Please see this week’s market overview from eToro’s world analyst workforce, which incorporates the newest market information and the home funding view.

Markets taking a pause after the ‘Trump rally’

Final week, fairness markets noticed the tip of the Trump rally, no less than for now. The S&P 500 Index closed above 6,000 for the primary time ever on Monday, however completed the week 2.1% decrease (see desk). Equally, the Dow Jones reached 44,000 earlier than ending down 1.2%. The Nasdaq 100 peaked above 21,000 however fell 3.4% from the shut on 8 November. US fairness indices surged after Trump’s election victory, pushed by guarantees of decrease taxes and fewer regulation, which have been anticipated to spice up entrepreneurship and income among the many nation’s largest firms.

Aside from cryptocurrencies, most different monetary markets have been weighed down by the prospect of extra tariffs within the coming months. The European STOXX 600 misplaced 0.7%, the Japanese Nikkei 225 dropped 2.2%, and the China-focused Hold Seng Index fell 6.3%. The US greenback strengthened additional to 1.05, bolstered by Jerome Powell’s assertion that ‘the Fed shouldn’t be in a rush to decrease rates of interest’ amid secure macroeconomic information and the expectation of doubtless greater inflation if the brand new Trump administration adopts extra expansive insurance policies. The sturdy greenback additionally negatively impacted rising markets (-3.8%), gold (-4.5%), and oil (-4%).

Crypto markets, nonetheless, responded positively when Trump introduced the creation of a brand new Division of Authorities Effectivity, which may be abbreviated to DoGE. This led Bitcoin to a brand new all-time excessive, closing above $90,000. The small measurement of the crypto market means it stays extremely unstable, particularly when even modest quantities of capital transfer between asset courses.

The week forward

Wanting forward, all eyes will likely be on NVIDIA’s quarterly earnings report, due on 20 November after the shut. Different firms set to report embody retailers Walmart and Goal, cybersecurity specialist Palo Alto Networks, and US-listed Chinese language corporations Baidu, PDD, NIO, and Xpeng. On 22 November, a number of nations will launch their flash PMI figures for November.

With the US Q3 earnings season almost full (93% of S&P 500 firms have already reported) and simply six full buying and selling weeks left till the year-end, traders may also be turning their consideration to the potential for a ‘Santa rally’ and to Outlook 2025 shows.

Blackwell chips and datacenters: NVIDIA’s outlook is essential to achieve new document highs

NVIDIA’s success story appears virtually too good to be true, and therein lies the danger. Even the smallest disappointments might set off a robust response from traders. Nonetheless, if NVIDIA delivers as anticipated, a brand new document excessive might solely be a matter of time. Regardless of excessive expectations, the chip big managed to keep away from vital profit-taking final week, and the inventory stays close to its document excessive.

The anticipation forward of the quarterly earnings report is palpable. Buyers are in search of solutions to key questions: the provision of the extremely sought-after Blackwell chips, progress within the datacenter division, and probably the subsequent upward revision of the corporate’s outlook. Forecasts recommend an 85% year-over-year enhance in earnings per share to $0.74 and an 82% year-over-year soar in income to $33.1 billion. Because the begin of the yr, the inventory has risen by a powerful 196.9%, or eight occasions the efficiency of the S&P 500.

Yen devaluation places the Financial institution of Japan within the highlight once more

For example of what’s occurring in foreign money markets, the yen continued to lose floor final week. The USDJPY pair rose by 1.8% to over 155 – its highest degree since July. This can be a direct results of Trump’s victory, which considerably boosted the US greenback and drove US bond yields greater. Merchants are pricing within the promised greater US import tariffs, that are fueling inflation expectations whereas making charge cuts much less probably.

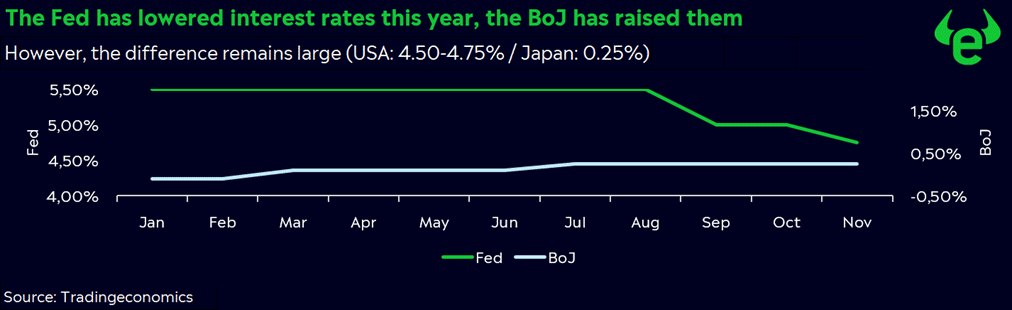

The US greenback obtained extra help from the rebound in US inflation, which rose to 2.6% in October. The present rate of interest differential between Japan and the US continues to make carry trades engaging, even because the financial insurance policies of the Fed and the Financial institution of Japan converge. Whereas the BoJ is elevating charges, the Fed is slicing them (see chart).

The scenario might turn into notably crucial if USDJPY continues its upward trajectory unchecked. The BoJ could also be pressured to lift charges earlier or extra aggressively. Consideration can also be centered on whether or not Japan might want to intervene within the foreign money market once more to cease the yen’s depreciation. This yr, Japan has already spent a document $63 billion on interventions. Japan’s inflation information on Friday will likely be key in assessing the BoJ’s subsequent steps.

Earnings and occasions

Earnings releases:

19 Nov. Walmart, Xpeng

20 Nov. NVIDIA, Palo Alto Networks, Goal, TJX, NIO

21 Nov. Baidu, PDD, Deere

This communication is for info and schooling functions solely and shouldn’t be taken as funding recommendation, a private suggestion, or a proposal of, or solicitation to purchase or promote, any monetary devices. This materials has been ready with out considering any explicit recipient’s funding targets or monetary scenario and has not been ready in accordance with the authorized and regulatory necessities to advertise impartial analysis. Any references to previous or future efficiency of a monetary instrument, index or a packaged funding product are usually not, and shouldn’t be taken as, a dependable indicator of future outcomes. eToro makes no illustration and assumes no legal responsibility as to the accuracy or completeness of the content material of this publication.