Welcome to the February CryptoSlate Alpha Month-to-month Snapshot, an unique round-up designed for our CryptoSlate Alpha subscribers.

In February, our complete stories and insightful articles delved deep into the crypto ecosystem, providing a mix of market evaluation, analysis insights, and forward-looking developments that would form the way forward for finance and know-how.

Our February Alpha Market Experiences included an in-depth have a look at the financial implications of the Fed’s reverse repo (RRP) facility and its potential ripple results on Bitcoin, alongside a crucial evaluation of credit score spreads and their significance for the crypto market.

We additionally explored why governments ought to favor regulating stablecoins over creating Central Financial institution Digital Currencies (CBDCs), providing a nuanced perspective on digital forex governance.

Analysis articles highlighted record-breaking financial funding in Bitcoin, analyzed the calm earlier than the storm in Bitcoin’s market conduct, and offered the unprecedented stability in Bitcoin futures and choices open curiosity.

Notably, our insights identified the crucial position of US exchanges in offering liquidity to the Bitcoin market and the shifting development in the direction of long-term holding as change balances dipped to their lowest since 2018.

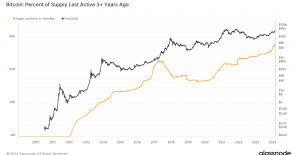

Our high Alpha Insights supplied a complete view of the crypto panorama, from the implications of HODL waves and on-chain metrics suggesting a speculative market and potential community well being declines to the numerous impression of short-term buying and selling volumes and institutional participation.

We dissected the true price of mining one Bitcoin, examined the speculative and resilient nature of Bitcoin traders, and supplied a granular evaluation of Bitcoin’s buying and selling patterns, provide distribution, and the results of ETFs on market dynamics.

Be part of us as we unpack these matters, providing our Alpha subscribers a wide selection of data-driven analyses and skilled commentary on the evolving crypto area.

February α Market Experiences

The financial implications of the Fed’s reverse repo (RRP) facility

CryptoSlate explores the intricacies of the RRP facility, exploring its impression on conventional monetary markets and its potential results on Bitcoin.

What are credit score spreads, why are they tight, and what does it imply for Bitcoin?

CryptoSlate’s dives into the idea of credit score spreads and analyze their present state to grasp their impression on the broader monetary and crypto markets, particularly on Bitcoin.

Why governments ought to regulate stablecoins as a substitute of creating CBDCs

CryptoSlate seems to be into the advantages of stablecoin regulation to discover why it might serve each non-public and public pursuits higher than CBDCs.

February α Analysis Articles

Report excessive realized cap exhibits unprecedented financial funding in Bitcoin

The Bitcoin community and its members have by no means been as economically invested in BTC as as they’re now.

The Bitcoin market faces a crucial second amid hovering unrealized income

Spot ETF inflows and bullish sentiment buoy Bitcoin, regardless of potential volatility from unrealized beneficial properties.

Bitcoin’s surge to $57K didn’t end in liquidation storm, defying anticipated development

Regardless of Bitcoin’s excessive flying, liquidations stay grounded — indicating a market that’s cautious.

Bitcoin futures and choices open curiosity soars in February

Bitcoin’s choices tilt in the direction of bullish calls, regardless of a short-term uptick in defensive places

Bitcoin community congestion eases as mempool clears in February

Bitcoin’s mempool unclogs in February bringing a breath of contemporary air to transaction processing.

How do US exchanges contribute to Bitcoin’s market liquidity?

US exchanges account for a comparatively small portion of the worldwide buying and selling quantity however present 49% of the worldwide liquidity, which suggests they’ve larger market depth to facilitate bigger transactions for a smaller variety of merchants.

Bitcoin change stability dips to lowest since 2018 as market shifts to HODLing

Bitcoin holders transfer away from exchanges in long-term holding development.

Rising stablecoin provide exhibits an inflow of capital into the crypto market

Rising stablecoin market cap exhibits elevated capital movement into crypto and investor readiness for market actions.

On-chain information exhibits Bitcoin provide is tightening

Unspent transaction outputs and accumulation developments sign a tightening Bitcoin provide amid rising institutional curiosity.

Futures open curiosity hits two-year peak with Bitcoin above $50k

Report excessive in Bitcoin futures open curiosity aligns with its worth breakthrough.

Bitcoin’s risk-adjusted return potential skyrockets as Sharpe Sign surges

Glassnode’s new metric exhibits a promising rebound in Bitcoin’s market sentiment.

Why did Bitcoin’s market cap surge by over $102 billion whereas realized cap solely grew by $4 billion?

Whereas Bitcoin’s market cap witnesses drastic improve, its realized cap gives a extra grounded perspective of worth.

Bitcoin above $44k spurs market confidence with spike in unrealized income

Profitability skyrockets amongst Bitcoin traders as market sentiment improves.

What Bitcoin’s buying and selling patterns on centralized exchanges inform us concerning the market

CryptoSlate’s evaluation of Kaiko information confirmed that almost all of worldwide Bitcoin buying and selling takes place exterior the U.S. on Binance.

Bitcoin choices present long-term bullishness and near-term pessimism

Bitcoin choices information exhibits a bullish future outlook amidst present market hesitation.

How ETFs affected Bitcoin’s provide distribution throughout cohorts

Spot Bitcoin ETFs precipitated important shifts in Bitcoin provide distribution.

Brief-term buying and selling quantity peaks as Bitcoin crosses $43,000

Bitcoin’s SLRV ratio exhibits spot Bitcoin ETFs most certainly spurred unprecedented short-term buying and selling volumes.

Whales and establishments lead the cost in Bitcoin’s change quantity surge

Glassnode information exhibits whales and establishments as major actors in Bitcoin’s change quantity rise.

Right here’s why Bitcoin perpetual futures market noticed excessive volatility in January

January sees merchants reassessing Bitcoin perpetual futures amidst rising ETF choices.

Marathon vs Riot: Analyzing the true price of mining 1 bitcoin

Estimating the true common price of mining a single Bitcoin for 2 of the most important publicly traded Bitcoin mining firms.

February High α Insights

Evaluation of HODL waves reveals a speculative market at play

Bitcoin’s journey from $25,000 to $50,000 not marked by excessive short-term hypothesis.

On-chain metrics reveal Bitcoin community’s well being hinting at potential decline

Month-to-month and yearly metrics of Bitcoin on-chain exercise reveal community well being and utilization developments, highlighting potential declines.

Bitcoin’s STH Realized Worth nears $40,000, signaling robust market momentum

Analyzing Bitcoin’s dynamics: The STH Realized Worth’s position in present market developments.

U.S. leads in Bitcoin worth surge as Asia sees decline

The US, with its bullish stance, leads the pack with a whopping 12,200% worth change.

Evaluation challenges Bitcoin diminishing returns concept amid current beneficial properties

Bitcoin’s present cycle showcases energy with an almost 287% appreciation from the low, difficult the diminishing returns concept.

2021 Bitcoin traders showcase long-term holding resilience

Bitcoin traders from 2021 decrease their price foundation by strategic purchases in a bear market.

After 153 days in $40k-$45k vary, Bitcoin goals to shut sixth ever month-to-month shut above $50k

Navigating above $50,000, Bitcoin suggests ongoing consolidation after breaking long-term vary.

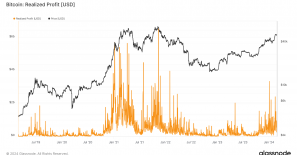

Brief time period holders despatched file $3 billion in revenue to exchanges

Spot ETF success propels Bitcoin past $58,000, showcasing investor confidence.

Bitcoin traders understand internet income for 128 consecutive days

Regardless of Bitcoin’s strong efficiency, 2024’s profit-taking depth fails to match the 2021 bull run’s fervor.

From file highs to notable lows: Bitcoin charges after the inscription booms

Bitcoin charges hit a brand new low, miners see fee-based income stabilize at 6%.

The put up From credit score spreads to HODLing patterns: Navigating February’s crypto market shifts appeared first on CryptoSlate.