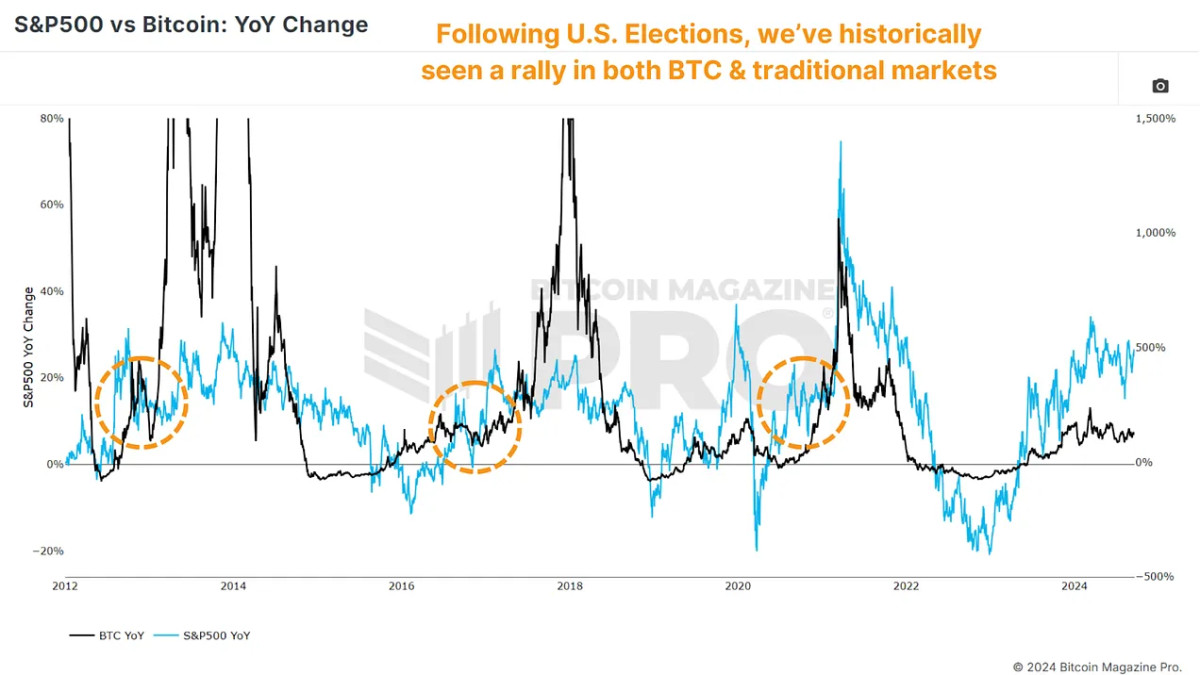

Because the U.S. presidential election approaches, it’s price analyzing how previous elections have influenced Bitcoin’s worth. Traditionally, the U.S. inventory market has proven notable tendencies round election durations. Given Bitcoin’s correlation with equities and, most notably, the S&P 500, these tendencies might supply insights into what would possibly occur subsequent.

S&P 500 Correlation

Bitcoin and the S&P 500 have traditionally held a powerful correlation, significantly throughout BTC’s bull cycles and durations of a risk-on sentiment all through conventional markets. This might phenomenon might probably come to an finish as Bitcoin matures and ‘decouples’ from equities and it’s narrative as a speculative asset. Nonetheless there’s no proof but that that is the case.

Publish Election Outperformance

The S&P 500 has usually reacted positively following U.S. presidential elections. This sample has been constant over the previous few many years, with the inventory market typically experiencing vital beneficial properties within the 12 months following an election. Within the S&P500 vs Bitcoin YoY Change chart we are able to see when elections happen (orange circles), and the value motion of BTC (black line) and the S&P 500 (blue line) within the months that comply with.

2012 Election: In November 2012, the S&P 500 noticed 11% year-on-year progress. A 12 months later, this progress surged to round 32%, reflecting a powerful post-election market rally.

2016 Election: In November 2016, the S&P 500 was up by about 7% year-on-year. A 12 months later, it had elevated by roughly 22%, once more exhibiting a considerable post-election increase.

2020 Election: The sample continued in 2020. The S&P 500’s progress was round 17-18% in November 2020; by the next 12 months, it had climbed to almost 29%.

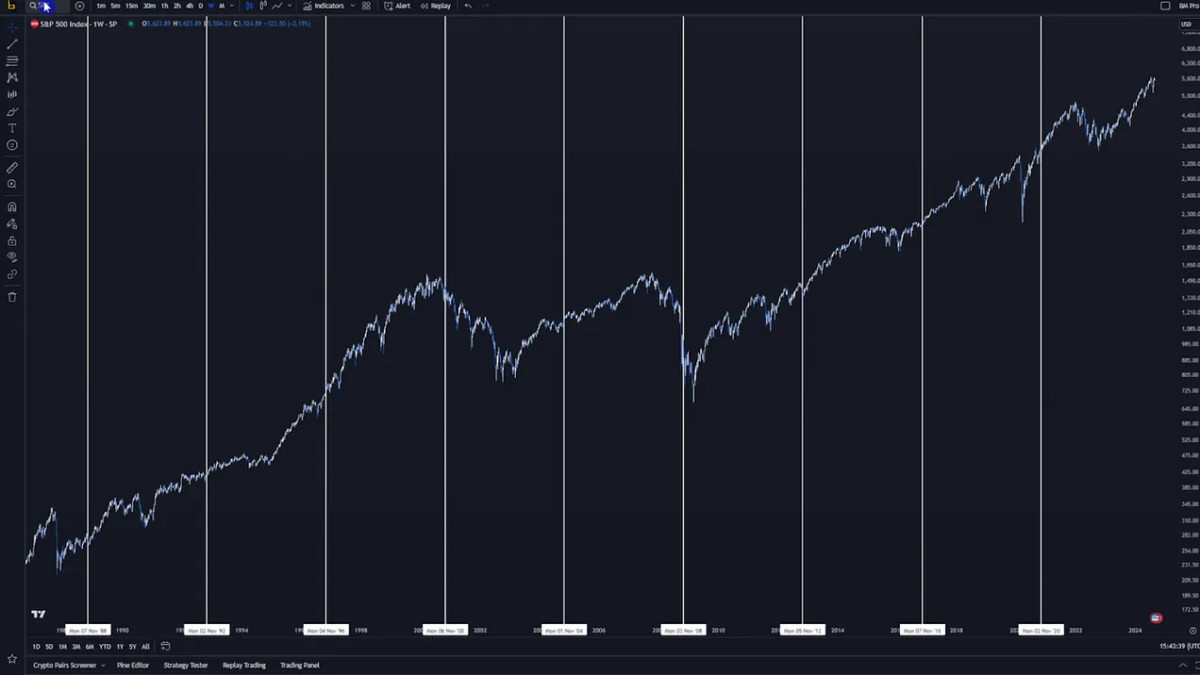

A Latest Phenomenon?

This isn’t restricted to the earlier three elections whereas Bitcoin existed. To get a bigger information set, we are able to take a look at the earlier 4 many years, or ten elections, of S&P 500 returns. Just one 12 months had adverse returns twelve months following election day (2000, because the dot-com bubble burst).

Historic information means that whether or not Republican or Democrat, the successful get together would not considerably affect these constructive market tendencies. As a substitute, the upward momentum is extra about resolving uncertainty and boosting investor confidence.

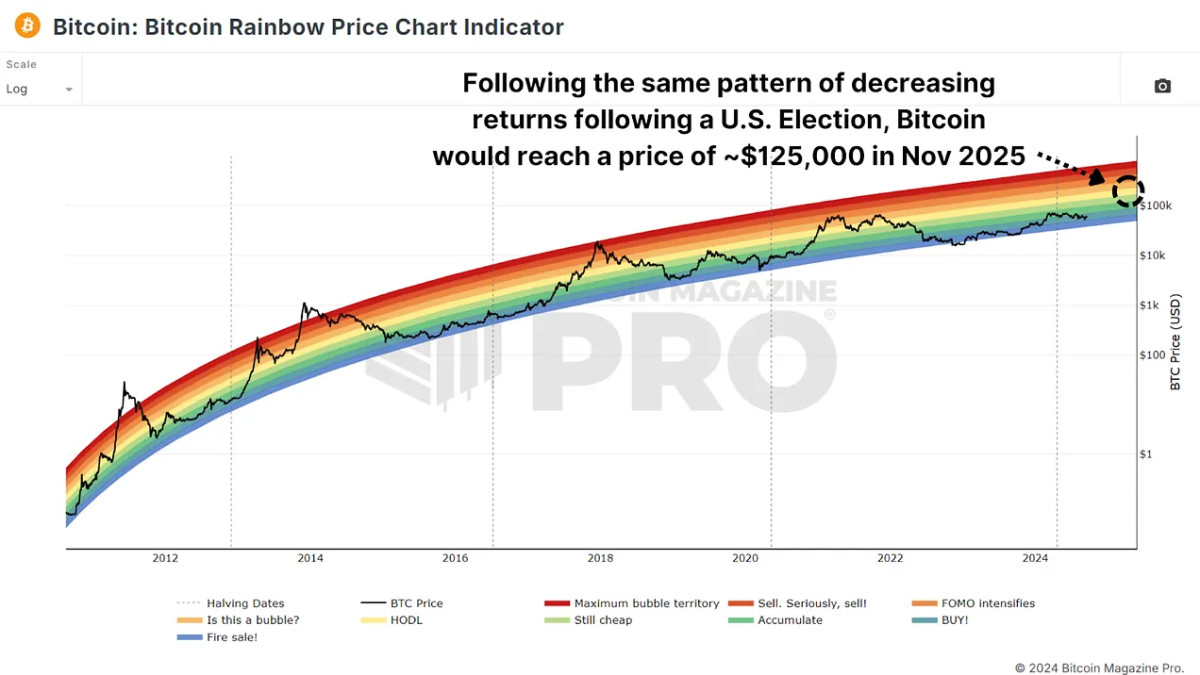

How Will Bitcoin React This Time

As we method the 2024 U.S. presidential election, it is tempting to take a position on Bitcoin’s potential efficiency. If historic tendencies maintain, we might see vital worth will increase. For instance:

If we expertise the identical proportion beneficial properties within the twelve months following the election as we did in 2012, Bitcoin’s worth might rise to $1,000,000 or extra. If we expertise the identical because the 2016 election, we might climb to round $500,000, and one thing much like 2020 might see a $250,000 BTC.

It is attention-grabbing to notice that every prevalence has resulted in returns reducing by about 50% every time, so possibly $125,000 is a practical goal for November 2025, particularly as that worth and information align with the center bands of the Rainbow Value Chart. It’s additionally price noting that in all of these cycles, Bitcoin really went on to expertise even increased cycle peak beneficial properties!

Conclusion

The information means that the interval after a U.S. presidential election is mostly bullish for each the inventory market and Bitcoin. With lower than two months till the following election, Bitcoin buyers might have cause to be optimistic in regards to the months forward.

For a extra in-depth look into this matter, take a look at a current YouTube video right here: Will The U.S. Election Be Bullish For Bitcoin?