Be a part of Our Telegram channel to remain updated on breaking information protection

The Hedera value prediction reveals that HBAR demonstrates a bullish development. It faces a vital resistance zone at $0.27, and a breakout relies on elevated quantity and market momentum.

Hedera Prediction Statistics Information:

Hedera value now – $0.23

Hedera market cap – $9.32 billion

Hedera circulating provide – 38.20 billion

Hedera whole provide – 50 billion

Hedera Coinmarketcap rating – #19

For crypto initiatives, it’s typically really helpful to focus on vital value milestones as early as doable. Trying on the efficiency of Hedera (HBAR), we will see its spectacular development since its all-time low of $0.01001 in January 2020, which marks a rise of over 2300%. Since then, the token has skilled substantial fluctuations, with its most up-to-date 24-hour value vary exhibiting a low of $0.1893 and a excessive of $0.2567. Regardless of reaching an all-time excessive of $0.5701 in September 2021, the value has since dropped by almost 57%, however its journey from its early days demonstrates exceptional development potential.

HBAR/USD Market

Key Ranges:

Resistance ranges: $0.35, $0.37, $0.39

Assist ranges: $0.10, $0.08, $0.06

Analyzing HBAR/USD, the latest value motion showcases a big upward momentum, reflecting a sturdy bullish development. Initially of the rally, HBAR exhibited robust help from its development band, which has traditionally offered dependable steerage for its value trajectory. After a short consolidation section final week between $0.15 and the development band, the cryptocurrency broke by this vary and started gaining upward momentum, highlighting the underlying energy of its market construction.

Hedera Worth Prediction: What May Be the Subsequent Course for Hedera (HBAR)?

The day by day chart signifies a bullish trajectory for Hedera (HBAR), with the value nearing a vital resistance zone between $0.25 and $0.27. Breaking above this zone may propel HBAR towards the $0.30-$0.32 vary. Nonetheless, overcoming this hurdle would require a considerable enhance in buying and selling quantity and market participation, with day by day quantity doubtlessly exceeding $2 billion, as seen in previous rallies. With out such momentum, HBAR could consolidate close to the resistance zone, setting the stage for a stronger transfer in favorable market circumstances.

However, the day by day development stays bullish, with potential resistance ranges at $0.35, $0.37, and $0.39 if the value breaks above the present channel. Conversely, a bearish flip may see the value testing help ranges at $0.10, $0.08, and $0.06, equivalent to the channel’s decrease boundary. Merchants ought to intently monitor quantity and market sentiment to gauge the probability of a decisive breakout or consolidation.

HBAR/BTC Might Acquire Extra Upsides

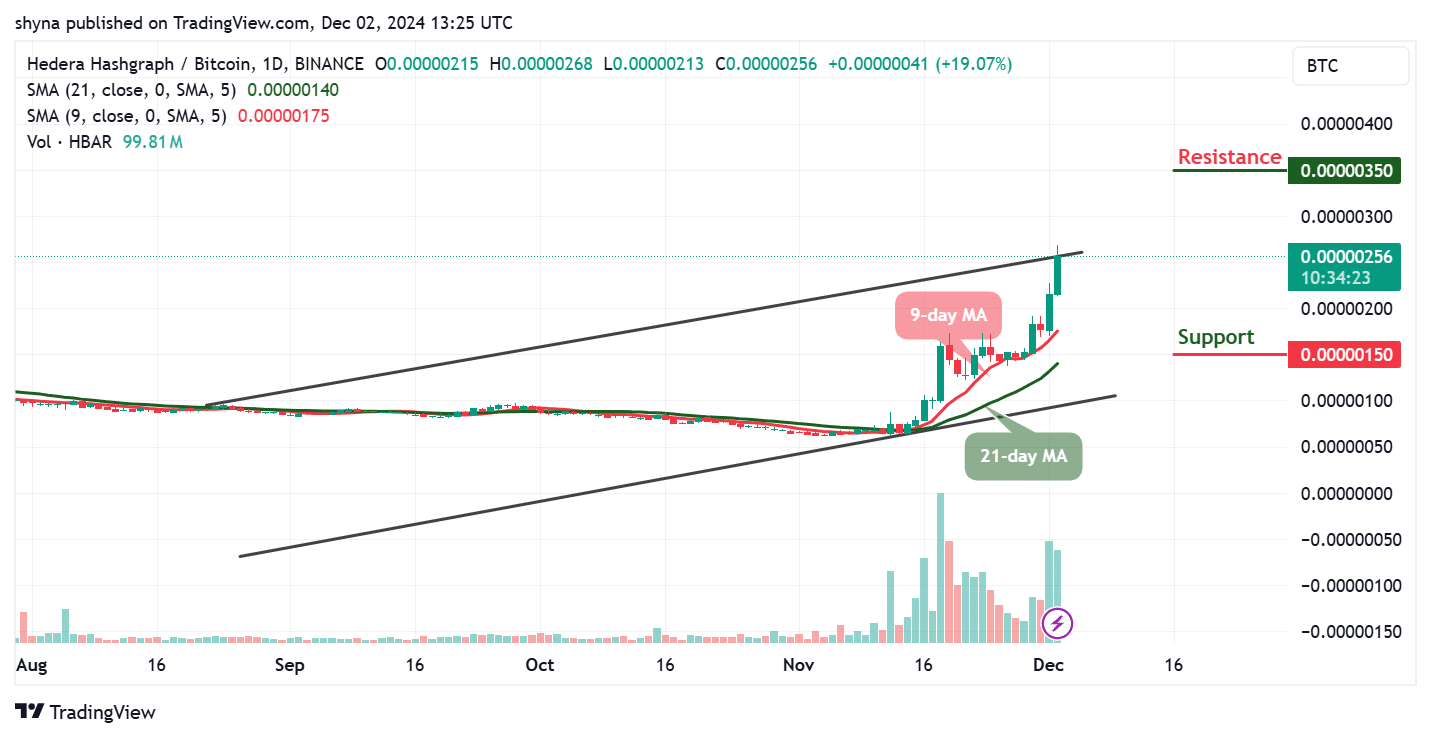

The day by day chart for Hedera Hashgraph (HBAR) towards Bitcoin (BTC) signifies robust bullish momentum, with the value presently at 256 SAT, reflecting a 19.07% achieve. A bullish crossover of the 9-day shifting common (MA) above the 21-day MA highlights short-term upward momentum. Elevated buying and selling quantity has bolstered the latest breakout, pushing the value towards the higher boundary of the ascending channel. Key resistance at 350 SAT is in focus, with a possible breakout above this degree paving the best way for additional upward motion.

In the meantime, the help at 150 SAT serves as a strong basis in case of a pullback, however the general development stays wholesome, as indicated by the formation of upper highs and better lows. The widening hole between the shifting averages helps a bullish outlook. Sustaining this momentum would require sustaining excessive buying and selling volumes and staying above the 9-day MA. If this development continues, HBAR may problem the higher boundary of the channel and surpass the 300 SAT resistance, solidifying its bullish trajectory towards Bitcoin.

On that observe, @dudebruhwhoa shared an replace along with his followers on X (previously Twitter), highlighting that $HBAR closed the week above the outer yellow channel on the long-term parallel channels chart. He reminded everybody that value targets may rise additional if $HBAR surpasses month-to-month resistance, notably if it strikes past parallel resistance.

$hbar closed the week above the outer yellow channel on the outdated long-term parallel channels chart, reminder that targets can go greater if we get above month-to-month resistance, particularly if above parallel resistance pic.twitter.com/F1yXYRPlEL

— wĦoabruℏdudebruℏ (@dudebruhwhoa) December 2, 2024

Hedera Options

HBAR’s technical outlook stays constructive, bolstered by rising buying and selling quantity and strong market fundamentals. Nonetheless, the important thing resistance degree and its relationship with Bitcoin dominance recommend that warning is warranted. Whereas a breakout is inside attain, a sustained uptrend will seemingly rely upon elevated market participation and investor confidence. On the similar time, Pepe Unchained is gaining appreciable traction within the meme coin house, having raised over $64 million with day by day inflows exceeding $1.5 million. The token’s enlargement is fueled by its Layer 2 blockchain capabilities, which embrace a decentralized trade (DEX), staking rewards, and the “Pepe pump pad,” enabling customers to create meme cash with ease.

NEW PEPE COIN ALTERNATIVE PEPE UNCHAINED Goes LIVE Quickly

With its robust development potential, the $PEPU token may see positive aspects of 10x to 100x as soon as listed on main exchanges like Binance and Coinbase. As demand continues to surge and the token turns into extra broadly accessible, now could be the right time to spend money on Pepe Unchained for substantial future returns.

Go to Pepe Unchained

Associated Information

Most Searched Crypto Launch – Pepe Unchained

Layer 2 Meme Coin Ecosystem

Featured in Cointelegraph

SolidProof & Coinsult Audited

Staking Rewards – pepeunchained.com

$40+ Million Raised at ICO – Ends December

Be a part of Our Telegram channel to remain updated on breaking information protection