Key Takeaways:

The rate of interest lower by the Fed didn’t convey the anticipated positivity within the crypto market, which as a substitute triggered a large sell-off, with Bitcoin sinking beneath $99,000.

The fears of the Fed slowing its fee cuts in 2025 and growing inflation have weakened investor sentiment.

The market has adopted a “wait-and-see” perspective, with buyers ready for additional financial and financial insurance policies which are going to be in place.

The cryptocurrency market simply skilled a wild day within the wake of the Federal Reserve’s announcement for a fee lower. As a substitute of rejoicing, buyers have seen a robust sell-off, driving Bitcoin and plenty of different altcoins into steep declines. What does this say for the way forward for the crypto market, and what’s going on?

Shock from the Price Reduce Resolution

On December 18, 2024, the Federal Reserve formally introduced a lower within the benchmark fee by 0.25% to maintain it inside the vary of 4.25%-4.50%. This, usually, would sound constructive, since a lower within the rate of interest would usually increase so-called ‘dangerous belongings,’ together with cryptocurrencies. The market, nevertheless, reacted fairly contrarily, beginning to transfer utterly in the other way.

Why is the Crypto Market “Bleeding”?

Doused Expectations: The crux of the problem lies in alerts about 2025. Powell prompt the Fed has tempered expectations and now sees two rate of interest cuts subsequent yr as a substitute of 4. That hawkish reassessment has led buyers to fret the financial coverage might be much less “accommodative” than their expectations.

Accelerating Inflation: The Fed additionally elevated its projection for PCE inflation on the finish of 2025 to 2.5% from 2.1%, hinting that inflationary pressures persist, and a delicate fee lower by the Fed can be exhausting to implement quickly.

Panic Promoting: These components mixed helped dampen market sentiment. Buyers are fearful about slower financial progress prospects and a possible decline in capital circulate into cryptocurrencies. The end result has been a whole sell-off.

Extra Information: How Does This Newest US Inflation Information (CPI at 2.7%) Replicate at The Crypto market?

Crypto Market “Shaken”

Bitcoin PlummetsInstantly after the Fed’s transfer, Bitcoin fell almost 5.4%, to $100,314. The cryptocurrency had surged to $108,000 following this week’s CPI knowledge, which confirmed inflation cooled greater than anticipated. The euphoria was short-lived.

Bitcoin fell

Altcoins Take a HitIt was not the one casualty. Main altcoins additionally suffered. Ethereum declined by greater than 6%, whereas XRP, Solana, and Dogecoin dropped round 10%, 7%, and 9%, respectively. The complete crypto market cap was wiped off upwards of $200 million in lower than someday.

Mass LiquidationsThis worth drop led to the liquidation of almost $700 million value of derivatives contracts previously 24 hours. Bitcoin and Ethereum every noticed over $100 million in lengthy positions liquidated.

Bitcoin: -5.4%

Ethereum: -6%

XRP: -10%

Solana: -7%

Dogecoin: -9%

Inventory Market Additionally “Wobbles”

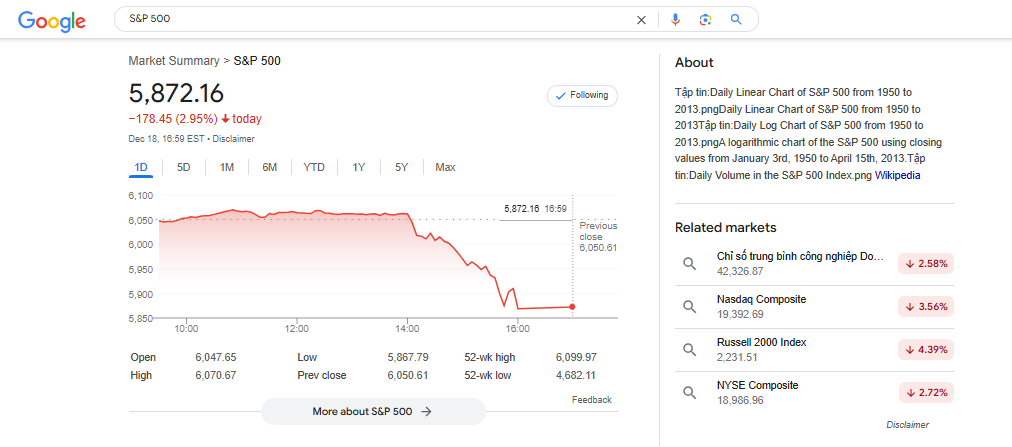

Furthermore, the Fed’s choice considerably hit the inventory market as nicely. The S&P 500 index declined noticeably. This underscores the shut correlation between crypto and equities in reacting to adjustments within the Fed’s insurance policies.

S&P 500 fell

Impression on the Close to Future

The “Wait-and-See” SectionThe crypto market is in a “wait-and-see” mode. Buyers will comply with the subsequent financial knowledge carefully, together with the actions of the Fed and different central banks.

Elevated Volatility DoubtlessWithin the brief run, the market is prone to be very risky, significantly because it enters the Christmas interval when there’s normally low liquidity.

Lengthy-Time period ComponentsNonetheless, it needs to be underlined that the crypto market demonstrated very robust progress all through 2024, regardless of inflation and high-interest charges. Influential long-term progress drivers for cryptocurrencies might come from favorable regulatory adjustments, extra institutional investments, or the formal approval of Bitcoin exchange-traded funds.

As an illustration, Bitcoin ETFs have seen big inflows of cash, much more than conventional gold ETFs. Which means establishments are lastly beginning to pay extra consideration to crypto.

Observations

This time round, the transfer by the Fed is an financial one however a “shock,” significantly to the crypto market, which had been driving excessive after immense progress in latest occasions. Super disappointment and nervousness are pure when priceless belongings drop in worth inside hours.

Alternatively, this serves as a reminder: the surprising, together with danger, is inherent in crypto. Buyers ought to maintain a cool head, consider info with care, and keep away from being swayed by short-term feelings. Don’t be overly pessimistic throughout “bloodbaths,” as they might current alternatives to purchase high quality belongings at higher costs.

Conclusion

The crypto market has its personal guidelines and could be very prone to macroeconomic influences. The Fed’s choice is amongst many, and understanding such developments is essential for any crypto investor.

Keep in mind, investing is a long-term recreation. Quick-term ups and downs shouldn’t shake your resolve. Continue learning, maintain researching, and make knowledgeable choices.