For the crypto and broader monetary market, FOMC day is upon us as soon as once more right now. And analysts agree that right now’s assembly shall be probably the most vital lately. Kurt S. Altrichter, a monetary advisor and founding father of Ivory Hill, even describes right now’s FOMC assembly because the “most vital of your life.” In a brand new put up on X, Altrichter explains why.

FOMC Preview

Central to right now’s FOMC assembly is the Federal Reserve’s potential indication of a September charge lower. In accordance with Altrichter, the monetary markets are virtually unanimously anticipating this transfer, with Fed fund futures indicating a near-certain probability of such an end result. “Market expectation is a robust sign for a September charge lower,” Altrichter factors out, marking right now’s replace as a pivotal second for monetary markets.

The important thing query for right now is: “How strongly does the Fed sign a September charge lower?” the knowledgeable explains. Buyers are directed to pay shut consideration to the FOMC’s assertion at 2:00 pm ET, particularly the third paragraph, which may subtly sign the Fed’s confidence in reaching its inflation targets.

Associated Studying

Altrichter advises, “Have a look at the third paragraph for this key sentence: The Committee doesn’t anticipate it is going to be applicable to cut back the goal vary till it has gained larger confidence that inflation is transferring sustainably towards 2 p.c.” Any modification on this wording can be a transparent sign that the Fed is nearing its inflation management objectives, probably paving the way in which for charge changes.

Altrichter outlines a number of potential outcomes from the assembly, every related to particular market reactions. In a dovish state of affairs, the Fed indicators a charge lower for September. Then, Altrichter expects a broad market rally, particularly in sectors much less delicate to rates of interest. “Yields and the greenback ought to fall modestly with a modest rally in commodities,” Altrichter predicts, suggesting important actions in normal and sector-specific indexes.

In a hawkish state of affairs, there shall be no change within the ahead steering by the US central financial institution. If the Fed maintains its present stance with out hinting at future cuts, the markets would possibly expertise a downturn. “Look out under and anticipate a pointy decline. SPX ought to fall by 1-2%,” he warns, noting that tech and progress sectors would possibly comparatively outperform as a result of their enchantment throughout larger yield durations.

How Will Bitcoin And Crypto React?

The potential changes in US financial coverage bear direct penalties for the Bitcoin and crypto markets. Crypto, typically considered as different investments, reacts sensitively to shifts in financial coverage, notably relating to rates of interest.

Associated Studying

If the dovish state of affairs materializes, this might make Bitcoin and cryptocurrencies extra interesting. A sign of decrease future charges may drive elevated funding into the crypto market, probably main to cost will increase as traders search larger returns in different property.

Conversely, ought to the Fed sign reluctance to chop charges, indicating a stronger financial outlook or issues about inflation, this might strengthen the US greenback and improve yields on conventional monetary devices. Such an setting would possibly result in a pullback within the crypto markets, because the comparative benefit of Bitcoin and cryptocurrencies diminishes in opposition to strengthening conventional yields.

Max Schwartzman, CEO of As a result of Bitcoin Inc, commented by way of X: “FOMC is [today] & its extremely vital as we get into the tip of this fed cycle… Right here is how the final 11 conferences have gone for Bitcoin…”

Thus, right now’s FOMC assembly is a watershed second for monetary markets globally, with important implications for each conventional and crypto markets. As Altrichter succinctly places it, “A Sept Fed charge lower has pushed the 2024 bull market. Tomorrow’s assembly will both reinforce that tailwind or refute it. If the Fed indicators a lower, the rally continues. No sign: markets may get ugly.”

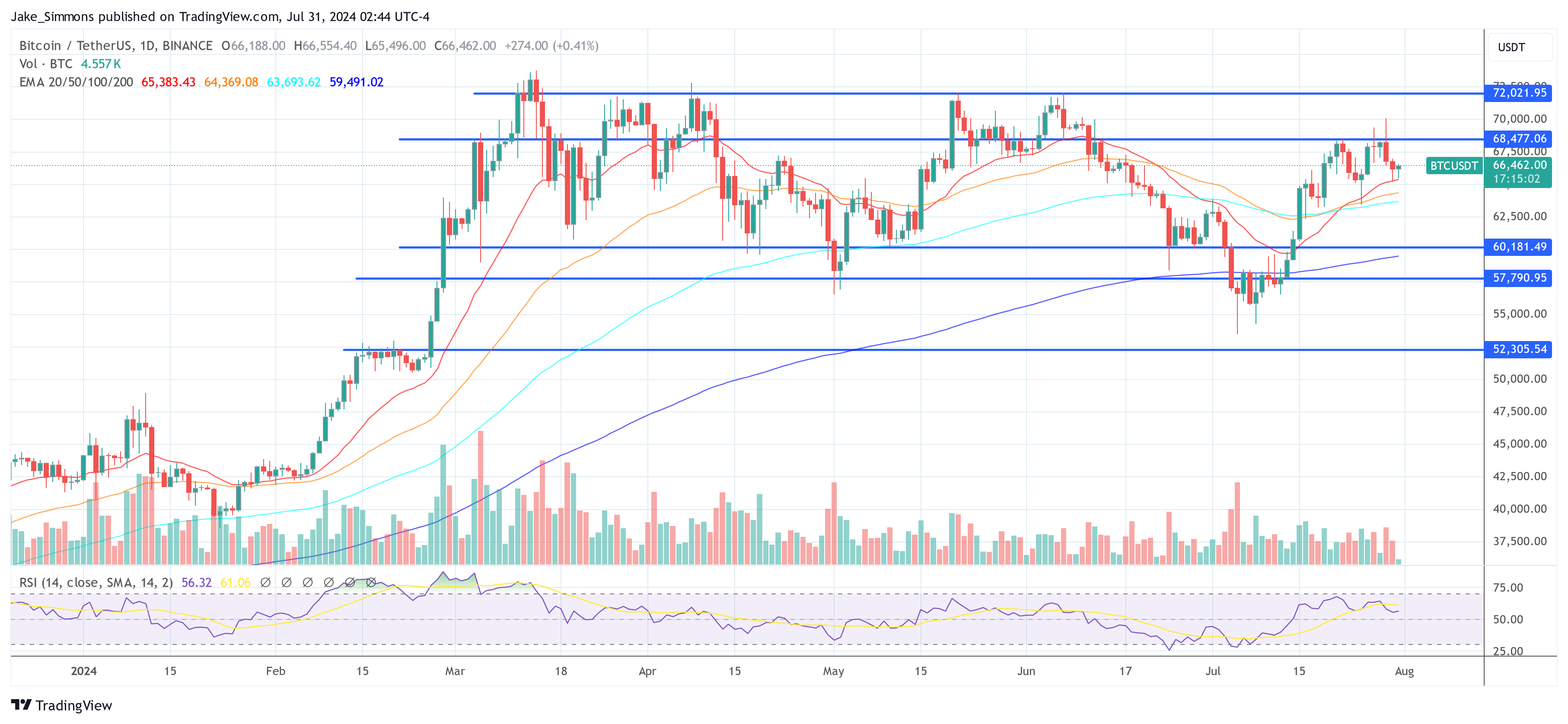

At press time, BTC traded at $66,462.

Featured picture from Shutterstock, chart from TradingView.com