The mixed Open Curiosity of the highest altcoins has seen restoration not too long ago, with Ethereum contributing to the most important a part of the swing.

Ethereum, XRP, Solana, And Dogecoin Have Seen A Rise In Open Curiosity

In a brand new put up on X, the on-chain analytics agency Glassnode has talked concerning the pattern within the Futures Open Curiosity of 4 high altcoins: Ethereum (ETH), Dogecoin (DOGE), XRP (XRP), and Solana (SOL).

The Futures Open Curiosity right here refers to a metric that retains observe of the overall quantity of futures market positions associated to a given asset or group of property which might be at present open on all centralized derivatives exchanges. It takes into consideration each shorts and longs.

When the worth of the metric rises, it means traders are opening up contemporary positions in the marketplace. Such a pattern is usually a signal that speculative curiosity within the coin goes up. Alternatively, the indicator registering a drop suggests the holders are both pivoting to de-risking or getting forcibly liquidated by their platform.

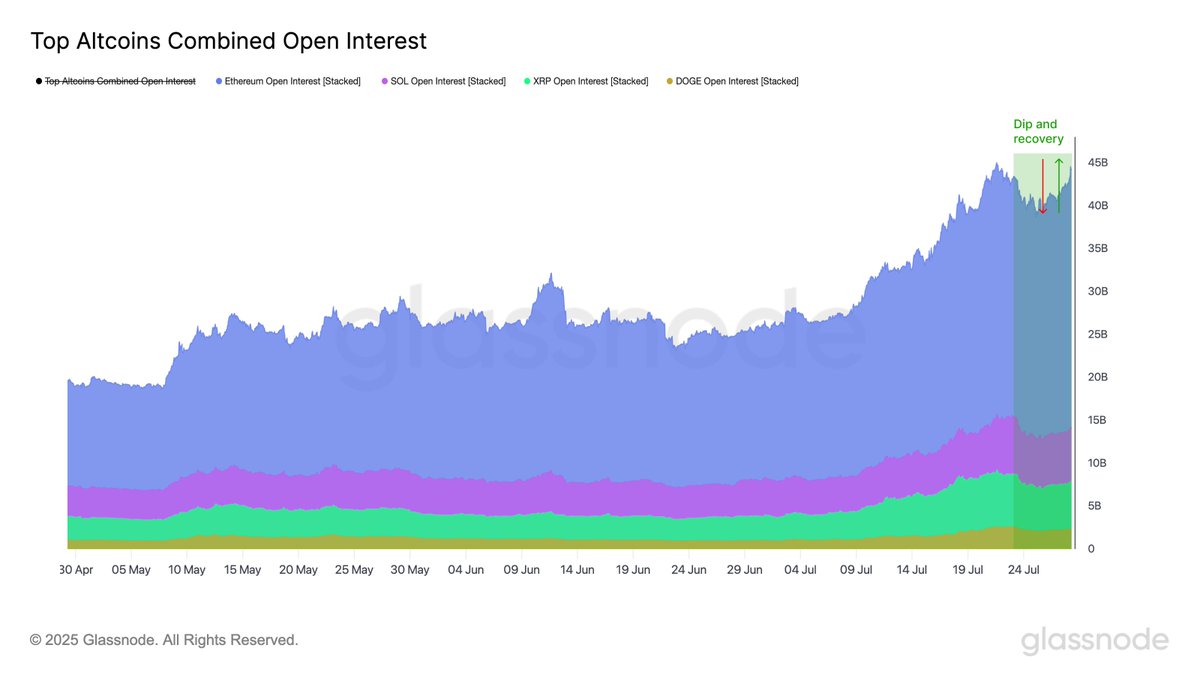

Now, right here is the chart shared by Glassnode that reveals the pattern within the Futures Open Curiosity for Ethereum, Solana, XRP, and Dogecoin over the previous couple of months:

The market appears to have seen contemporary positioning in latest days | Supply: Glassnode on X

As displayed within the above graph, the mixed Futures Open Curiosity for these high altcoins hit a excessive of $45 billion final week, however speculative curiosity cooled off, and the metric witnessed a decline.

This week, the merchants seem like again in full drive because the indicator has virtually totally recovered, reaching the $44.5 billion mark following a pointy rebound. It’s additionally seen within the chart that Ethereum sawthe largest a part of the swing, whereas Solana and XRP had been extra secure. Dogecoin kind of prevented the rollercoaster solely with an almost flat pattern.

Usually, an increase within the Futures Open Curiosity is usually a trace that the market may be about to show extra unstable. Provided that Ethereum has seen the sharpest uptick in speculative curiosity, it could be extra liable to seeing a violent leverage flush.

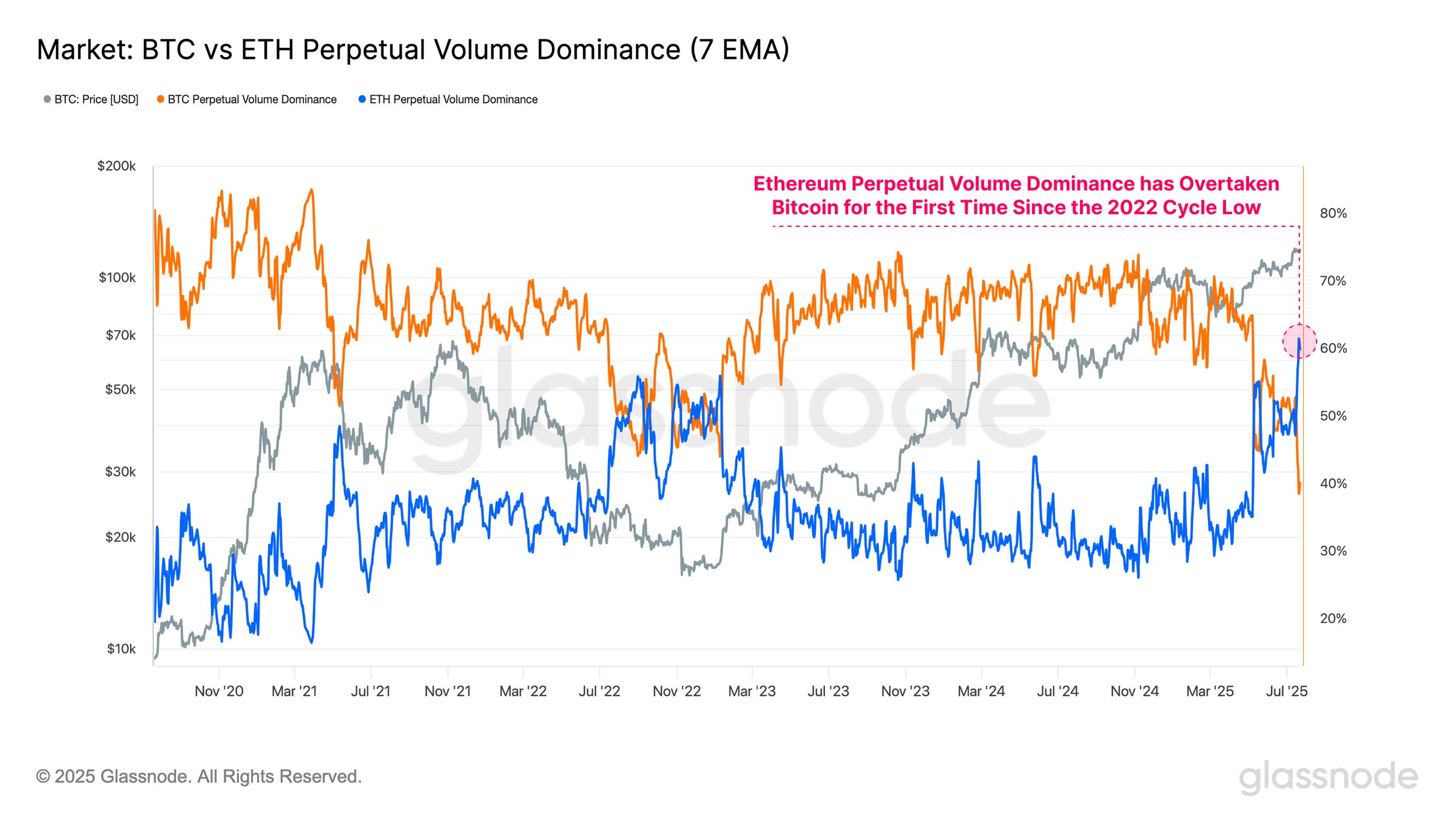

In associated information, Ethereum is dominating within the Perpetual Futures market, because the analytics agency has identified in one other X put up.

The Perp Quantity share of Bitcoin and Ethereum in contrast over the previous couple of years | Supply: Glassnode on X

As Glassnode has highlighted within the chart, the Ethereum Perpetual Futures Quantity dominance has not too long ago overtaken Bitcoin’s for the primary time because the 2022 cycle low. “This shift confirms a significant rotation of speculative curiosity towards the altcoin sector,” notes the analytics agency.

BTC Worth

Bitcoin has continued its latest pattern of sideways motion as its worth continues to be buying and selling across the $118,900 stage.

Seems like the worth of the coin has been caught in consolidation not too long ago | Supply: BTCUSDT on TradingView

Featured picture from Dall-E, Glassnode.com, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluation by our group of high know-how consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.