Bitcoin can’t appear to go away the $60,000 value stage because it continues to commerce in uncertainty. On Saturday, August 3, the cryptocurrency skilled one other sharp decline, briefly dipping under the $60,000 mark.

Though this drop lasted just a few minutes, it was fairly important, particularly on condition that Bitcoin had traded above $62,000 earlier the identical day. This fluctuation has notably impacted market contributors, resulting in the liquidation of quite a few lengthy positions.

Associated Studying

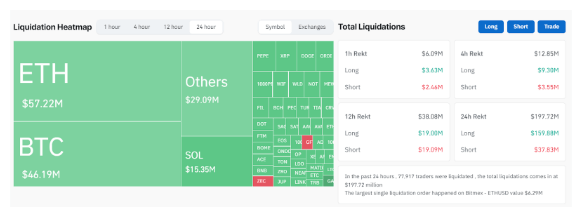

On the time of writing, over $197 million price of leveraged positions have been liquidated previously 24 hours. Notably, this determine soared to as a lot as $288 million through the peak of the promoting stress.

Bitcoin And Market Liquidations

The persistent incapability of Bitcoin to take care of a steady place above $60,000 highlights the uncertainty and speculative nature of the cryptocurrency market. Merchants and buyers stay cautious, intently monitoring its value actions.

This cautious strategy has possible been amplified by latest stories of repayments initiated by the bankrupt crypto lender Genesis International Capital, which flooded the market with extra digital property, primarily Bitcoin and Ethereum.

Contemplating Bitcoin and Ethereum’s dominance over the market, this cautious strategy has inadvertently led to a lingering bearish sentiment surrounding different cryptocurrencies. Though Bitcoin and Ethereum skilled the very best liquidated positions, the affect has spilt over into different digital property.

In response to Coinglass knowledge proven under, Ethereum led the market with $57.22 million price of leveraged positions liquidated. Bitcoin adopted intently with $46.19 million in liquidations and Solana with $15.35 million.

The entire liquidation quantity reached $197.72 million, with the bulk ($159.88 million) in lengthy positions. Most of those liquidations occurred on Binance, OKX, and Bybit, with $85.88 million, $65.83 million, and $16.47 million in liquidations, respectively, every exhibiting an 80% lengthy liquidation fee.

Prevailing Bearishness

The crypto trade isn’t any stranger to sporadic liquidations of such big quantities. Contemplating the prevailing short-term bearish sentiment, most of those liquidations have repeatedly been on lengthy positions. On June 24, the market witnessed virtually $300 million price of positions liquidated in beneath 24 hours. Equally, over $360 million price of positions have been liquidated on June 7 when the Bitcoin value crashed from $71,000 to $68,000.

Associated Studying

Current market dynamics recommend that the trade won’t be out of the woods but regarding such liquidations. Bitcoin continues to wrestle to carry above $60,000, a development that might persist within the coming weeks. That is partly as a result of Spot Bitcoin ETFs, which have traditionally been a catalyst for Bitcoin value surges, ended final week on a destructive be aware. Particularly, they concluded Friday’s buying and selling session with $237.4 million in outflows, the biggest day by day outflow since Could 1.

Featured picture from The Michigan Each day, chart from TradingView