Ethereum’s layer-1 community has witnessed a drastic decline in income, plummeting by 99% since March 2024.

Knowledge from Token Terminal reveals that community income peaked at over $35 million on March 5. Nevertheless, by Sept. 2, every day income had plunged to a yearly low of round $200,000.

Market observers attribute this decline to the expansion of layer-2 (L2) networks and the March Dencun improve, which decreased charges for L2 transactions and reshaped Ethereum’s income construction. Token Terminal said:

“Key metrics that present how decrease transaction charges on L2s have elevated utilization, but in addition pushed down the income on the L1.”

Submit-upgrade transaction exercise has shifted from Ethereum’s mainnet to L2 networks, resulting in elevated every day transactions and lively customers on these platforms.

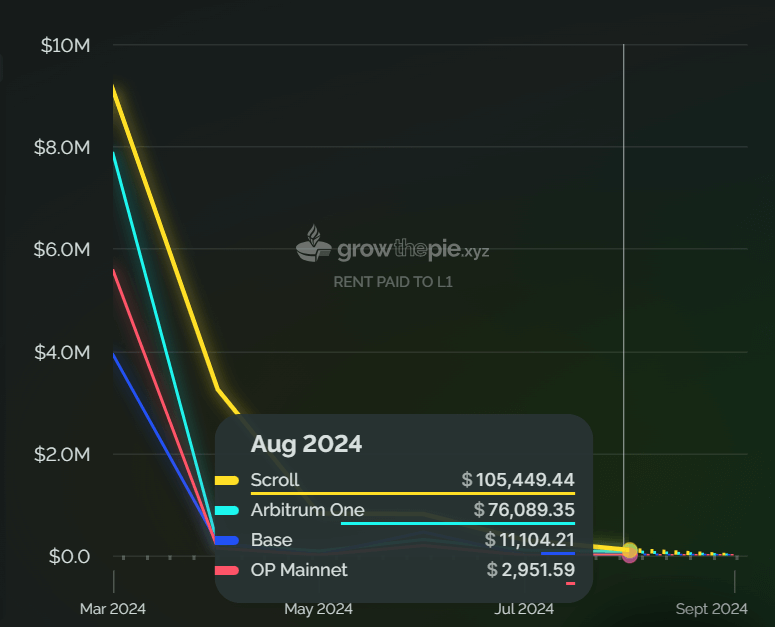

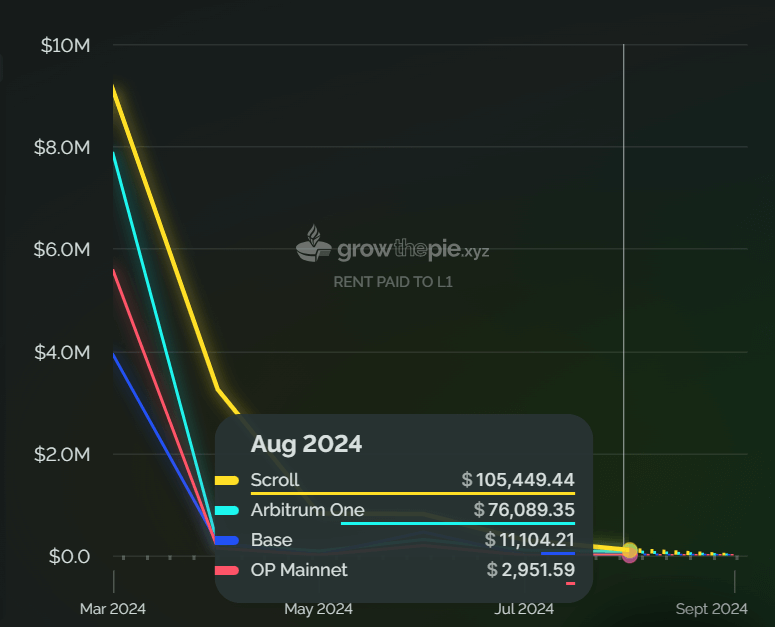

Nevertheless, this migration has considerably impacted Ethereum’s charge income. For example, Coinbase’s L2 community, Base, generated $2.5 million in income in August however paid solely $11,000 to choose the mainnet, underlining the shift in worth from Ethereum’s base layer.

Crypto analyst Kun warned that if this pattern continues, L2 networks may dominate and doubtlessly abandon Ethereum’s mainnet, particularly for client purposes. He emphasised the necessity for Ethereum to develop precious use circumstances on its mainnet or threat a extreme valuation subject.

He added:

“ETH L1 wants precious use circumstances on mainnet that can not be sieged or it’s a must to hope that L2 utilization is so massive that principally you want 100000 occasions the utilization on L2 to get the identical worth you probably did on mainnet with a tiny fraction which then creates a valley of valuation points.”

‘Loss of life spiral’

Bitcoin investor Fred Krueger has echoed these considerations, suggesting that Ethereum may face a “loss of life spiral” if its low income state of affairs persists.

He identified that Ethereum’s present charge income of $200,000 per day equates to $73 million yearly, removed from enough to maintain its market cap of $300 billion.

Krueger argues {that a} extra life like valuation may be nearer to $3 billion, underscoring the disconnect between Ethereum’s charge earnings mannequin and its market valuation. He mentioned:

“[Ethereum is] not equal to an organization making $73 million a 12 months in revenue, or perhaps a firm making $73 million a 12 months in income. That $73 million is not even enough to purchase again all of the inflation that naturally involves ETH validators.”

Talked about on this article