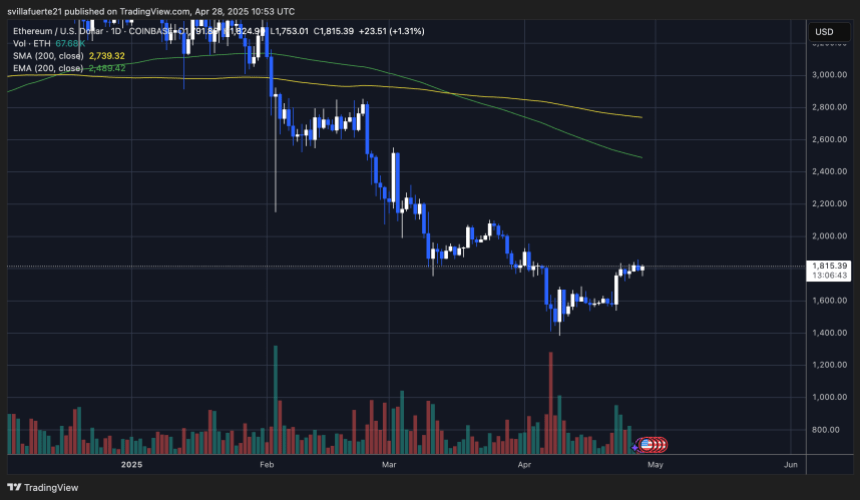

Ethereum is now dealing with a crucial take a look at because it trades inside a good vary, sitting beneath the $1,850 resistance and above the $1,750 assist. After a powerful restoration from the $1,400 stage earlier this month, bulls have managed to stabilize value motion, however the true problem is now unfolding. To substantiate a sustainable bullish construction, Ethereum should decisively reclaim the $2,000 stage within the coming days.

Market sentiment stays cautious as Ethereum consolidates beneath resistance whereas macroeconomic uncertainty continues to weigh on danger belongings. High crypto analyst Huge Cheds shared insights on X, highlighting a technical concern: Ethereum is displaying a 4-hour bear divergence on the On-Steadiness Quantity (OBV) indicator, together with an higher shadow construction.

With volatility anticipated to rise and merchants carefully looking forward to a breakout or breakdown, the approaching periods might outline Ethereum’s pattern for the subsequent a number of weeks. Bulls must act rapidly to take care of momentum and stop bears from regaining management.

Ethereum Battles Resistance As Bulls Attempt To Maintain Management

Ethereum is beginning to present early indicators of a bullish construction on low time frames, giving bulls hope for a broader restoration. After pushing from the $1,400 native low, ETH has managed to carry above key transferring averages and consolidate inside a good vary. Nevertheless, the market stays extremely cautious, and promoting stress might enhance rapidly if bulls fail to reclaim larger ranges.

Momentum has shifted in Ethereum’s favor over the previous few days, and several other analysts are calling for a possible large breakout if key resistance ranges are breached. A confirmed breakout above $1,850 might open the door for a swift transfer again to the $2,000 psychological stage. However, dangers stay elevated, and an opposing bearish view means that Ethereum might revisit the $1,300 zone if bulls lose management.

Ched’s crucial insights level out that Ethereum is forming a 4-hour bearish divergence on the On-Steadiness Quantity (OBV) indicator. This, mixed with the looks of an higher shadow on native construction, alerts weakening shopping for stress. In accordance with Cheds, a brief place might be triggered if Ethereum loses the $1,750 assist zone, which might verify a breakdown from the present consolidation sample.

Technical Particulars: Key Ranges To Change Construction

Ethereum is buying and selling at $1,815 after days of tight consolidation and modest upward motion. Bulls have managed to defend the $1,750-$1,800 assist vary, however the true take a look at stays forward. To shift the broader bearish construction right into a confirmed bullish pattern, Ethereum should reclaim the $2,100 stage. With out this breakout, any rallies are more likely to be seen as momentary reduction inside a broader downtrend.

Holding above the $1,800 stage is crucial within the coming days. A agency base above this zone would assist construct sturdy demand and create the situations wanted for a sustained restoration rally. Bulls are gaining some short-term momentum, however they nonetheless face a market clouded by macroeconomic uncertainty and cautious sentiment.

If Ethereum fails to take care of assist at $1,750, draw back dangers will develop quickly. Breaking beneath this zone might set off a pointy sell-off, doubtless sending ETH towards the $1,500 mark. Because the market exhibits indicators of power, Ethereum’s subsequent transfer will likely be decisive. It would decide whether or not it could be a part of a bigger restoration pattern or proceed struggling inside a unstable and unsure setting.

Featured picture from Dall-E, chart from TradingView