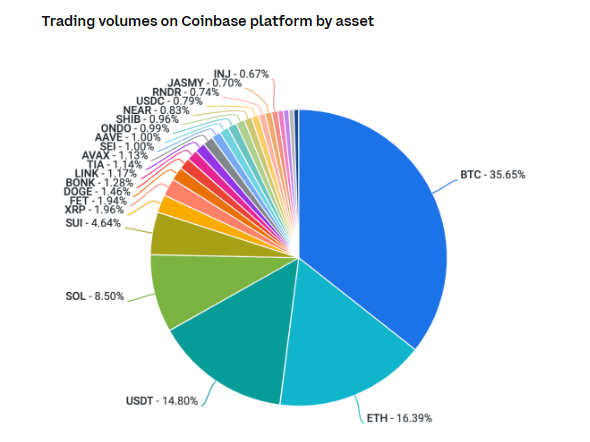

Supply: Coinbase

Supply: Coinbase

Although Ethereum’s efficiency has improved, buyers proceed to be anxious concerning the latest sell-offs by the Ethereum Basis. The inspiration not too long ago bought 100 ETH, due to this fact bringing the whole ETH bought this yr to greater than 3,500. Such acts have potential results on market temper in addition to steady development of initiatives contained in the Ethereum community.

Future Tendencies And Investor Sentiment

Because the hyperlink between the cryptocurrency market and the inventory market grows stronger, buyers are rethinking their plans. Increasingly folks within the crypto house need to be taught extra about areas aside from Bitcoin and Ethereum, similar to choices.

Memecoins similar to Shiba Inu and PEPE have not too long ago acquired reputation amongst buyers, with sure sectors—similar to gaming and Layer 2 options—reporting spectacular positive factors of as much as 17% in only one week.

As October approaches—a historically sturdy month for cryptocurrencies—there’s conjecture that favorable market circumstances might result in extra worth will increase throughout each asset sorts.

The rising participation of institutional buyers in crypto markets has additionally affected this development since their buying and selling patterns often match these of shares.

Featured picture from Pexels, chart from TradingView