After trailing Bitcoin for many of the 12 months, BTC Dominance is falling, and ETH ▲5.17% has surged previous expectations with a 44% rally from its July low of $2,373 to over $3,526.

It additionally helps that information hit this week that former Palantir and PayPal co-founder Peter Thiel purchased 9% of an Ethereum Treasury firm. The shift in momentum comes as institutional demand heats up and Ethereum ETFs acquire steam, placing stress on Bitcoin’s dominance available in the market.

However does this imply the Bitcoin bull run is over? Right here’s what you need to know:

ETH/BTC Breakout Hints at a Structural Development Shift

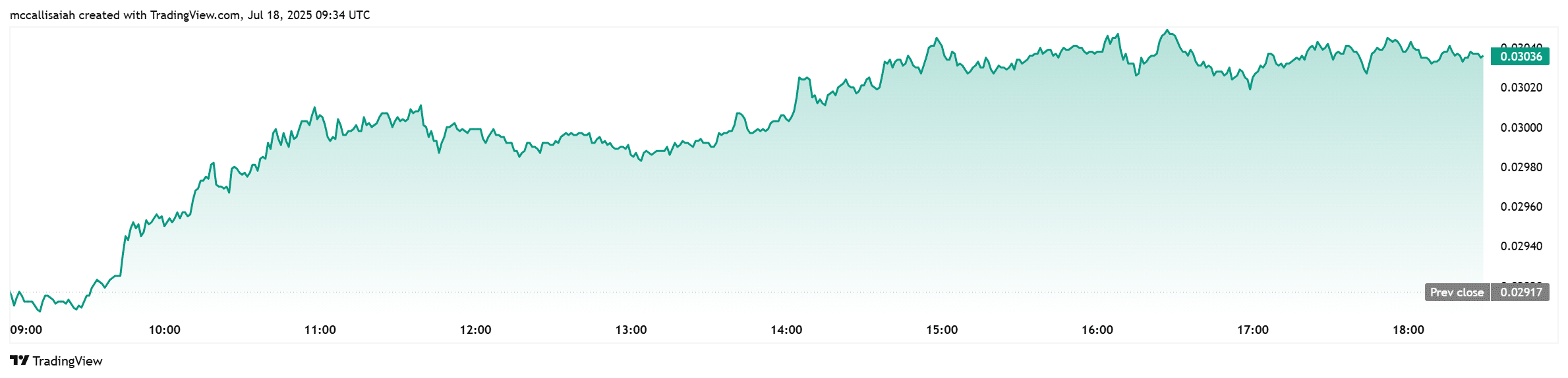

After greater than a 12 months of decline, the ETH/BTC ratio is lastly exhibiting indicators of life. It lately broke by way of resistance at 0.02629 BTC and is now urgent up in opposition to 0.02968, a stage that, if cleared, might set the stage for a full-blown uptrend in Ethereum’s valuation relative to Bitcoin.

“If ETH/BTC can keep its bullish bias, then there’s a 99% probability BTC Dominance has topped.” – Matthew Hyland, crypto analyst, by way of X

After a brutal slide that started in 2023 and worsened by way of mid-2024, ETH/BTC is exhibiting early indicators of life. The rebound off the 0.015–0.020 vary hints at a potential long-term pattern shift.

However Bitcoin isn’t on the ropes but. As 99Bitcoins analysts identified, BTC dominance (BTC.D) has but to interrupt its bullish construction. A full ETH/BTC uptrend might take weeks or months to play out, leaving room for BTC to rally.

Bitcoin Dominance Drops, Opening the Door to Altcoin Season

A part of Ethereum’s energy stems from renewed institutional curiosity. In July alone, Ethereum ETFs posted internet inflows of over 79,674 ETH — roughly $256 million — with iShares’ fund accumulating almost 56,000 ETH ($180M+).

Against this, Bitcoin ETFs logged larger greenback inflows — about $404 million — however Ethereum’s charge of ETF development relative to its market cap is noteworthy.

Trump once more purchased $3,000,000 $ETH.

Ethereum is taking the lead.

pic.twitter.com/WttEZ5w8Tn

— Ted (@TedPillows) July 18, 2025

Bitcoin dominance has dropped over 5.4%, breaking under a key ascending trendline and now sitting at 62.47%.

If the reversal sticks, the subsequent leg of the cycle might tilt towards altcoins with Ethereum main the cost.

What Comes Subsequent for ETH?

A clear break above the 0.038 BTC resistance would lock in Ethereum’s reversal narrative — and switch institutional eyes squarely on ETH.

Within the meantime, ETH continues to profit from favorable ETF flows, Trump household assist, rising investor sentiment, and declining BTC dominance. ETH is about to cook dinner.

EXPLORE: Tether CEO Paolo Ardoino Hopes For Internet Constructive From US Elections, Says Bitcoin Strategic Reserve Is A Nice Thought: 99Bitcoins Unique

Be part of The 99Bitcoins Information Discord Right here For The Newest Market Updates

Key Takeaways

The clock is ticking on one in every of crypto’s longest authorized dramas, and the XRP value may very well be able to rocket.

All eyes are on Powell this week. As inflation lingers and labor metrics soften.

The put up Ethereum Outpaces Bitcoin in July Surge as ETF Inflows, BTC Dominance Shift Market Dynamics appeared first on 99Bitcoins.