Q2 2025 delivered a decisive message: after a turbulent section, crypto is again on high! The cryptocurrency sector posted a sturdy 21.72% return, outdoing each main US fairness index by a large margin.

The crypto market left US equities within the mud. In response to 99Bitcoins’ Q2 2025 Crypto Market Report revealed on 10 July 2025, “most US fairness indices stayed under 15% in quarter-to-date (QTD) positive factors, solely the S&P 500 Data Know-how sector stood out with an 18.4% rise; the broader S&P 500 gained simply 7.37%. In distinction, the crypto market outperformed all of them with a robust 21.72% return.”

Apparently, the crypto business noticed a 18% drop in Q1 2025. Therefore, the Q2 rebound is a notable restoration. The crypto positive factors of the second quarter of 2025 surpasses its efficiency in earlier years, reversing a 14.44% fall in Q2 2024.

DISCOVER: 9+ Greatest Excessive-Danger, Excessive-Reward Crypto to Purchase in July 2025

So, What Drove Crypto’s Outperformance?

What helped propel Bitcoin’s dominance to a four-year excessive of 63%? Institutional investor curiosity stood out. Whereas retail merchants shifted focus in the direction of altcoins, establishments favored Bitcoin.

In response to the 99Bitcoins’ report traders’ curiosity in crypto picked up in Q2.” In April, blockchain-related mentions in SEC filings hit a document excessive of 5,830, seemingly as a result of Trump administration’s pro-crypto strategy,” the report said.

Moreover, the US authorities supplied much-needed regulatory readability, passing key legal guidelines and govt orders that broadly assist the crypto market. Notably, the removing of IRS reporting guidelines for DeFi platforms and relaxed necessities for banks partaking in crypto actions boosted confidence throughout the sector.

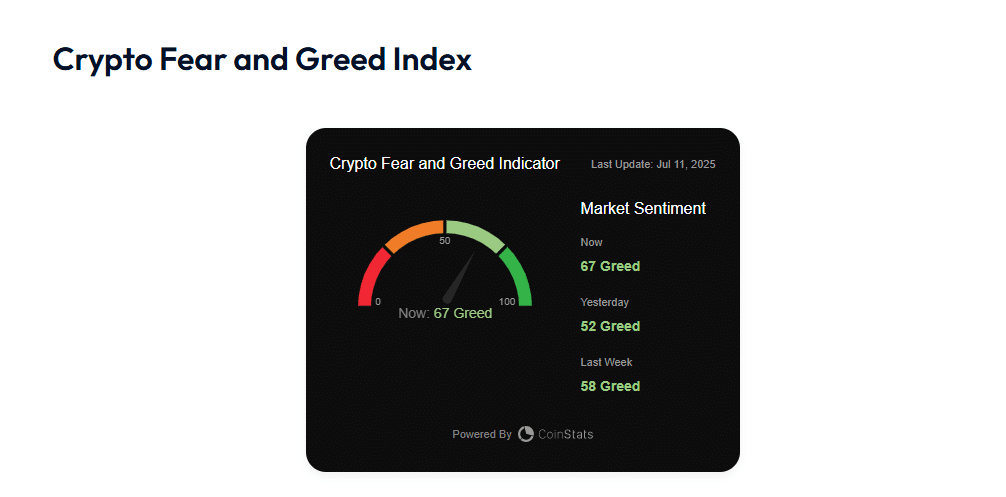

After hitting a low in March 2025, the crypto Concern and Greed index rebounded into “greed” territory for over 60 days, buoyed by constructive coverage indicators.

Simply yesterday, Bitcoin -the world’s Most worthy crypto -soared pushing above $117,000, just for consumers to aggressively step in as we speak, lifting BTC ▲6.76% to an all-time excessive of $118,409. The Concern and Greed Index from 99Bitcoins reveals a studying of “67.”

Learn Extra: Bitcoin Hits ATH With out FOMO, Bitcoin Hyper Raises $2.3M

Chris Wright, International Head of Advertising at 21Shares weighed in. “We imagine that Bitcoin ETFs will entice 50% extra inflows this yr in comparison with final yr,” he stated. “This may lead to web inflows of roughly $55 billion in 2025, representing a rise of round $20 billion year-over-year. If this development continues, the overall property below administration may practically double from simply over $110 billion at present, to over $200 billion by the tip of the yr.”

Stablecoins Steal the Highlight

The Web3 sector noticed a surge in job openings for June 2025. Whereas Ripple, Arbitrum Basis, Stellar, and Ava Labs are among the many corporations actively recruiting for varied roles, OKX, and Kraken have introduced an enlargement of their Web3 groups. “Hiring surges like this are typical throughout bull markets and replicate robust perception within the business’s development potential,” the report stated.

However, stablecoins led sector-wide demand. In response to the report, 81% of small and medium companies (SMBs) accustomed to crypto are inquisitive about utilizing stablecoins for each day operations.

Furthermore, the variety of fortune 500 firms planning to make use of stablecoins has triples since 2024.

Circle’s profitable IPA- the place the corporate’s inventory value soared 168% on debut – is proof od stablecoin associated urge for food and publicity.

DISCOVER: 16 Subsequent Crypto to Explode in 2025: Knowledgeable Cryptocurrency Predictions & Evaluation

The publish Crypto’s 21.72% Surge in Q2 2025 Leaves Wall Avenue Behind appeared first on 99Bitcoins.