Are you in search of the simplest approach to get crypto portfolio information? With Moralis’ Token API and our crypto portfolio tracker endpoint, you’ll be able to seamlessly get any pockets’s token balances – together with metadata, costs, and way more – with a single API name. For somewhat sneak peek of how this works, try the instance beneath:

import fetch from ‘node-fetch’;

const choices = {

technique: ‘GET’,

headers: {

settle for: ‘software/json’,

‘X-API-Key’: ‘YOUR_API_KEY’

},

};

fetch(‘https://deep-index.moralis.io/api/v2.2/wallets/0xcB1C1FdE09f811B294172696404e88E658659905/tokens?chain=eth’, choices)

.then(response => response.json())

.then(response => console.log(response))

.catch(err => console.error(err));

All you need to do is set up the required dependencies, exchange YOUR_API_KEY along with your Moralis API key, and configure the deal with parameter to suit your question. Then, when you run the code above, you’ll get a response that appears like this:

{

//…

“consequence”: [

{

“token_address”: “0xa0b86991c6218b36c1d19d4a2e9eb0ce3606eb48”,

“symbol”: “USDC”,

“name”: “USD Coin”,

“logo”: “https://cdn.moralis.io/eth/0xa0b86991c6218b36c1d19d4a2e9eb0ce3606eb48.png”,

“thumbnail”: “https://cdn.moralis.io/eth/0xa0b86991c6218b36c1d19d4a2e9eb0ce3606eb48_thumb.png”,

“decimals”: 6,

“balance”: “4553447”,

“possible_spam”: false,

“verified_contract”: true,

“balance_formatted”: “4.553447”,

“usd_price”: 1.001818879776249,

“usd_price_24hr_percent_change”: 0.1818879776249283,

“usd_price_24hr_usd_change”: 0.0018221880998897314,

“usd_value”: 4.561729172660522,

“usd_value_24hr_usd_change”: 0.008297236936878599,

“native_token”: false,

“portfolio_percentage”: 100

},

//…

]

}

This response not solely incorporates the token balances of the pockets in query but in addition options metadata, costs, value modifications over time, and way more. As such, when utilizing this endpoint, you get every thing it is advisable construct a crypto portfolio view!

To be taught extra about this, try the official token balances with costs documentation web page or be a part of us on this article!

Additionally, for those who want to begin utilizing our APIs your self, don’t overlook to enroll with Moralis. You possibly can create an account freed from cost, and also you’ll acquire quick entry to all our industry-leading improvement instruments!

Overview

Whether or not you’re constructing a portfolio tracker, cryptocurrency pockets, crypto tax software, or different Web3 platforms, you usually want easy accessibility to portfolio information. This lets you seamlessly show your customers’ token balances – together with costs, metadata, and extra. But, sourcing the info you want generally is a advanced process. And given the numerous choices for querying portfolio information, how do you discover the very best different?

All through this text, we’ll introduce you to the simplest approach to question portfolio information – Moralis’ Token API. With the Token API and our crypto portfolio tracker endpoint, you’ll be able to seamlessly question a pockets’s token balances – together with metadata, costs, and extra – with single strains of code. Consequently, it doesn’t matter if you have already got an current dapp or need to construct a brand new one from scratch; this information is tailor-made for you. Let’s go!

Introducing Moralis’ Token API – Best Technique to Get Portfolio Knowledge

Moralis’ Token API is the {industry}’s most complete interface for ERC-20 token information. The Token API helps each single token throughout ten+ EVM-compatible chains. This contains stablecoins like USDC, meme cash like Shiba Inu, and every thing in between!

With solely single strains of code, you’ll be able to effortlessly use the Token API to question token balances, metadata, transactions, and way more. Consequently, when working with this top-tier Web3 API, you’ll be able to construct every thing from cryptocurrency wallets to portfolio trackers with out breaking a sweat.

So, why do you have to leverage Moralis and the Token API when constructing Web3 initiatives?

Complete: Moralis enriches all of its API responses with transaction decodings, market information, deal with labels, metadata, and extra from a number of sources. Doing so permits us to ship the {industry}’s most complete Web3 APIs. Easy and Cross-Chain Compatibility: Request and response constructions are common throughout all APIs and endpoints, offering you and your crew with a seamless developer expertise. What’s extra, our APIs are cross-chain suitable, supporting the largest blockchains, together with Ethereum, Polygon, Solana, and plenty of others. Trusted: Tons of of 1000’s of Web3 builders and huge enterprise prospects, together with MetaMask, Delta, and Polygon, already use and belief Moralis’ Web3 APIs.

Additionally, for those who want to try all our industry-leading improvement instruments, please try our Web3 API web page!

With an summary of Moralis and the Token API, let’s now discover the final word crypto portfolio tracker endpoint!

Final Crypto Portfolio Tracker Endpoint

As you now know, Moralis presents the {industry}’s most complete Web3 APIs. We enrich all our API responses with metadata, deal with labels, transaction decodings, and way more. Consequently, with the Token Stability endpoint, you get every thing it is advisable construct a crypto portfolio view in a single single API response.

Let’s discover what this seems to be like in follow!

With Moralis’ Token Stability endpoint, you’ll be able to seamlessly question the token balances – together with metadata, costs, and way more – of any pockets with only one single name:

GET https://deep-index.moralis.io/api/v2.2/wallets/0xd8da6bf26964af9d7eed9e03e53415d37aa96045/tokens?chain=eth

In return for calling the endpoint above, you’ll get a response that appears like this:

{

//…

“consequence”: [

{

“token_address”: “0xa0b86991c6218b36c1d19d4a2e9eb0ce3606eb48”,

“symbol”: “USDC”,

“name”: “USD Coin”,

“logo”: “https://cdn.moralis.io/eth/0xa0b86991c6218b36c1d19d4a2e9eb0ce3606eb48.png”,

“thumbnail”: “https://cdn.moralis.io/eth/0xa0b86991c6218b36c1d19d4a2e9eb0ce3606eb48_thumb.png”,

“decimals”: 6,

“balance”: “4553447”,

“possible_spam”: false,

“verified_contract”: true,

“balance_formatted”: “4.553447”,

“usd_price”: 1.001818879776249,

“usd_price_24hr_percent_change”: 0.1818879776249283,

“usd_price_24hr_usd_change”: 0.0018221880998897314,

“usd_value”: 4.561729172660522,

“usd_value_24hr_usd_change”: 0.008297236936878599,

“native_token”: false,

“portfolio_percentage”: 100

},

//…

]

}

The response above is totally enriched with token metadata, costs, value modifications over time, and way more for every token. From right here, you’ll be able to merely combine this information into your initiatives and construct your individual crypto portfolio view in a heartbeat!

However why does the crypto portfolio tracker endpoint matter? And the way does it differ from the competitors?

Why the Crypto Portfolio Tracker Endpoint Issues

The crypto portfolio tracker endpoint clearly highlights the advantages of Moralis’ complete APIs and demonstrates the richness of our API responses. With this single endpoint, you’re in a position to fetch the balances, together with metadata, costs, and extra, from any deal with. As such, when utilizing Moralis, you don’t must trouble with a number of endpoints and suppliers!

Let’s summarize the principle advantages of the crypto portfolio tracker endpoint beneath:

Streamlined Developer Expertise: Fetch all of the portfolio information you want in a single API name. This ends in fewer suppliers, much less programming logic, and an total extra streamlined developer expertise. Improved Consumer Expertise: With entry to real-time value information, value modifications over time, and way more, you may give your customers a complete view of their portfolio and optimize the consumer expertise. Save Time: Get rid of the necessity for a number of API requests the place it is advisable fetch balances, metadata, and costs individually. This lets you decrease the event effort and time wanted to construct a portfolio view. In return, you get extra time to concentrate on different components of the event course of so you’ll be able to carry extra worth to your customers.

How Does the Endpoint Examine to the Competitors?

With Moralis’ Token Stability endpoint, you get a pockets’s balances – together with metadata, costs, and extra for every token – with one single endpoint. To focus on the worth of this, let’s examine Moralis to our two foremost rivals: Alchemy and QuickNode.

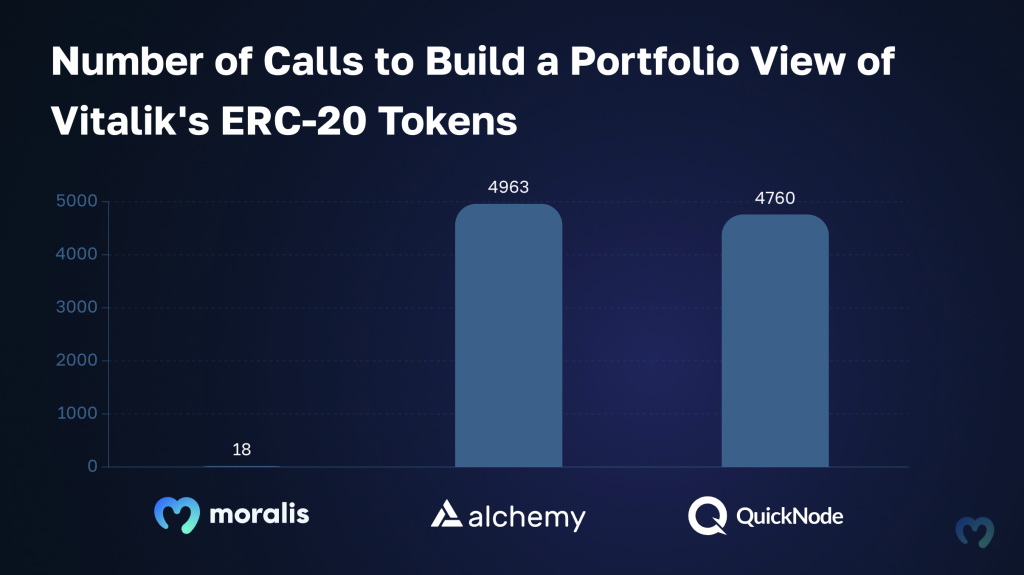

We lately performed a take a look at utilizing the Web3 APIs from Moralis, Alchemy, and QuickNode to create a portfolio view of Vitalik Buterin’s ERC-20 tokens. In doing so, we in contrast the variety of calls required to finish this process for every supplier. Take a look at the outcomes of our take a look at beneath:

Because the chart above demonstrates, you solely want 18 calls to fetch all the info when working with Moralis. As compared, the identical process calls for 1000’s and 1000’s of calls when utilizing Alchemy and QuickNode. So, why are we seeing such drastically completely different outcomes between Moralis and the opposite suppliers?

When utilizing Alchemy and QuickNode, you will need to first use one endpoint to fetch the pockets’s stability. From there, it is advisable question one other endpoint to get the metadata of every token. Lastly, you will need to use a third-party API supplier like CoinGecko or CoinMarketCap to fetch value information. As compared, with Moralis, you get all this info from one single endpoint!

If you need a extra complete breakdown of our take a look at, try our information evaluating the {industry}’s main Web3 API suppliers!

3-Step Tutorial: Methods to Name Moralis’ Crypto Portfolio Tracker Endpoint

With an summary of Moralis’ Token API and our crypto portfolio tracker endpoint, we’ll now present you methods to name the Token Stability endpoint in three steps:

Step 1: Get a Moralis API KeyStep 2: Write a Script Calling the Token Stability EndpointStep 3: Run the Code

Nonetheless, earlier than we will get going with step one, we have to cope with a few stipulations!

Stipulations

In case you haven’t already, it is advisable set up and arrange the next earlier than persevering with:

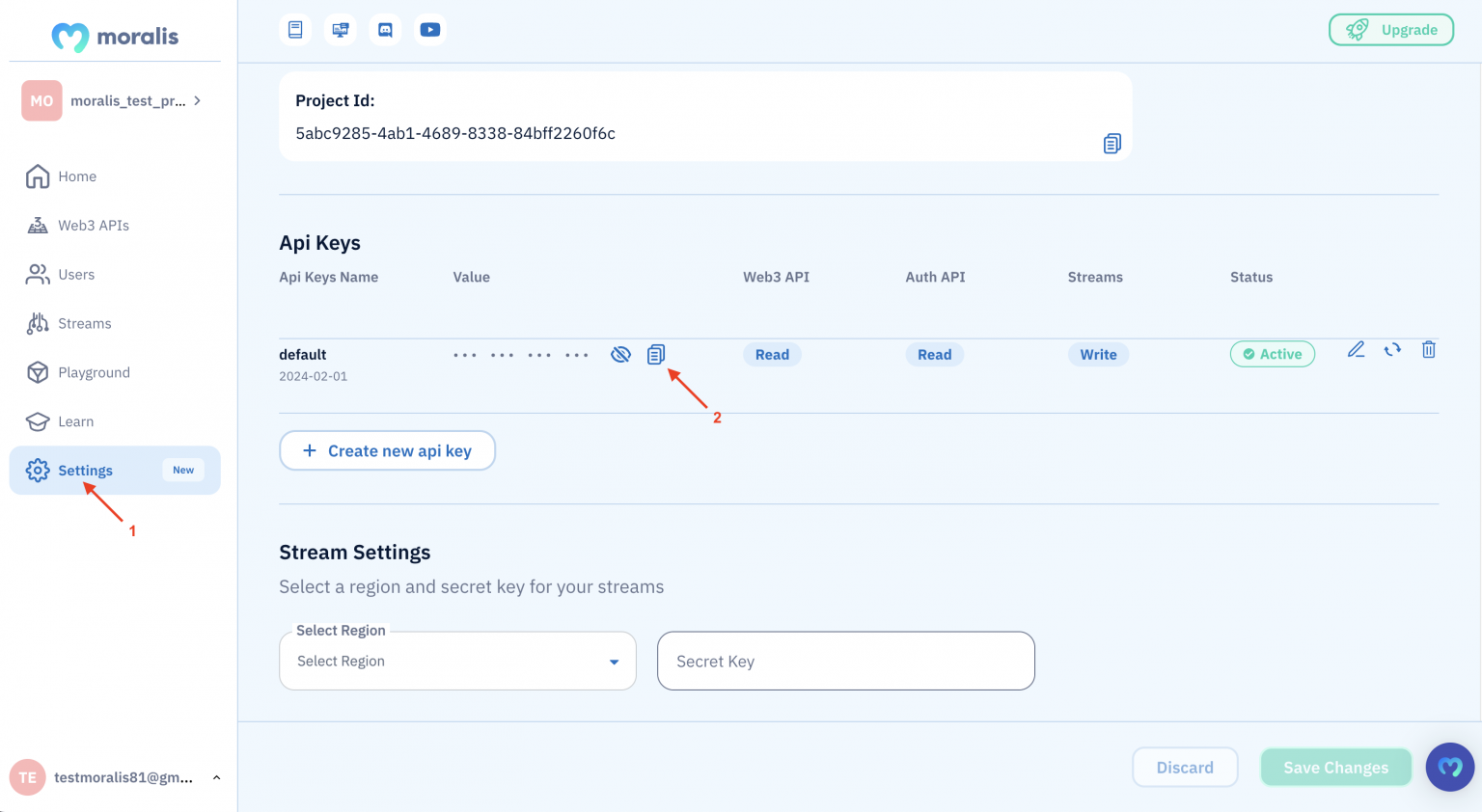

Step 1: Get a Moralis API Key

Create a Moralis account by clicking on the button on the prime proper:

Subsequent, go to the ”Settings” tab, scroll right down to the ”API Keys” part, and replica your key:

Maintain it for now, as you’ll want it within the subsequent part.

Step 2: Write a Script Calling the Token Stability Endpoint

Arrange a brand new folder in your most well-liked IDE and run the next terminal command to initialize a brand new undertaking:

npm init

Subsequent, set up the required dependencies by working the next command within the terminal:

npm set up node-fetch –save

npm set up moralis @moralisweb3/common-evm-utils

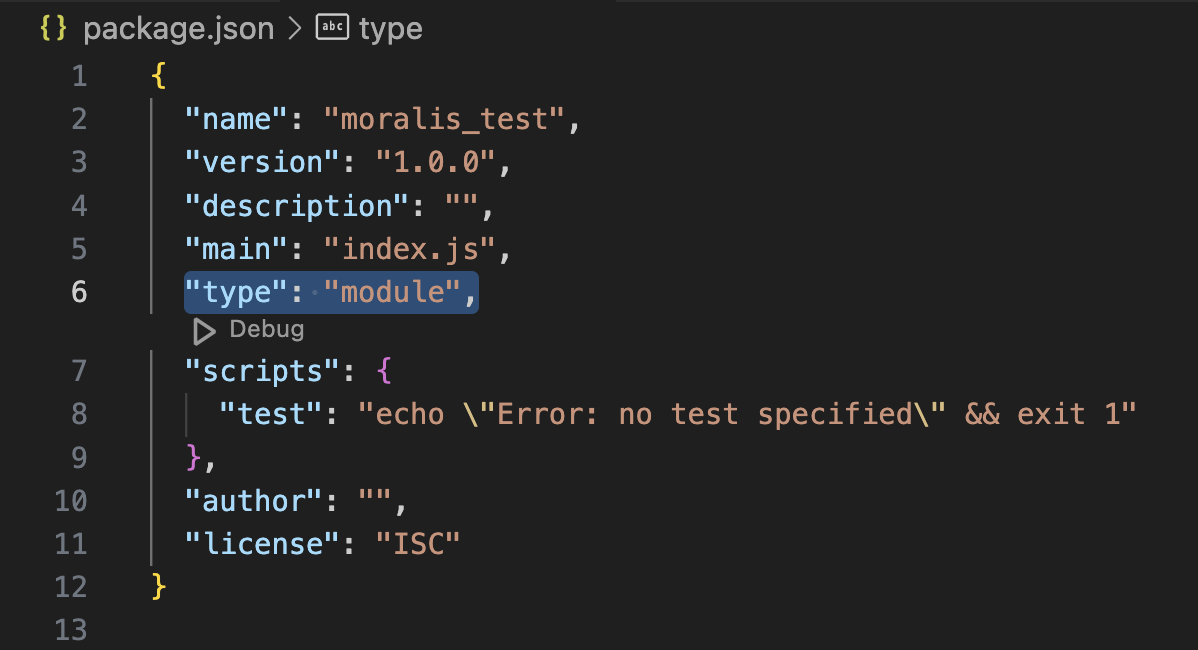

From right here, open your ”package deal.json” file and add ”sort”: ”module” to the listing:

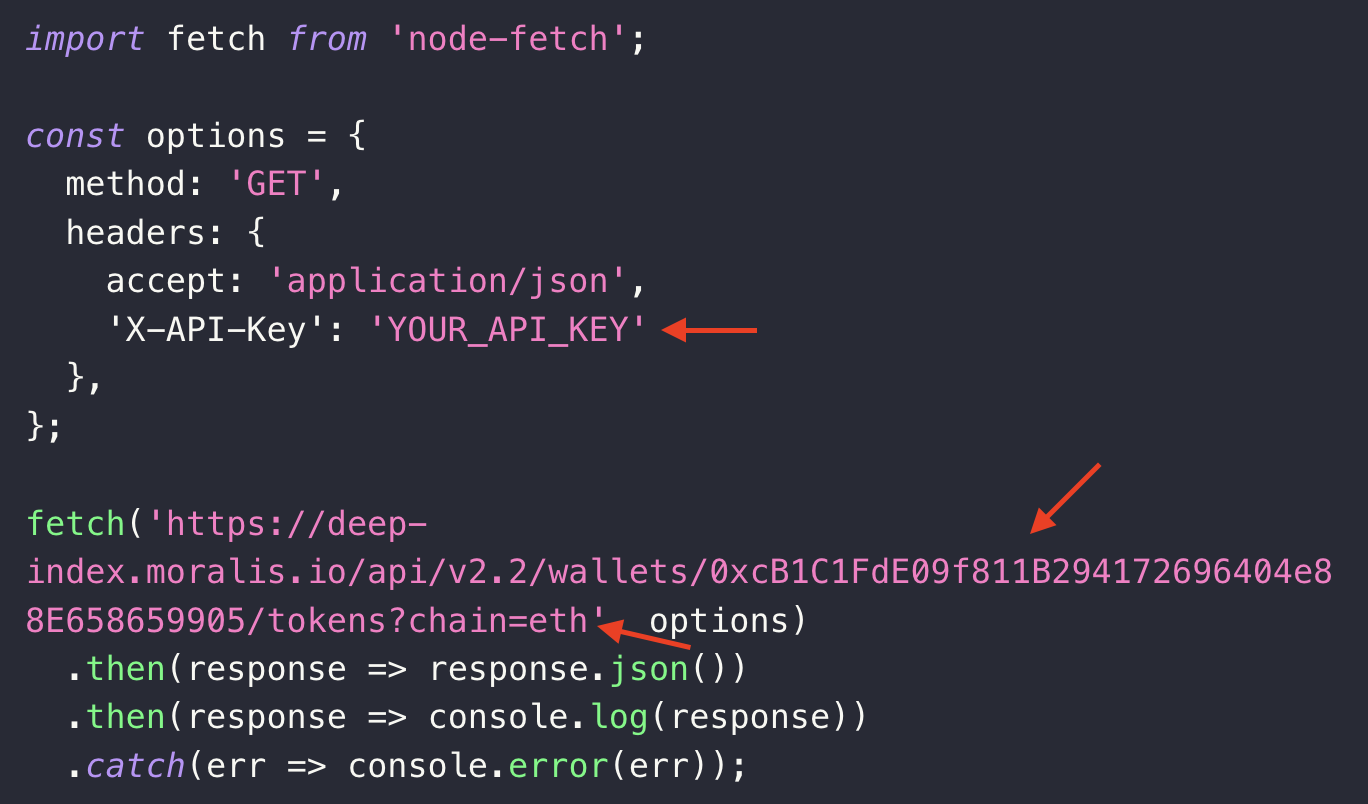

You possibly can then create a brand new ”index.js” file and add the next code:

import fetch from ‘node-fetch’;

const choices = {

technique: ‘GET’,

headers: {

settle for: ‘software/json’,

‘X-API-Key’: ‘YOUR_API_KEY’

},

};

fetch(‘https://deep-index.moralis.io/api/v2.2/wallets/0xcB1C1FdE09f811B294172696404e88E658659905/tokens?chain=eth’, choices)

.then(response => response.json())

.then(response => console.log(response))

.catch(err => console.error(err));

Subsequent, add your Moralis API key by changing YOUR_API_KEY and configure the deal with and chain parameters to suit your question:

That’s it: you’re now able to run the code!

Step 3: Run the Code

Open a brand new terminal, cd into the foundation folder of your undertaking, and run this command:

node index.js

When you run the code, you’ll get a response that appears just like this:

{

//…

“consequence”: [

{

“token_address”: “0xa0b86991c6218b36c1d19d4a2e9eb0ce3606eb48”,

“symbol”: “USDC”,

“name”: “USD Coin”,

“logo”: “https://cdn.moralis.io/eth/0xa0b86991c6218b36c1d19d4a2e9eb0ce3606eb48.png”,

“thumbnail”: “https://cdn.moralis.io/eth/0xa0b86991c6218b36c1d19d4a2e9eb0ce3606eb48_thumb.png”,

“decimals”: 6,

“balance”: “4553447”,

“possible_spam”: false,

“verified_contract”: true,

“balance_formatted”: “4.553447”,

“usd_price”: 1.001818879776249,

“usd_price_24hr_percent_change”: 0.1818879776249283,

“usd_price_24hr_usd_change”: 0.0018221880998897314,

“usd_value”: 4.561729172660522,

“usd_value_24hr_usd_change”: 0.008297236936878599,

“native_token”: false,

“portfolio_percentage”: 100

},

//…

]

}

That’s it; it doesn’t must be tougher to get the token balances, together with costs, metadata, and extra, from any pockets when utilizing Moralis’ Token API!

Along with the crypto portfolio tracker endpoint, there’s loads of different information you’ll be able to question utilizing the Token API. As such, let’s discover three further endpoints you’ll possible discover useful in your improvement endeavors:

getWalletTokenTransfers() – Get the switch historical past of any pockets: const response = await Moralis.EvmApi.token.getWalletTokenTransfers({

“chain”: “0x1”,

“deal with”: “0x1f9090aaE28b8a3dCeaDf281B0F12828e676c326”

}); getTokenPrices() – Question the value of any token: const response = await Moralis.EvmApi.token.getTokenPrice({

“chain”: “0x1”,

“deal with”: “0x7d1afa7b718fb893db30a3abc0cfc608aacfebb0”

}); getTokenMetadata() – Fetch the metadata of any token: const response = await Moralis.EvmApi.token.getTokenMetadata({

“chain”: “0x1”,

“addresses”: [

“0xA0b86991c6218b36c1d19D4a2e9Eb0cE3606eB48”

]

});

To be taught extra in regards to the numerous endpoints of Moralis’ Token API, try the official Token API documentation web page!

What Can You Construct with the Token API? – Use Circumstances for the Crypto Portfolio Tracker Endpoint

There are a lot of cases if you, as a developer, have to combine crypto portfolio information into your initiatives. As such, let’s discover three distinguished use circumstances for Moralis’ Token API and the crypto portfolio tracker endpoint!

Crypto Tax Instruments: Crypto tax instruments are specialised software program designed to assist people and companies calculate and report cryptocurrency-related taxes. Given the challenges related to the taxation of cryptocurrencies – together with their volatility, the complexity of monitoring good points and losses over a number of transactions, and the evolving regulatory panorama – these platforms play an important function within the area.

An amazing instance of a crypto tax software is Koinly. Koinly imports all consumer transactions, finds the costs on the time of the trades and calculates taxes based mostly on this information. So, when constructing a platform like this, you want entry to token balances, metadata, and costs.

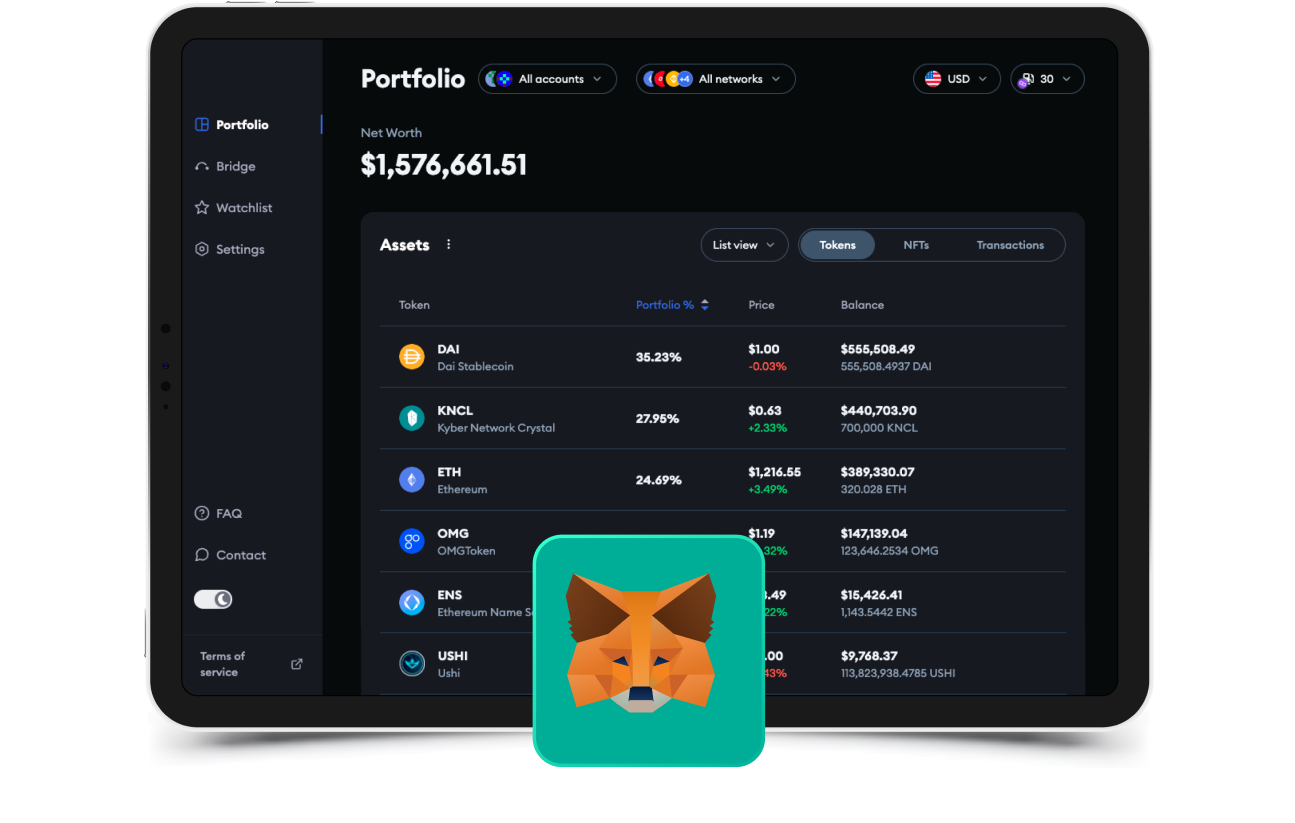

Portfolio Trackers: Portfolio trackers are apps that permit customers to watch the efficiency of their digital property. Moreover, they offer customers an organized approach to monitor and handle their fungible tokens and NFTs in a single place.

An instance of a distinguished portfolio tracker is Delta – an industry-leading platform for monitoring digital property, together with cryptocurrencies, NFTs, and shares. Delta makes use of Moralis’ Why Did It Transfer API to tell customers not solely when the worth of tokens modifications but in addition why the value will increase or decreases.

Cryptocurrency Wallets: Cryptocurrency wallets are platforms that permit customers to retailer their digital property. The most effective wallets additionally present instruments for purchasing, promoting, and swapping cryptocurrencies. As such, they offer customers the power to totally handle their fungible and non-fungible tokens.

An amazing instance of a cryptocurrency pockets supplier leveraging Moralis’ Web3 APIs is MetaMask. MetaMask is the {industry}’s main cryptocurrency pockets, with tens of millions and tens of millions of lively customers throughout the globe.

Abstract: Crypto Portfolio Tracker Endpoint – Get Portfolio Knowledge with a Single API Name

With Moralis’ Token API and our crypto portfolio tracker endpoint, you’ll be able to seamlessly fetch token balances, together with metadata and costs, with only one single name. Simply try the Token Stability endpoint in motion down beneath:

import fetch from ‘node-fetch’;

const choices = {

technique: ‘GET’,

headers: {

settle for: ‘software/json’,

‘X-API-Key’: ‘YOUR_API_KEY’

},

};

fetch(‘https://deep-index.moralis.io/api/v2.2/wallets/0xcB1C1FdE09f811B294172696404e88E658659905/tokens?chain=eth’, choices)

.then(response => response.json())

.then(response => console.log(response))

.catch(err => console.error(err));

Merely set up the required dependencies, exchange YOUR_API_KEY, configure the deal with parameter to suit your question, and run the code. In return, you’ll get a response that appears one thing like this:

{

//…

“consequence”: [

{

“token_address”: “0xa0b86991c6218b36c1d19d4a2e9eb0ce3606eb48”,

“symbol”: “USDC”,

“name”: “USD Coin”,

“logo”: “https://cdn.moralis.io/eth/0xa0b86991c6218b36c1d19d4a2e9eb0ce3606eb48.png”,

“thumbnail”: “https://cdn.moralis.io/eth/0xa0b86991c6218b36c1d19d4a2e9eb0ce3606eb48_thumb.png”,

“decimals”: 6,

“balance”: “4553447”,

“possible_spam”: false,

“verified_contract”: true,

“balance_formatted”: “4.553447”,

“usd_price”: 1.001818879776249,

“usd_price_24hr_percent_change”: 0.1818879776249283,

“usd_price_24hr_usd_change”: 0.0018221880998897314,

“usd_value”: 4.561729172660522,

“usd_value_24hr_usd_change”: 0.008297236936878599,

“native_token”: false,

“portfolio_percentage”: 100

},

//…

]

}

The totally enriched response above incorporates the token balances, together with metadata, costs, value modifications over time, and way more for every token. As such, with this single endpoint, you’ll be able to seamlessly construct a crypto portfolio tracker view with out breaking a sweat!

In case you preferred this crypto portfolio tracker endpoint article, contemplate testing extra content material right here on the weblog. As an illustration, learn our most up-to-date information on methods to question the Ethereum blockchain or learn to construct on OP Mainnet.

Additionally, don’t overlook to enroll with Moralis. You possibly can create an account without cost, and also you’ll acquire prompt entry to all our industry-leading Web3 APIs!