Cause to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business specialists and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

A sudden surge of institutional and company curiosity in Ethereum (ETH) is setting the stage for what Bitwise Asset Administration’s chief funding officer Matt Hougan calls a “structural imbalance” between provide and demand—one that might propel costs nicely past the cryptocurrency’s already‑speedy ascent this 12 months.

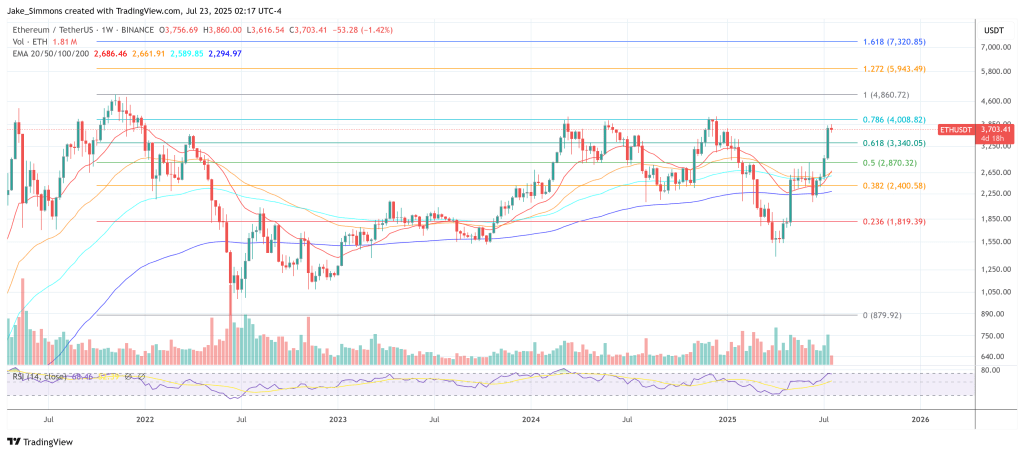

In a memo circulated to purchasers on 22 July 2025, Hougan famous that Ether has climbed greater than 65 p.c prior to now month and over 160 p.c since April. The rally, he argues, is being pushed not by sentiment alone however by a dramatic mismatch between the quantity of Ether produced by the community and the portions now being absorbed by trade‑traded merchandise (ETPs) and newly shaped “ETH treasury” firms.

Ethereum Demand Shock Is Inevitable

“Typically it truly is that straightforward,” Hougan wrote, echoing his lengthy‑standing thesis that, within the brief run, asset costs are dictated primarily by flows. He drew a direct parallel to bitcoin’s explosive efficiency following the launch of U.S. spot bitcoin ETPs in January 2024, when “ETPs, firms, and governments acquired greater than 1.5 million bitcoin, whereas the Bitcoin blockchain produced simply over 300,000.”

Associated Studying

The identical dynamic, he contends, has lastly taken maintain within the Ether market—solely extra forcefully. Between 15 Could and 20 July, spot Ether ETPs attracted greater than $5 billion in web inflows, whereas a handful of publicly traded firms started stockpiling the token as a major treasury asset. Among the many most aggressive patrons:

Bitmine Immersion Applied sciences (BMNR) amassed 300,657 ETH—about $1.13 billion at present costs—and declared an ambition “of acquiring 5 p.c of all ETH provide.”

SharpLink Gaming (SBET) bought 280,706 ETH ($1.06 billion) and disclosed plans to lift a further $6 billion for future acquisitions.

Bit Digital (BTBT) liquidated its bitcoin reserves after elevating $170 million, redirecting the proceeds to greater than 100,000 ETH (roughly $375 million).

The Ether Machine (DYNX) outlined an preliminary public providing constructed round a $1.6 billion Ether treasury.

In combination, ETPs and public firms purchased roughly 2.83 million Ether—valued at north of $10 billion—through the 9‑week stretch. Over the identical interval, the Ethereum community created solely about 88,000 ETH in new issuance, a ratio of demand to provide that Hougan calculates at 32 to 1. “No surprise the value of ETH has soared,” he noticed.

Whether or not that strain continues is now the central query for buyers. Hougan’s reply is an unequivocal sure. He factors out that, even after the latest shopping for spree, Ether stays underneath‑owned relative to bitcoin within the ETP market: Ether funds management lower than 12 p.c of the belongings held by bitcoin ETPs, regardless of ETH’s market capitalisation standing at roughly one‑fifth of BTC’s. “With all the joy surrounding stablecoins and tokenization—that are primarily constructed on Ethereum—we predict that can change,” he mentioned, predicting billions of {dollars} in extra inflows “within the subsequent few months.”

Associated Studying

In the meantime, the economics of listed “crypto treasury” companies seem like self‑reinforcing. Shares of BMNR and SBET every commerce at almost twice the web worth of the Ether they maintain, a premium that incentivises administration groups to difficulty fairness, increase capital, and buy nonetheless extra ETH. “So long as that continues to be true, you’ll be able to wager Wall Avenue companies will funnel cash into extra ETH purchases,” Hougan wrote.

Bitwise tasks that ETPs and treasury firms may take up as a lot as $20 billion value of Ether—round 5.33 million cash at current costs—over the approaching 12 months. The protocol’s issuance schedule, against this, is predicted so as to add solely about 800,000 ETH to circulation throughout the identical window, implying a 7‑to‑1 imbalance.

“That’s an excellent greater ratio than we’ve seen for Bitcoin because the spot ETPs launched,” Hougan mentioned.Sceptics typically argue that Ether’s lengthy‑time period provide shouldn’t be capped in the way in which bitcoin’s is, and that its valuation hinges on elements past easy shortage, comparable to community utilization and transaction charges. Hougan doesn’t dispute these factors however insists they’re secondary within the close to time period. “Within the brief time period, the value of every part is about by provide and demand, and proper now, there may be extra demand for ETH than provide,” he concluded.

At press time, ETH traded at $3,703.

Featured picture created with DALL.E, chart from TradingView.com