Ethereum (ETH) which is addressed as ultra-sound cash attributable to its deflationary provide methodology, now seems to be dealing with new challenges which have prompted some analysts to query whether or not this narrative nonetheless holds.

A outstanding crypto analyst, Thor Hartvigsen, lately highlighted this problem in an in depth submit on X, the place he mentioned the present state of Ethereum’s price technology and provide dynamics.

Is ETH Now not Extremely-Sound cash?

Hartvigsen identified that August 2024 is “on monitor to be the worst month by way of charges generated on the Ethereum mainnet since early 2020.” This decline is basically attributed to the introduction of blobs in March, which allowed Layer 2 (L2) options to bypass paying important charges to Ethereum and ETH holders.

Because of this, a lot of the exercise has shifted from the mainnet to those layer two (L2) options, with a lot of the worth being captured on the execution layer by the L2s themselves.

Consequently, Ethereum has develop into internet inflationary, with an annual inflation fee of roughly 0.7%, which means that the issuance of latest ETH presently outweighs the quantity being burned via transaction charges.

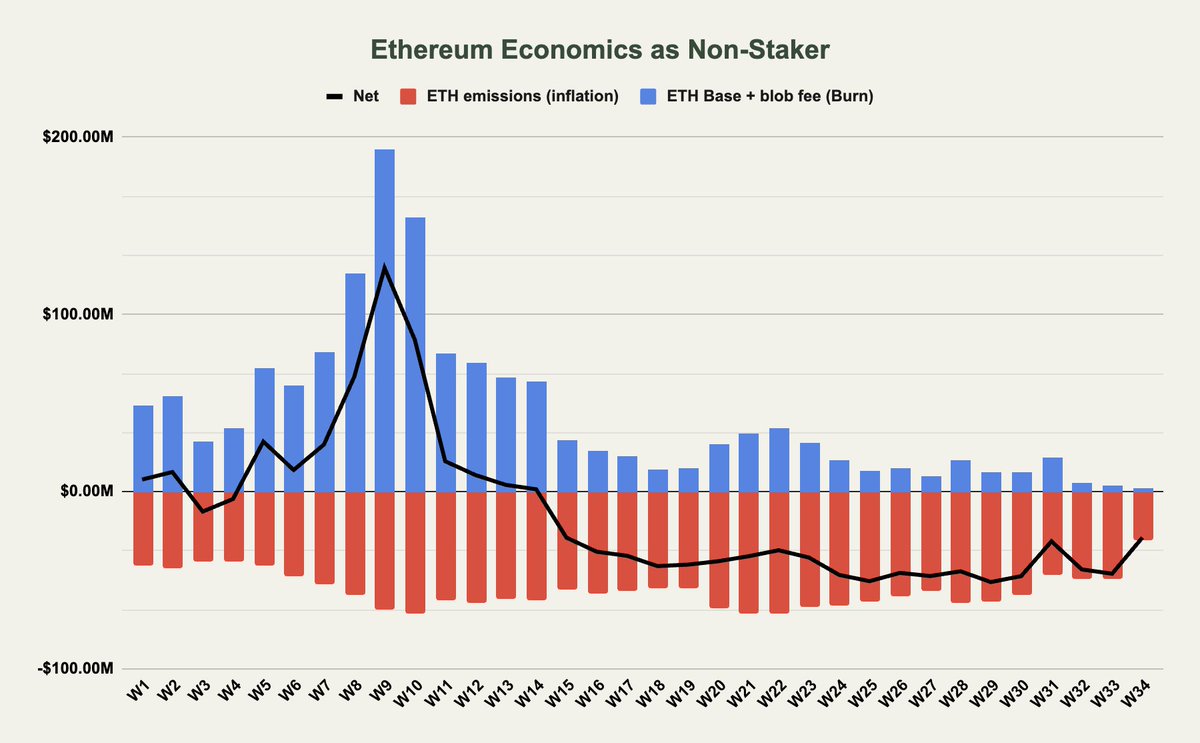

Hartvigsen disclosed the impression of this on Non-Stakers and Stakers: In accordance with the analyst, non-stakers primarily profit from Ethereum’s burn mechanism, the place base charges and blob charges are burned, decreasing the general provide of ETH.

Nevertheless, with blob charges usually at $0 and the bottom price technology lowering, non-stakers are seeing much less profit from these burns. On the identical time, precedence charges and Miner Extractable Worth (MEV), which aren’t burned however quite distributed to validators and stakers, don’t profit non-stakers instantly.

Moreover, the ETH emissions that move to validators/stakers have an inflationary impact on the availability, which negatively impacts non-stakers. Because of this, the online move for non-stakers has turned inflationary, particularly after the introduction of blobs.

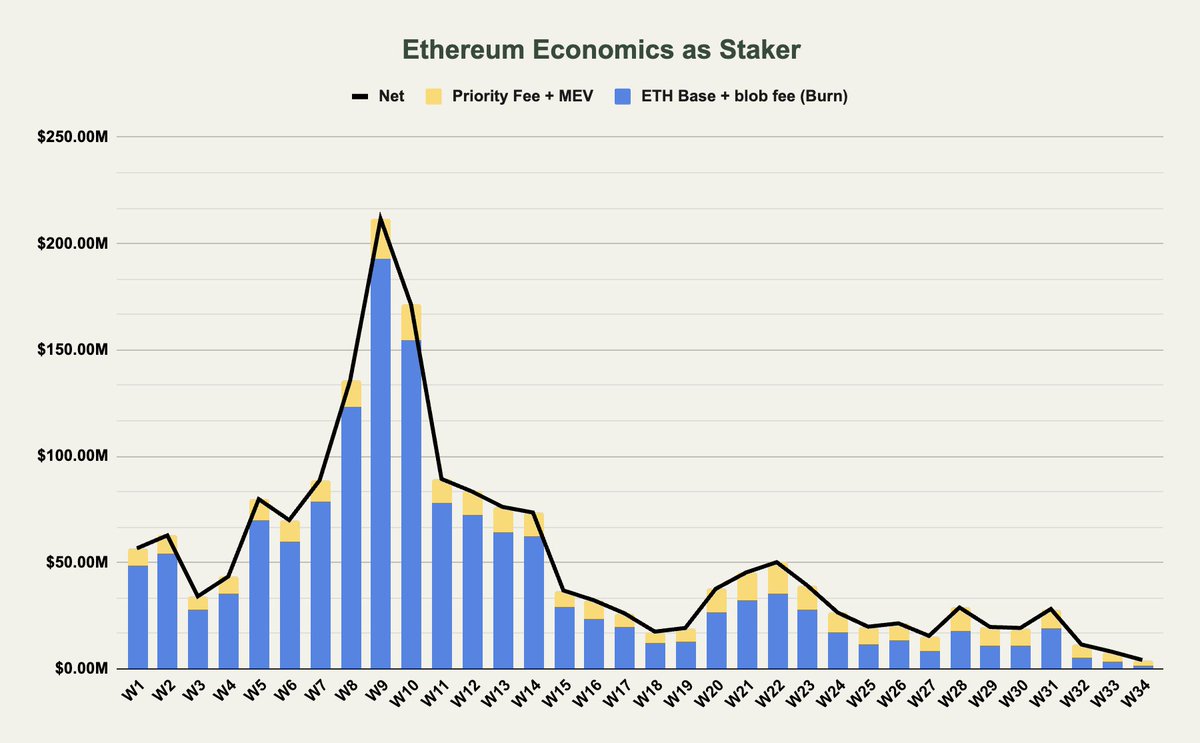

For stakers, the scenario is considerably completely different. Hartvigsen revealed that stakers seize all of the charges, both via the burn or through staking yield, which means that the online impression of ETH emissions is neutralized for them.

Nevertheless, regardless of this benefit, stakers have additionally seen a major drop within the charges flowing to them, down by greater than 90% since earlier this yr.

This decline raises questions concerning the sustainability of the ultra-sound cash narrative for Ethereum. To reply that, Hartvigsen sated

Ethereum not carries the extremely sound cash narrative which might be for the higher.

What’s Subsequent For Ethereum?

Thus far, it’s fairly evident with the present tendencies that Ethereum’s ultra-sound cash narrative could not be as compelling because it as soon as was.

With charges lowering and inflation barely outpacing the burn, Ethereum is now extra akin to different Layer 1 (L1) blockchains like Solana and Avalanche, which additionally face related inflationary pressures, says Hartvigsen.

Hartvigsen notes that whereas Ethereum’s present internet inflation fee of 0.7% per yr continues to be considerably decrease than different L1s, the lowering profitability of infrastructure layers like Ethereum could necessitate a brand new strategy to sustaining the community’s worth proposition.

One potential resolution the analyst mentioned is rising the charges that L2s pay to Ethereum, although this might pose aggressive challenges. Concluding the submit, Hartvigsen famous:

Zooming out, infra-layers are generally unprofitable (examine Celestia producing ~$100 in each day income), particularly if viewing inflation as a price. Ethereum is not an outlier with a internet deflationary provide and, like different infra-layers, require one other technique to be valued.

Featured picture created with DALL-E, Chart from TradingView