January 2024 noticed notable fluctuations in Bitcoin’s perpetual futures market, mirrored within the funding fee, open curiosity (OI), and buying and selling volumes. Perpetual futures, in contrast to conventional futures, shouldn’t have an expiration date, permitting merchants to carry positions indefinitely. A important side of those devices is the perpetual futures funding fee, a mechanism designed to anchor the futures costs to the spot market. This fee will be optimistic or destructive, relying on whether or not the market is bullish or bearish.

The start of the month noticed a bullish development, with Bitcoin’s worth rising to $46,940 by January 8, aligning with a excessive funding fee of 0.0003790. This situation indicated that merchants have been keen to pay a premium to carry lengthy positions, anticipating additional worth will increase.

Nevertheless, as January progressed, the market skilled volatility, with Bitcoin’s worth dropping to $39,450 by January 22 after which recovering to $43,260 on January 29. The funding fee mirrored these worth actions, showcasing the fluctuating market sentiment. Probably the most important shift occurred in direction of the top of the month when the funding fee plummeted to 0.00001789 regardless of a comparatively secure Bitcoin worth. This sharp drop suggests a change in dealer sentiment or technique, presumably indicating a much less bullish outlook.

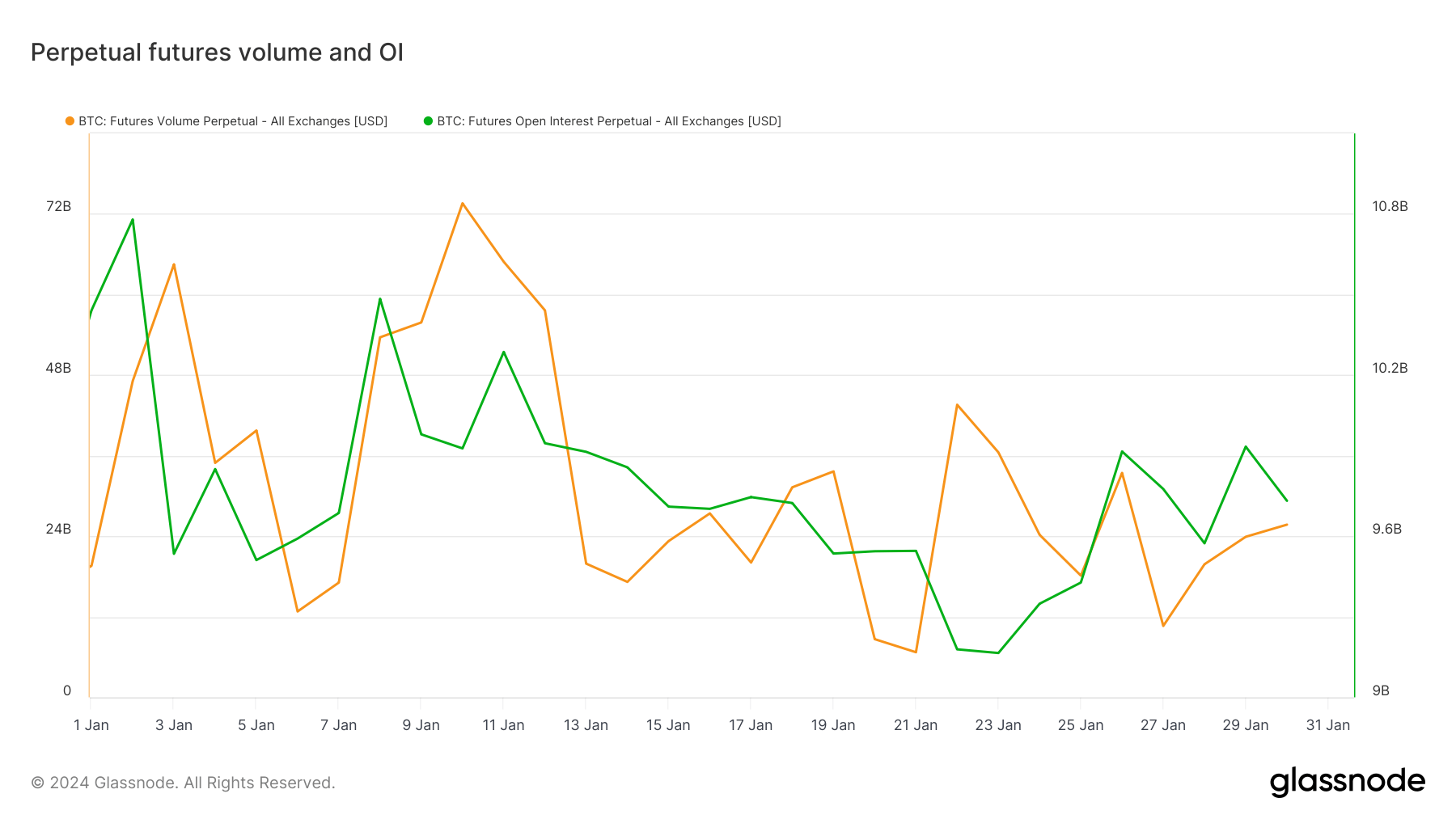

This transformation in sentiment can also be evident within the open curiosity and buying and selling volumes for perpetual futures. The year-to-date (YTD) excessive in open curiosity was $10.771 billion on January 2, with buying and selling volumes peaking at $73.783 billion on January 10, signaling robust market exercise. This era of heightened exercise correlates with the preliminary bullish sentiment within the Bitcoin market.

In distinction, the YTD low in open curiosity was recorded on January 23 at $9.165 billion, coinciding with the bottom buying and selling quantity of $6.718 billion. This decline signifies a big pullback in market exercise, doubtlessly reflecting bearish sentiment or a response to exterior components, such because the market’s correction throughout this era.

By January 30, the open curiosity had reasonably recovered to $9.731 billion, with buying and selling volumes at $25.721 billion. Whereas this marks an enchancment from mid-January lows, it nonetheless denotes a extra cautious stance out there.

The introduction of spot Bitcoin ETFs on January 10 doubtless performed a task on this volatility. These ETFs supply buyers a brand new approach to acquire publicity to Bitcoin, doubtlessly attracting some away from perpetual futures. The shift in direction of ETFs could possibly be attributed to their perceived decrease danger and larger regulatory acceptance than futures, particularly perpetual contracts.

The numerous drop within the funding fee on the finish of January, coupled with the adjustments in open curiosity and buying and selling volumes, signifies a shift in market sentiment. Initially bullish, the market sentiment transitioned to a extra cautious or bearish outlook by the month’s finish. The introduction of spot Bitcoin ETFs doubtless influences this shift, as they supply a brand new avenue for Bitcoin publicity and may need diverted some curiosity from perpetual futures.

These developments counsel a various danger urge for food amongst merchants and presumably a diversification of funding methods.

The submit Right here’s why Bitcoin perpetual futures market noticed excessive volatility in January appeared first on CryptoSlate.